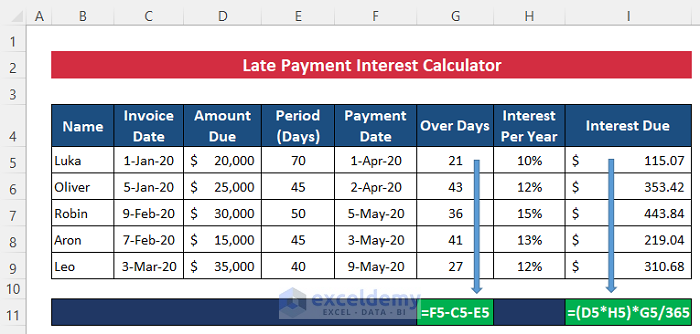

Here’s an overview of the late interest calculator we’re building in the article. You can follow along or download the template to use immediately.

Download the Calculator

You can download the free Excel template from here.

How to Make a Late Payment Interest Calculator in Excel

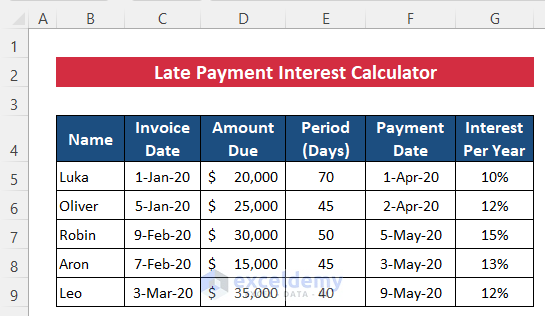

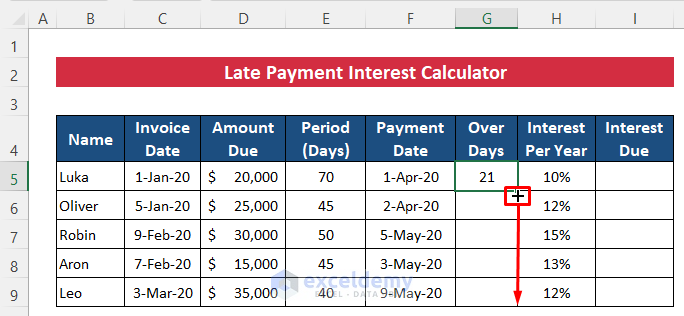

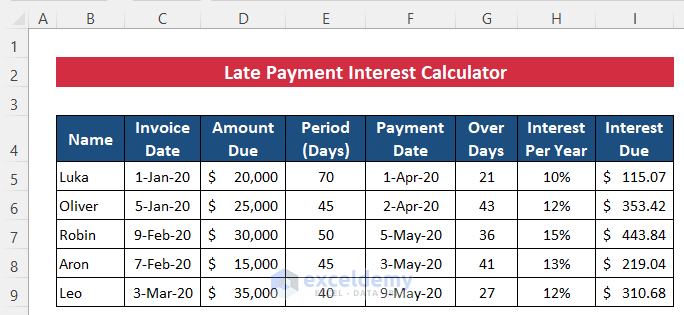

We’ll use the following dataset that represents some buyers’ invoice details-their invoice dates, due amounts, contacted payment periods, contacted payment dates, and interest rates.

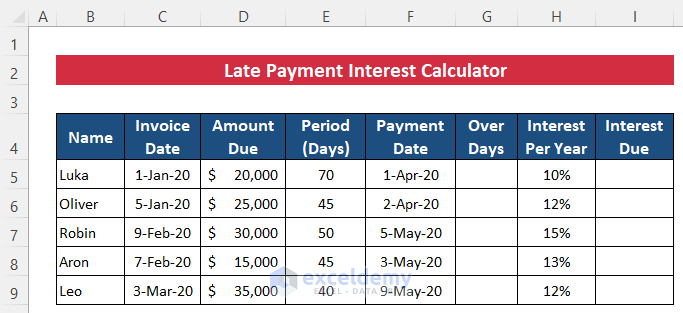

We have added two new columns to find the over-days and due interest.

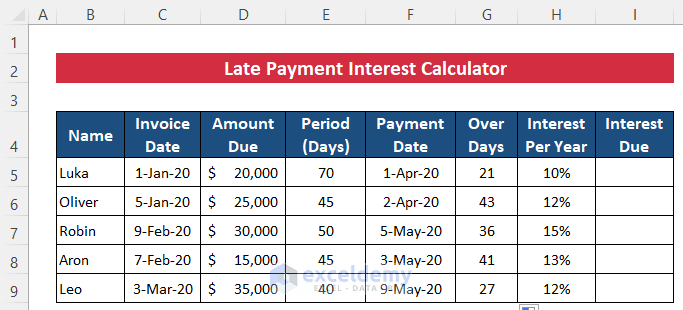

Let’s start with the overdue duration.

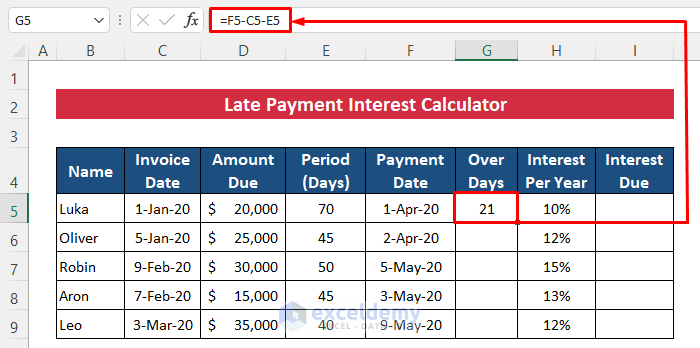

- Select cell G5.

- Copy the following formula in it:

=F5-C5-E5- Hit Enter to get the output.

- Drag down the Fill Handle icon over the cells G6:G9 to copy the formula.

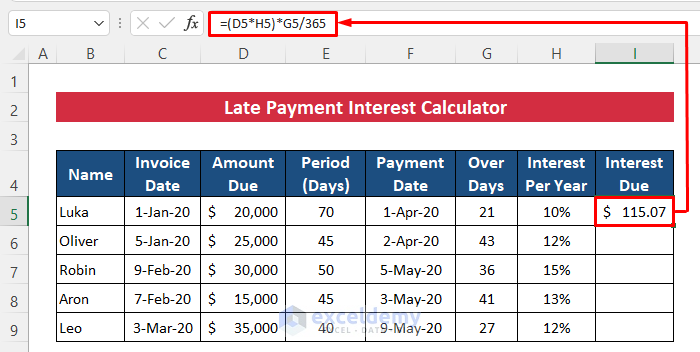

Now let’s go for the due interests using a formula.

- In cell I5 copy the following formula:

=(D5*H5)*G5/365- Press the Enter button.

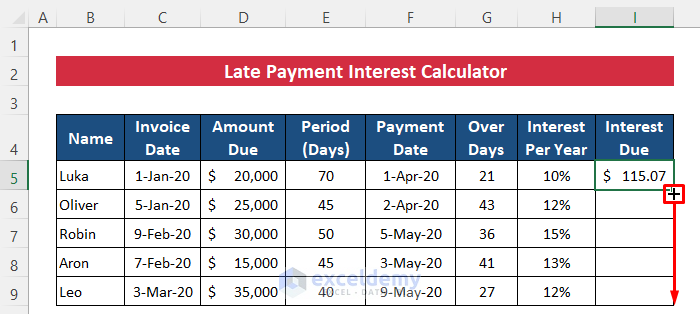

- Drag down the Fill Handle icon for the cells I6:I9 to get all the other due interests.

- You will get all the interests.

Read More: Create a Simple Interest Loan Calculator with Excel Formula

Things to Remember

- Don’t forget to divide the day number by 365 because the interest rate is given in per year format.

- Make sure that the cells containing rates are in Percentage format.

Further Readings

- How to Create an Accrued interest calculator in excel

- Create a Monthly Accrued Interest Calculator in Excel

- How to Create FD Interest Calculator in Excel

- How to Make TDS Interest Calculator in Excel

- Create TDS Late Payment Interest Calculator in Excel

- Create a Post-Judgement Interest Calculator in Excel

- How to Create a Money Market Interest Calculator in Excel

- How to Generate GST Interest Calculator in Excel

- Make Service Tax Late Payment Interest Calculation in Excel

<< Go Back to Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!

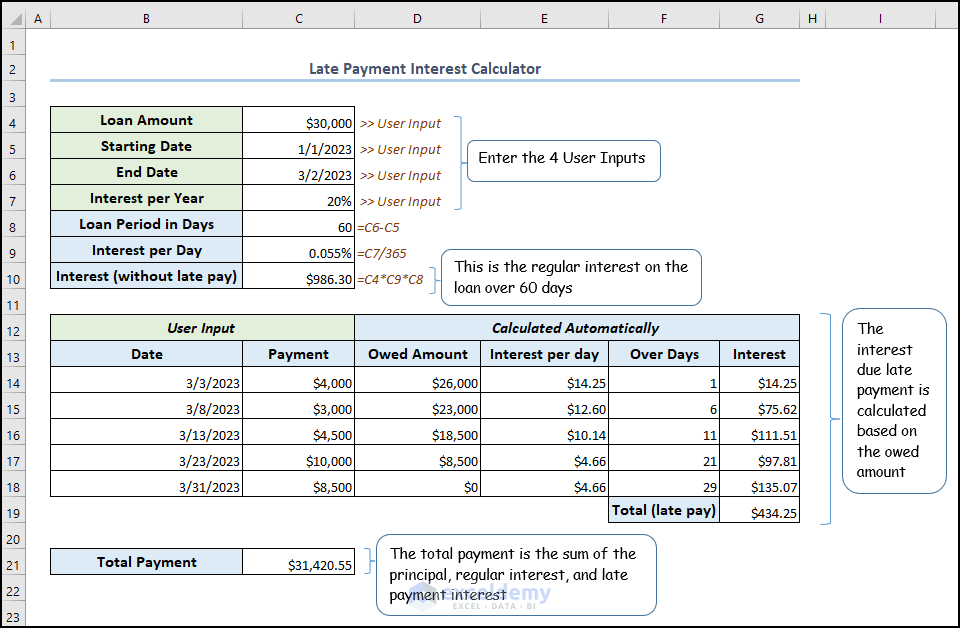

Sir I have question about this. If my customer is giving late payment for example his 60 days.but after 60 if he has Give me 30000.but he is giving me 4000 then after 5 days he is giving me 3000 like this he is giving then I hv charge for interest for this payment

Hello Avinash,

Thank you for your query. We have attached an Excel file with the answer to your question. Make sure to download the file.

Late Payment Interest Calculator.xlsx

Here is a snapshot from the Excel file.

Hope this helps. Have a good day.

Regards,

ExcelDemy