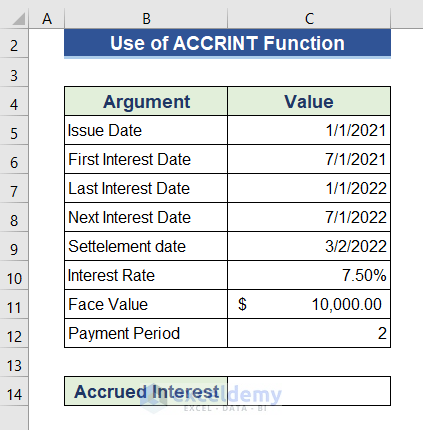

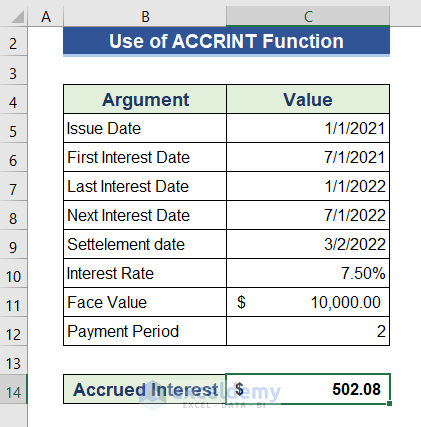

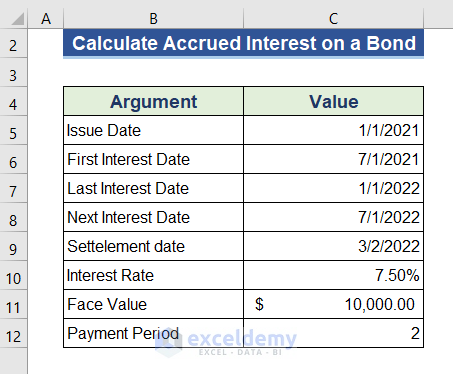

We will show how to calculate this accrued interest on a bond using different formulas in Excel. We will calculate the accrued interest based of the information in our sample dataset. Here, interest will be accrued bi-annually. The initial price of the bond is $10,000 and our settlement date is 3/2/2022, so the accrued interest will be calculated from the issue date to this date.

Method 1 – Apply the ACCRINT Function to Calculate Accrued Interest on a Bond

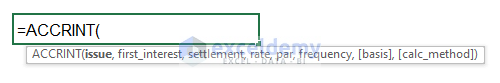

The ACCRINT function gives the profit from a bond periodically.

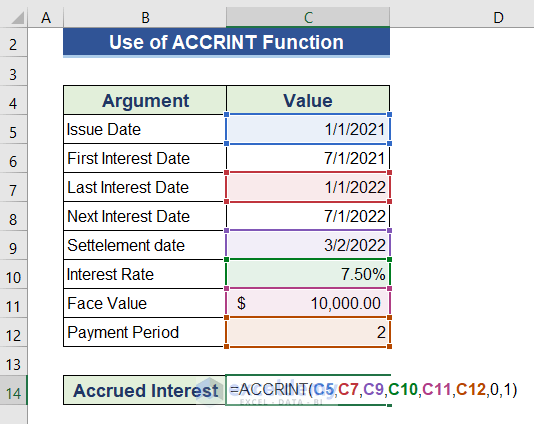

Steps:

- Add a new cell to calculate the accrued interest.

- Go to the new cell.

- Insert the following formula.

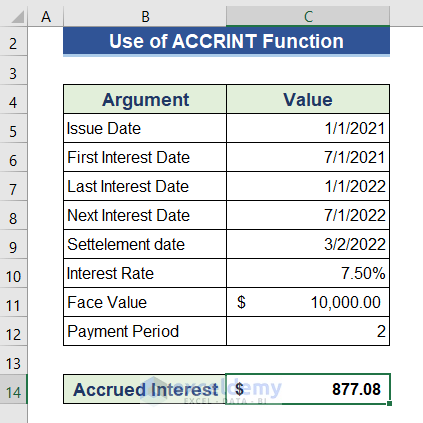

=ACCRINT(C5,C7,C9,C10,C11,C12,0,1)- Press Enter.

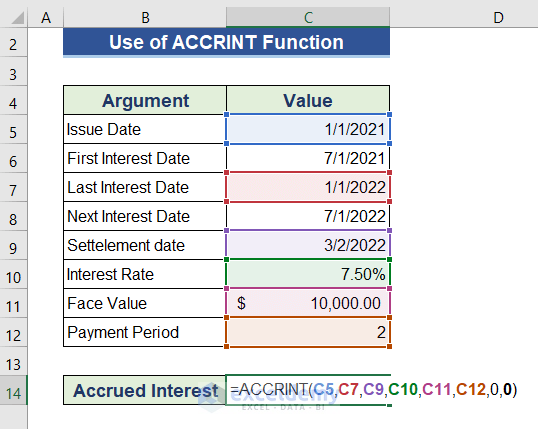

We can also calculate the accrued interest on a bond from the last interest date.

- Change the last argument of the formula from 1 to 0.

=ACCRINT(C5,C7,C9,C10,C11,C12,0,0)- Click the Enter button.

This accrued interest is from the last payment date to the settlement date.

Read More: How to Calculate Accrued Interest on a Loan in Excel

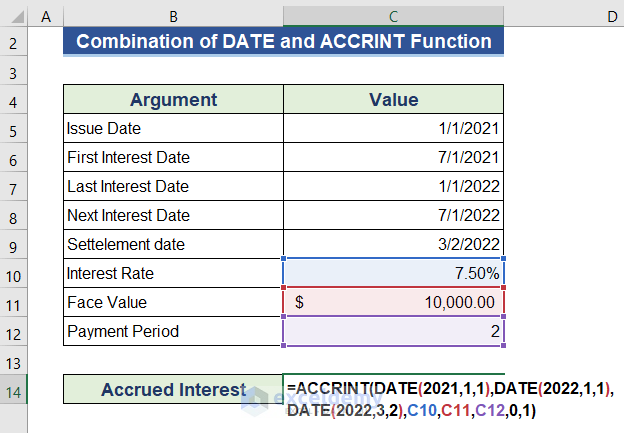

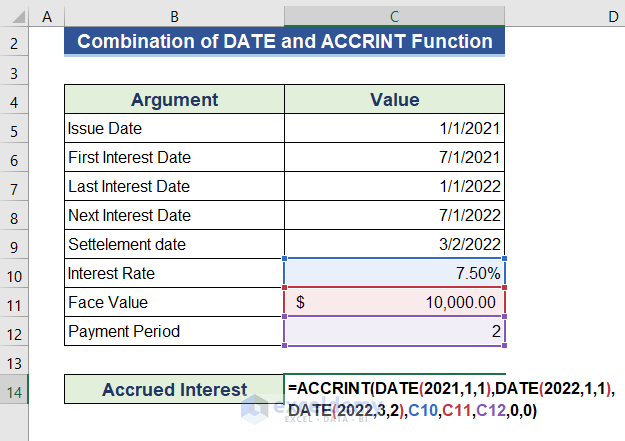

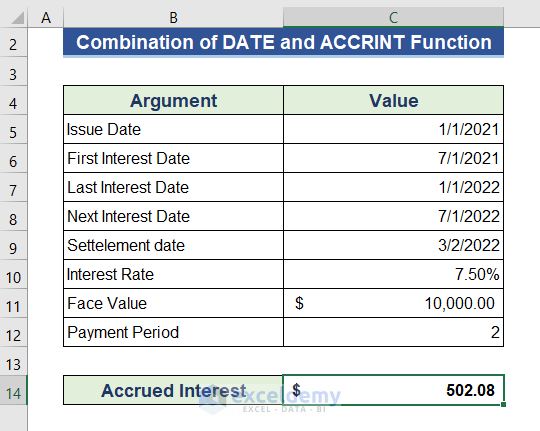

Method 2 – Combine DATE and ACCRINT Functions to Determine Accrued Interest

The DATE function gives a date value from some sequential numbers.

Steps:

- Go to cell C14.

- Insert the following formula. We input dates directly through the DATE function here.

=ACCRINT(DATE(2021,1,1),DATE(2022,1,1),DATE(2022,3,2),C10,C11,C12,0,1)- Press the Enter button.

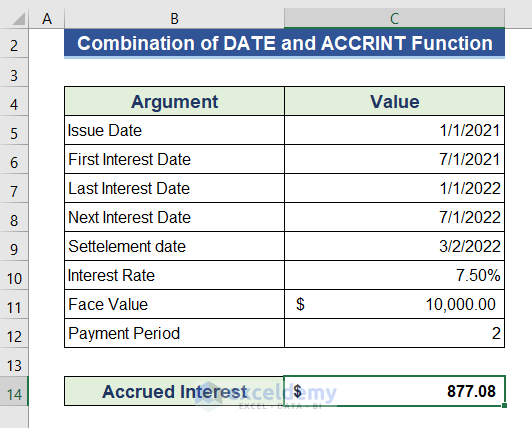

We get the accrued interest from the issue date.

We can also determine the accrued interest from the last interest payment date to the settlement date:

- Modify the last argument of the formula from 1 to 0.

=ACCRINT(DATE(2021,1,1),DATE(2022,1,1),DATE(2022,3,2),C10,C11,C12,0,0)- Here’s the result.

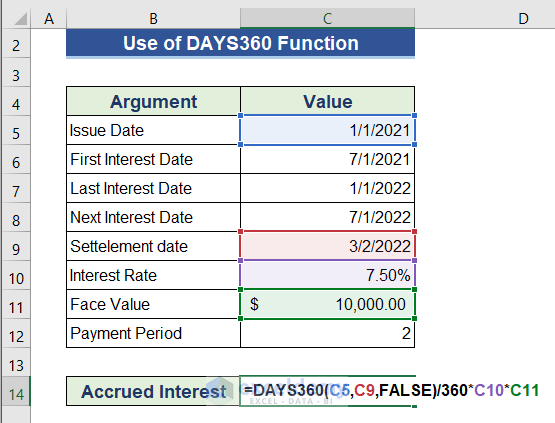

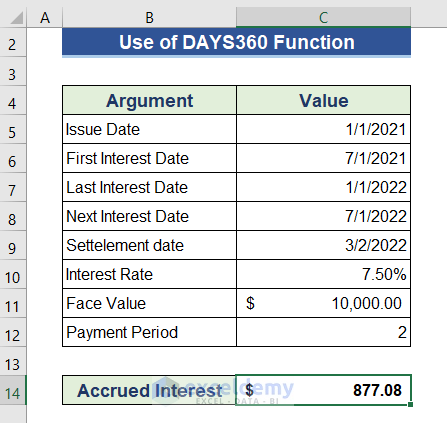

Method 3 – Measure the Accrued Interest on a Bond Using the DAYS360 Function

The DAYS360 function considers every month to be 30 days and the whole year is 360 days.

Steps:

- Go to cell C14.

- Insert the following formula.

=DAYS360(C5,C9,0)/360*C10*C11- Press Enter.

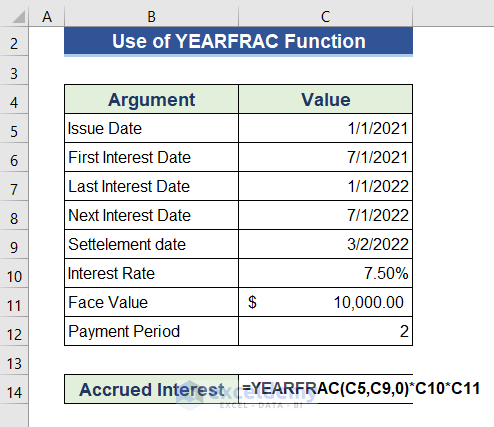

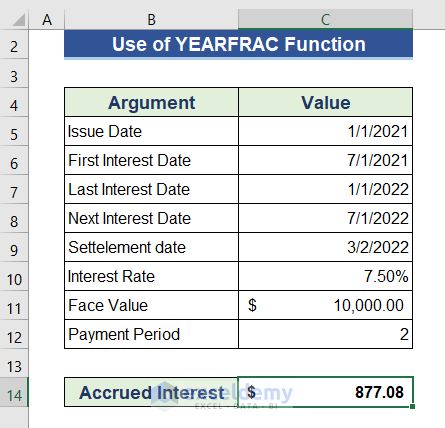

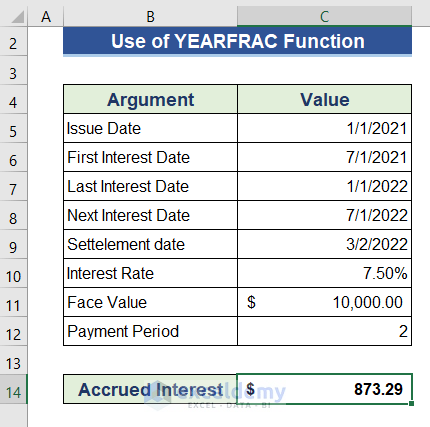

Method 4 – Estimate the Accrued Interest Using the YEARFRAC Function

The YEARFRAC function represents the fraction value of the year calculating the difference between two dates.

Steps:

- Go to cell C14 and insert the following formula.

=YEARFRAC(C5,C9,0)*C10*C11- Press Enter.

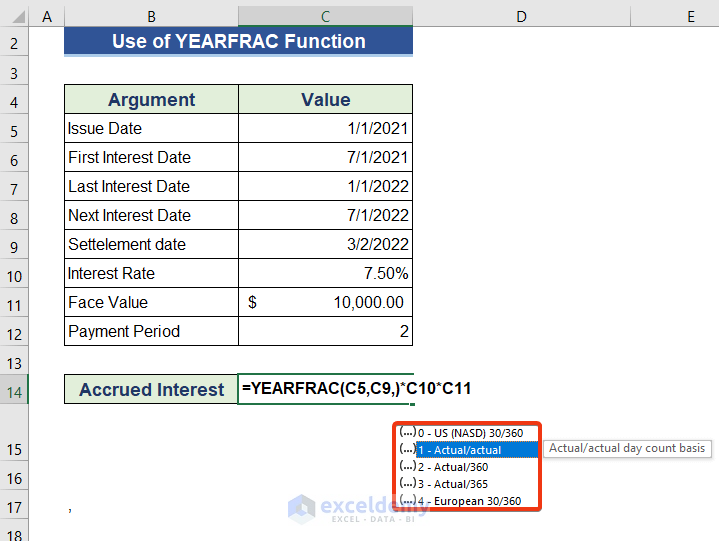

We calculated the value based on U.S. standards. We can get other standards by changing the 3rd argument of the YEARFRAC function.

4 alternative options are available here.

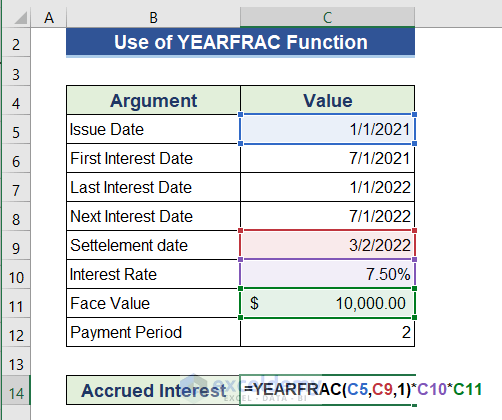

- To get the interest based on the actual day count, choose 1 as the last argument.

=YEARFRAC(C5,C9,1)*C10*C11- Here’s the result.

Read More: How to Calculate Accrued Interest on Fixed Deposit in Excel

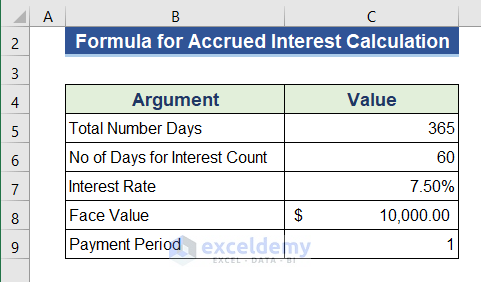

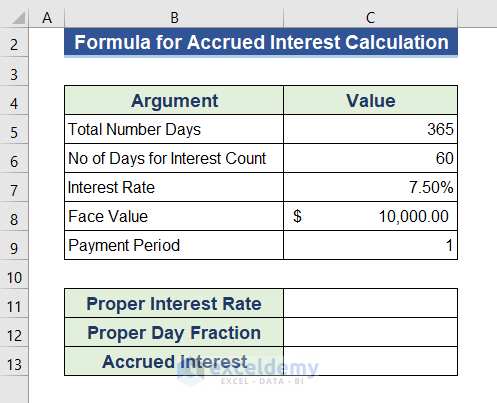

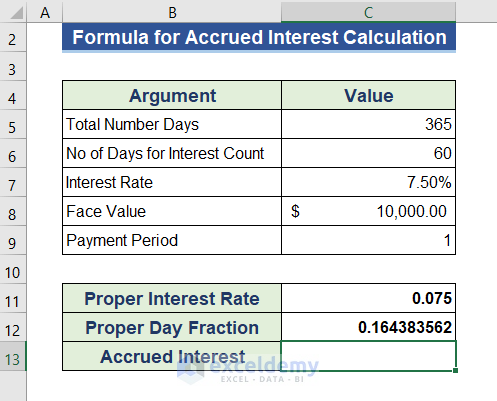

Method 5 – Make a Formula to Calculate the Accrued Interest

We have the following dataset that does not contain any date value.

We will create a new formula based on the equation below.

Accrued interest = Face Value* Proper Interest Rate* Proper Day Fraction

- We added 3 rows in the dataset for calculation.

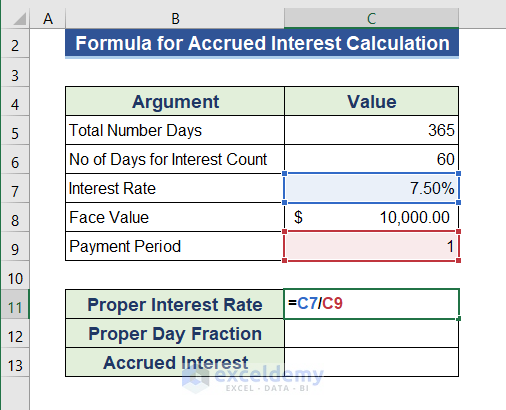

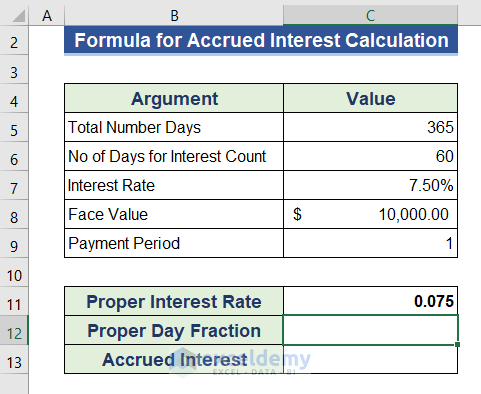

- Go to cell C11 now.

- Determine the Proper Interest Rate by applying the following formula.

=C7/C9- Press the Enter button.

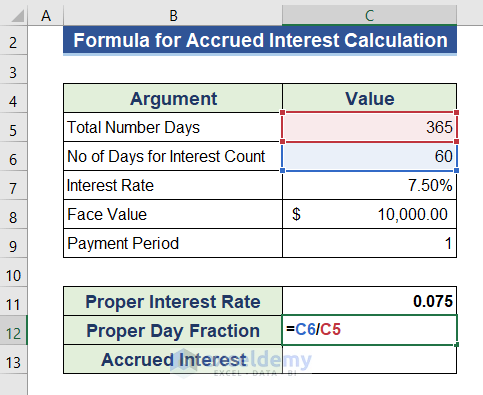

- Use the formula below to calculate the Proper Day Fraction.

=C6/C5- Click the Enter button.

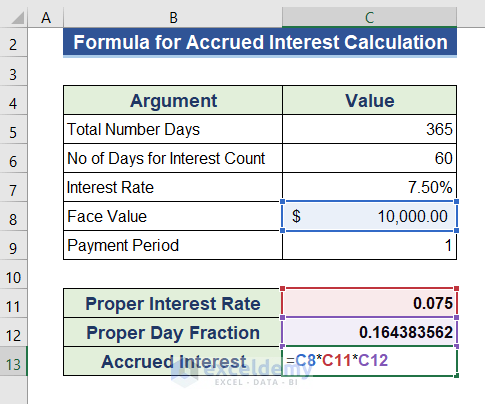

- Multiply the Face Value, Proper Interest Rate, and Proper Day Fraction in cell C13.

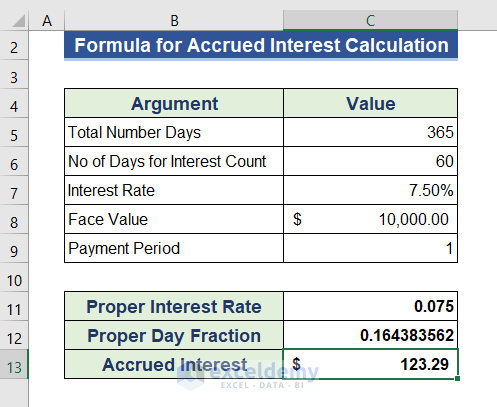

=C8*C11*C12- Press Enter.

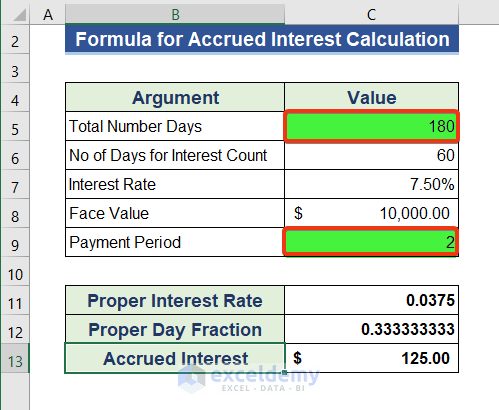

- We calculated the accrued interest on a bond annual basis. We can modify this formula for a bi-annual interest by changing the Total Number of Days and Payment Period of the dataset.

Things to Remember

- In the U.S., we use 30/360 for corporate and municipal bonds, while U.S. Treasury notes and bonds use the actual/actual day count basis.

- Only the ACCRINT formula accurately returns accrued interest on any date.

- Carefully select the dates when using the ACCRINT function.

Download the Practice Workbook

=Related Articles

- How to Calculate Gold Loan Interest in Excel

- How to Calculate Credit Card Interest in Excel

- How to Calculate Home Loan Interest in Excel

- How to Calculate Interest on a Loan in Excel

- How to Calculate Principal and Interest on a Loan in Excel

<< Go Back to Excel for Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!