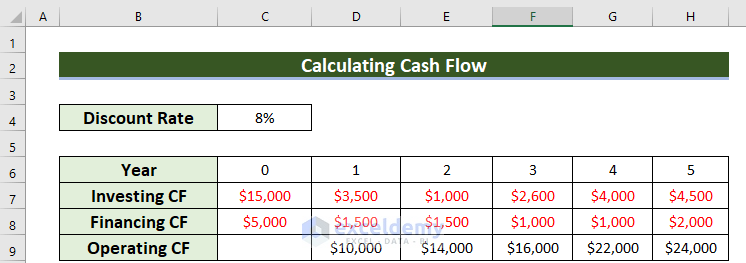

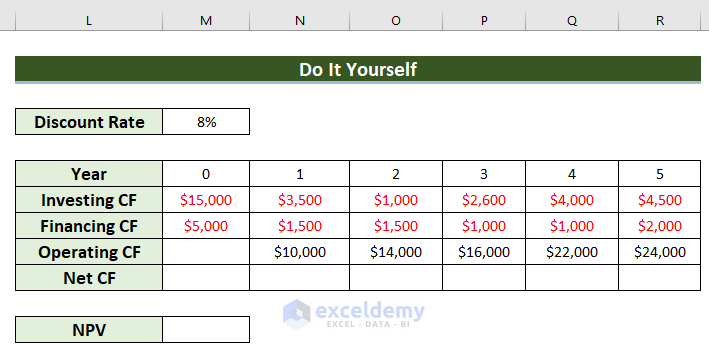

Below is a dataset with 5 Rows: Discount Rate, Year, Investing CF, Financing CF, and Operating CF.

Investing Cash Flow and Financing Cash Flow denote the cash outflows for a business that have negative values (in red).

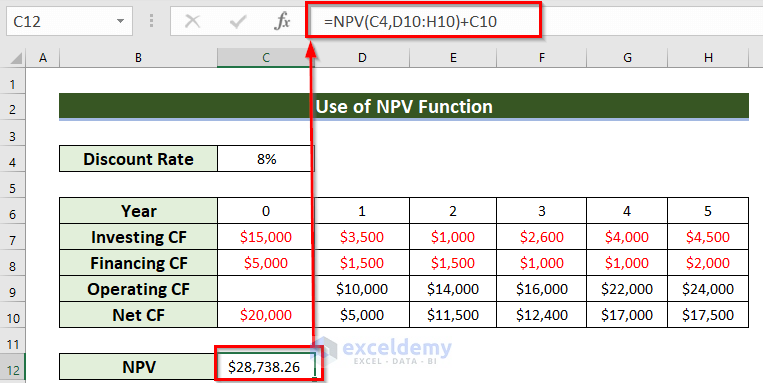

Method 1 – Using the NPV Function

Steps:

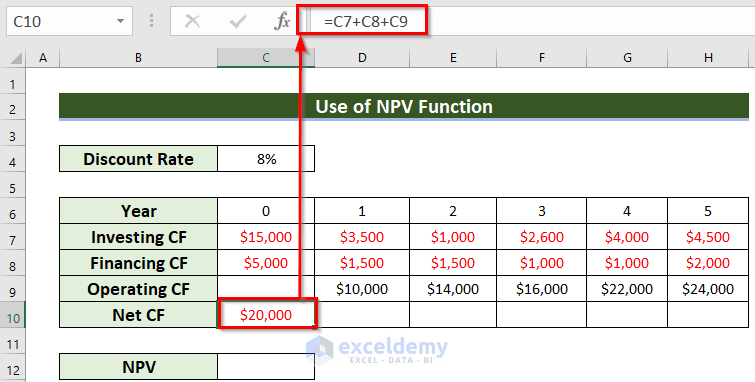

- Select a cell, C10, where you want to see the Net CF.

- Enter the following formula in cell C10:

=C7+C8+C9- Press ENTER.

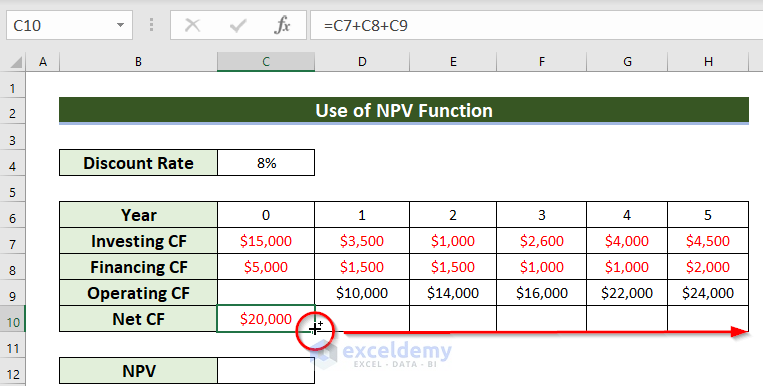

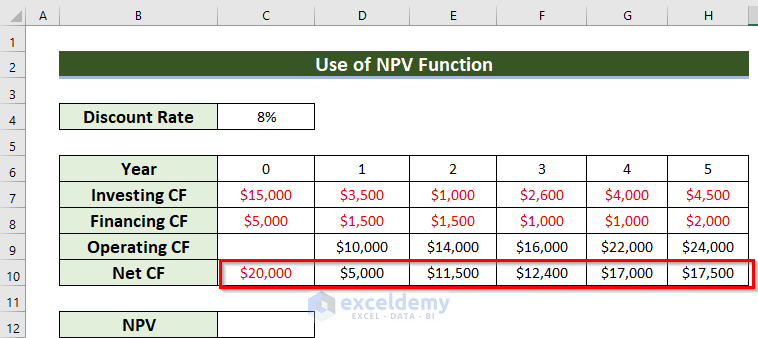

- Drag the Fill Handle icon horizontally to AutoFill the data in the rest of the cells D10:H10.

You can see the Net Cash Flow for all those given periods.

- Select a cell, C12, where you want to keep the Net Present Value.

- Enter the following formula in cell C12:

=NPV(C4,D10:H10)+C10- Press ENTER to get the result.

You will get the Net present value of Cash flow.

Formula Breakdown

The NPV function will return the Net present value based on a discount rate, cash inflows, and cash outflows of an investment.

- C4 is the Discount Rate.

- The data range D10:H10 denotes the cash flows.

- NPV(C4,D10:H10)—> becomes $48,738.26.

- I have included the total outflows of the beginning year. As C10 is the outflow amount of the initial year, thus, I have added the value of the C10 cell.

- So, $48,738.26+(-$20,000)—> turns $28,738.26.

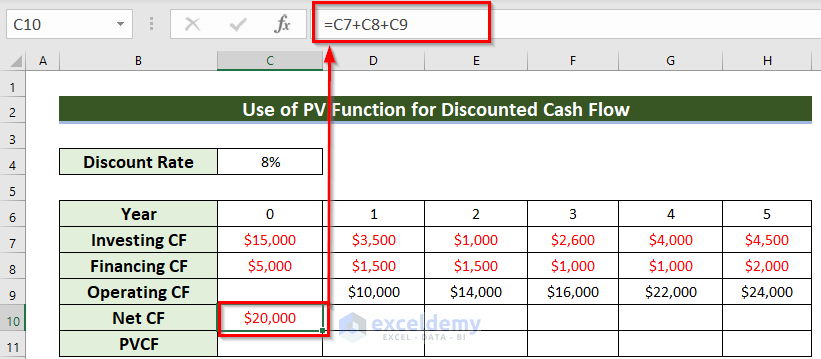

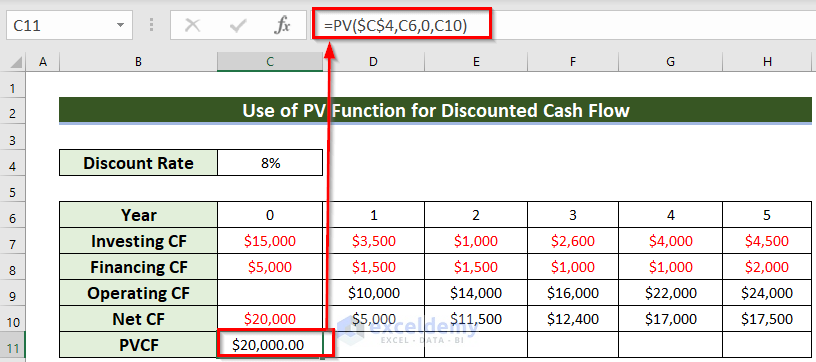

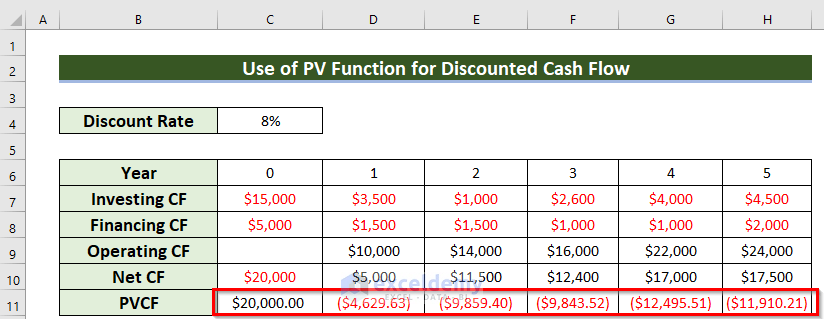

Method 2 – Employing PV Function

Steps:

- Select a cell, C10, where you want to see the Net CF.

- Enter the following formula in cell C10:

=C7+C8+C9- Press ENTER to get the result.

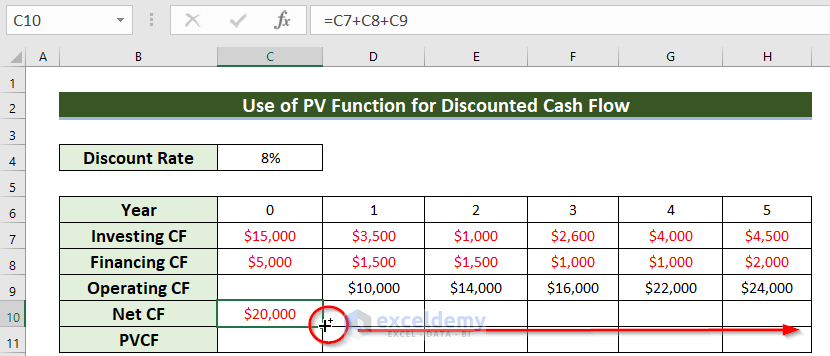

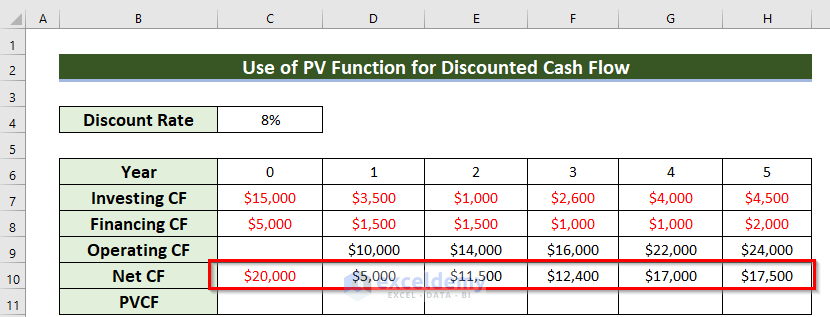

- Drag the Fill Handle icon horizontally to AutoFill the data in the rest of the cells D10:H10.

You will get the Net Cash Flow.

- Select a cell, C11, where you want to keep the Present Value.

- Enter the following formula in cell C11:

=PV($C$4,C6,0,C10)- Press ENTER to get the result.

You will get the Present value of Cash flow.

Formula Breakdown

Here, the PV function will return the Present Value of an investment.

- $C$4 denotes the discount rate. Here, the Dollar sign ($) denotes that the value is fixed.

- C6 denotes NPER as the period of time.

- 0 denotes that you don’t know the PMT.

- C10 denotes the Net Cash flow as Future Value.

- Drag the Fill Handle icon horizontally to AutoFill the data in the rest of the cells D11:H11.

You will get all the Present value of the Cash flow.

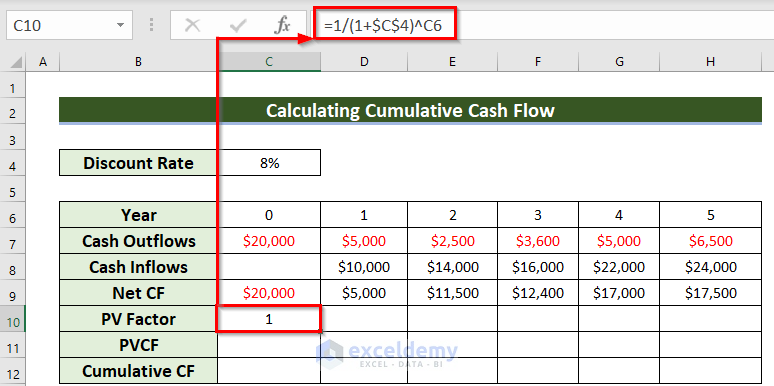

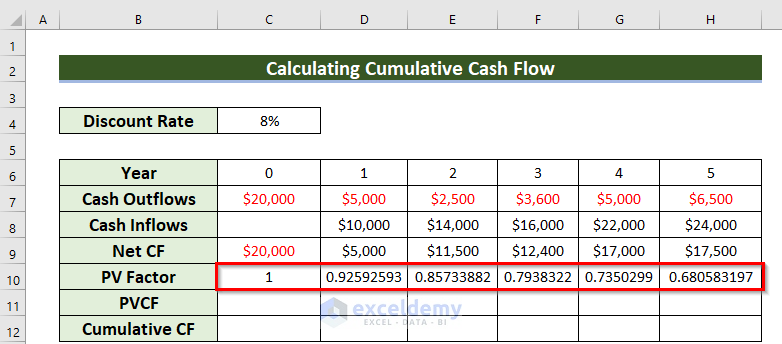

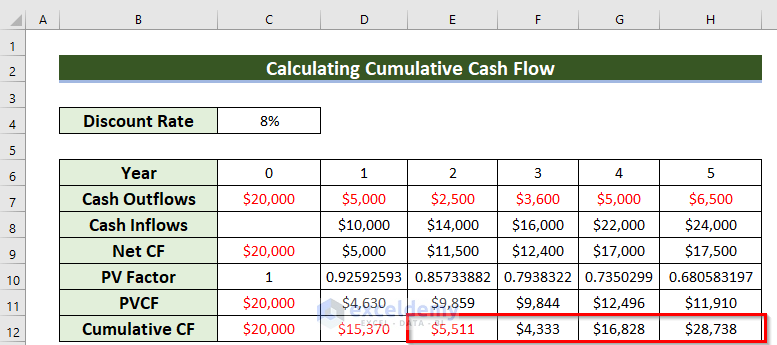

Method 3 – Using a Generic Formula

Steps:

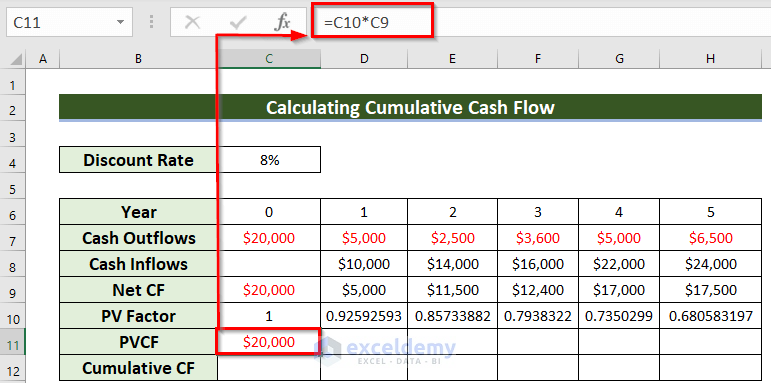

- Select a cell, C10, where you want to keep the PV factor.

- Enter the following formula in cell C10.

=1/(1+$C$4)^C6- Press ENTER to get the result.

Formula Breakdown

- Here, I have added 1 with the discount rate.

- 1+$C$4—> becomes 108%.

- I have kept the Year as the power function.

- 108%^C6—> turns 1.

- I have divided 1 by the previous output.

- 1/1—> returns 1.

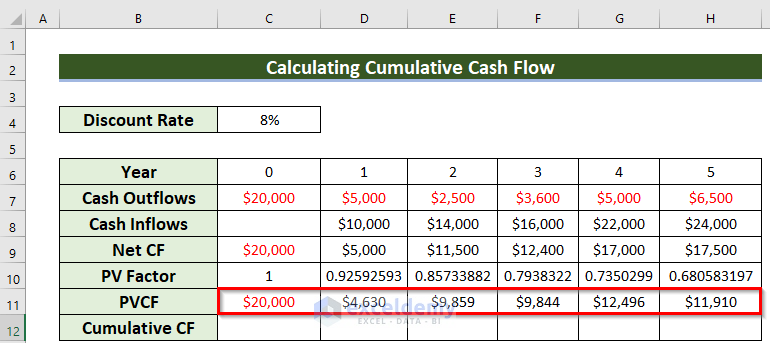

- Drag the Fill Handle icon horizontally to AutoFill the data in the rest of the cells D10:H10.

You will get all the Present value factors.

- Select a cell, C11, where you want to keep the Present Value.

- Enter the following formula in the C11 cell.

=C10*C9In this formula, I have multiplied the PV factor with the Net Cash flow.

- Press ENTER to get the result.

You will get the present value of Cash flow.

- Drag the Fill Handle icon horizontally to AutoFill the data in the rest of the cells D11:H11.

You will get all the Present value cash flow.

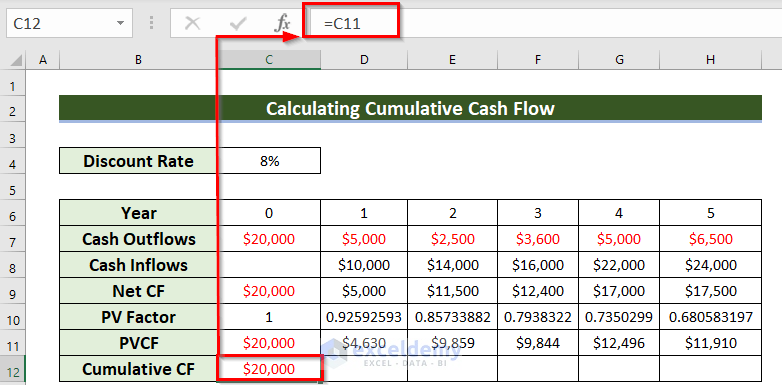

- Enter the following formula in cell C12:

=C11In this formula, I have used the value of the C11 cell.

- Press ENTER to get the result.

You will get the 1st Cumulative Cash flow.

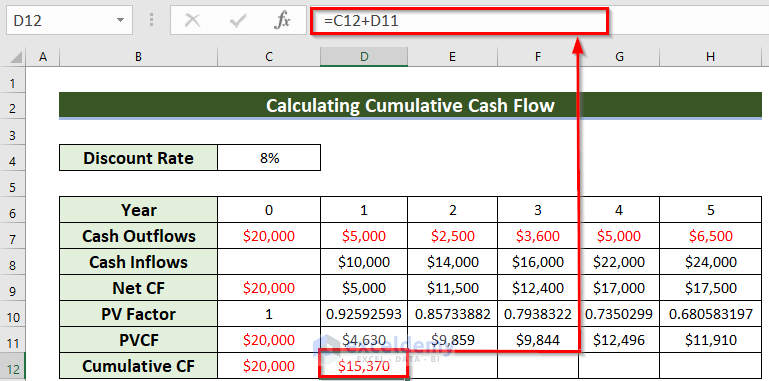

- Enter the following formula in cell D12:

=C12+D11- Press ENTER to get the result.

This is the 2nd Cumulative Cash flow.

- Drag the Fill Handle icon horizontally to AutoFill the data in the rest of the cells E12:H12.

You will get all the Cumulative Cash flow for the given periods.

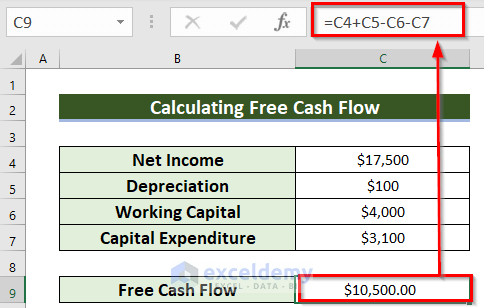

Method 4 – Calculating Free Cash Flow

Steps:

- Select a cell, C9, where you want to keep the Free Cash Flow.

- Enter the following formula in cell C9:

=C4+C5-C6-C7In this formula, I have added Net income and Depreciation. From that added value, I have subtracted Working capital and Capital expenditures.

- Press ENTER to get the result.

You will get the Free Cash Flow.

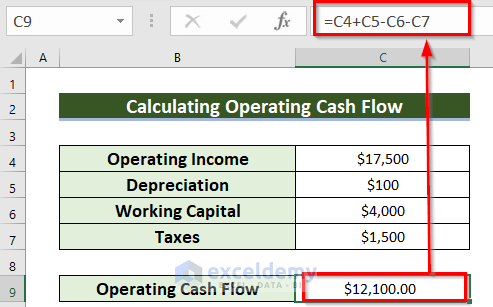

Method 5 – Calculating Operating Cash Flow

Steps:

- Select a cell, C9, where you want to keep the Operating Cash Flow.

- Enter the following formula in cell C9:

=C4+C5-C6-C7In this formula, I have added Operating income and Depreciation. From that added value, I have subtracted Working capital and Taxes.

- Press ENTER to get the result.

You will get the Operating Cash Flow.

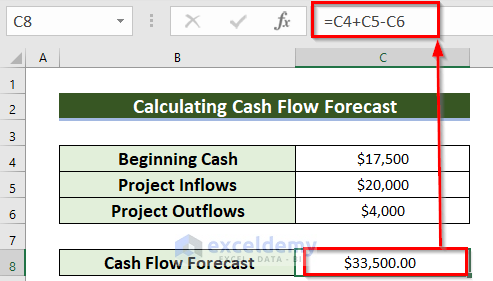

Method 6 – Calculating Cash Flow Forecast

Steps:

- Select a cell, C8, where you want to keep the Cash Flow Forecast.

- Enter the following formula in cell C8:

=C4+C5-C6In this formula, I have added the Beginning Cash and Project Inflows. And, from that added value I have subtracted Project Outflows.

- Press ENTER to get the result.

You will get the Cash Flow Forecast.

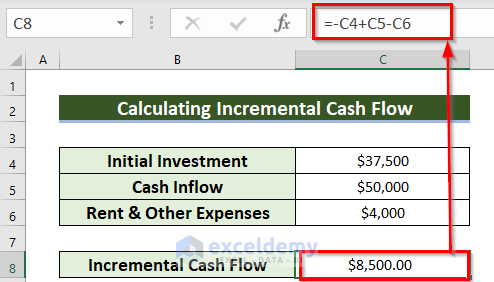

Method 7 – Finding Incremental Cash Flow

Steps:

- Select a cell, C8, where you want to keep the Incremental Cash flow.

- Enter the following formula in cell C8:

=-C4+C5-C6In this formula, I have subtracted Initial Investment and Rent & Other expenses from the total Cash Inflow.

- Press ENTER to get the result.

You will get the Incremental Cash flow.

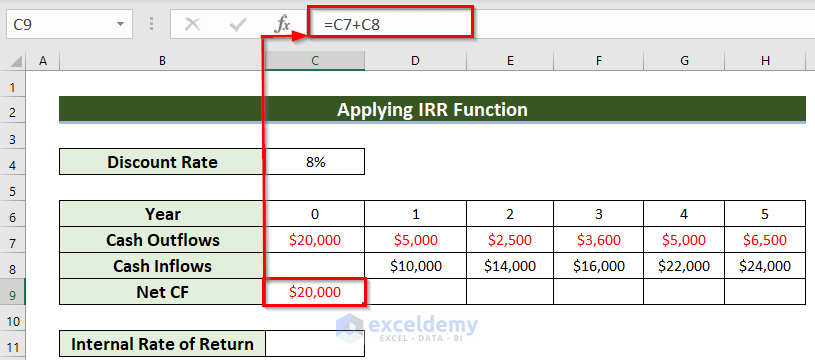

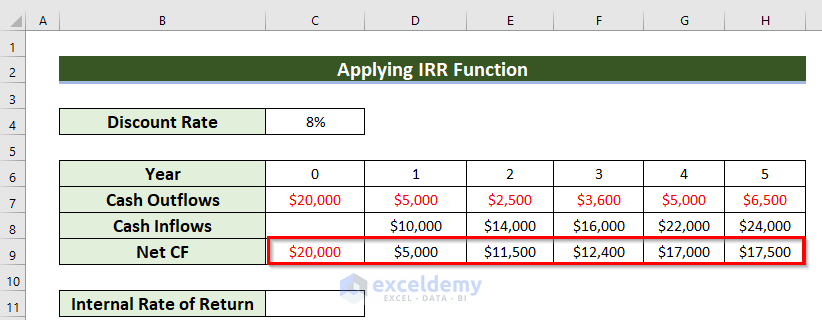

Method 8 – Calculating Internal Return Rate

Steps:

- Select a cell, C9, where you want to see the Net CF.

- Enter the following formula in cell C9:

=C7+C8In this formula, I have added all the cash flows to find the net cash flow.

- Press ENTER to get the result.

- Drag the Fill Handle icon horizontally to AutoFill the data in the rest of the cells D9:H9.

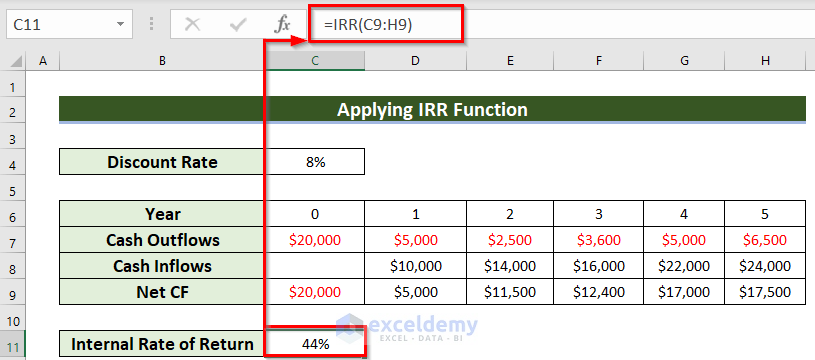

- Select another cell, C11, to keep the Internal Rate of Return.

- Enter the following formula in cell C11:

=IRR(C9:H9)Here, C9:H9 is the data range for the IRR function.

- Press ENTER to get the result.

You will get the Internal Rate of Return for the Cash flow.

Things to Remember

- Here, you must use the negative sign for all the Cash outflows. Otherwise, you have to modify all those given formulas. But, in the case of examples 4 to 7 you don’t need to use minus sign as input.

Practice Section

Now, you can practice.

Download the Practice Workbook

You can download the practice workbook from here:

Excel Cash Flow Formula: Knowledge Hub

- How to Calculate Annual Cash Flow in Excel

- How to Calculate Incremental Cash Flow in Excel

- How to Calculate Discounted Cash Flow in Excel

- How to Forecast Cash Flow in Excel

- How to Calculate Free Cash Flow in Excel

- How to Calculate Cumulative Cash Flow in Excel

- How to Draw a Cash Flow Diagram in Excel

- How to Track Cash Flow in Excel

- How to Create a Personal Cash Flow Statement in Excel

- How to Calculate Operating Cash Flow Using Formula in Excel

- How to Calculate Payback Period in Excel

- How to Calculate Payback Period with Uneven Cash Flows

- Calculating Payback Period in Excel with Uneven Cash Flows

- How to Calculate Discounted Payback Period in Excel

- How to Apply Discounted Cash Flow Formula in Excel

- How to Calculate Operating Cash Flow in Excel

- How to Create a Cash Flow Waterfall Chart in Excel

<< Go Back to Excel Formulas for Finance | Excel for Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!