Looking for ways to make a TDS late payment interest calculator in Excel? Then, this is the right place for you. Here, you will find a simple step by step way to make a TDS late payment interest calculator in Excel.

What Is TDS?

TDS (Tax Deducted at Source) is a part of tax that any person has to pay under Income Tax Act when making any payment such as salary, rent, commission etc. There is a specific payment period in which that person has to pay the TDS amount. Otherwise, a specific rate of interest will be added monthly or annually for late payments.

Download Practice Workbook

You can download the workbook to practice yourself.

Step by Step Procedures to Make TDS Late Payment Interest Calculator in Excel

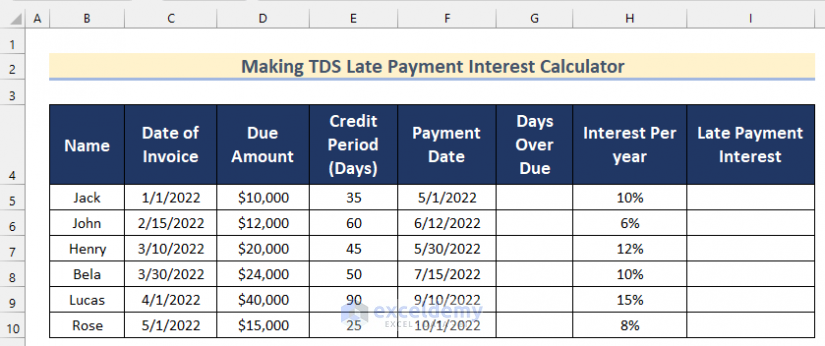

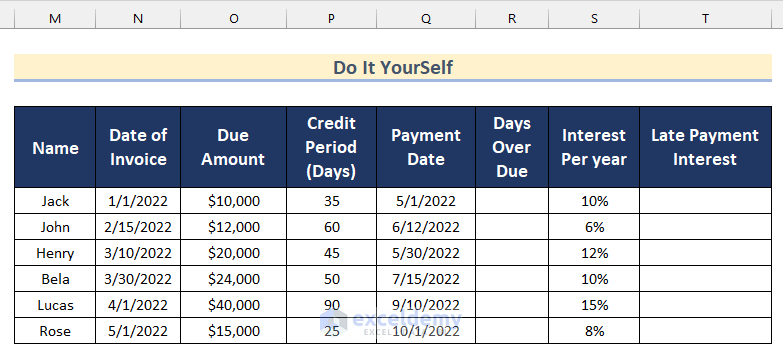

Suppose, you have a dataset containing the Name, Date of Invoice, Due Amount, Credit Period, Payment Date and Interest Per Year of some citizen. They did not pay their TDS amount on the Date of payment. So, now they have to pay interest for late payments. You can calculate this interest amount by making a TDS late payment interest calculator by going through the steps given below.

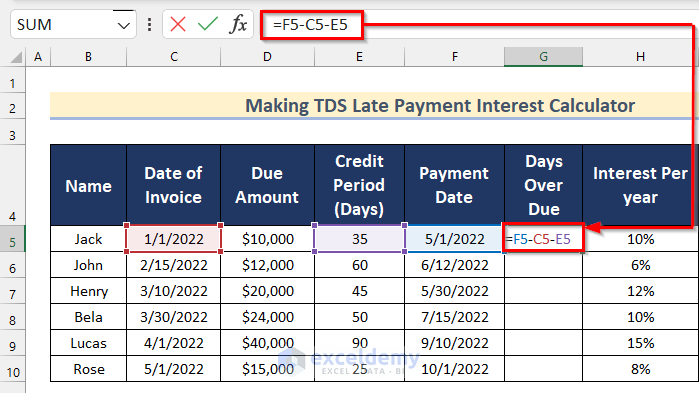

Step 1: Calculating Days Over Due for Payment

In the first steps, you will have to calculate the Days Overdue for payment. To do that follow the steps given below.

- In the beginning, select Cell G5 and insert the following formula.

=F5-C5-E5

- Then, press Enter.

- After that, drag down the Fill Handle tool to AutoFill the formula for the rest of the cells.

- Finally, you will get all the values of Days Over Due.

Read More: Create Late Payment Interest Calculator- Download for Free

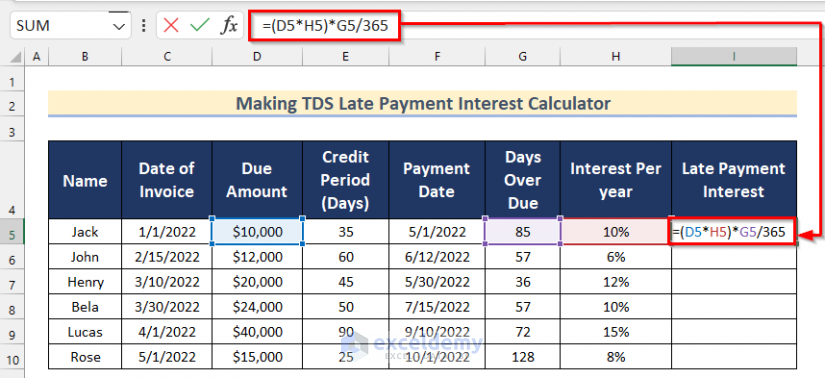

Step 2: Determining Late Payment Interest in Excel

In the second step, we will show you how you can determine the value of Late Payment Interest in Excel. Follow the steps given below to do it on your own.

- Firstly, select Cell I5 and insert the following formula.

=(D5*H5)*G5/365

- After that, press Enter and drag down the Fill Handle tool to AutoFill the formula for the rest of the cells.

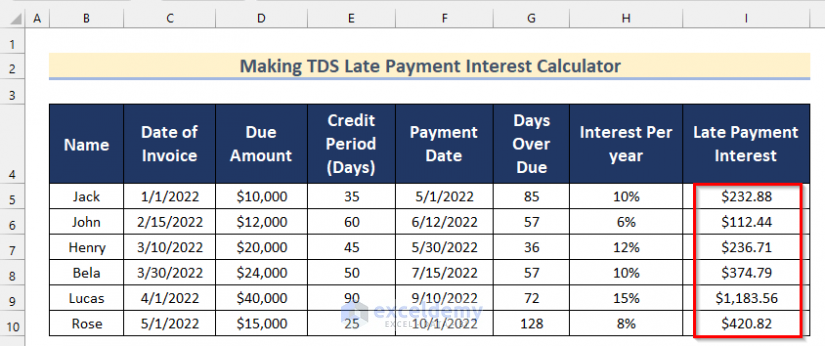

- Now, you will get all the values of Late Payment Interest.

- That’s how you can make a TDS payment interest calculator in Excel.

Read More: Make Service Tax Late Payment Interest Calculation in Excel

Practice Section

In the article, you will find an Excel workbook like the image given below to practice on your own.

Conclusion

So, in this article, we have shown you ways to make a TDS late payment interest calculator in Excel. I hope you found this article interesting and helpful. If something seems difficult to understand, please leave a comment. Additionally, please let us know if there are any more alternatives that we may have missed.

Further Readings

- How to Create an Accrued interest calculator in excel

- Create a Monthly Accrued Interest Calculator in Excel

- How to Create FD Interest Calculator in Excel

- How to Make TDS Interest Calculator in Excel

- Make a Prejudgement Interest Calculator in Excel

- Create a Post-Judgement Interest Calculator in Excel

- How to Create a Money Market Interest Calculator in Excel

- How to Generate GST Interest Calculator in Excel

- Create a Simple Interest Loan Calculator with Excel Formula

<< Go Back to Interest Calculator | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!