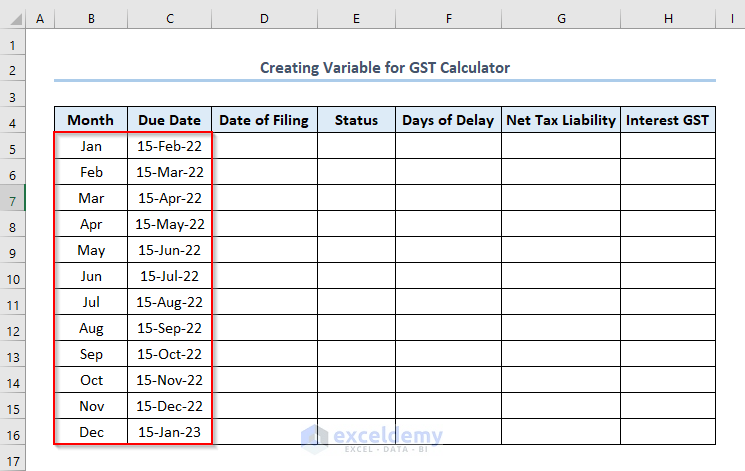

Method 1 – Creating Variable for GST Calculator

You need to assign variable names for calculating GST interest and put them in the column headings. We assigned the following variable names for our calculator.

- Month

- Due Date

- Date of Feeling

- Status

- Days of Delay

- Net Tax Liability

- Interest GST

Assign the Month and Due Date to file GST. We have created our calculator for the whole year( from January to December) and taken the Due Date 15th for every month. The variables added are like the picture below.

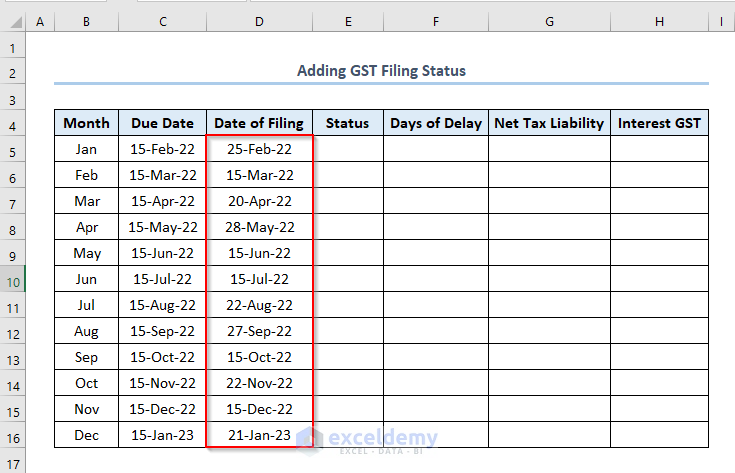

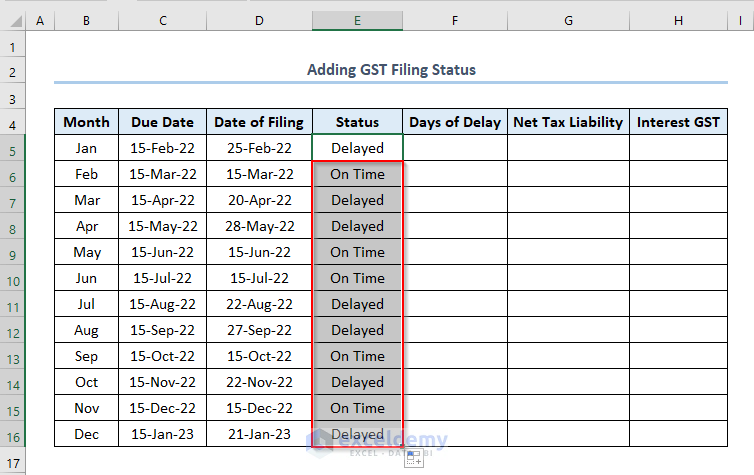

Method 2 – Adding GST Filing Status

You need to add GST Filing Status.

- Put the Date of Filing in D5:D16 range.

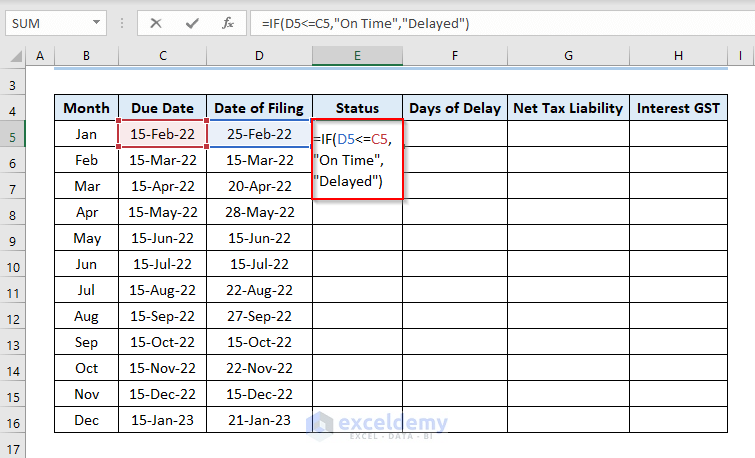

- We need to calculate whether the Date of Filing has passed the due date. Write the formula in the E5 cell like this.

=IF(D5<=C5,"On Time","Delayed")

D5 and C5 refer to the first Date of Filing and the first Due Date.

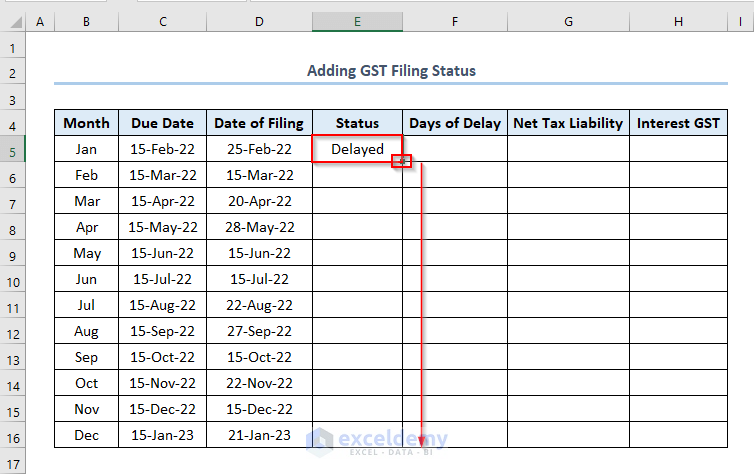

- Press ENTER to get the output as Delayed.

- Use the Fill Handle by dragging down the cursor while holding the right-bottom corner of the E5 cell like this.

- Get the output like this.

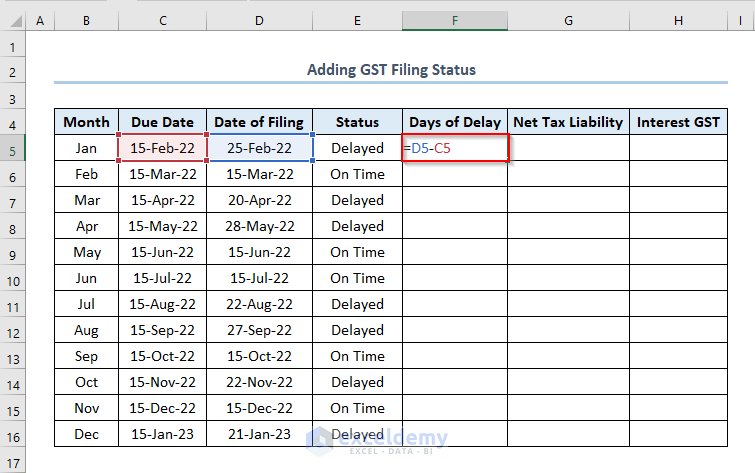

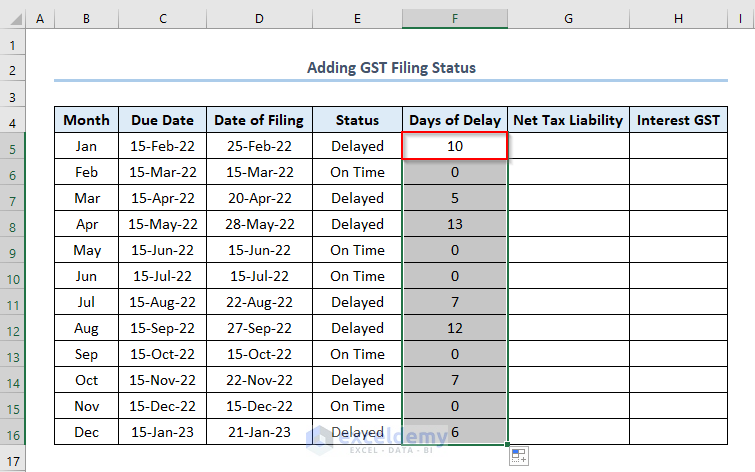

- Find the Days of Delay in Column F. Write the formula in the F5 cell like this.

=D5-C5

- Press ENTER and use the Fill Handle to get all the outputs like this.

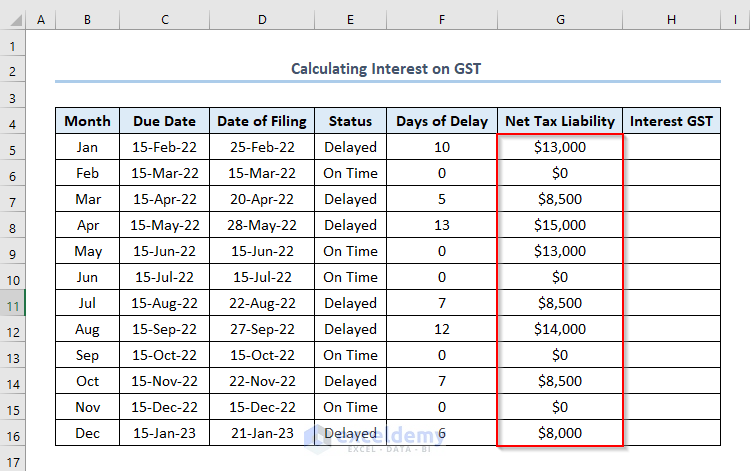

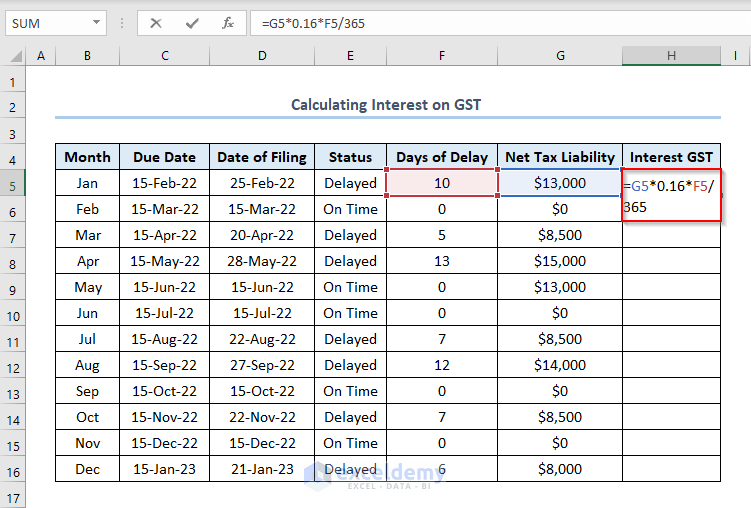

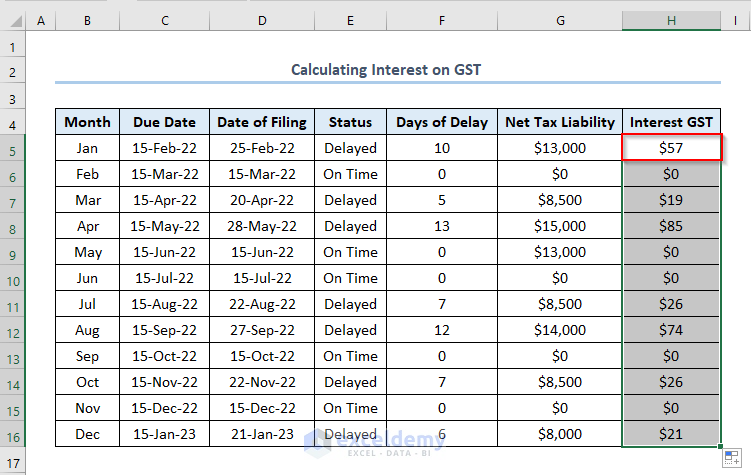

Method 3 – Calculating Interest on GST

To calculate interest on GST, we have to find out the Net Tax Liability first. Assign Net Tax Liability for the concerned months. In our dataset, we have Net Tax Liability 8 times. For your case, find it from your notice and assign them as per the direction.

Interest will be counted for the months we haven’t paid the GST on time. We have considered the Interest Rate as 16%. You can proceed on your own.

- In the H5 cell, write the formula to calculate Interest on GST.

=G5*0.16*F5/365G5 and F5 refer to the first value of Net Tax Liability and Days of Delay.

- Press ENTER and use the Fill Handle to get all the Interest GST as outputs.

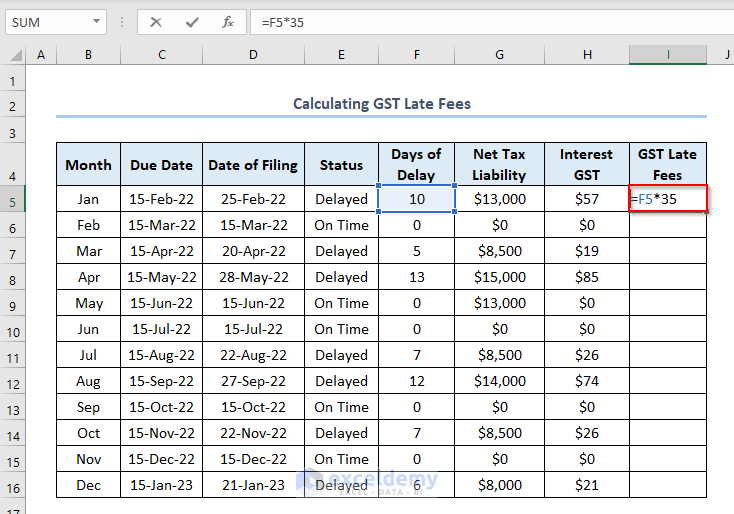

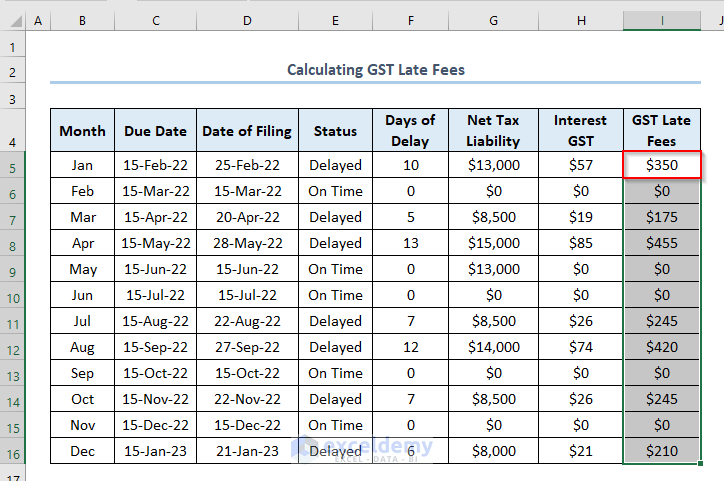

How to Calculate GST Late Fees and Total Payable Amount

Also calculate GST Late Fees from the GST Interest Calculator. Calculate the GST Late Fees for the number of Delayed Days. Consider Late Fees Per Day as 35.

Get the total late fees, multiply the number of Delayed Days by Late Fees Per Day.

Get the total late fees, write the following formula in the I5 cell like this.

=F5*35

- Press ENTER and use the Fill Handle.The outputs will be like this.

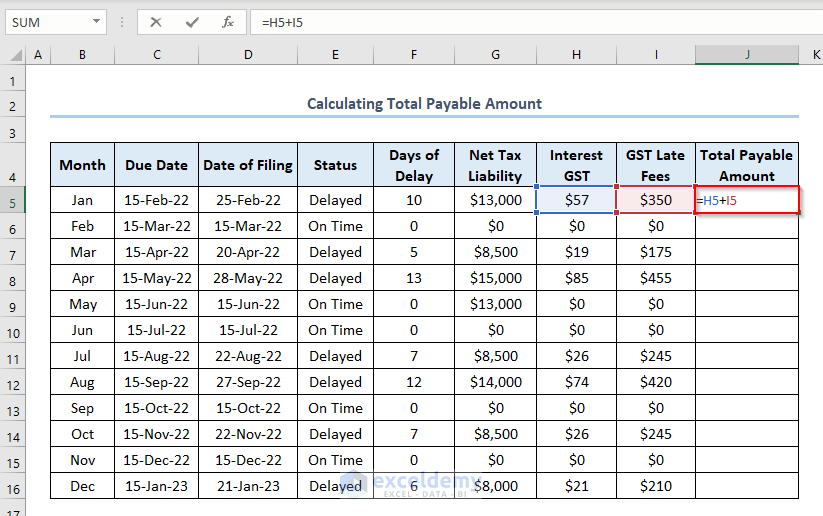

- If you want to calculate the Total Payable Amount per month in Column J, write the formula in the J5 cell like this.

=H5+I5H5 and I5 refer to the Interest GST and GST Late Fees in January.

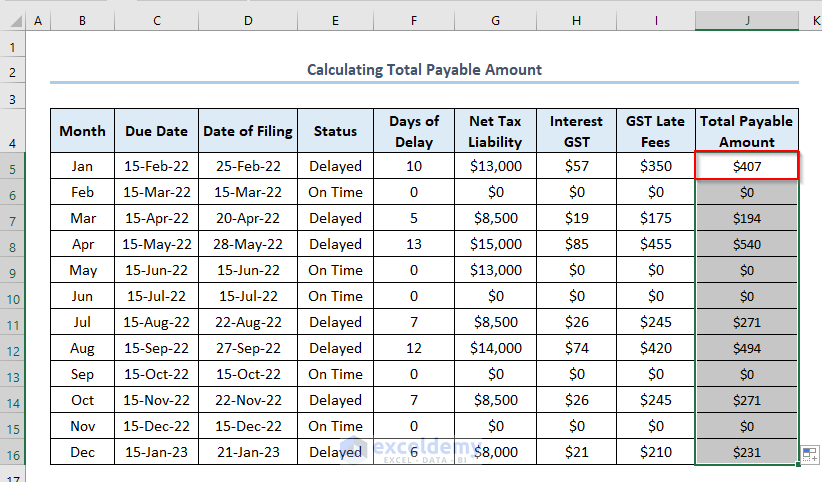

- Press ENTER and use the Fill Handle.

- Get the Total Payable Amount for each month like this.

Download Practice Workbook

Further Readings

- How to Create an Accrued interest calculator in excel

- Create a Monthly Accrued Interest Calculator in Excel

- How to Make TDS Interest Calculator in Excel

- Create TDS Late Payment Interest Calculator in Excel

- Create a Post-Judgement Interest Calculator in Excel

- How to Create a Money Market Interest Calculator in Excel

<< Go Back to Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!