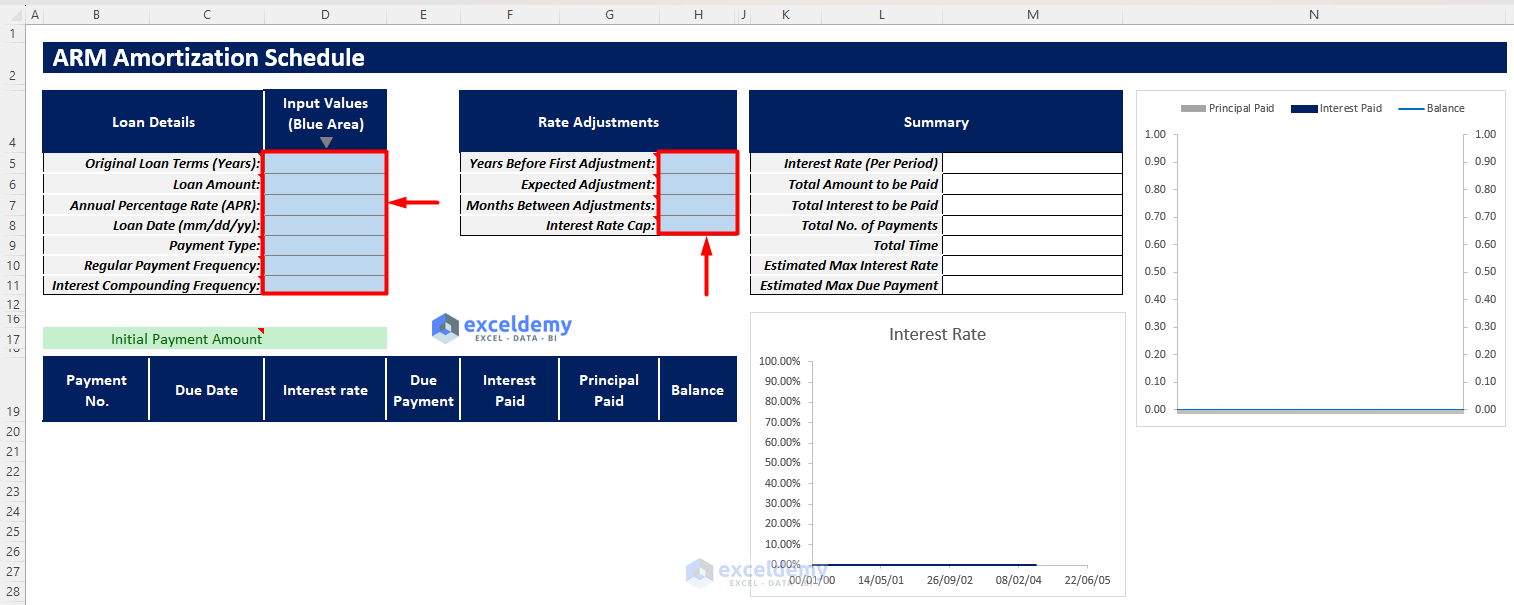

Instructions:

- Open the ARM Amortization Schedule template and insert all the required inputs in the blue-shaded area of the Input Values column. The necessary inputs are:

- Original Loan Terms (Years)

- Loan Amount

- Annual Percentage Rate

- Loan Date

- Payment Type

- Regular Payment Frequency

- Interest Compounding Frequency

- Years Before First Adjustment

- Expected Adjustment

- Months Between Adjustments

- Interest Rate Cap

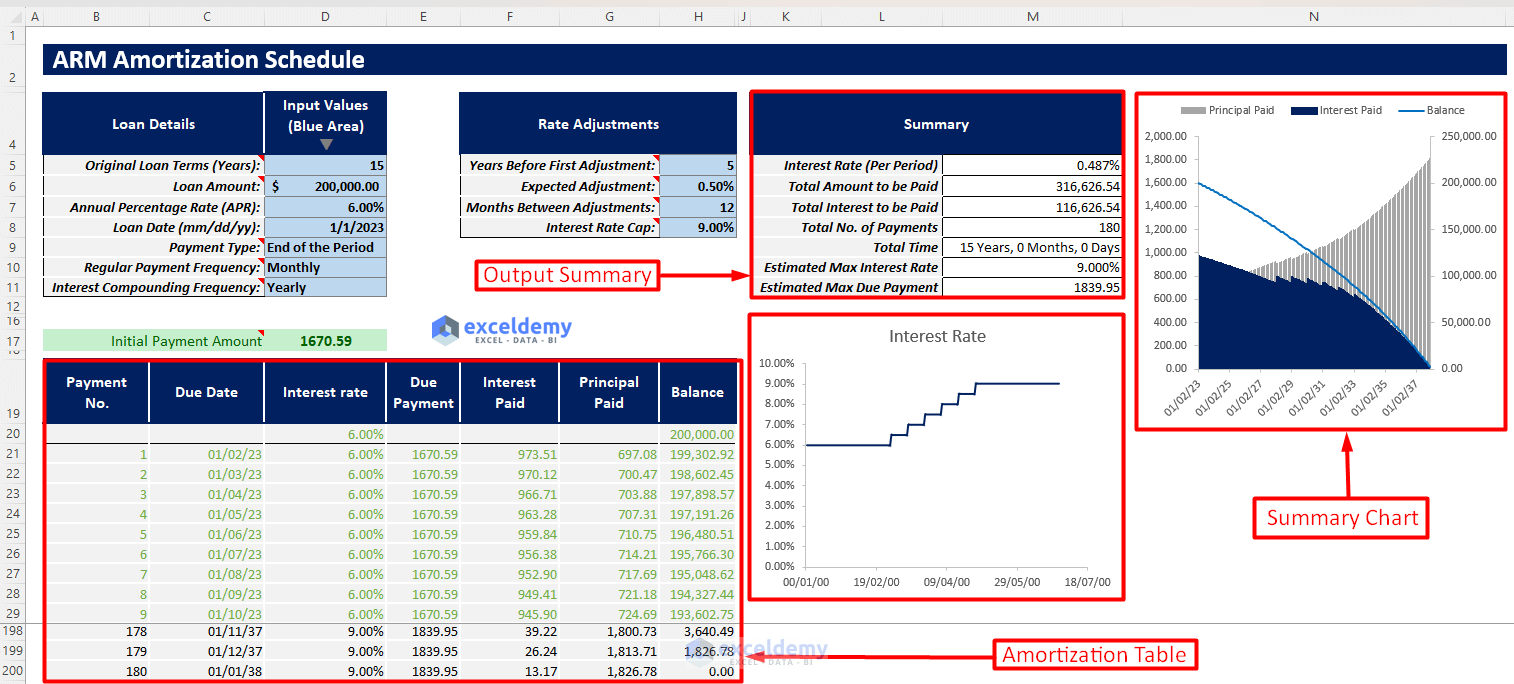

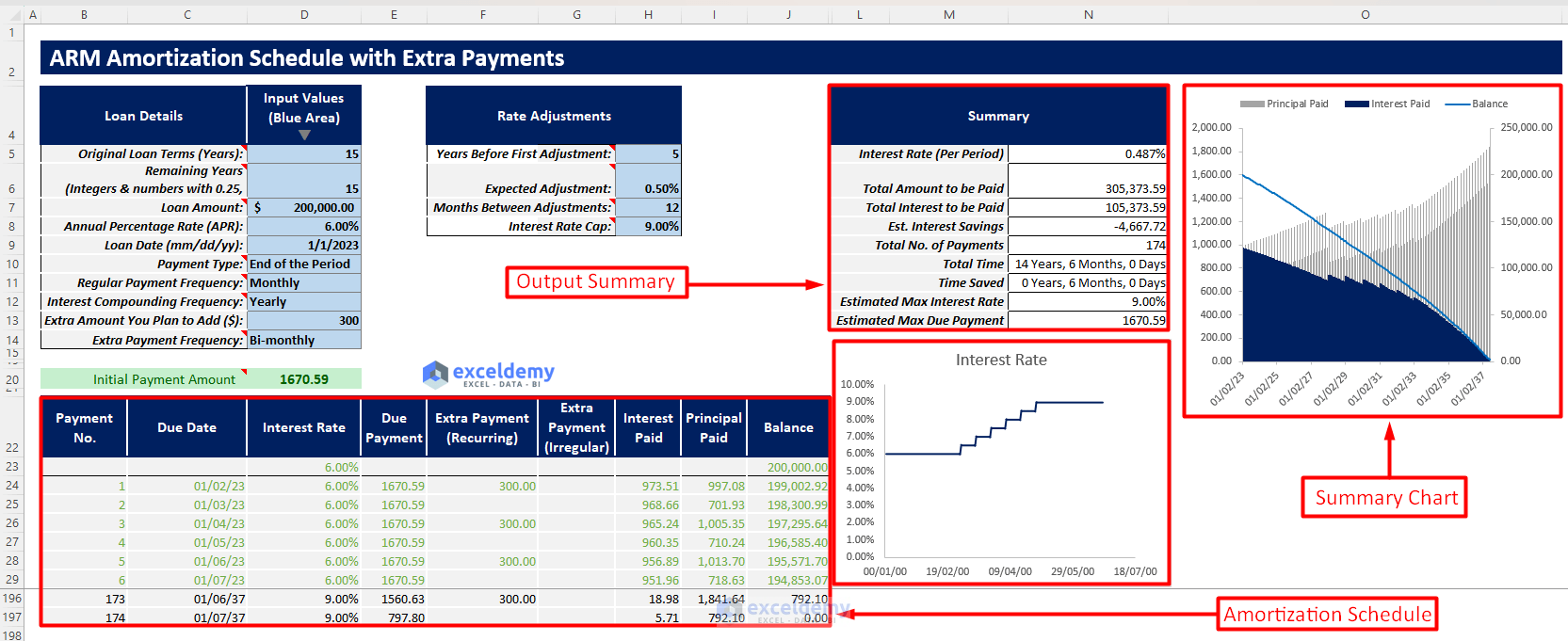

- After inserting the inputs, you will find the required initial payment amount and amortization schedule along with a summary chart for your adjusted rate mortgage.

- You will also find an output summary containing all the important outputs. such as:

- Interest Rate (Per Period)

- Total Amount to be Paid

- Total Interest to be Paid

- Total No. of Payments

- Total Time

- Estimated Max Interest Rate

- Estimated Max Due Payment

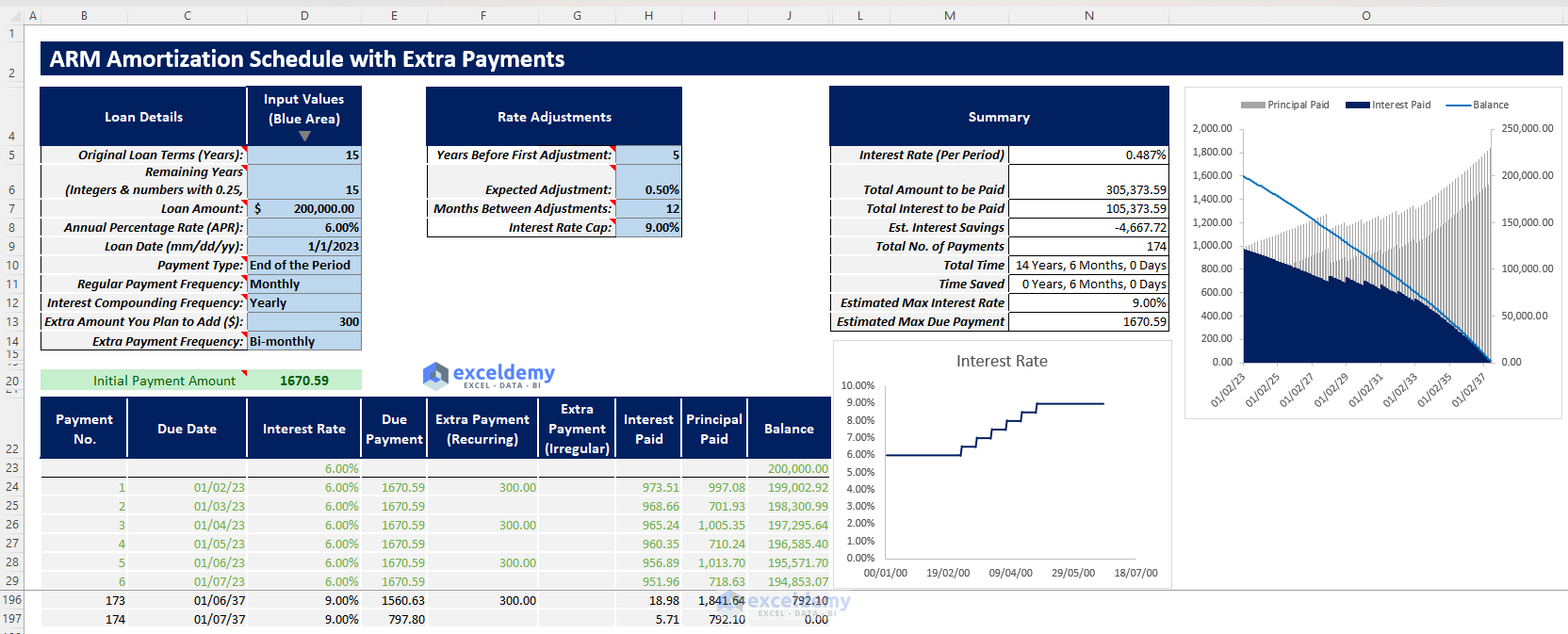

Excel ARM Amortization Schedule with Extra Payments (Regular/Irregular) Template

In this template, you will be able to insert those regular or irregular extra payment entries to find your adjusted rate mortgage amortization schedule with extra payments.

How to Use This Template

Go through the instructions below to use this template properly.

Instructions:

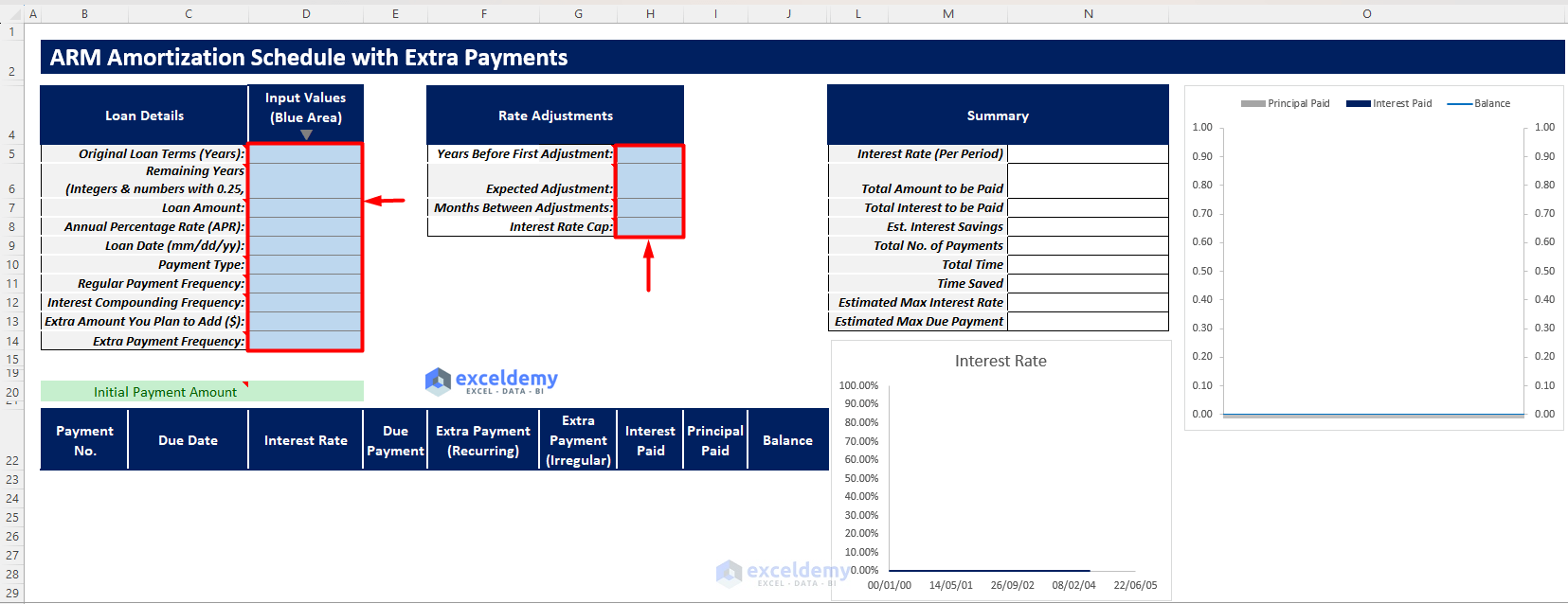

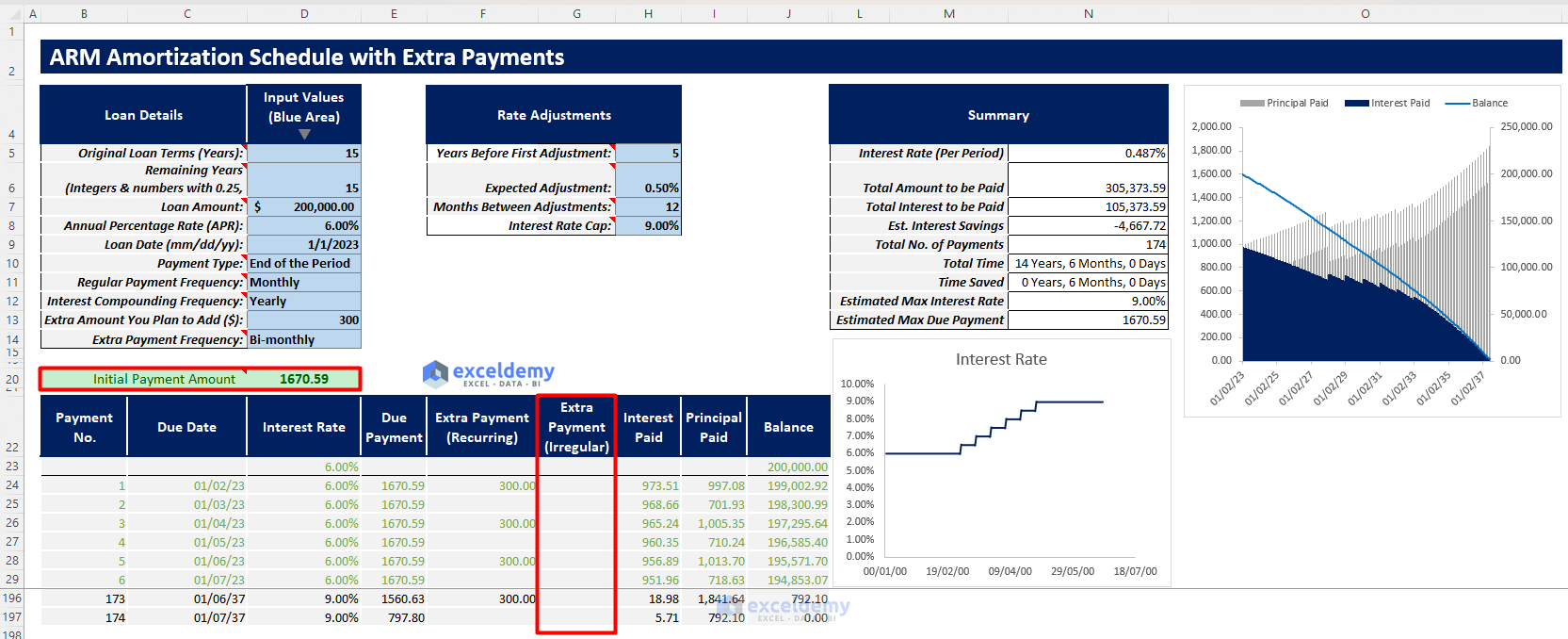

- Open the ARM Amortization Schedule(Extra Payments) sheet and insert all the required inputs in the blue shaded area of the Input Values column.

- Your required initial payment amount and arm amortization schedule. To insert irregular extra payments, you have to do it manually in the Extra Payments (Irregular) column of the amortization schedule.

- Find the final amortization schedule along with an output summary containing all important outputs such as estimated interest savings, time saved, etc.

- Find a summary chart showing the principal paid, interest paid, and remaining balance trend over the loan tenure.

ARM Amortization Schedule Excel Template Tips

- Follow the added notes in the loan parameters to insert proper values and choose proper dropdowns.

- When choosing interest compounding frequency, choose it as equal to or greater frequency than the chosen regular payment frequency.

- When choosing extra payment frequency, choose it as a multiple of your chosen regular payment frequency.

Necessary Terms to Know Before Working with ARM Amortization Schedule Template

1. Years Before First Adjustment: This is the number of years before your loan’s first adjustment. So, before you reach this term of years, you will be charged with the initial interest rate for your loan.

2. Expected Adjustment: This is the adjustment rate that your interest will increase or decrease after each adjustment. If your initial interest rate is 6% and the adjustment increment rate is 0.5%, then after each adjustment, your interest will increase to 6.5%,7%, 7.5%, and so on.

3. Months Between Adjustments: This is the number of months that will continue the adjusted interest rate. If this value is 12, this means the adjusted interest rate will be continued for 12 months and then another adjustment will occur after 12 months.

4. Interest Rate Cap: This is the maximum interest rate that can be reached by adjusting the initial interest rate. If this value is 9%, this means the interest rate will be adjusted until it reaches 9%, and when it reaches 9%, it will not increase anymore.

What Is ARM Amortization Schedule?

The ARM amortization schedule is a special amortization schedule where the interest rate is not fixed, rather it varies at a certain rate after a certain interval period. As a result, the regular payment to repay the loan changes after each adjustment. This type of loan is common for long-time loans as the interest rate should be increased or decreased according to various economic factors.

How Does ARM Amortization Schedule Work?

ARM amortization schedule starts with an initial interest rate. The required initial payment and interest accrued are calculated based on this rate. However, this rate is not constant. The interest rate increases or decreases after a certain period at a certain adjustment rate. And, it continues to increase or decrease at the adjustment rate with a certain interval period number. It increases or decreases up to a certain interest rate cap. So, the required payment and accrued interest change over the loan tenure according to these certain values.

What Are the Types of ARM Amortization Schedule?

There are several types of ARM amortization schedule. Such as:

- 10/1 ARM: The interest rate will be fixed for 10 years and it will start to change according to the adjustment rate at one-year intervals after the initial 10 years.

- 7/1 ARM: The interest rate will be fixed for 7 years and it will change according to the adjustment rate each year.

- 5/1 ARM: The interest rate will be fixed for 5 years and it will change according to the adjustment rate each year.

- 3/1 ARM: The interest rate will be fixed for 3 years and it will change according to the adjustment rate each year.

What are the Pros and Cons of the ARM Amortization Schedule?

Adjusted rate mortgage might be both a good idea and a bad idea according to loan purpose and various loan parameters.

The pros of this mortgage are:

- As the interest rate is fixed for the first several years, the interest might be lesser for the first several years.

- As the future is uncertain, the interest rate might decrease. As a result, the due payment might decrease after the first several years.

- As there is an interest rate cap, if the interest rate increases, it can not exceed the cap rate which will restrict the increment of due payment.

The cons of this mortgage are:

- As interest rates might increase due to an uncertain future, the interest rate might increase after the first several years which would increase due payment.

- There might be several hidden fees associated with this type of loan which would increase the total loan amount to be paid.

Download Excel Template

Download Excel TemplateFor: Excel 2007 or later

License: Private Use

Related Articles

- Preparing Bond Amortization Schedule in Excel

- Excel Interest Only Amortization Schedule with Balloon Payment Calculator

- Amortization Schedule with Balloon Payment and Extra Payments in Excel

- Excel Student Loan Amortization Schedule

- Amortization Schedule Excel Template with Extra Payments

- Excel Car Loan Amortization Schedule Template

- Excel Car Loan Amortization Schedule with Extra Payments Template

<< Go Back to Amortization Schedule | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!