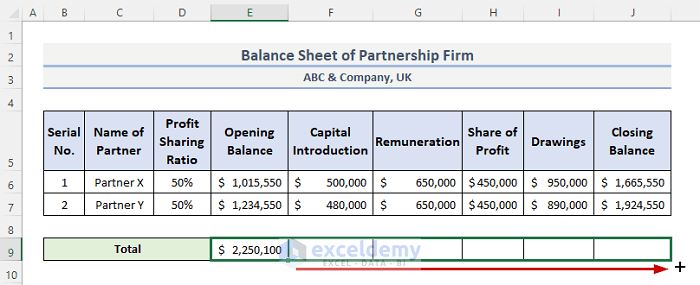

Step 1 – Make an Excel Document

Prepare the Excel file to create a format of the balance sheet of the partnership firm.

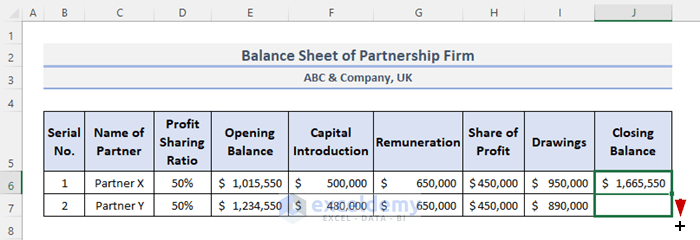

- We put two headings; one is the Balance Sheet of Partnership Firm which is in Heading 2 and the other one is ABC & Company which is in Heading 3.

Read More: How to Create Daily Bank Balance Report Format in Excel

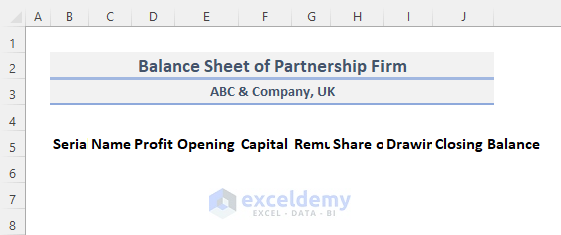

Step 2 – Insert Balance Sheet’s Contents

We have to insert all the necessary information in the Excel sheet. For this, we will need nine columns.

- We put the Serial Number in column B. The serial number is a special identifying number.

- We place the name of Name of Partners.

- The Profit Sharing Ratio. It is frequently used in partnership-style businesses.

- Insert the Opening Balance. The opening balance is the sum of money in a business’s credit at the start of a new fiscal year.

- The Capita Introduction, which the majority of sizable brokerage companies provide as a part of their prime trading plan.

- Remuneration is the overall pay an employee receives.

- Put the Share of Profit,

- The Drawing is the process of withdrawing money out of a bank account or corporate assets for personal consumption.

- The Closing Balance.

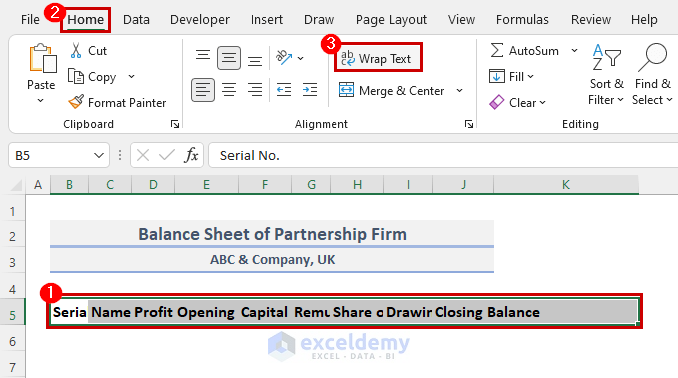

- After putting all the contents, they do not show properly. To show them appropriately, select the whole row of the contents.

- Go to the Home tab from the ribbon.

- In the Alignment category, click on Wrap Text. This will adjust the weight and height.

- To change the alignment and put colors on all the contents, Select the whole row and go to the Home

- In the Alignment group, select the Middle Align and the Align Left.

- In the Font group, select the Fill Color (White, Background 1, Darker 5%).

Read More: Income and Expenditure Account and Balance Sheet Format in Excel

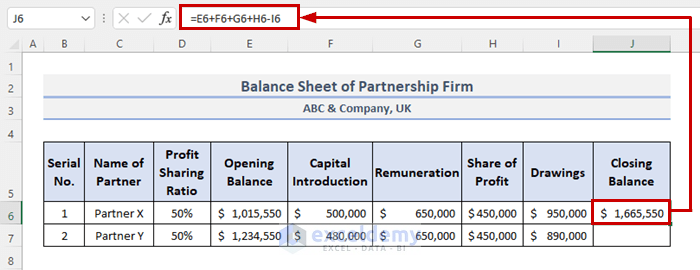

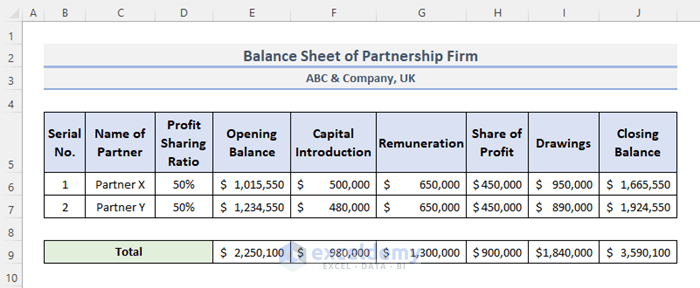

Step 3 – Add Category Values

- Select the cell where we want to put the result of the closing balance. In our case, we will choose cell J6.

- Insert the following formula in the cell.

=E6+F6+G6+H6-I6- Press Enter.

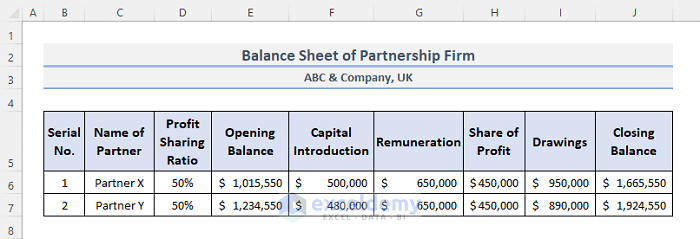

- Drag the Fill Handle icon down to duplicate the formula over the range. Or, to AutoFill the range, double-click on the plus (+) symbol.

- The result of the closing balance will be shown in column J.

Read More: Balance Sheet Format of a Company in Excel

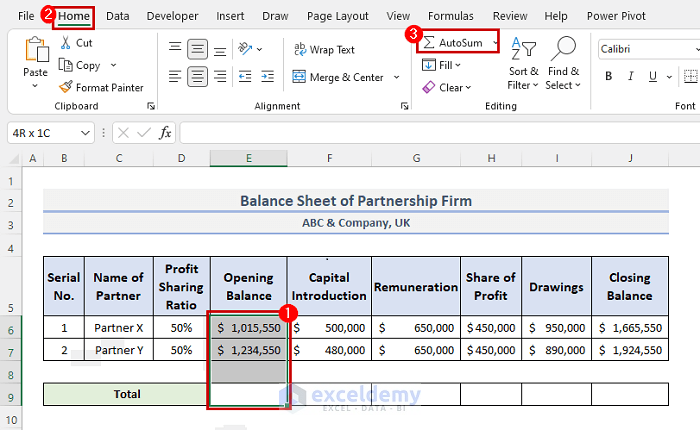

Step 4 – Total of Importance from Balance Sheet of Partnership Firm

- Select cell E9 and press the Shift key on your keyboard and go up.

- Go to the Home tab from the ribbon.

- Click on the AutoSum feature, under the Editing

- You will see the result. Or you can use the SUM function in Excel. The SUM function is a built-in function, categorized under the Math/Trig Function. This adds each value in a range of cells before returning the total.

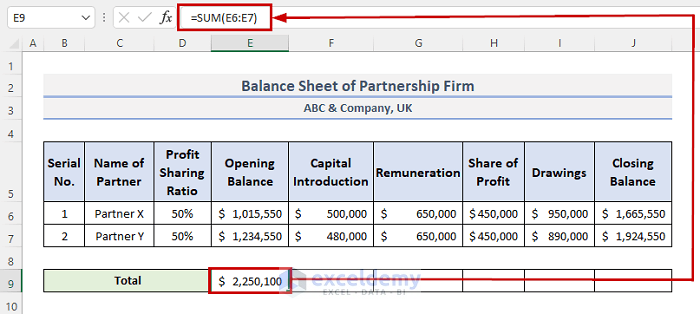

- Select the second cell E9, and enter the following formula:

=SUM(E6:E8)- Press Enter.

- Drag the Fill Handle icon to the right to copy the formula over the range.

- This is the format of the balance sheet of the partnership firm.

Read More: Create a Balance Sheet Format for Trading Company in Excel

Download Practice Workbook

You can download the workbook and practice with them.

Related Articles

- Balance Sheet Format in Excel for Proprietorship Business

- How to Create Projected Balance Sheet Format for 3 Years in Excel

- Create Projected Balance Sheet Format for Bank Loan in Excel

- How to Create NGO Balance Sheet Format in Excel

<< Go Back to Balance Sheet | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!