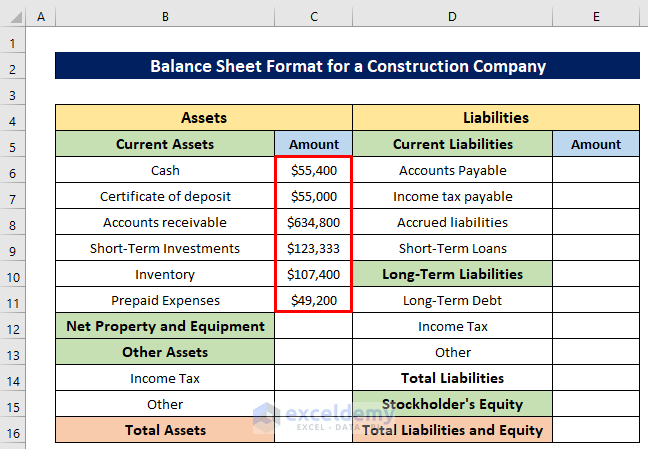

Method 1 – Insert Current Assets

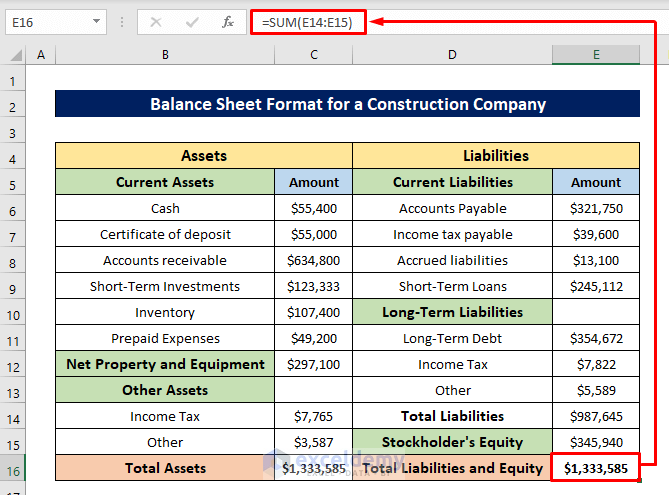

Insert the amount for the current assets. A current asset is a term on a company’s balance sheet that might be cash, equivalent to cash, or something that can be converted into cash within a year. In our format, this section has 6 terms- Cash, Certificate of deposit, Account receivable, Short-term investments, Inventory, and Prepaid expenses.

Assets are added just for example purposes; if you have more current assets, feel free to add in this part. Insert the corresponding amount for each term.

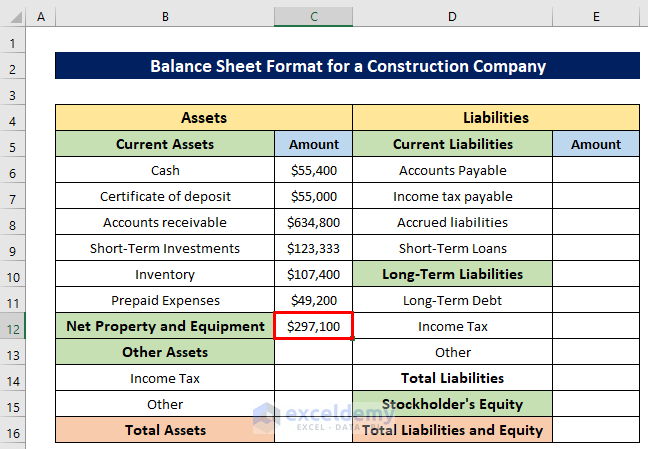

Method 2 – Insert Net Property and Equipment

It is called the Net PP&E, which means all kinds of physical assets that a company buys like lands, buildings, furniture, and electric equipment to run a business. It is a non-current asset. We inserted a total amount for this section. If you have different parts then add them under this section.

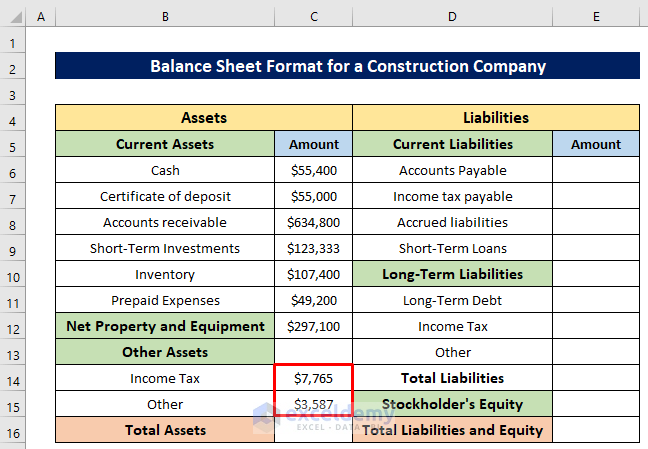

Method 3 – Insert Other Assets

Insert the other assets like Income tax and other taxes, etc.

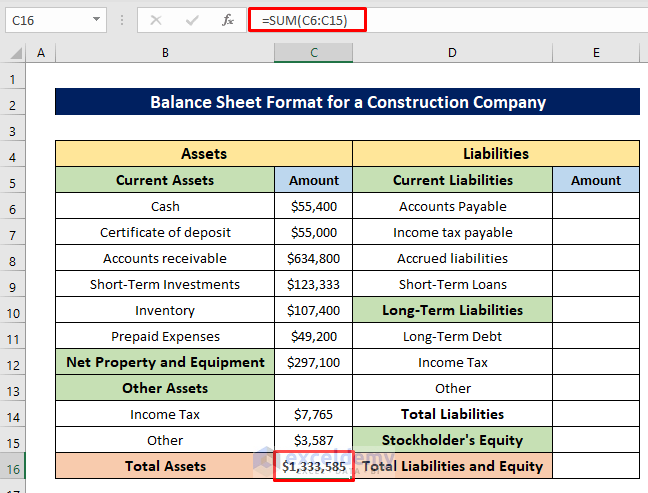

Method 4 – Calculate Total Assets

Different sections for the assets are inserted, now we’ll calculate the total assets by using the SUM function. After getting the total assets, compare them with the liabilities. Insert the following formula in Cell C16 and hit the ENTER button-

=SUM(C6:C15)

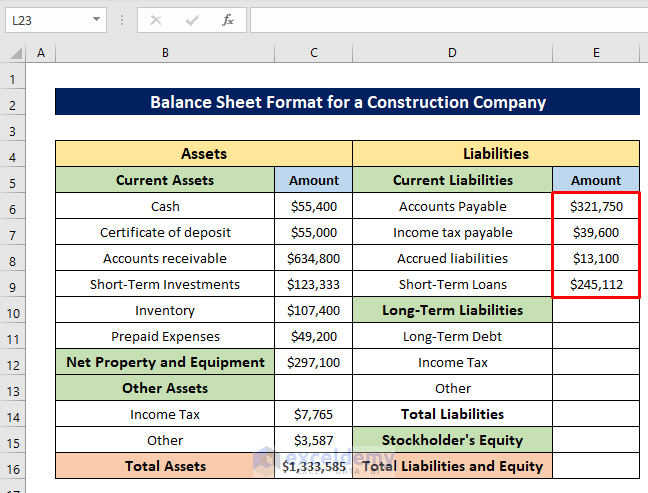

Method 5 – Insert Current Liabilities

A company’s current liabilities are the debts or obligations that must be paid to creditors within one year. We inserted different current liabilities here, such as Accounts payable, Income tax payable, Short-term loans, etc., and inserted their corresponding values.

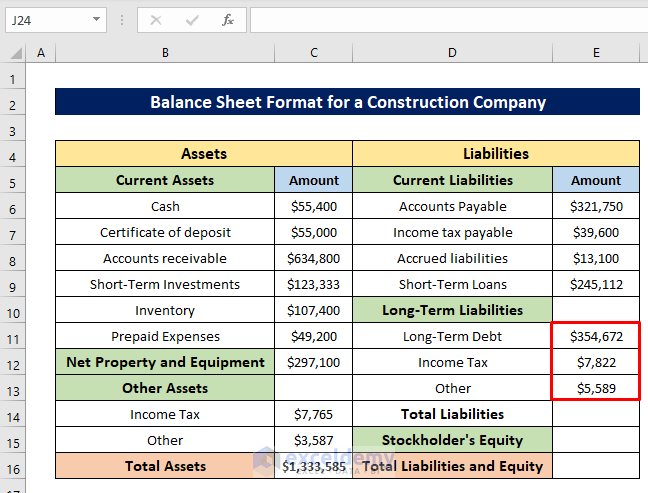

Method 6 – Insert Long-Term Liabilities

Long-term liabilities are also known as long-term debts. They are debts that a company owes third-party creditors that it has to pay beyond 12 months. This is different from current liabilities, which a company must pay within 12 months. We inserted the amounts for Long-term debt, Income tax, and other debts.

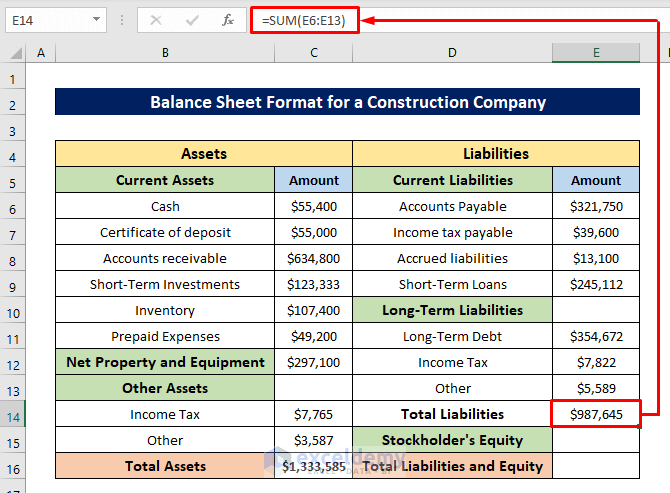

Method 7 – Calculate Total Liabilities

Calculate the total liabilities by adding the Current liabilities and Long-term liabilities using the SUM function again. Insert the following formula in Cell E14 and press the ENTER button-

=SUM(E6:E13)

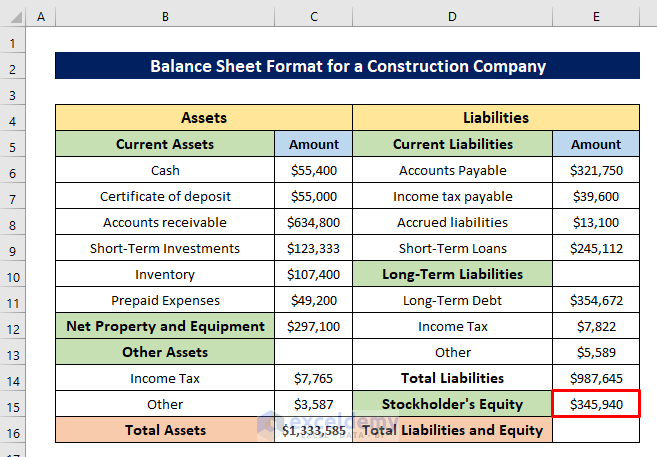

Method 8 – Insert Stockholder’s Equity

It is the asset amount remaining in a business after settling all the liabilities. Calculate it as the capital given to a business by the company’s shareholders, along with the donated capital and other earnings achieved by different business operations. We inserted the total shareholders’ equity amount in Cell E15.

Method 9 – Calculate Total Liabilities and Equity

Before comparing with the total assets, we’ll have to find the total liabilities and equity by adding Stocholder’s equity and Total liabilities. Take the help of the SUM function of Excel. In Cell E16, write the following formula and hit the ENTER button-

=SUM(E14:E15)

The total amount of assets and liabilities will be the same for a perfect balance sheet. See that the total assets and total liabilities matched, which means there’s no mistake in our calculation.

Why Do We Need a Balance Sheet?

- The interested parties can have an idea about the company by seeing its balance sheet to take decisions for investment.

- It helps the bank to take decisions for giving a loan by analyzing the company’s financial ability. If the balance sheet qualifies then the bank agrees to give loans.

- The balance sheet helps to determine the risks and returns of a company.

- A balance sheet helps to calculate the other useful ratios for other financial calculations.

Download Practice Workbook

You can download the free Excel workbook from here and practice independently.

Related Articles

- Balance Sheet Format in Excel for Proprietorship Business

- Create a Format of Balance Sheet of Partnership Firm in Excel

- How to Create Projected Balance Sheet Format for 3 Years in Excel

- Create Projected Balance Sheet Format for Bank Loan in Excel

- How to Create NGO Balance Sheet Format in Excel

<< Go Back to Balance Sheet | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!