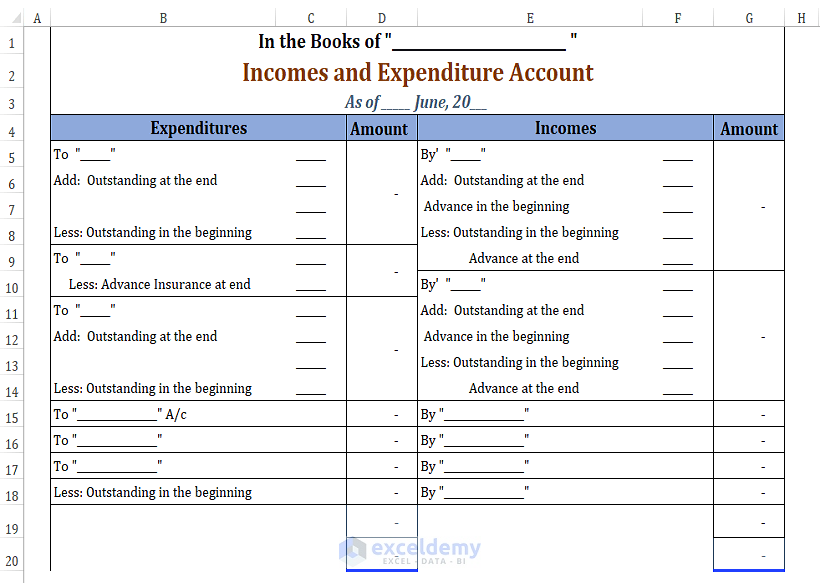

This is a typical Income and Expenditure Account and Balance Sheet.

What Is an Income and Expenditure Account?

An Income and Expenditure Account is needed to know whether the balance of a non-trading entity is surplus or deficit. The account depicts the financial status of the entity. The account is similar to the profit and loss account of a business institution.

Key Features of an Income and Expenditure Account

(i) Non-trading entities’ Income and Expenditure Accounts are similar to the Profit and Loss Accounts of trading entities.

(ii) Similar to all other financial accounts, Income and Expenditure Accounts are created by strictly following the double-entry system of bookkeeping .

(iii) These accounts are created at the end of the year.

(iv) The balance sheet of this account depicts surplus or deficit balance.

(v) The surplus or deficit balance from the income and expenditure account is usually moved to a Capital Fund Account.

(vi) It is common not to incorporate capital Income or Expenditure accounts in this type of account.

Read More: How to Create Daily Bank Balance Report Format in Excel

Creating an Income and Expenditure Account and Balance Sheet Format in Excel

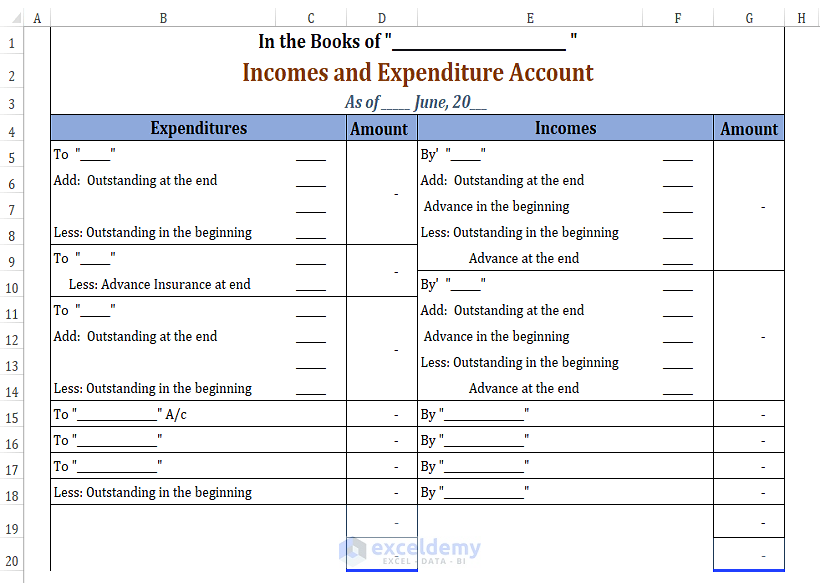

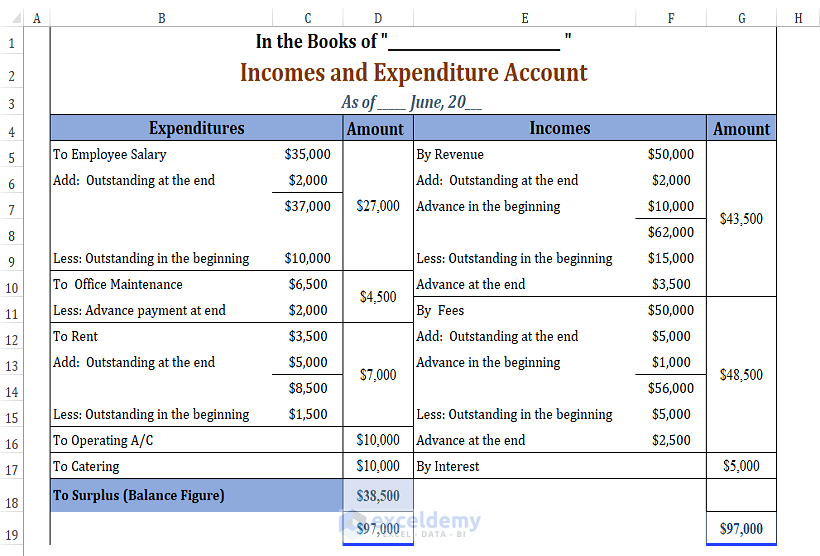

A typical Income and Expenditure and Balance Sheet contains 2 separate columns for Income and Expenditure. Both Income and Expenditure have their own Amount column with additional or discounted amount entries. This is a possible sample.

Users can add rows to an account’s Balance Sheet. The format of entries may vary, but the basic Account and Balance Sheet format remains the same.

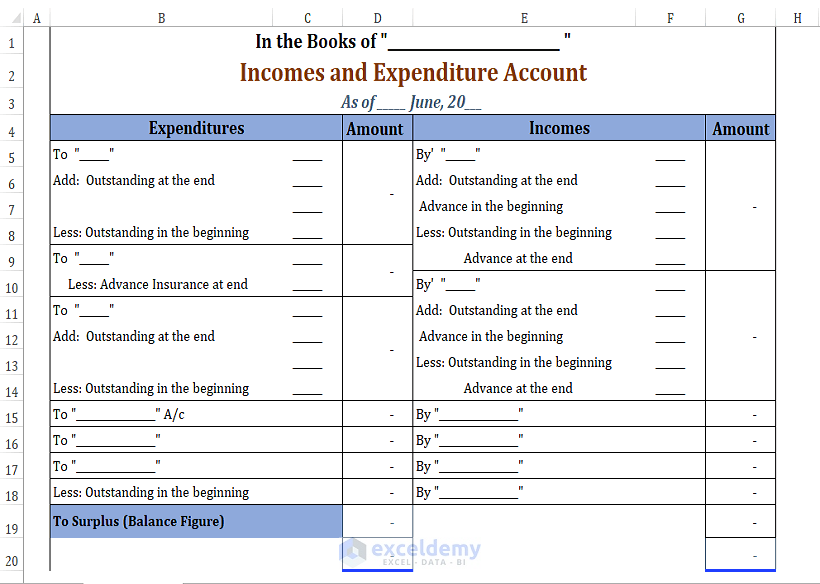

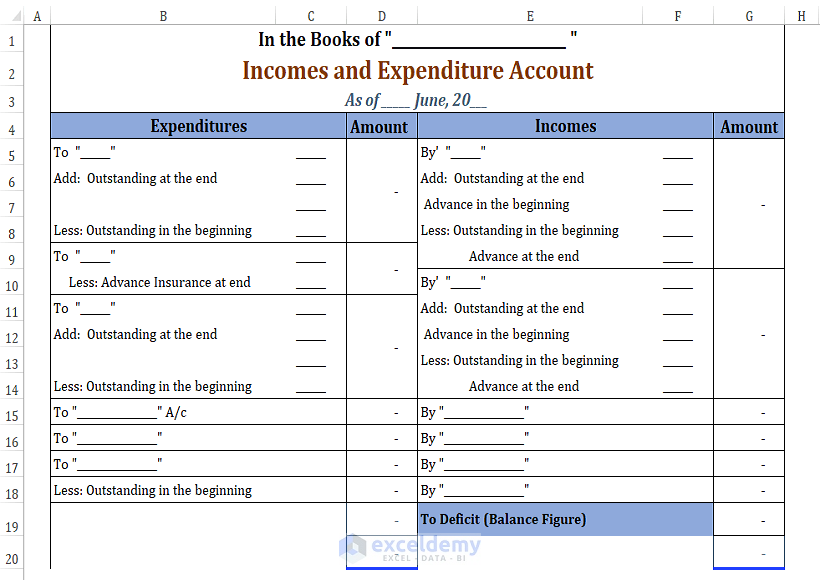

There are two kinds of Income and Expenditure and Balance Sheet formats depending on the final calculated amount. If incomes exceed expenditures, the balance is referred to as Surplus Balance. Otherwise, it’s referred to as Deficit Balance.

Read More: Balance Sheet Format of a Company in Excel

Surplus Balance Sheet Format

The Surplus Balance occurs when the total income amount is greater than the expenditures. The Surplus Balance figure is usually placed under the Expenditure column. This is an Income and Expenditure and Balance Sheet sample:

Read More: Create a Balance Sheet Format for Trading Company in Excel

Deficit Balance Sheet Format

Unlike the Surplus Balance, a Deficit Balance happens when the expenditure amount is greater than the accumulated income. The Deficit Balance is usually placed under the Incomes column. This is a Deficit Balance account sample:

Example of an Account and Its Balance Sheet

An Income and Expenditure and Balance Sheet may contain additional information regarding the different phases of a transaction:

(i) Employees’ Salary Outstanding at the end of the month is $2,000.

(ii) Employees’ Salary Outstanding, in the beginning of the month, is $10,000.

(iii) Advance Office Maintenance payment is $2,000.

(iv) Office Rent Outstanding at the end is $5,000.

(v) Office Rent Outstanding, in the beginning, is $1,500.

(vi) Revenue Outstanding at the end of the month is $2,000

(vii) Revenue Outstanding inthe beginning of the month is $15,000.

(viii) Revenue Advance, in the beginning, is $10,000.

(ix) Revenue Advance, at the end, is $3,500.

(x) Fees’ Outstanding, at the end of the month is $5,000.

(xi) Fees’ Outstanding, in the beginning of the month, is $5,000.

(xii) Fees’ Advance, in the beginning, is $1,000.

(xiii) Fees Advance, at the end, is $2,500.

This is the sample:

Read More: Balance Sheet Format for Construction Company in Excel

Download Excel Workbook

Practice with the attached workbook. You can also use it as a Template.

Related Articles

- Balance Sheet Format in Excel for Proprietorship Business

- Create a Format of Balance Sheet of Partnership Firm in Excel

- How to Create Projected Balance Sheet Format for 3 Years in Excel

- Create Projected Balance Sheet Format for Bank Loan in Excel

- How to Create NGO Balance Sheet Format in Excel

<< Go Back to Balance Sheet | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!

Sir / Madam

Good day to you

I am looking for an income and expenditure account in Indian format. Would it be possible for you to send it to me?

Thank you for your question. Here is your Indian Format.

We have a situation where Repair funds from society members was collected in prior year in monthly installments and expenses incurred for painting and repairs in nest year. What should be done to present the expense properly in expenditure account in the year of exps. Please suggest format with example.

Hello Kumar Chavan,

You need to create two sheets to present your expenses.

Firstly, create Income and Expenditure Account sheet to record all incomes and expenditures for the year, including the deferred income adjustment for repairs.

Then, create Balance Sheet to present the assets, liabilities, and equity as of the year-end date.

Here is your Example Format: Template for Income and Expenditure Account and Balance Sheet.xlsx

Regards

ExcelDemy