This template will be helpful to bankers, business owners, job holders, financial planners, and all kinds of lenders and borrowers looking to take or give away a loan.

Download the Excel Template

Download Excel TemplateFor: Excel 2007 or later

License: Private Use

⏷What Is Car Loan Amortization Schedule?

⏷Car Loan Amortization Schedule Excel Template

⏵How to Use This Template

⏵Car Loan Amortization Schedule with Extra Payments (Regular/Irregular) Template

⏷Car Loan Amortization Schedule Excel Template Tips

What Is a Car Loan Amortization Schedule?

A car loan amortization schedule is an amortization schedule to visualize the principal paid, interest paid, and remaining balance of someone’s car loan after each payment. This amortization table is specifically designed for car loans by which the borrower can find how much s/he should pay to pay off his/her loan within his/her loan tenure and how his/her loan balance decreases over the loan terms.

Car Loan Amortization Schedule Excel Template

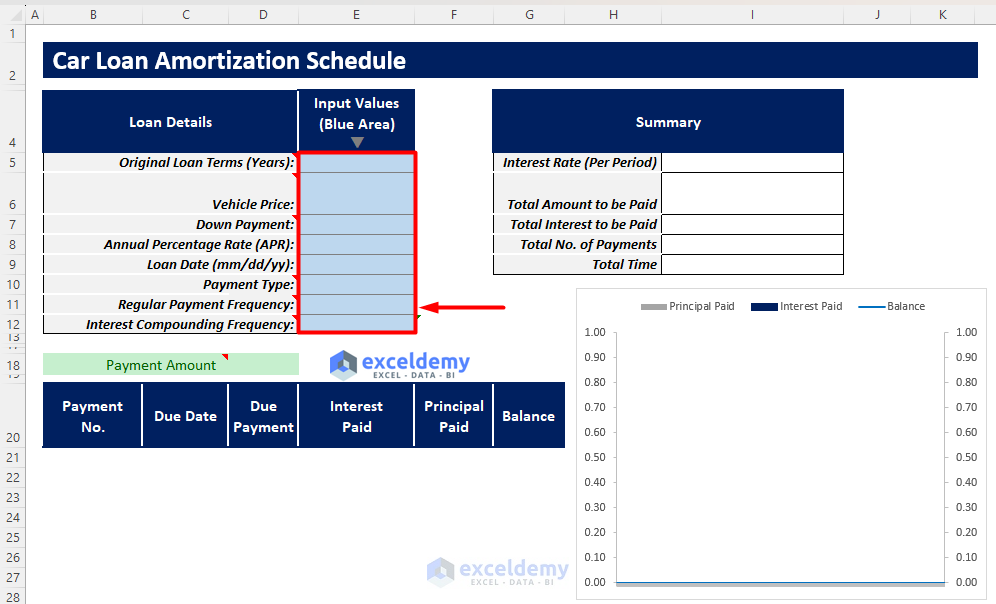

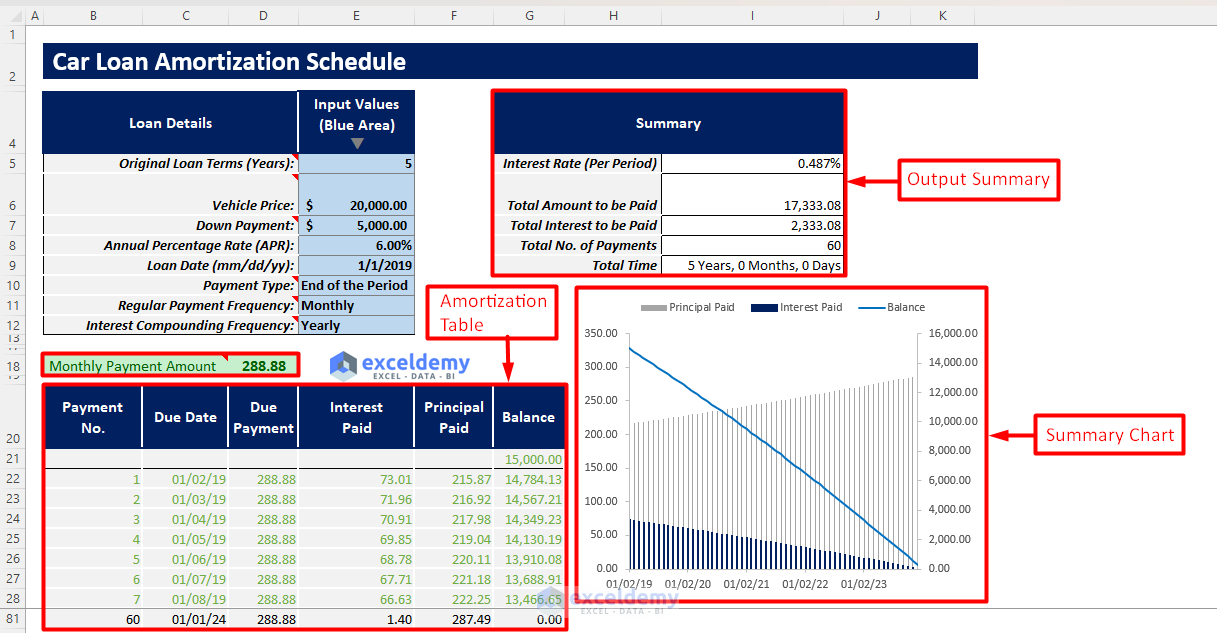

You can generate your car loan amortization schedule from this template by inserting the necessary input values. You will get your required regular payments to pay off the loan, and you will get your principal paid, interest paid, and remaining balance after each payment. You will get an output summary focusing on all the important outputs and a summary chart displaying interest paid, principal paid, and balance trend over the loan tenure.

How to Use This Template

Instructions:

- Insert all the required input values and choose the necessary dropdowns in the blue-shaded area of the Input Values column. The required inputs are:

- Original Loan Terms (Years)

- Vehicle Price

- Down Payment

- Annual Percentage Rate

- Loan Date (mm/dd/yyyy)

- Payment Type

- Regular Payment Frequency

- Interest Compounding Frequency

- You will get the required regular payment amount and the necessary amortization table for your car loan.

- You will also find an output summary containing the following outputs.

- Interest Rate (Per Period)

- Total Amount to be Paid

- Total Interest to be Paid

- Total No. of Payments

- Total Time.

- Here is a summary chart containing the trends of your car loan’s principal paid, interest paid, and balance.

Read More: Multiple Loan Amortization Schedule Excel Template

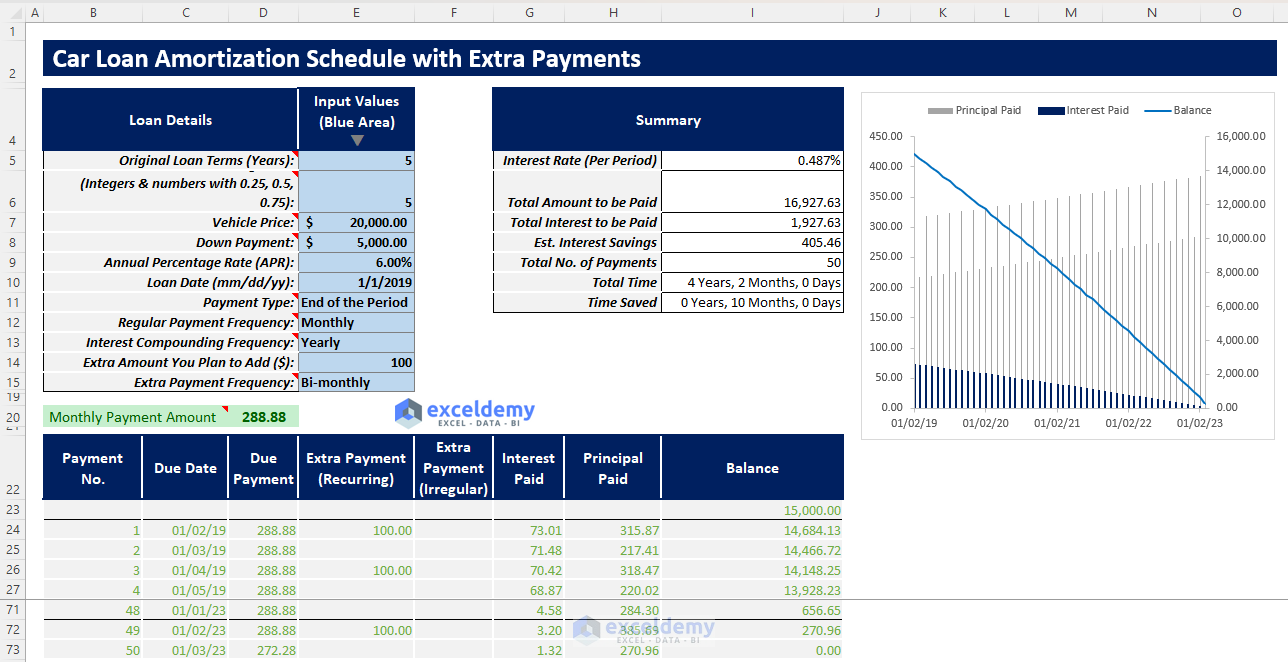

Car Loan Amortization Schedule with Extra Payments (Regular/Irregular) Template

This template is quite similar to the previous template. But, in this template, you would get an extra feature. You can add irregular/regular payments during your loan repayment process.

Say a car loan borrower got some extra money during his loan repayment, and now he wants to make some extra payments regularly or irregularly to pay off his loan more quickly than before. In this car loan amortization schedule with an extra payments template, s/he can add his/her regular extra payments in the Extra Amount You Plan to Add and Extra Payment Frequency input fields. To add irregular extra payments, s/he can do this in the Extra Payment (Irregular) column. This will repay the loan quicker and give lesser interest throughout the loan tenure.

Read More: Amortization Schedule with Irregular Payments in Excel

Car Loan Amortization Schedule Excel Template Tips

- Insert all the necessary inputs and choose all the necessary dropdowns properly.

- To avoid mistakes, follow the notes given in the loan parameters.

- Choose interest compounding frequency as equal to or greater than regular payment frequency. Otherwise, it would result in an error. So, if you choose regular payment as monthly, you must choose interest compounding frequency as monthly, bi-monthly, semi-annually, or yearly.

- The dark blue line in the chart shows Interest Paid, the ash line shows Principal Paid, and the light blue line shows the Balance trend over the loan tenure.

Related Articles

- Preparing Bond Amortization Schedule in Excel

- Excel Interest Only Amortization Schedule with Balloon Payment Calculator

- Amortization Schedule with Balloon Payment and Extra Payments in Excel

- Excel Student Loan Amortization Schedule

- ARM Amortization Schedule Excel Template

- Amortization Schedule Excel Template with Extra Payments

<< Go Back to Amortization Schedule | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!