Excel is the most widely used tool for dealing with massive datasets. We can perform myriads of tasks of multiple dimensions in Excel. Professionals often use Excel to create financial statements. In this article, I will show you how to create a balance sheet format for a trading company in Excel.

Introduction to Balance Sheet

Projected balance sheets, also known as pro forma balance sheets, show estimated changes in a company’s financial status, such as investments, other assets, liabilities, and equity financing. Company owners or accounting professionals use projections to learn more about their business and forecast income and expenses for the future.

In general, a balance sheet contains 3 portions. And, these are Assets, Liabilities, and Owners’ equity. Balance sheets for an individual are organized according to the equation:

Assets: These are the main resources owned by the organization. They can be classified into many types. Like Current and Fixed assets, Tangible, and Intangible assets, etc.

Liabilities: They are things that the organization owes to a person or a company like cash, loans, etc.

Equity: The portion of a business belongs to the owner. This is the difference between assets and liabilities.

Read More: How to Create Daily Bank Balance Report Format in Excel

3 Steps to Create Balance Sheet Format for Trading Company in Excel

In this article, I have divided the process of creating a balance sheet into 3 easy steps. However, there is no fixed rule for this.

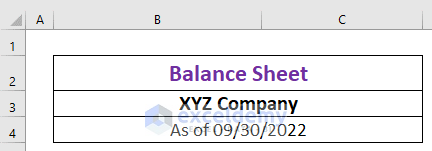

Step 1: Create Format Outline

The first step is to create an outline. The balance sheet should start with a heading followed by the company’s name and the date it is being created.

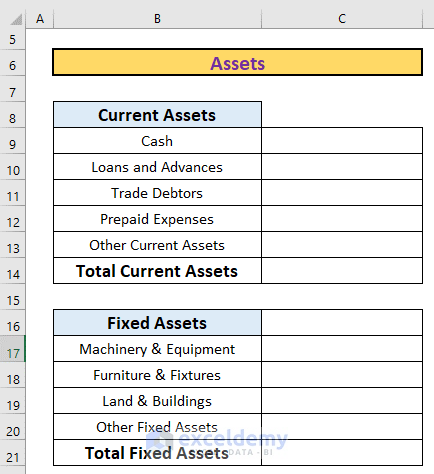

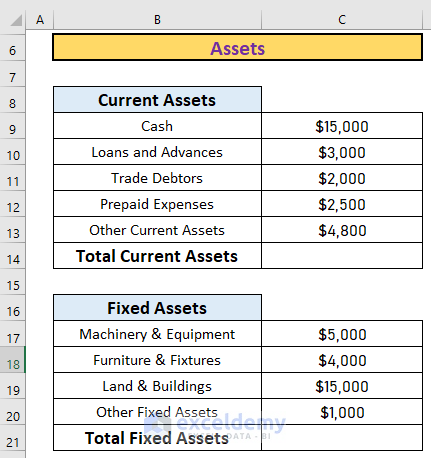

Assets

These are the main resources an organization owns. There are many types of assets like Current and Fixed assets, Tangible, and Intangible assets, etc.

The balance sheet includes assets in the following way.

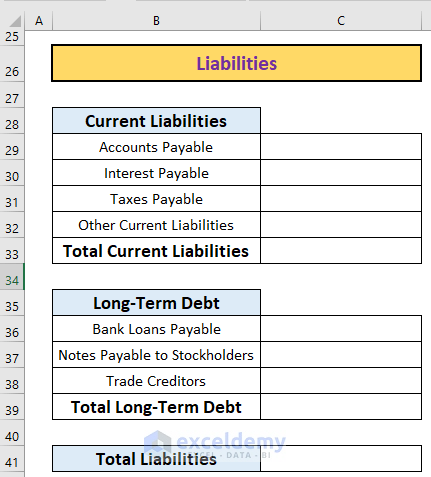

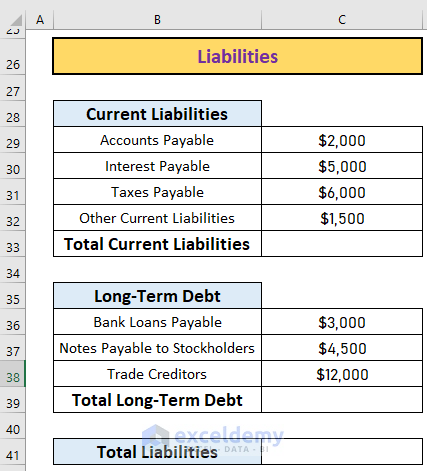

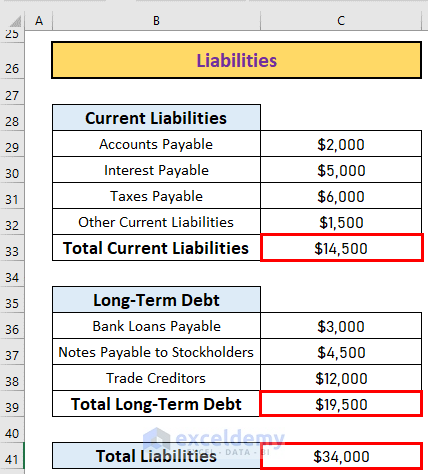

Liabilities

Liabilities are mainly of two types. Long-term liabilities and current liabilities. Long-term liabilities are the liabilities that are payable beyond 12 months. The current liabilities must be paid within 12 months.

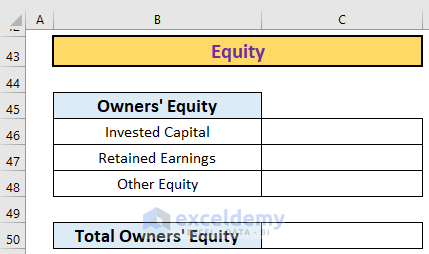

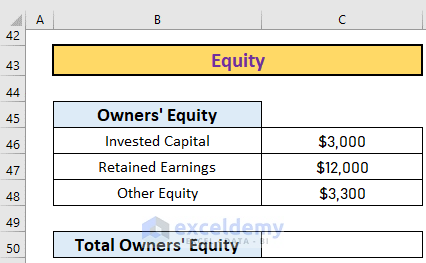

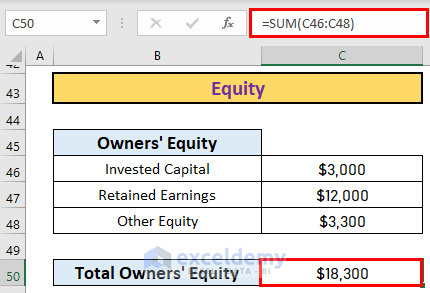

Owner’s Equity

Next comes the Owner’s Equity. The outline for this might look like this.

Read More: Income and Expenditure Account and Balance Sheet Format in Excel

Step 2: Write Down the Information

Now, you have to give the inputs correctly. Write down the information in the correct places.

Assets

First comes the assets. Here is a sample of all the asset accounts with their values.

Liabilities

Next comes the liabilities. You must categorize the accounts into long-term and current liabilities.

Owner’s Equity

Finally, put the information correctly for the Owner’s Equity accounts.

Read More: Balance Sheet Format of a Company in Excel

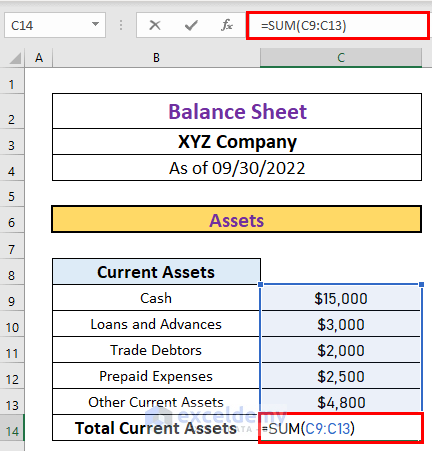

Step 3: Calculate Total Assets, Liabilities, and Owner’s Equity

Now, I will calculate total assets, liabilities, and owner’s equity. I will use the SUM function to calculate these values.

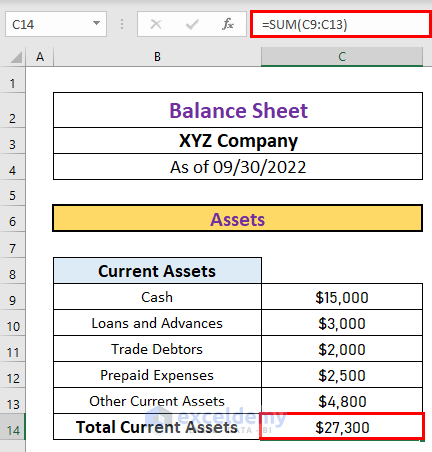

First of all, I will calculate the total current assets. To do so,

- Go to C14 and write down the following formula

=SUM(C9:C13)- Then, press ENTER to get the output.

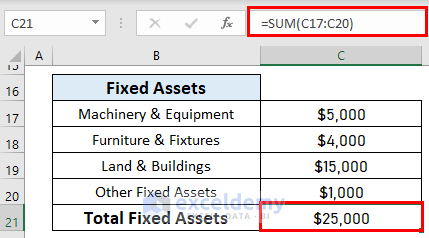

Similarly, calculate the total fixed asset.

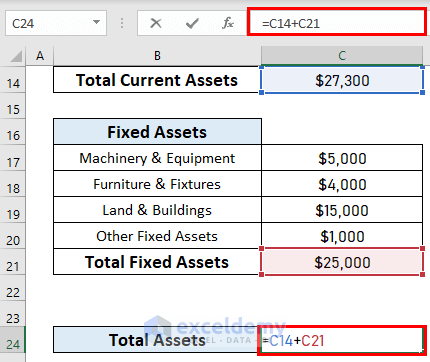

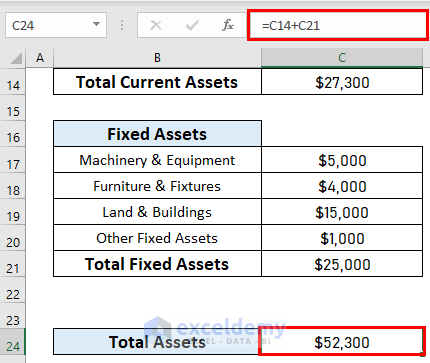

Now, we will calculate the total assets for the current period. To do so,

- Go to C24 and write down the following formula

=C14+C21- Then, press ENTER to get the output.

- Now, we will calculate the liabilities in the same way.

- The Equity calculation will follow the same way.

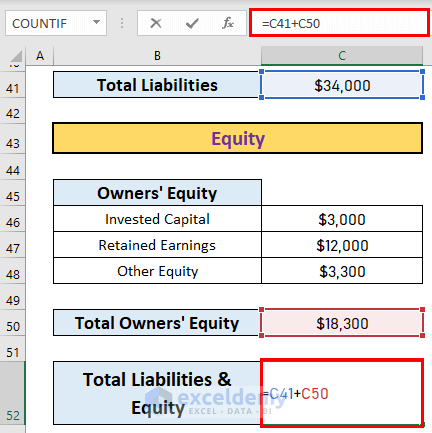

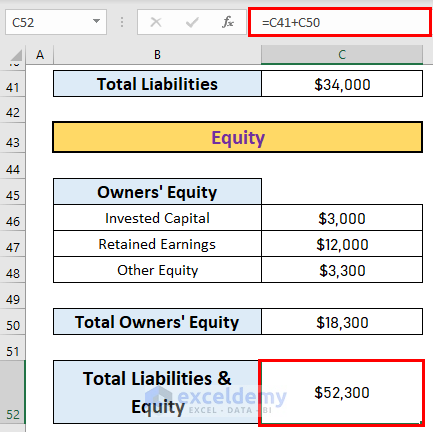

- The balance sheet includes total liabilities and owner’s equity. So we will now calculate that.

- To do so, go to C52 and write down the following formula

=C41+C50- Then press ENTER to get the output.

Read More: Balance Sheet Format for Construction Company in Excel

Things to Remember

- The total asset will equal the sum of total liabilities and equity.

Download Practice Workbook

Download this balance sheet format and use it.

Conclusion

In this article, I have explained how to create a balance sheet format for a trading company in Excel. I hope it helps everyone. If you have any suggestions, ideas, or feedback, please feel free to comment below.

Related Articles

- Balance Sheet Format in Excel for Proprietorship Business

- Create a Format of Balance Sheet of Partnership Firm in Excel

- How to Create Projected Balance Sheet Format for 3 Years in Excel

- Create Projected Balance Sheet Format for Bank Loan in Excel

- How to Create NGO Balance Sheet Format in Excel

<< Go Back to Balance Sheet | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!