Method 1 – Create Format Outline

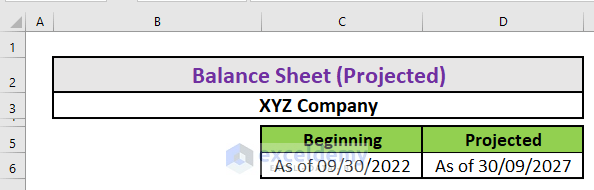

The balance sheet should start with a heading followed by the company’s name and the date it is being created. This is what it looks like.

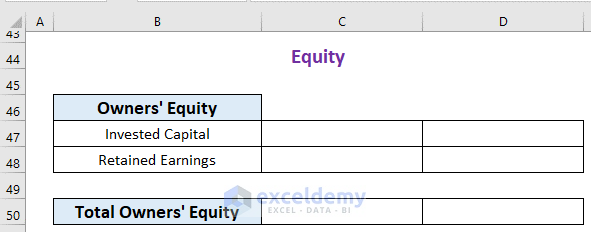

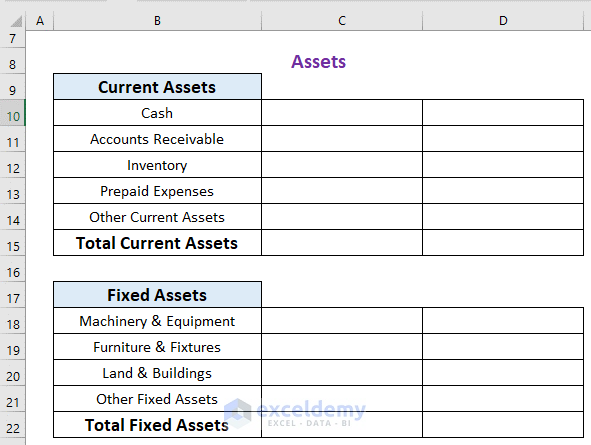

Asset

These are the main resources an organization owns. There are many types of assets, such as Current and Fixed assets, Tangible and Intangible assets, etc.

The balance sheet includes assets in the following way.

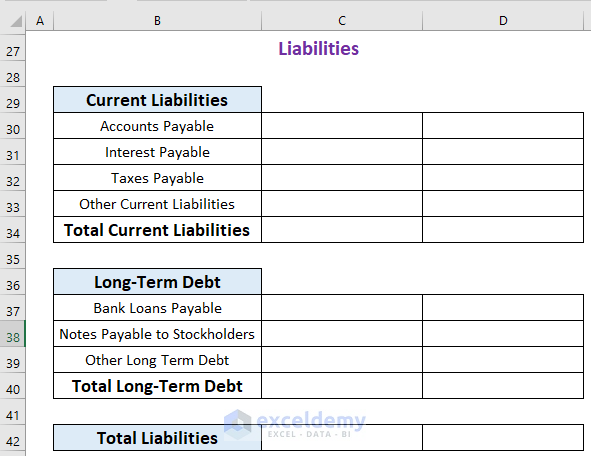

Liabilities

Liabilities are mainly of two types: Long-term liabilities and current liabilities. Long-term liabilities are the liabilities that are payable beyond 12 months. The current liabilities must be paid within 12 months.

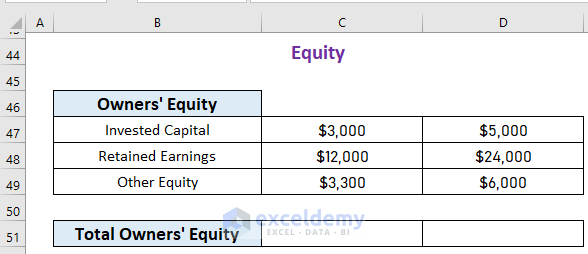

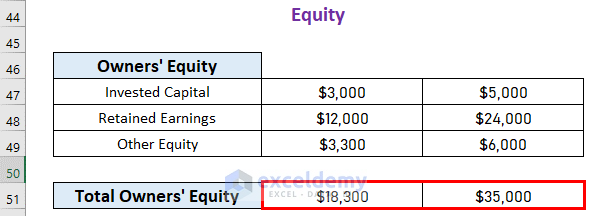

Owner’s Equity

The outline for Owner’s Equity looks like this.

Method 2 – Write Down Information about the Asset

Give the inputs and write down the information correctly.

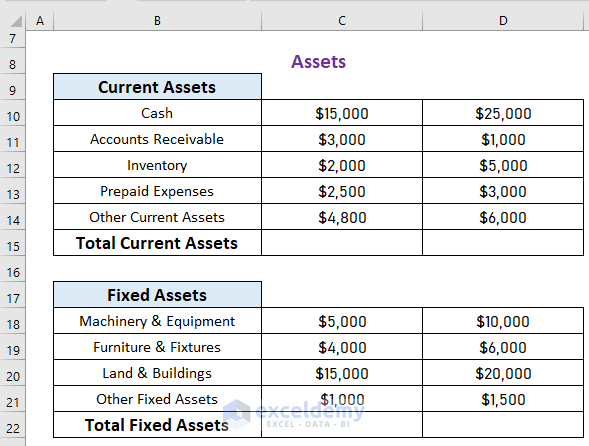

Asset

Here is a sample of all the asset accounts with their values.

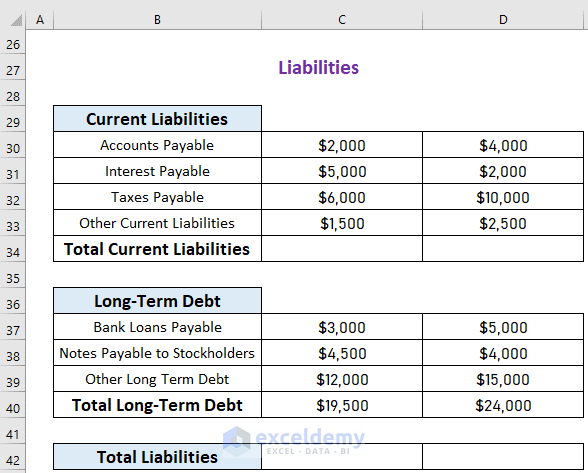

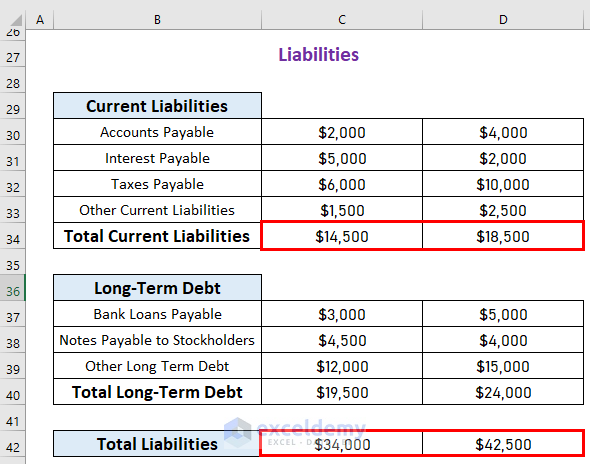

Liabilities

You must categorize the accounts into long-term and current liabilities.

Owner’s Equity

Put the information correctly for the Owner’s Equity accounts.

Method 3 – Calculate Total Assets, Liabilities, and Owner’s Equity

Calculate total assets, liabilities, and owner’s equity. Use the SUM function to calculate these values.

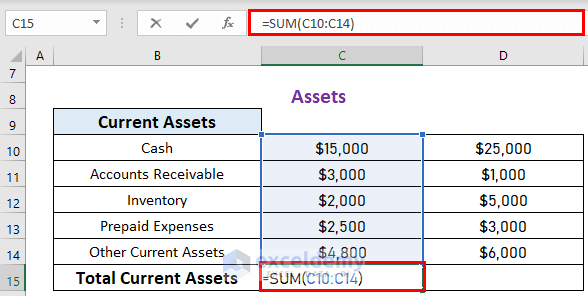

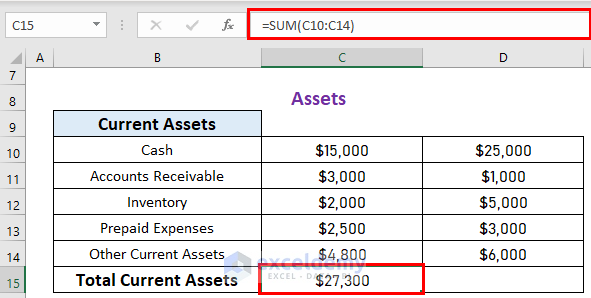

Calculate the total current assets. To do so,

- Go to C15 and write down the following formula

=SUM(C10:C14)- Press ENTER to get the output.

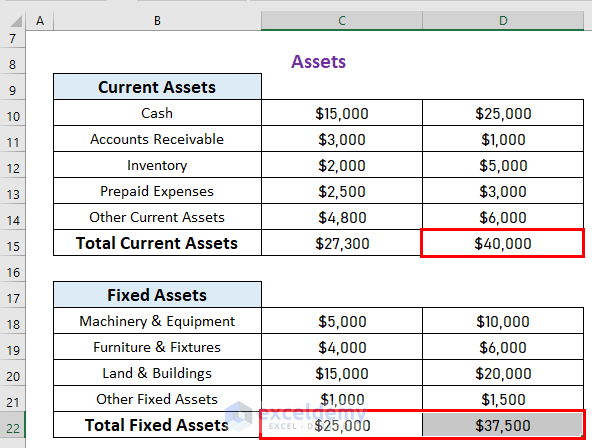

- Calculate the total current asset for the projected period and the total fixed asset for both the current and projected period.

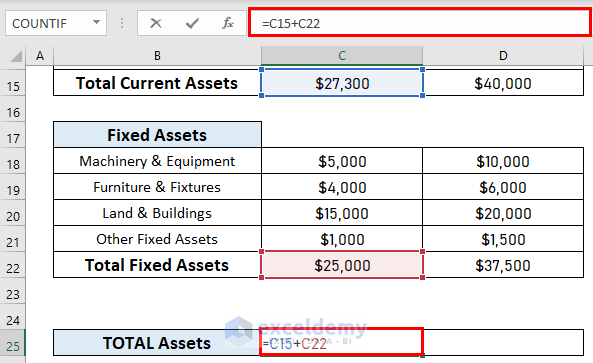

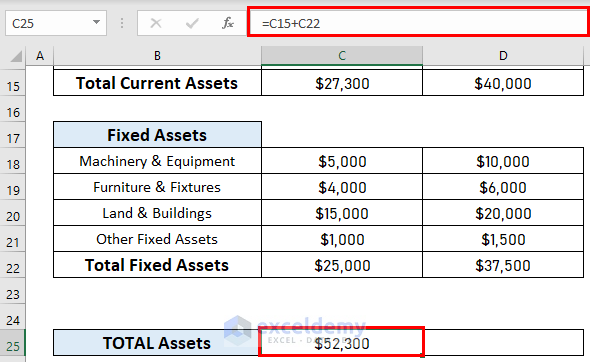

Calculate the total assets for the current period. To do so,

- Go to C25 and write down the following formula

=C15+C22- Press ENTER to get the output.

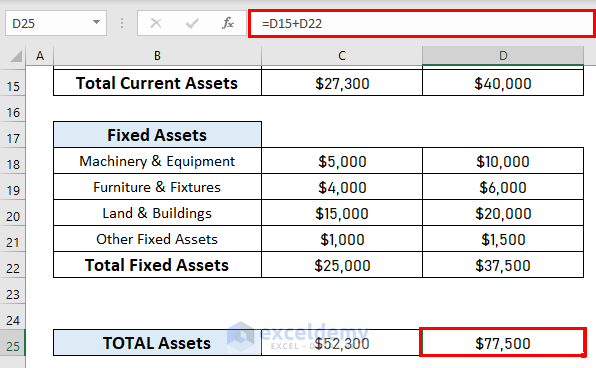

- Calculate the total assets for the projected period.

- Calculate the liabilities just like the assets.

- Equity calculation will follow the same way.

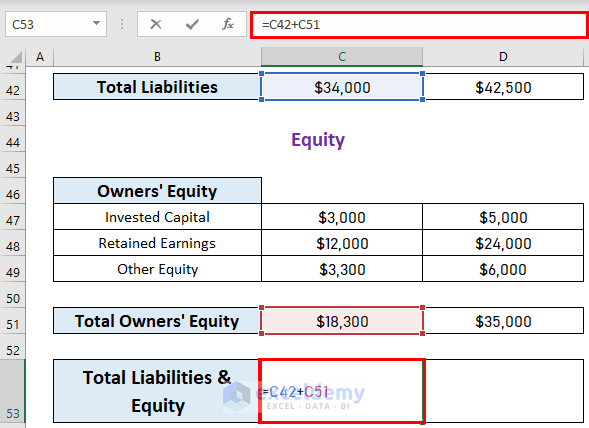

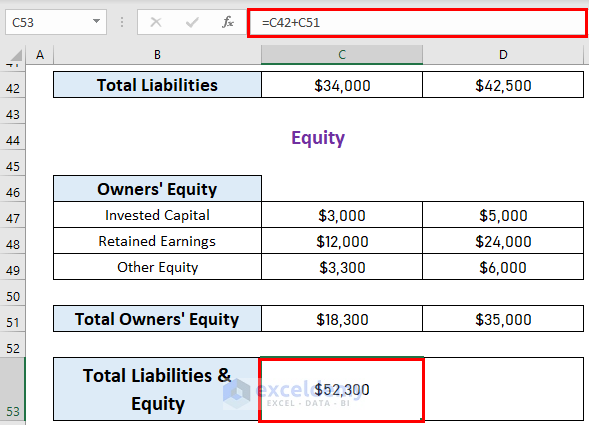

- The balance sheet includes total liabilities and owner’s equity.

- Go to C53 and write down the following formula

=C42+C51- Press ENTER to get the output.

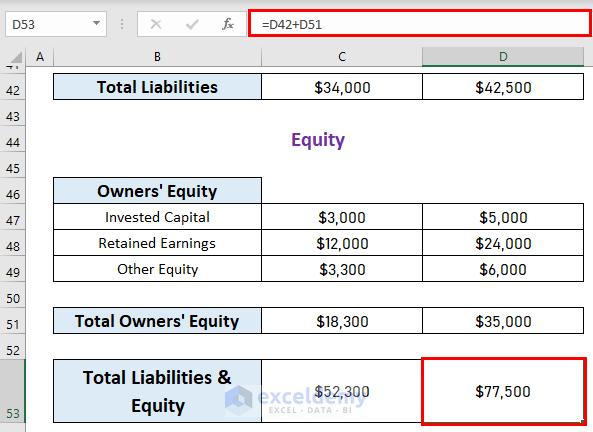

- Do the same for the projected period.

Things to Remember

- The total asset will equal the sum of total liabilities and equity.

- Projected values are based on forecasts.

Download Practice Workbook

Download this projected balance sheet format.

Related Articles

<< Go Back to Balance Sheet | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!