Whether you run your own business manage your personal finance, or do corporate jobs, simple interest (SI) is an important topic for you. You can calculate the simple interest rate simply using a formula. Microsoft Excel provides the facility to calculate anything with a formula, so you can calculate simple interest in Excel with ease. In this blog, you will learn about what simple interest is, how it works, and how to use the simple interest formula in Excel with 3 relevant examples and practical applications.

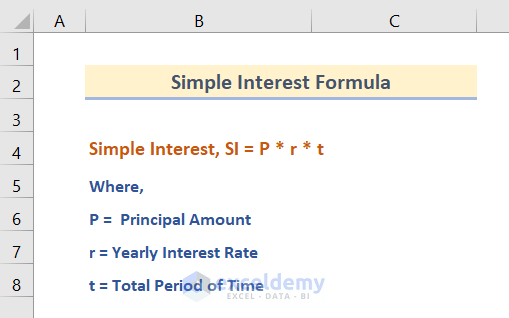

What is Simple Interest (SI)?

Simple Interest (SI) is the net amount of interest charged by the lender to the borrower considering the principal amount borrowed, the total period of time, and the yearly interest rate.

For example, you’ve borrowed $1M for 3 years. So, after 3 years when you pay the money back, suppose you need to pay $1.5M. So, you are returning the money with an extra $0.5M. This is additional amount is simple interest.

Simple Interest Formula

As simple interest comprises principal amount, interest rate, and tenure, we can write it down as follows:

Simple Interest = Principal Amount*Rate of Interest*Total Period of Time

Using symbolic letters, we can rewrite the simple interest formula like the equation below:

SI = P * r * tWhere,

P = Principal Amount

r = Yearly Interest Rate

t = Total Period of time

Now let’s learn to calculate the total amount due which is also known as Total Accrued Money.

Total Accrued Money = Principal Amount + Simple Interest

Here, Interest can be further calculated as

Simple Interest = Principal Amount*Rate of Interest*Total Period of Time

Now as a whole, we can write the formula as:

Total Accrued Money = Principal Amount+Principal Amount*Rate of Interest*Total Period of Time

Using symbolic letters, we can rewrite the whole formula like the equation below:

A = P*(1 + r * t)Where,

A = Total Accrued Money (Principal Amount + Interest)

P = Principal Amount

r = Yearly Interest Rate

t = Total Period of time

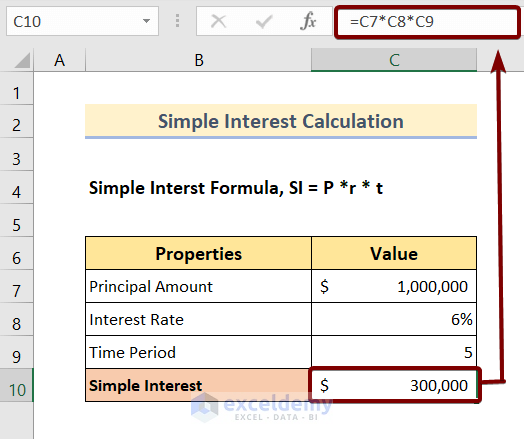

Example-1: Calculating Simple Interest to be Paid by an Individual with Formula

Problem: Chris has taken a loan of $1,000,000 with a yearly interest rate of 6% for 5 years. Now calculate the simple interest paid by Chris at the end of the tenure.

Solution:

Here,

The principal amount is $1,000,000

The yearly Interest rate is 6%

The time period is 5 years

Now to calculate the simple interest in Excel, we have created a data table of two columns. The first column of the data table holds properties such as principal amount, interest rate, time period, etc.

The second column, Value contains the corresponding values for each of the properties specified in the Properties column.

At the end of the data table, we’ve created another row to show the simple interest value.

Now, all you can do is,

❶ First select cell C10 to insert the simple interest formula.

❷ Now type the following formula within cell C10.

=C7*C8*C9Where C7 contains the principal amount, C8 contains the yearly interest rate, and lastly, C9 contains the total period of time.

❸ Finally press the ENTER button to execute the simple interest formula.

After hitting the ENTER button, we can see the simple interest amount is $300,000.

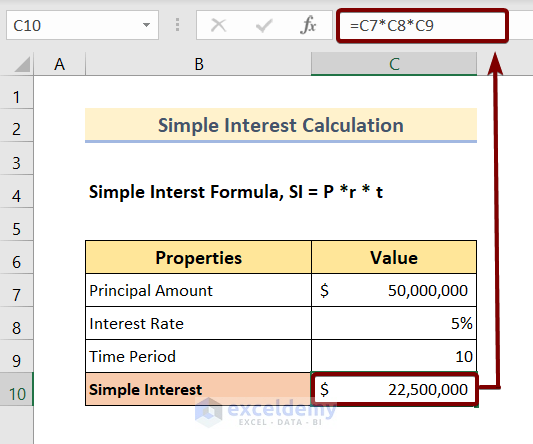

Example-2: Applying Formula to Estimate Simple Interest of a Company after a Certain Period

Problem: XYZ Corporation has issued a 10 years-long loan of $50,000,000 with an annual interest rate of 5% from ABC Bank. Now find out the total amount of simple interest that needs to be paid back to ABC bank after 10 years.

Solution:

In this case,

The principal amount is $50,000,000

The Interest rate per year is 5%

The tenure is 10 years

Now, to calculate the simple interest rate using this information, follow the steps below:

❶ Type the following simple interest formula in cell C10.

=C7*C8*C9❷ After that hit the ENTER button to get the simple interest amount.

From the result of the simple interest formula, we can see that the total amount of the simple interest rate is $22,500,000. This amount of simple interest will pay back the XYZ Corporation to the ABC bank after 10 years of time.

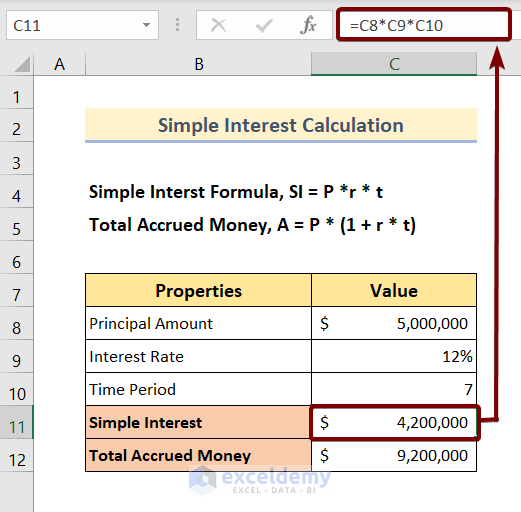

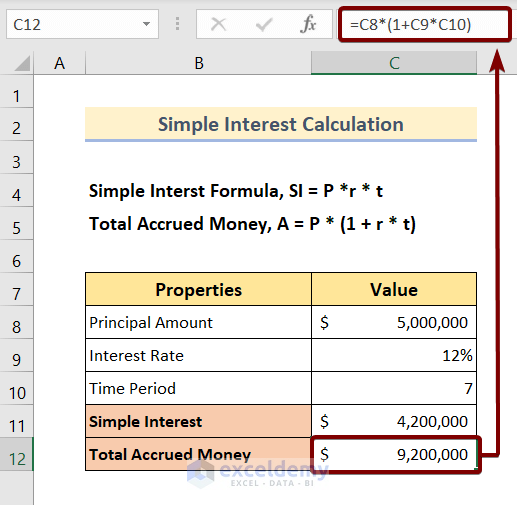

Example-3: Evaluating Total Amount to be Paid by a Company for a Certain Amount of Loan

Problem: X Industries Ltd. has borrowed an amount of $5,000,000 for 7 years with an annual interest rate of 12%. Now calculate the simple interest that X Industries Ltd. has to pay back at the end of the tenure. Also, calculate the total accrued money.

Solution:

In this particular simple interest problem,

The principal amount is $5,000,000

The yearly Interest rate is 12%

The tenure is 7 years

Now, to calculate the simple interest in Excel,

❶ Type the following simple interest formula in cell C11.

=C7*C8*C9As we are inserting the simple interest formula in cell C11, we will get the formula result in Cell C11.

Throughout the simple interest formula, cell C8 contains the principal amount which is $5,000,000. Cell C9 contains the yearly interest rate which is 12%, and lastly, cell C10 contains the tenure which is 7 years.

❷ When you’ve finished inserting the simple interest formula, just press the ENTER button.

After pressing the ENTER button, we can see that the simple interest amount is $4,200,000 after 7 years of tenure.

To calculate the total amount of money that needs to pay back,

❶ Type the following formula within cell C12.

=C8*(1+C9*C10)❷ To execute the formula, press the ENTER button.

That’s it.

After pressing the ENTER button, we can see that the total accrued money amount is $9,200,000.

Application of Simple Interest (SI)

- The simple interest formula is largely used by banks to provide savings bank account services.

- Short-term loans such as car loans, certificates of deposits and savings accounts, term deposits, etc. use the simple interest formula immensely.

Things to Remember

📌 While calculating the simple interest using the formula in Excel, you don’t need to worry about the yearly interest rate in percentage. Because Microsoft Excel can calculate directly with percentage values.

Download the Practice Workbook

You can download the Excel file from here and practice along with it.

Conclusion

To sum up, we have discussed simple interest formulas in Excel with 3 practical examples. You are recommended to download the practice workbook attached along with this article and practice all the methods with that. And don’t hesitate to ask any questions in the comment section below. We will try to respond to all the relevant queries ASAP.

How to Apply Simple Interest Formula in Excel: Knowledge Hub

- How to Calculate Simple Interest on Reducing Balance in Excel

- Convert Compound Interest to Simple Interest in Excel

- How to Calculate Simple Interest Loan Payments in Excel

- How to Calculate Daily Simple Interest in Excel

- How to Calculate Simple Interest and Compound Interest in Excel

<< Go Back to Excel for Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!

Perhaps a good example to include would be simple interest with annual payments. Ex: I owe $50,000, and I make a $5,000 payment every year – how much is owed after 10 years?

Thanks,

ChrisP

Hello CHRISP,

Thank you for your question, we have included a screenshot of the results and you can find the Excel file linked below.

Calculating Simple interest.xlsx

Regards,

ExcelDemy