What is the Gold Loan Interest?

A gold loan is a kind of secured loan that is provided by financial institutions in exchange for the gold owned by the loan applicant. An interest is applied, depending on:

- The amount of loan amount: the lesser the loan amount, the greater the interest rate.

Method 1 – Using the Excel PMT Function to Calculate the Gold Loan Interest

This is the syntax of the PMT function:

PMT(rate, nper, pv, [fv], [type])

rate is the annual interest rate of the loan.

nper is the loan tenure (number of years for which the loan is approved).

pv is the principal value or the initial loan amount.

fv is the future value; optional.

type specifies when the payment is due; optional.

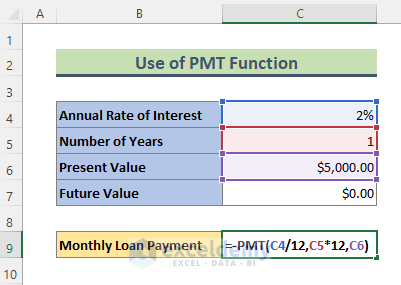

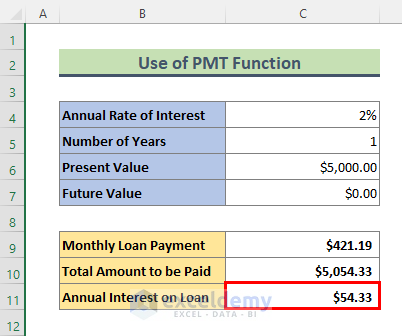

You have taken a 1-year gold loan from a bank with an interest rate of 2% and a loan amount of $5,000. To calculate the monthly loan payment for the borrowed amount and find the total interest:

Steps:

- Enter the formula in C9 and press Enter.

=-PMT(C4/12,C5*12,C6)In the PMT formula, the interest rate is divided by 12 to calculate monthly payments.

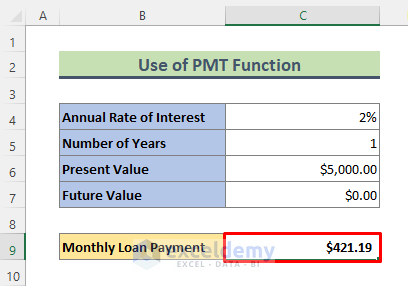

This the monthly payment.

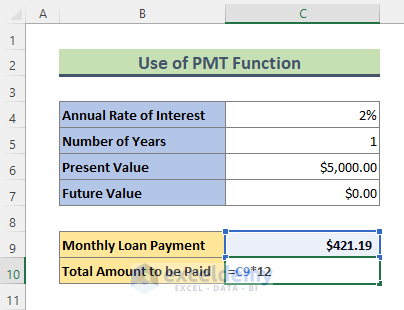

- To calculate the interest, enter the formula in C10.

=C9*12- Press Enter.

The output is $5,054

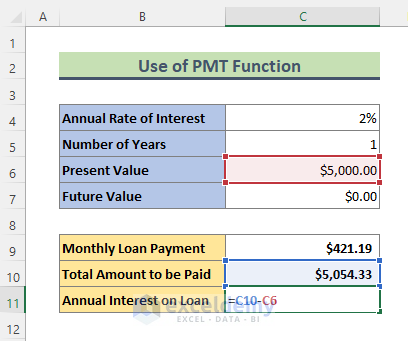

- To calculate the total amount of interest, enter the following formula in C11.

=C10-C6- Press Enter to see the result.

Method 2 – Using a Mathematical Formula to Find the Gold Loan Interest

The generic formula is:

= [ P x R X (1 + R) ^ N] / [ (1 + R) ^N – 1] P is the principal amount.

R is the interest rate.

N is the number of payments in the loan period.

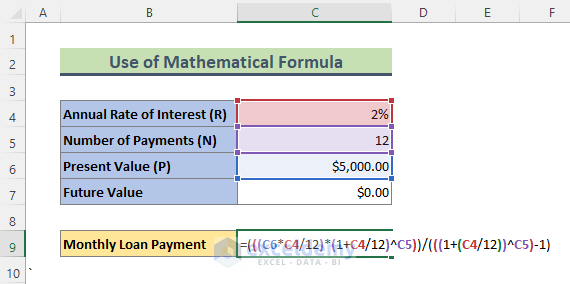

Consider the example in the previous method (12 months, interest rate: 2%, loan amount: $5,000) and calculate the EMI.

Steps:

- Enter the formula in C9.

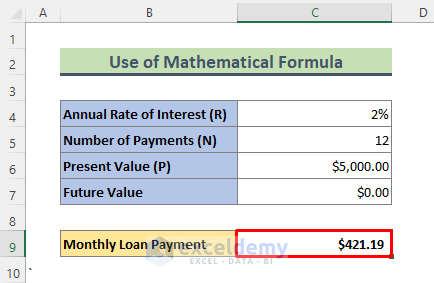

=(((C6*C4/12)*(1+C4/12)^C5))/(((1+(C4/12))^C5)-1)- Press Enter.

The monthly loan payment is $421.19.

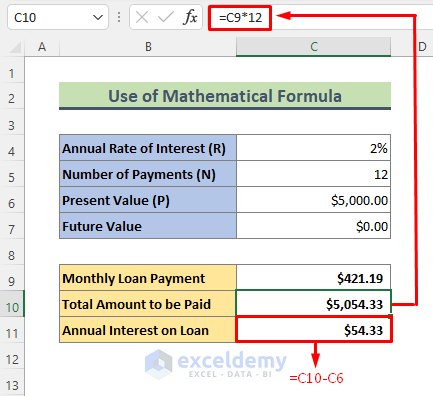

- To calculate the total payable amount and total interest use the formulas in Method 1 to see the results.

Read More: How to Calculate Principal and Interest on a Loan in Excel

Things to Remember

The PMT function returns the payable amount as a negative number (red color, closed in parenthesis); which means the money is getting deducted from your bank account. To see the payable amount as a positive number, add a minus (-) sign at the beginning of the PMT formula.

You can calculate the gold loan interest using the EMI calculator.

Download Practice Workbook

Download the practice workbook here.

Related Articles

- How to Calculate Accrued Interest on a Bond in Excel

- How to Calculate Accrued Interest on Fixed Deposit in Excel

- How to Calculate Accrued Interest on a Loan in Excel

- How to Calculate Home Loan Interest in Excel

- How to Calculate Credit Card Interest in Excel

<< Go Back to Excel for Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!