How to Use This Template

Instructions:

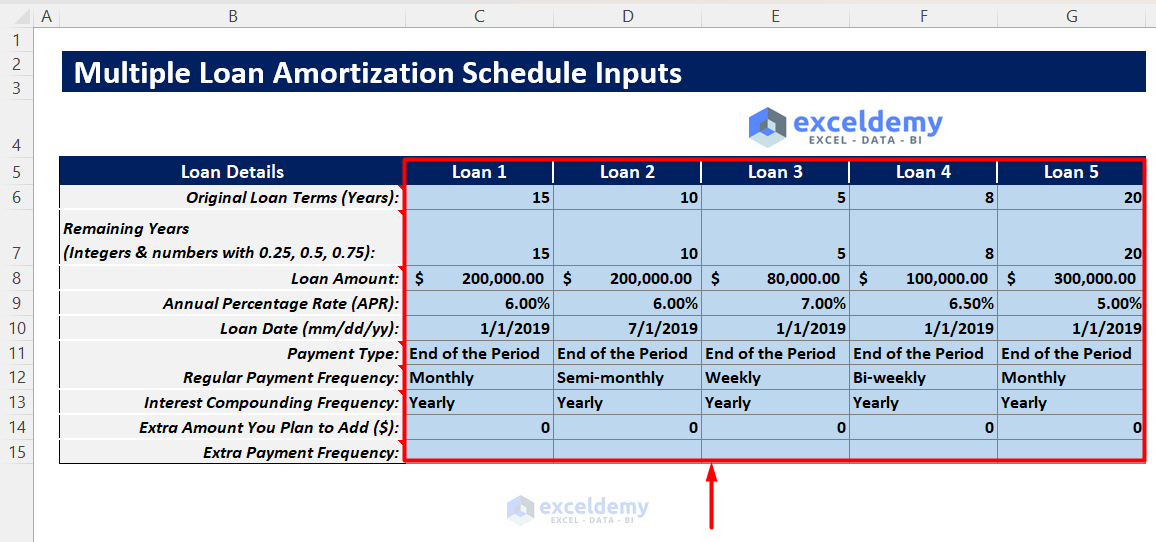

- Open the file and go to the Loan Input sheet. Insert your multiple loan parameter values and choose the required dropdowns in the blue shaded area.

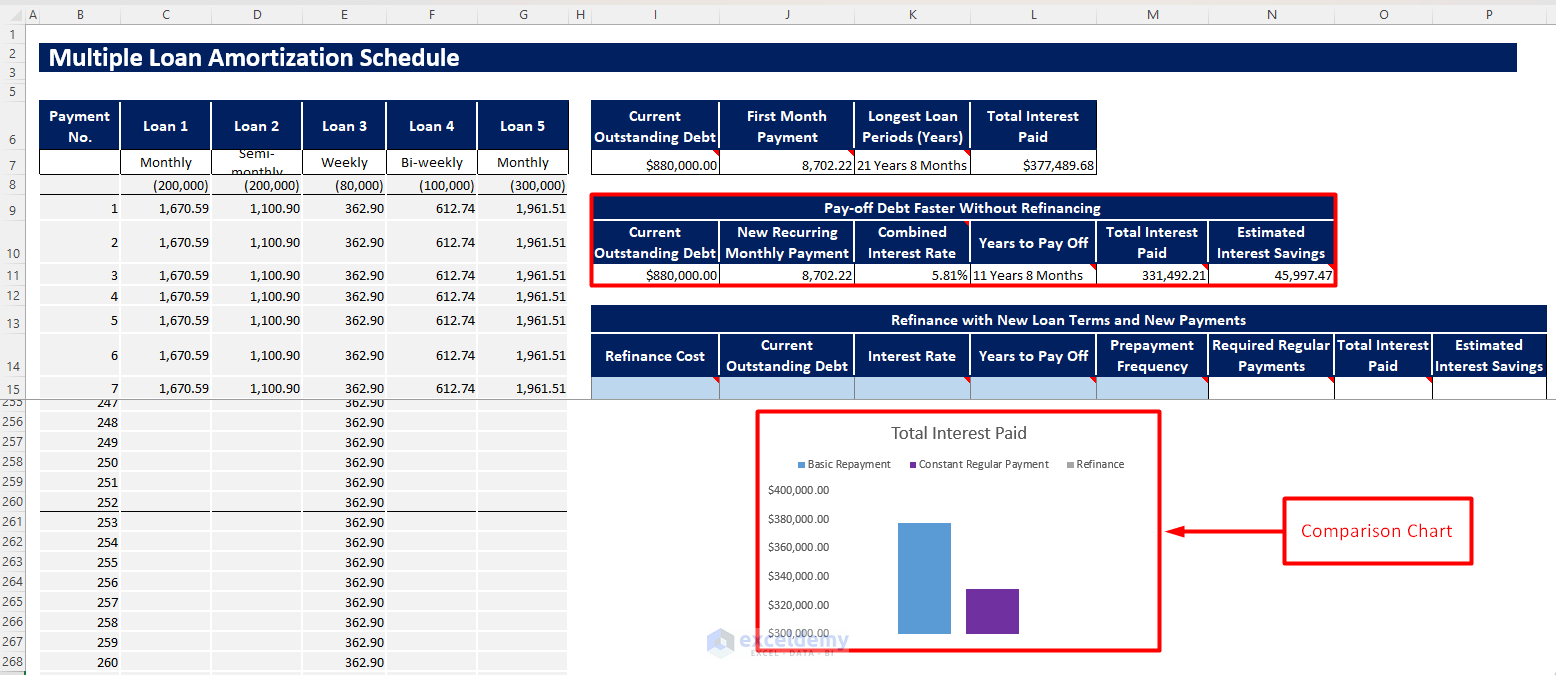

- After inserting the parameters, you will get your multiple loan amortization schedule and necessary output values on the right side.

- Apart from basic loan repayment approach outputs, you will also get outputs for following the “Paying off your debts without refinancing” approach.

- You can also compare the interest paid values between the approaches and create a comparison chart to do so quickly.

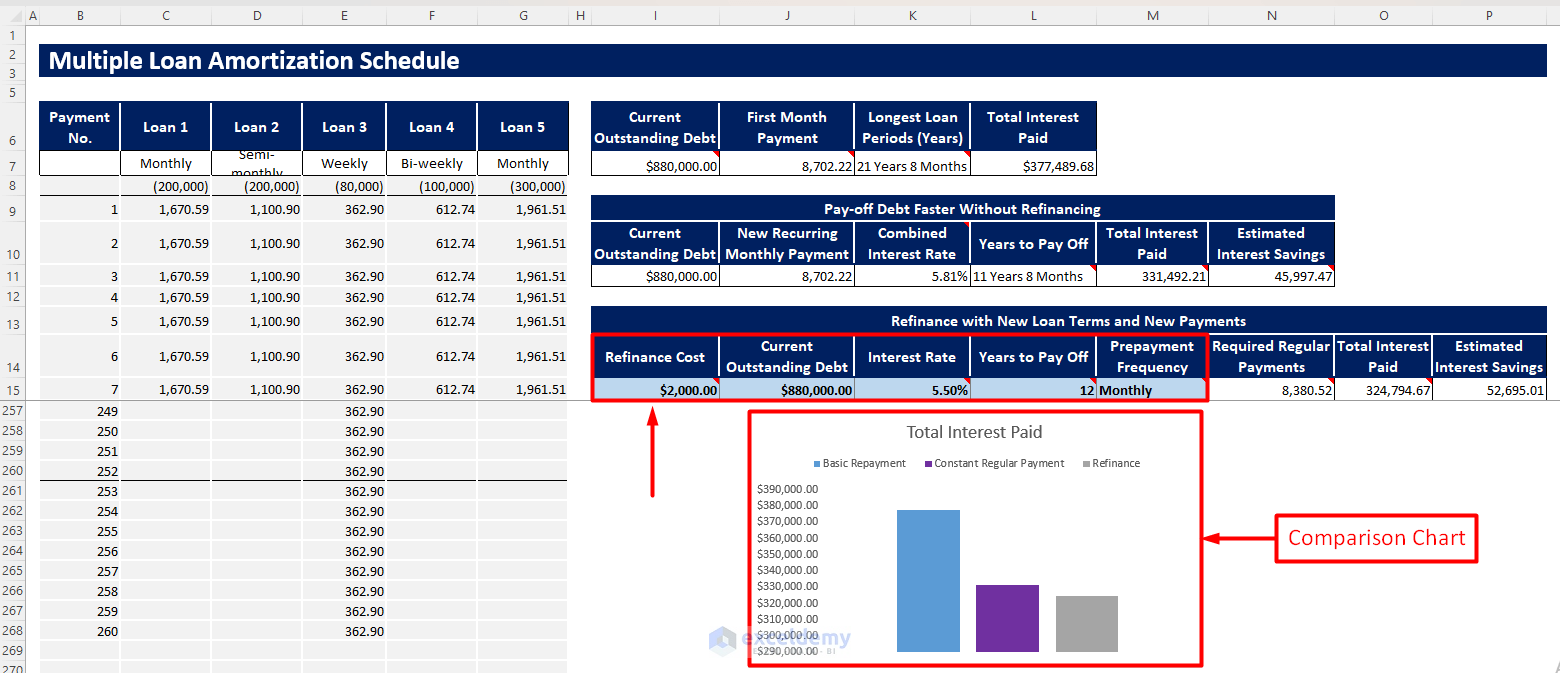

- To determine whether refinancing helps your multiple loans, insert necessary inputs in the blue shaded area of the “Refinance with New Loan Terms and New Payments” table. You will automatically receive the necessary outputs on the right side, along with a summary chart showing a live comparison of interest paid for following different approaches.

Multiple Loan Amortization Schedule Excel Template Tips

- Insert all the required inputs properly and choose all the dropdowns.

- Follow the inserted notes in the parameters to enter input values.

- If you want to get an individual amortization schedule of your loans, you will see that there are several hidden sheets for individual loans. Unhide them, and you will see all outputs for individual loans.

- If you insert extra payments, then follow the notes properly to avoid any errors.

- When choosing interest compounding frequency, do not choose any frequency lesser than your chosen regular payment frequency. Otherwise, it would show you an error.

Download Excel Template

Download Excel TemplateFor: Excel 2007 or later

License: Private Use

Related Articles

- Amortization Schedule with Irregular Payments in Excel

- Excel Car Loan Amortization Schedule with Extra Payments Template

- Preparing Bond Amortization Schedule in Excel

- Interest Only Amortization Schedule with Balloon Payment Template Excel

- Excel Car Loan Amortization Schedule Template

- Excel Student Loan Amortization Schedule

- ARM Amortization Schedule Excel Template

<< Go Back to Amortization Schedule | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!