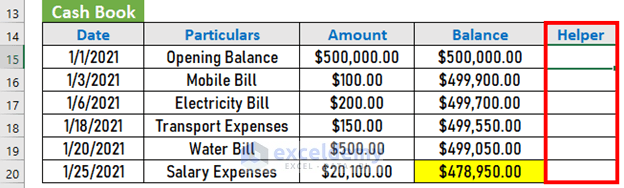

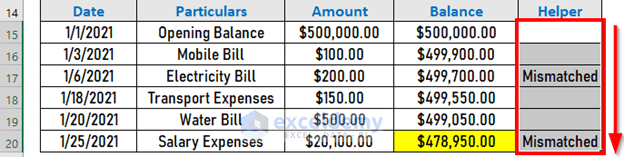

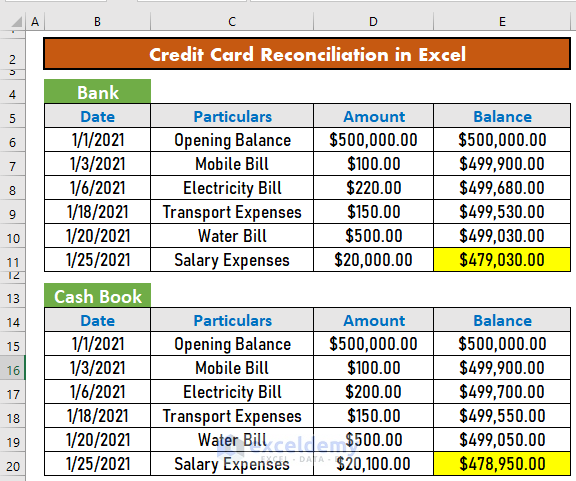

The dataset below showcases bank and the accountant’s cash book statements.

There are discrepancies in these statements. To reconcile them:

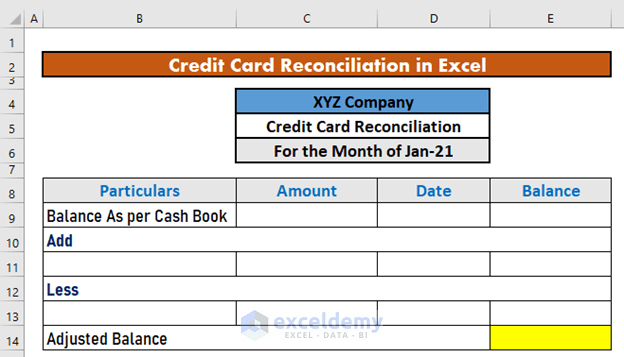

Step 1 – Prepare the dataset to perform Credit Card Reconciliation

Include all the differences between the statements.

Read More: How to Do Bank Reconciliation in Excel

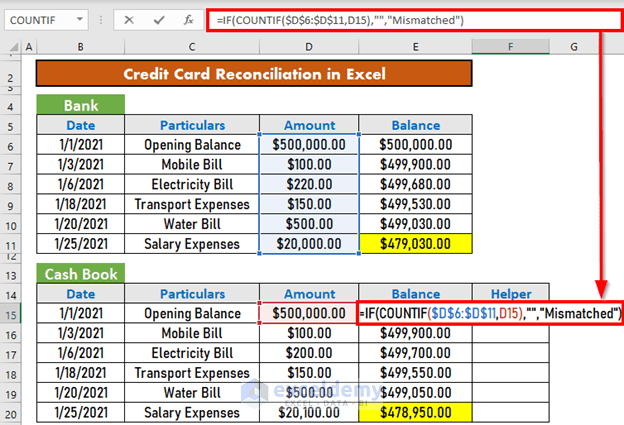

Step 2 – Find Mismatches Between Statements

Use the COUNTIF and IF functions.

- Insert a helper column in the cash book statement.

- Enter the following formula in F15.

=IF(COUNTIF($D$6:$D$11,D15),"","Mismatched")Formula Breakdown:

- COUNTIF($D$6:$D$11,D15) → This is the logical test. If the value in D15 is present in D6:D11, the condition is TRUE. Otherwise, FALSE.

- Output: TRUE.

- IF(COUNTIF($D$6:$D$11,D15),””,”Mismatched”) → If the condition is TRUE, the output will be a blank. Otherwise, “Mismatched”.

IF(TRUE,””,”Mismatched”) - Output: “”

- Press ENTER to see the output.

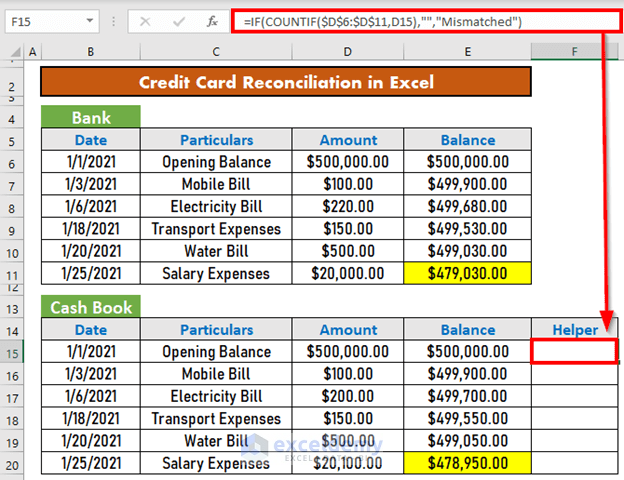

- Drag down the Fill Handle to see the result in the rest of the cells.

Read More: How to Reconcile Vendor Statements in Excel

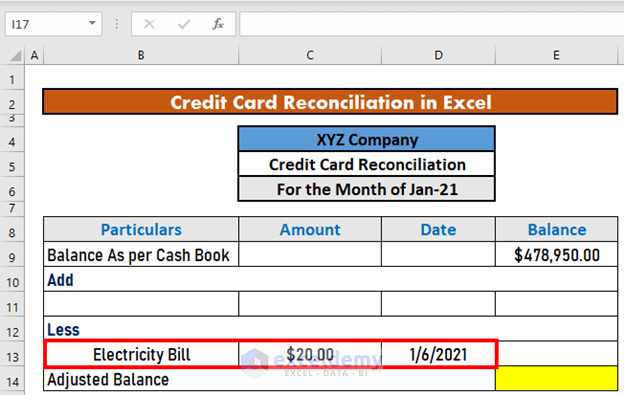

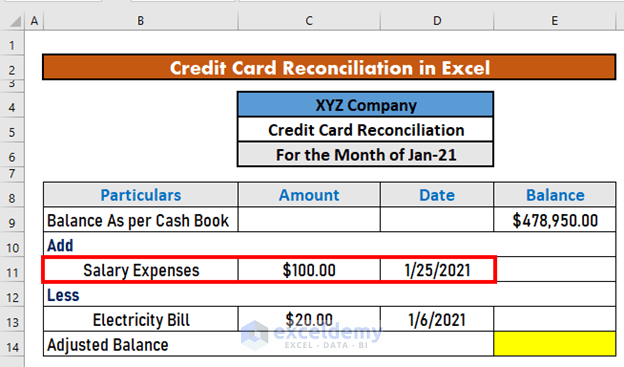

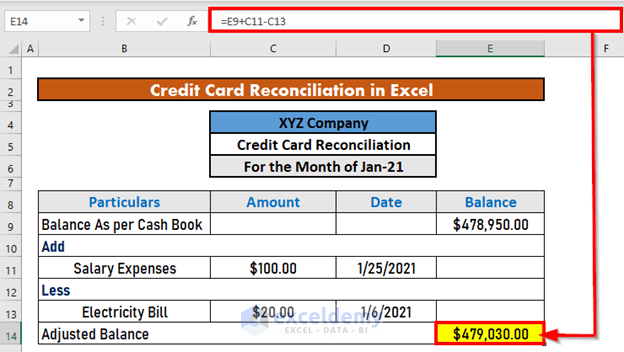

Step 3 – Record Mismatches in a Reconciliation Statement

Adjust mismatches in the reconciliation statement.

Here, the Electricity Bill and Salary Expenses are mismatched. The Electricity Bill is $20 less than the original payment. Due payment was $200, but $220 was paid. In the cash book balance, deduct $20.

The mismatch for Salary Expense is $100. Here, add it to your cash book balance.

Read More: Automation of Bank Reconciliation with Excel Macros

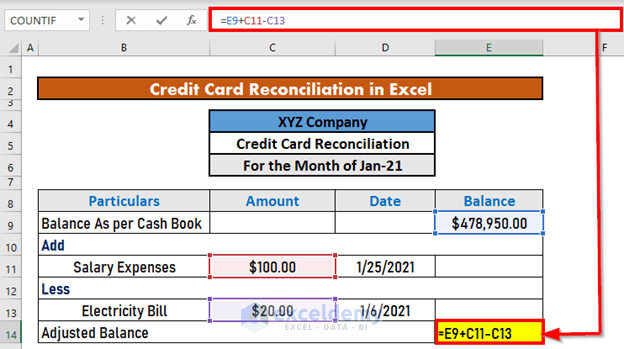

Step 4 – Calculate the Adjusted Balance

- Go to E14 and enter the following formula

=E9+C11-C13- Press ENTER.

This is the output.

Read More: How to Reconcile Data in Excel

Things to Remember

- Your cash book balance should match the bank statement

Download Practice Workbook

Download the workbook and practice.

Related Articles

- How to Do Intercompany Reconciliation in Excel

- How to Do Reconciliation in Excel

- How to Reconcile Two Sets of Data in Excel

- How to Reconcile Data in 2 Excel Sheets

- How to Perform Bank Reconciliation Using VLOOKUP in Excel

<< Go Back to Excel Reconciliation Formula | Excel for Accounting | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!