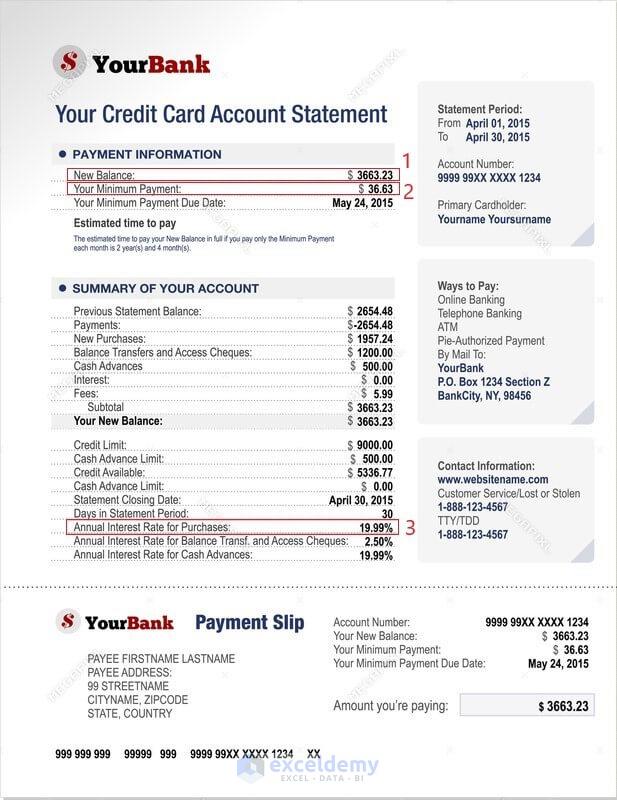

To calculate the interest on a credit card you need to know the Current Balance, Minimum Payment Percentage, and Annual Interest Rate.

This is the credit card statement:

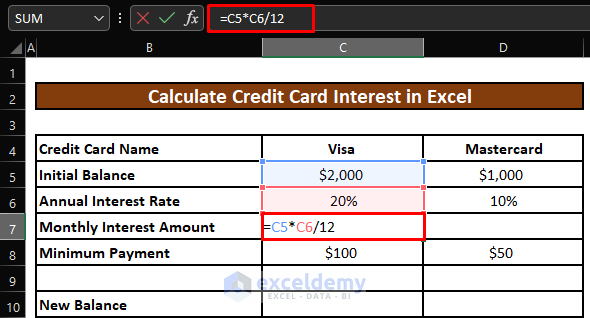

Step 1 – Calculate the Monthly Interest Amount to Find the Credit Card Interest

Calculate the monthly interest amount.

- Enter the following formula.

=C5*C6/12Formula Breakdown:

C5 = Initial Balance = $2,000

C6 = Annual Interest Rate = 20%

The annual interest rate is divided by 12.

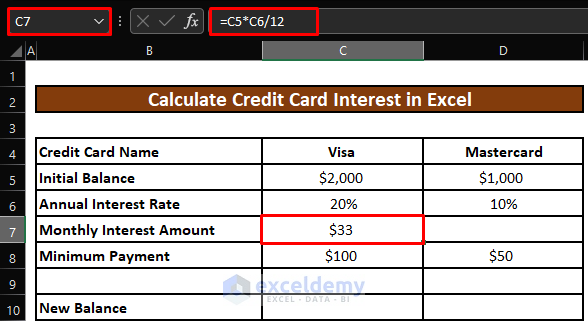

- Press ENTER to see the monthly interest amount for the Visa credit card.

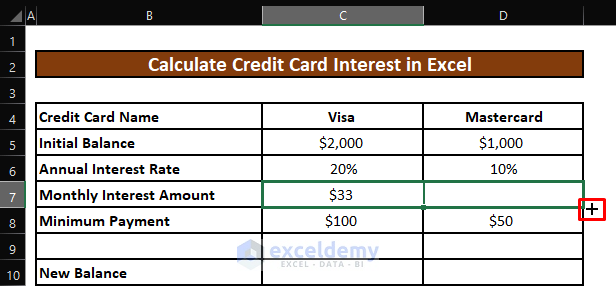

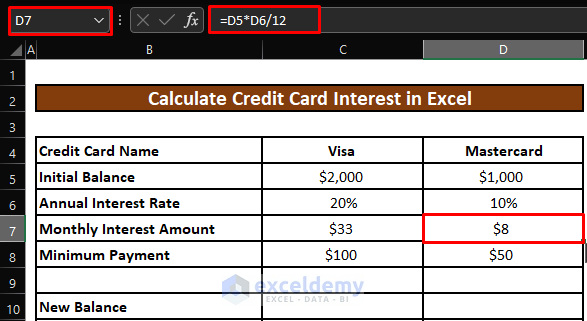

- Drag the Fill Handle to the right to apply the formula to the Mastercard credit card.

- This is the output.

Read More: How to Calculate Interest on a Loan in Excel

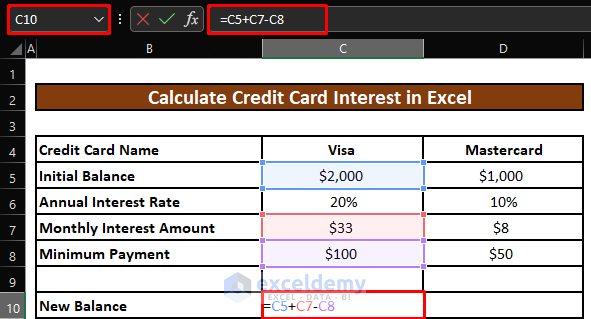

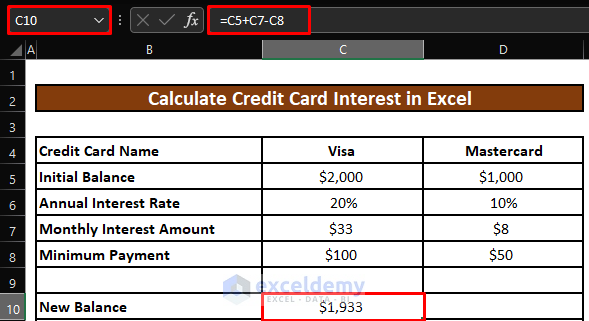

Step 2 – Find the New Balance to be Paid to Calculate the Credit Card Interest

- Enter the formula.

=C5+C7-C8Formula Breakdown:

C5 = Initial Balance = $2,000

C7 = Monthly Interest Amount= $33

C8 = Minimum Payment = $100

Subtract the Minimum Payment from the sum of the Initial Balance and the Monthly Interest Amount to calculate the New Balance.

- Press ENTER to see the New Balance for the Visa credit card.

- Drag the Fill Handle to the right to apply the formula to the Mastercard credit card. You will get the New Balance.

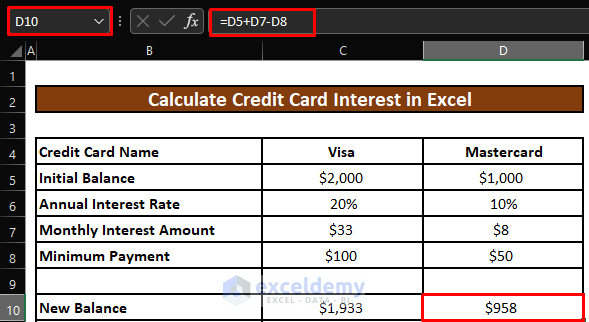

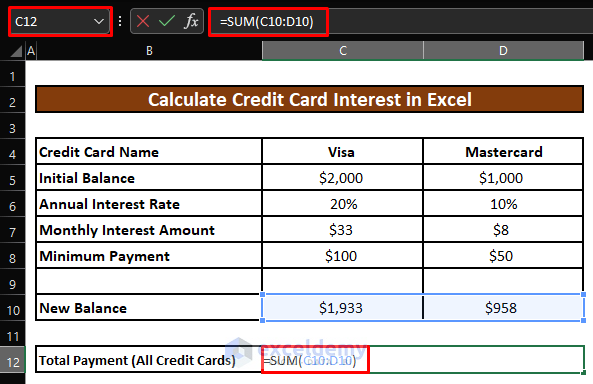

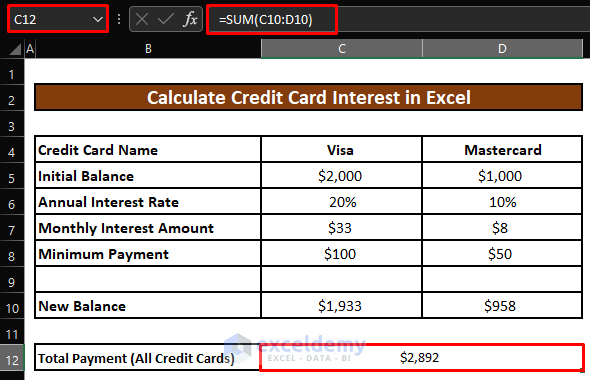

Step 3 – Calculate the New Balance to be Paid in Excel

- Enter the formula.

=SUM(C10:D10)Formula Breakdown:

C10 = New Balance for the Visa credit card= $1,933

D10 = New Balance for the Mastercard credit card= $958

The SUM function sums all cell values in the given range: both Visa and Mastercard credit cards New Balances to calculate the Total Payment for the 2 credit cards.

- Press ENTER to see the Total Payment for both credit cards.

Quick Notes

Initial Balance, Monthly Interest Amount, and Minimum Payment must be in Currency format. The Annual Interest Rate must be in Percentage format: Select a cell and right-click it. Select Format Cells. Choose Currency or Percentage format.

Download Practice Workbook

Download the practice workbook.

Related Articles

- How to Calculate Home Loan Interest in Excel

- How to Calculate Gold Loan Interest in Excel

- How to Calculate Principal and Interest on a Loan in Excel

- How to Calculate Accrued Interest on Fixed Deposit in Excel

- How to Calculate Accrued Interest on a Bond in Excel

- How to Calculate Accrued Interest on a Loan in Excel

<< Go Back to Excel for Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!