Have you some idle money in your hands? Do you want to invest it somewhere on a short-term basis? If the answers to these questions are yes, then the money market is the desired solution for you. Here, we will take you through 4 easy and quick steps for creating a money market interest calculator in Excel. So, let’s go through the article to get dominance in the matter.

What Is Money Market?

The money market fund is one kind of short-term investment. The difference between the money market and the capital market depends mainly on the time spent on investment. For money market purposes, the term “money” refers to a variety of assets that can be quickly converted into cash. This can be any type of resource. It can include short-term government securities, bills of exchange, or bankers’ acceptances. It entails huge overnight cash transfers between banks and the government. The vast majority of money market transactions are wholesale exchanges between businesses and financial institutions. At last, we can say that one of the foundational elements of the world financial system is the money market.

4 Steps to Create Money Market Interest Calculator in Excel

Excel is an obvious tool for our day-to-day activities. We can largely bank on Excel for a myriad of purposes that involve calculations. Here, we’ll create a money market interest calculator in Excel. So let’s explore them step by step.

Here, we have used the Microsoft Excel 365 version, you may use any other version according to your convenience. If any methods won’t work in your version, then leave us a comment.

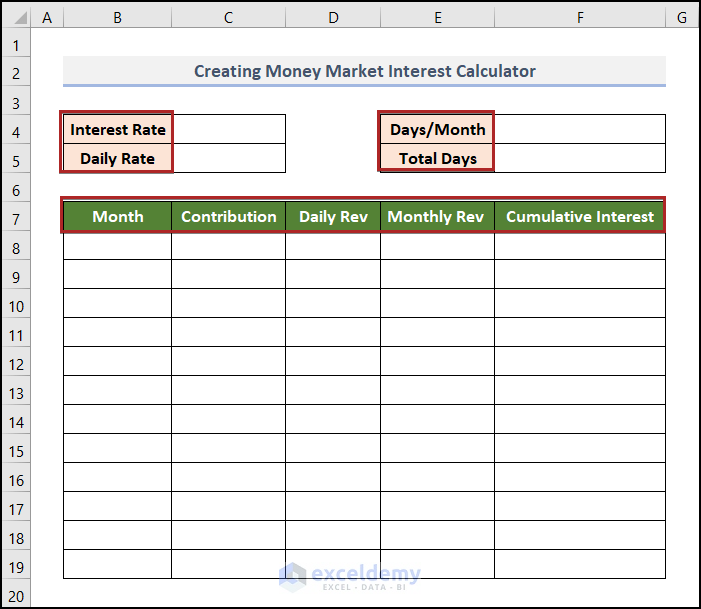

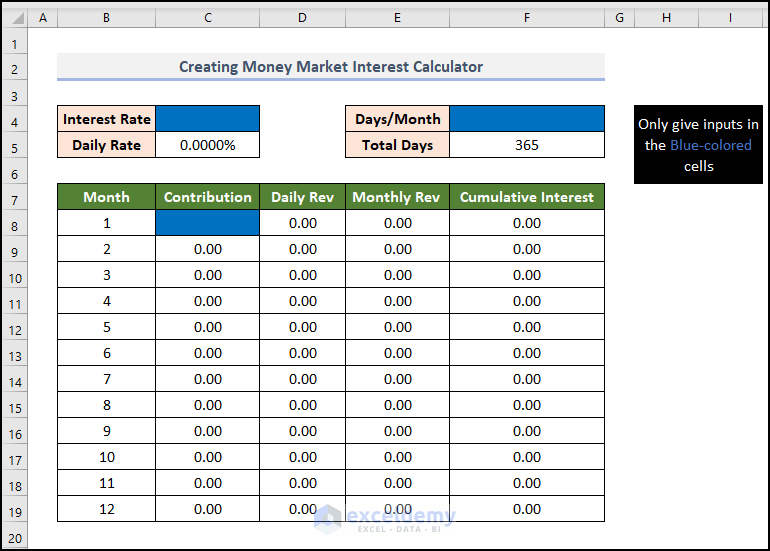

Step 01: Create Basic Outline

First of all, we’ve to construct a basic outline where all the information will exist. It’s simple and easy. Just follow along.

📌 Steps:

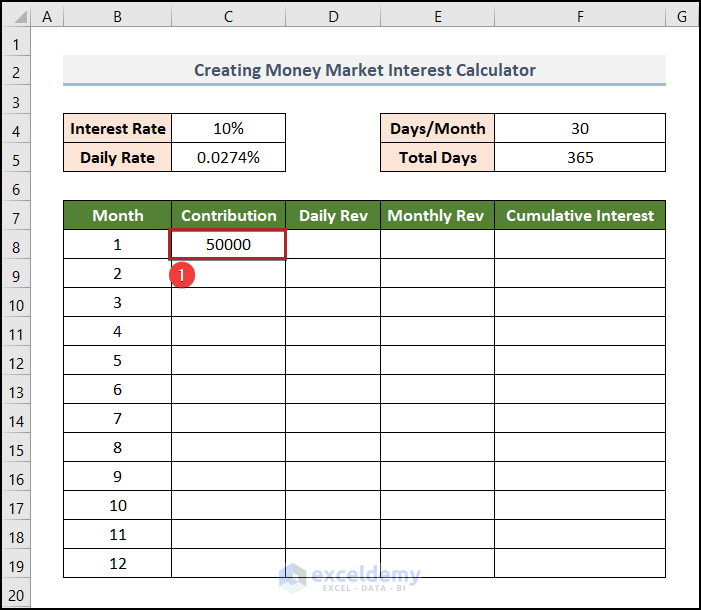

- At the very beginning, we built an input range in the C4:C5 range. Here, we can insert the Interest Rate manually. The Daily Rate will be calculated automatically. We’ll see that in a moment.

- Then, in the F4:F5 range, we created an input area for Total Days in a year. Also, we’ve to enter the number of Days/Month here.

- In the last table, we can see a number of headings. Let’s talk about them. At first, there is the number of Months. Let’s say someone makes a deposit at the start of a month. Then it will be month 1. The next month is month 2 and will continue like this. The heading Contribution means the first deposit he made at the start of the investment. Daily Rev means his daily earnings from the interest. Multiplying it with the number of days per month gives us the Monthly Rev. Now, let’s come to the most important thing: Cumulative Interest. It means the total running interest also. In easy words, it’s the amount of interest including previous months. We can understand it more clearly in the last step.

Read More: Make a Prejudgement Interest Calculator in Excel

Step 02: Determine Daily Interest Rate

As a money market fund is one kind of short-term investment, the interest is calculated on a daily basis. Because the interest rate changes every day. So, we need a daily interest rate to do the calculation. Let’s explore this step by step.

📌 Steps:

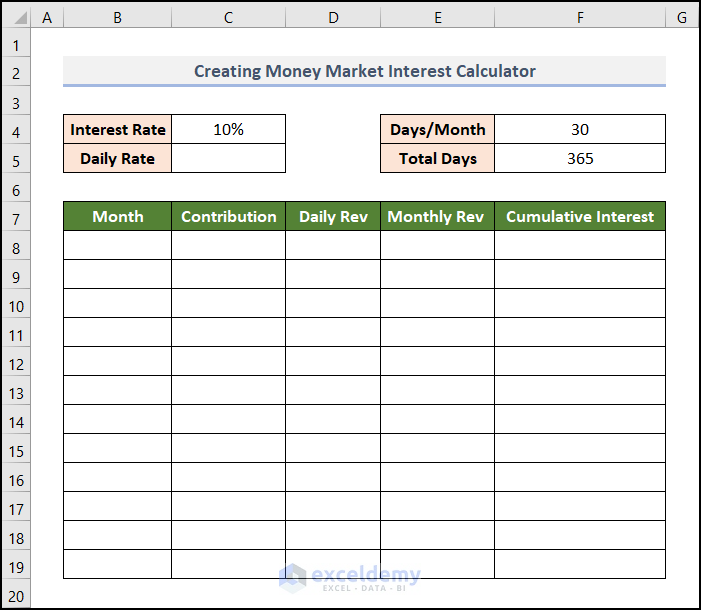

- Firstly, we assumed an Interest Rate of 10%. Basically, this is an annual rate of interest.

- Secondly, we considered 30 days per month and 365 days in a whole year.

Now, we’ll calculate the Daily Rate from the above information.

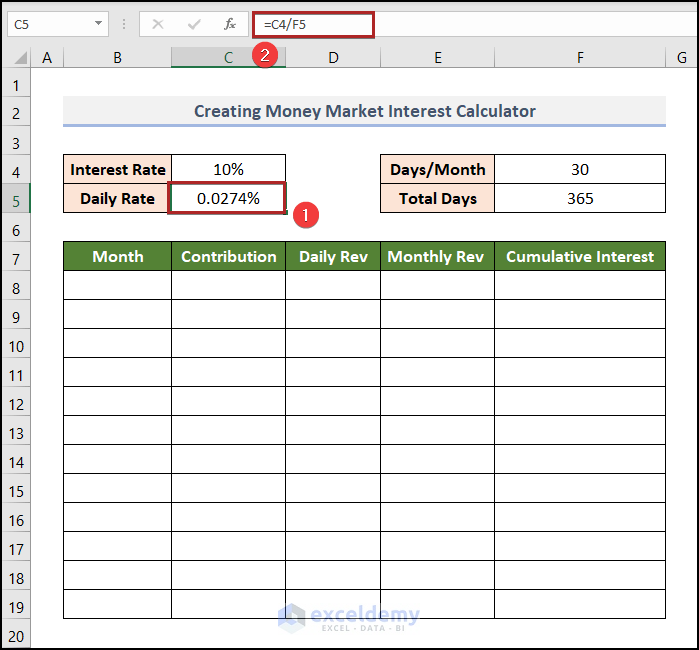

- At this time, go to cell C5 and place the following formula into the Formula Bar.

=C4/C5

Here, we divide the annual interest rate by the number of days in a year, which is 365. With this calculation, we get the daily rate of interest.

- After that, press the ENTER key.

Read More: Create a Post-Judgement Interest Calculator in Excel

Step 03: Calculate Daily and Monthly Revenue

In this step, we’ll compute the daily earnings as well as the monthly income from the investment. So, let’s see the process in detail.

📌 Steps:

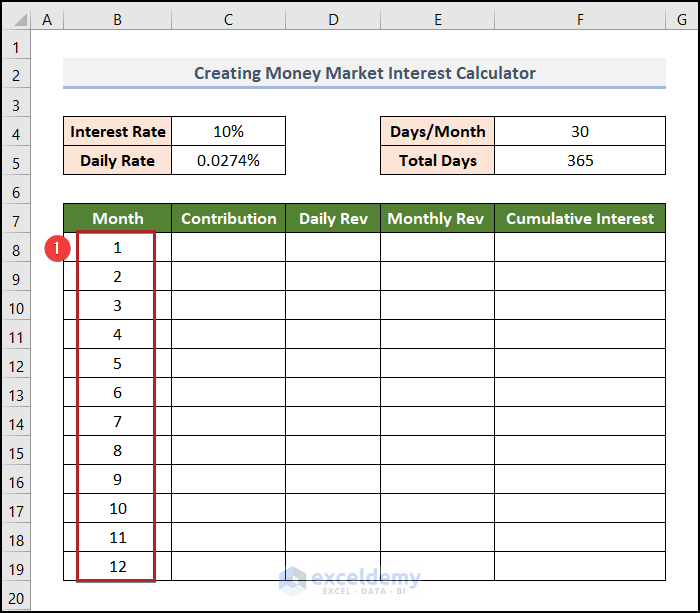

- Initially, write down the number of months in order. See the image below to do that easily.

- Then, keep the primary deposit amount in cell C8. In this case, we took it as 50,000.

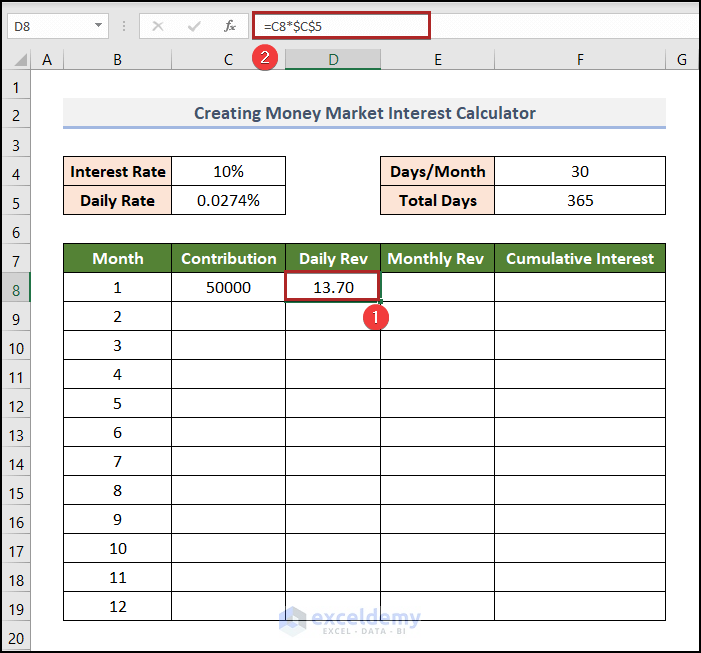

=C8*$C$5

Actually, we multiplied the deposit amount in cell C8 with the daily interest rate in cell C5 to get the Daily Rev.

- Following this, press ENTER.

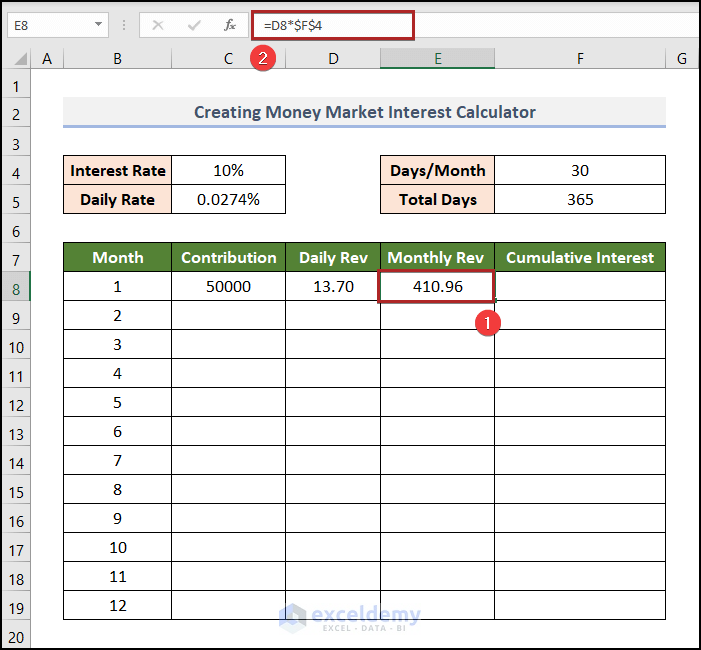

- Next, go to cell E8 and paste the following formula into that cell.

=D8*$F$4

In this formula, we multiplied the Daily Rev in cell D8 with the number of Days/Month in cell F4.

- Later, hit ENTER.

Read More: Create a Simple Interest Loan Calculator with Excel Formula

Step 04: Compute Total Running Interest

Currently, we’ll learn how to calculate the cumulative interest. In the first month, it’s different from the other months. So, without further delay, let’s dive in!

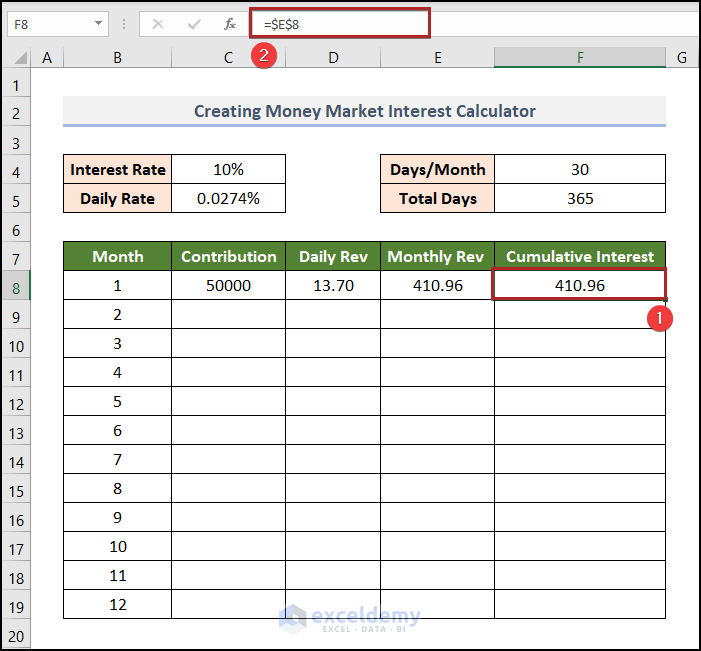

- Primarily, select cell F8 and put the following formula into the cell.

=$E$8

That means it gets the corresponding Monthly Rev from cell E8.

- As usual, tap the ENTER key.

To calculate the second month’s cumulative interest, we’ve to fill in the previous cells.

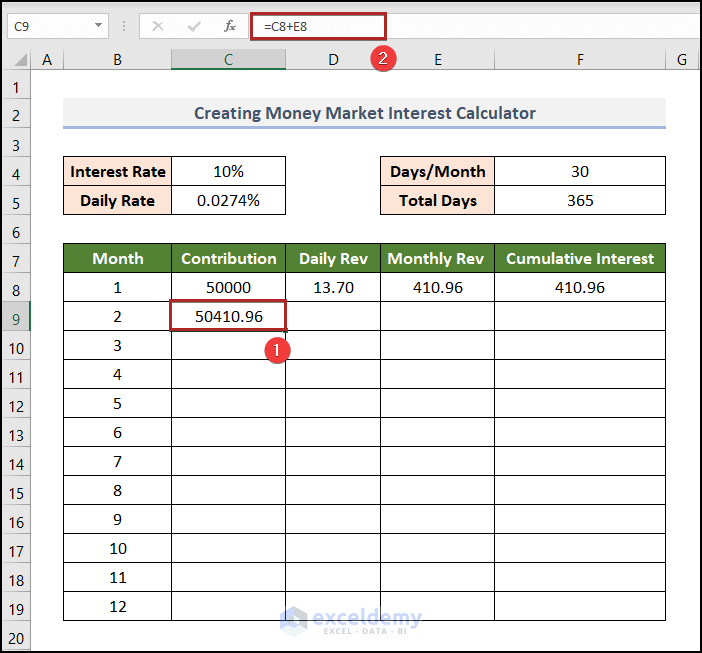

- Presently, move to cell C9 and enter the following formula.

=C8+E8

It concludes the monthly revenue of the previous month in cell E8 with the deposit amount in cell C8.

- As always, press ENTER.

Note: The interest amount for the second month will be calculated based on this amount in cell C9.

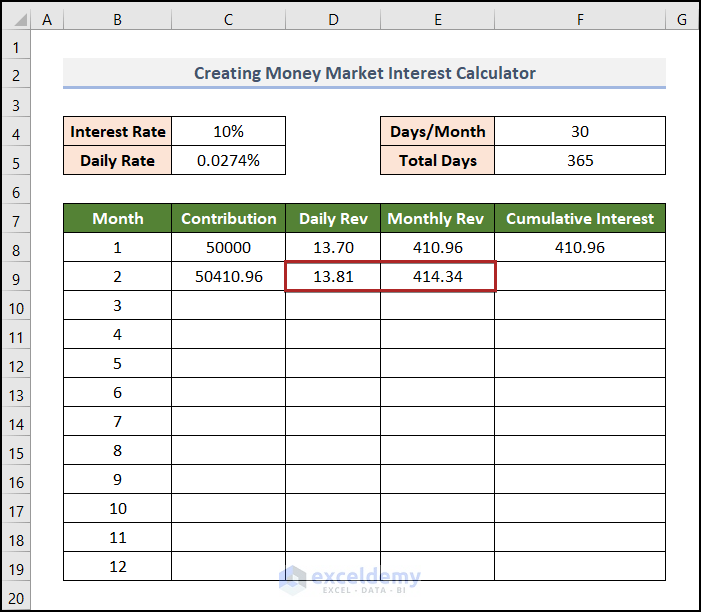

- Then, calculate the amount of Daily Rev and Monthly Rev just like in Step 03.

Finally, we can determine the cumulative interest amount for the second month.

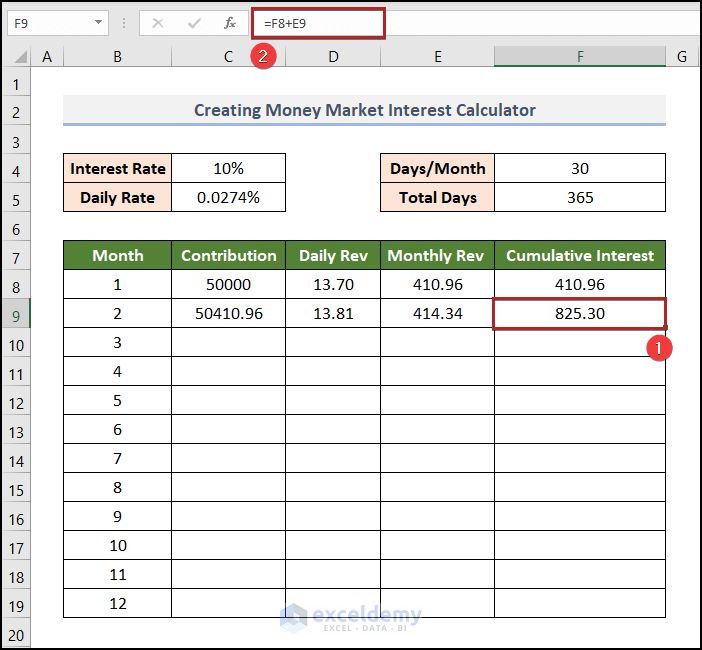

- To do this, go to cell F9 and write down the following formula.

=F8+E9

It interprets that we can get the cumulative interest by adding up the amount of interest for the current month in cell E9 with the previous month’s cumulative interest in cell F8.

- Lastly, tap ENTER.

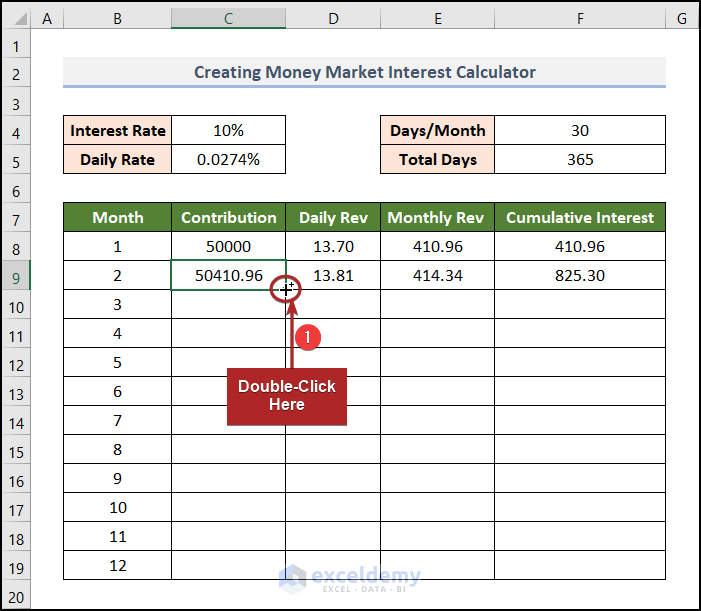

- At present, bring the cursor to the right-bottom corner of cell C9, and immediately, it’ll look like a plus (+) sign. Actually, it’s the Fill handle tool.

- Now, double-click on it.

- Suddenly, the remaining cells in this column get filled automatically.

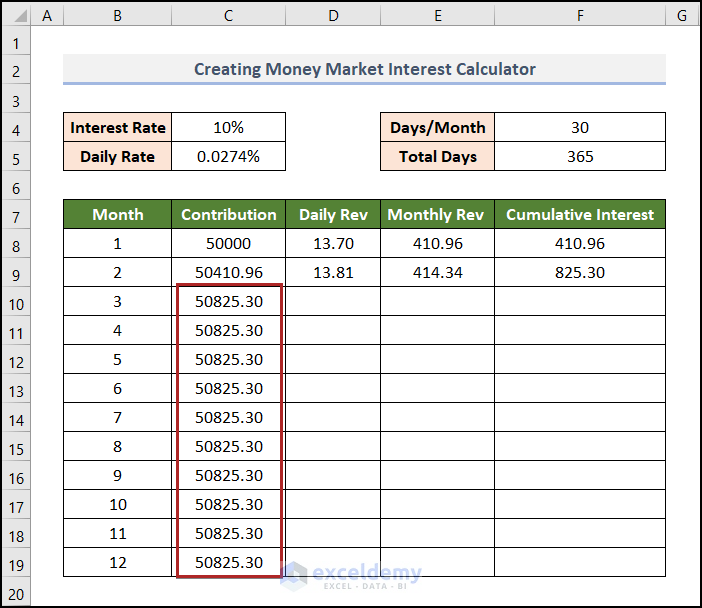

Note: The results shown are incorrect now. But don’t worry. It will be properly fixed after the completion of the task.

- Then, do the same for columns D, E, and F also.

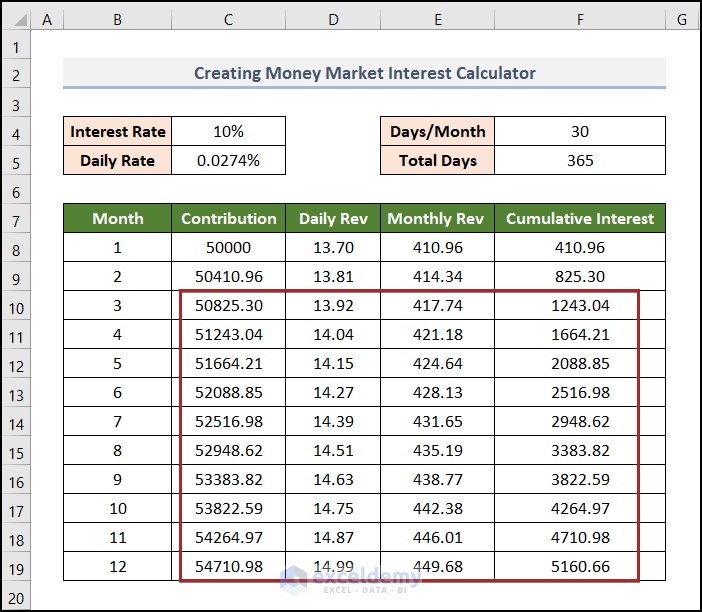

Now, look at the table. It is now perfect with the numbers. The amount in cell F19 is the final amount of interest gained from the money market account after completing 1 year.

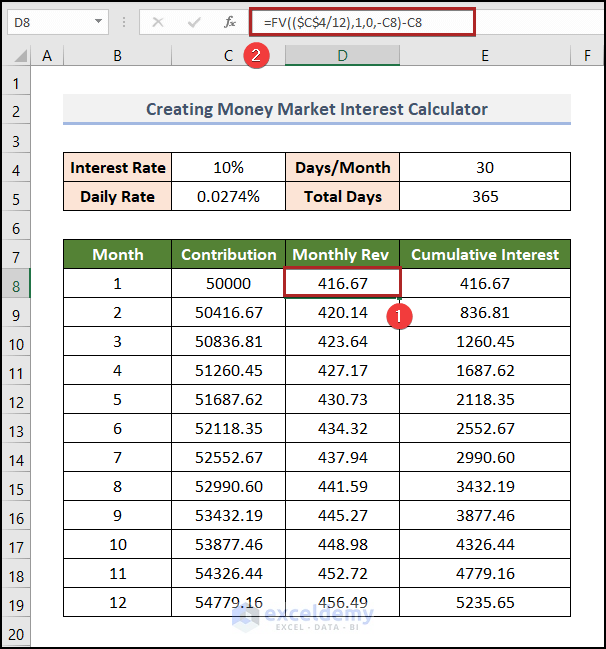

We can get a closer result using the FV function. See the image below to grasp the concept properly.

Read More: Create Late Payment Interest Calculator- Download for Free

Practice Section

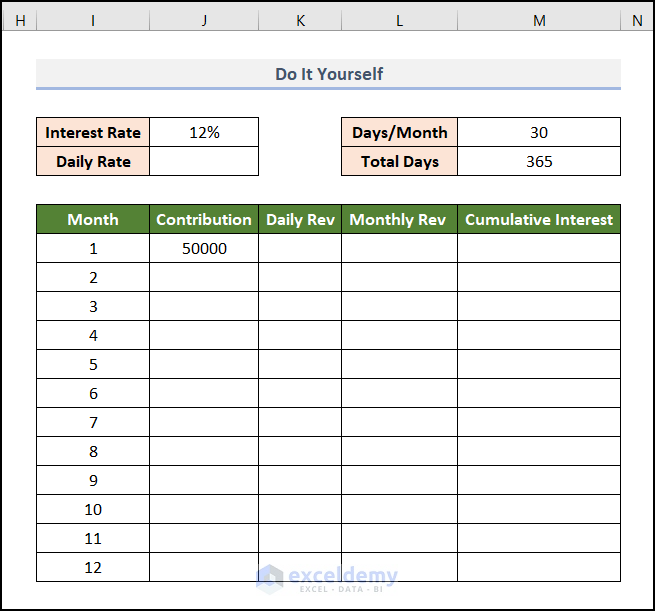

For doing practice by yourself, we have provided a Practice section like the one below on the right side. Please do it by yourself.

Free Template: Ready to Use

In this workbook, we have added an extra sheet concluding with a free Money Market Interest Calculator template. You can use this in your daily life. Also, you may change or edit it according to your needs. You just have to fill up the blue-colored cells. Other calculations will be done automatically.

You may download the following Excel workbook for better understanding and practice yourself.

Conclusion

This article provides easy and brief solutions to create a money market interest calculator in Excel. Don’t forget to download the Template file. Thank you for reading this article. We hope this was helpful. Please let us know in the comment section if you have any queries or suggestions.

Related Articles

- How to Create an Accrued interest calculator in excel

- Create a Monthly Accrued Interest Calculator in Excel

- How to Create FD Interest Calculator in Excel

- How to Make TDS Interest Calculator in Excel

- Create TDS Late Payment Interest Calculator in Excel

- How to Generate GST Interest Calculator in Excel

- Make Service Tax Late Payment Interest Calculation in Excel

<< Go Back to Interest Calculator | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!