What Is GPF Interest?

Government or non-government personnel can use the General Provident Fund (GPF) as an excellent savings tool. This is calculated through an interest rate which is known as GPF interest. Employees contribute with a part of their salary, accumulating a balance in the GPF account, which will be refunded upon retirement.

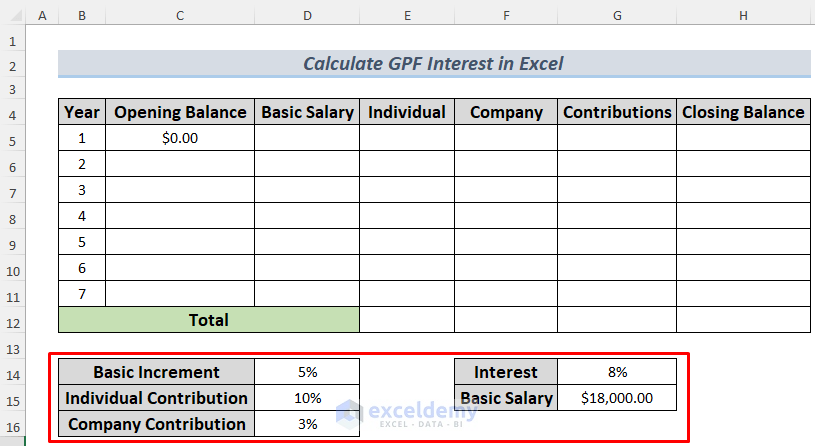

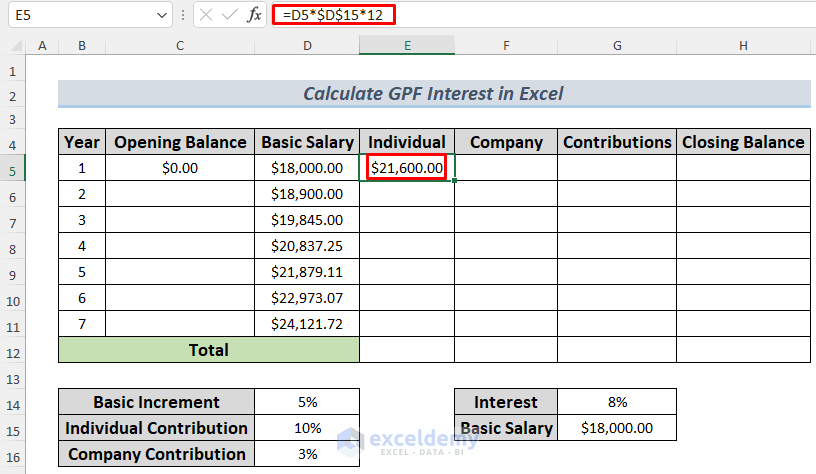

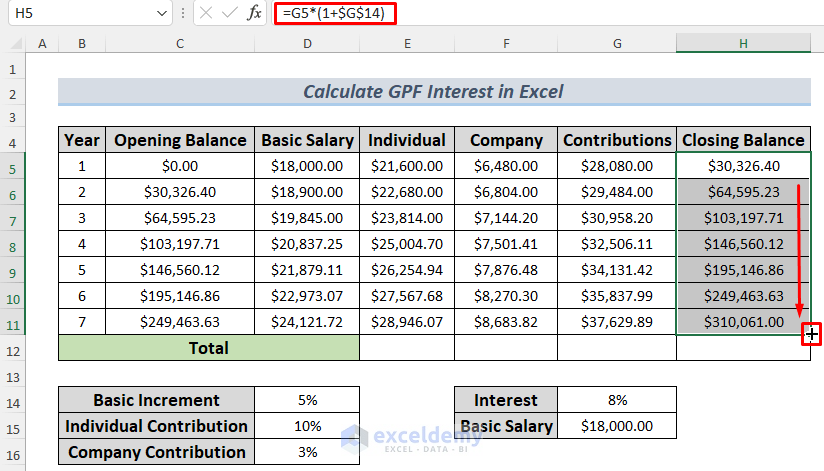

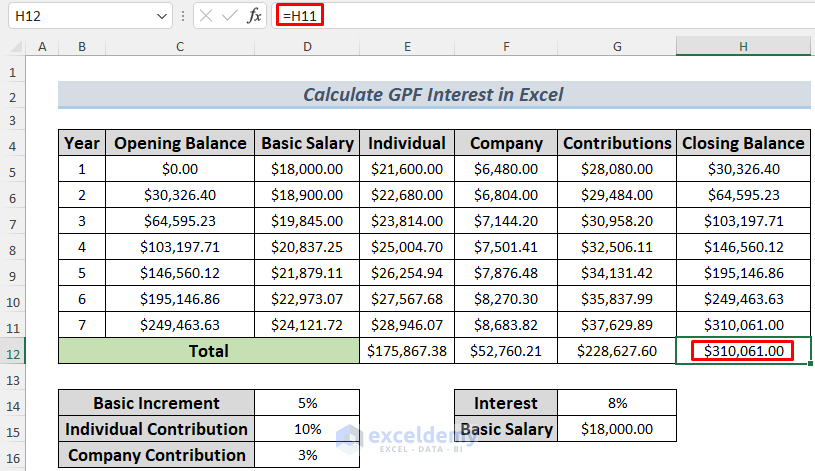

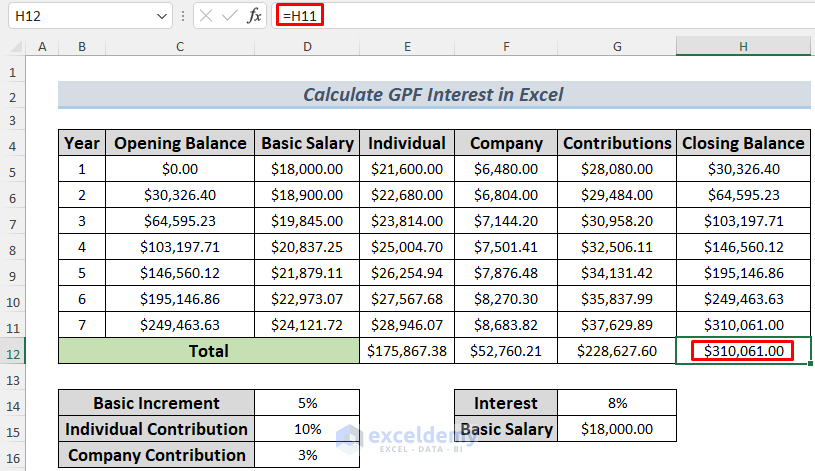

This is a sample Provident Fund dataset based on various parameters.

Step 1: Inserting Primary Data

- Insert columns to store the variables and insert the primary data: Basic Salary, Interest Rate, Basic Increment, Individual and Company Contributions.

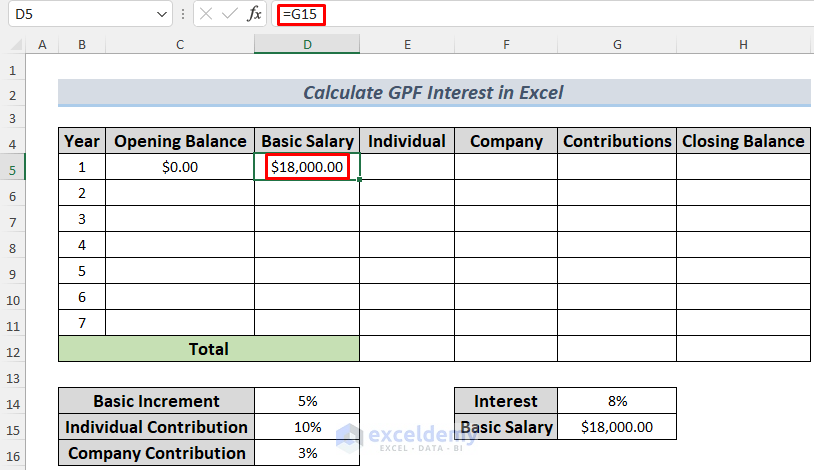

Step2 : Calculating Basic Salaries for 7 Years

To calculate the Basic Salaries for the next 7 years based on a yearly increment:

- Enter the following formula in C5 and press ENTER. This formula will store the Basic Salary in C5.

=G15

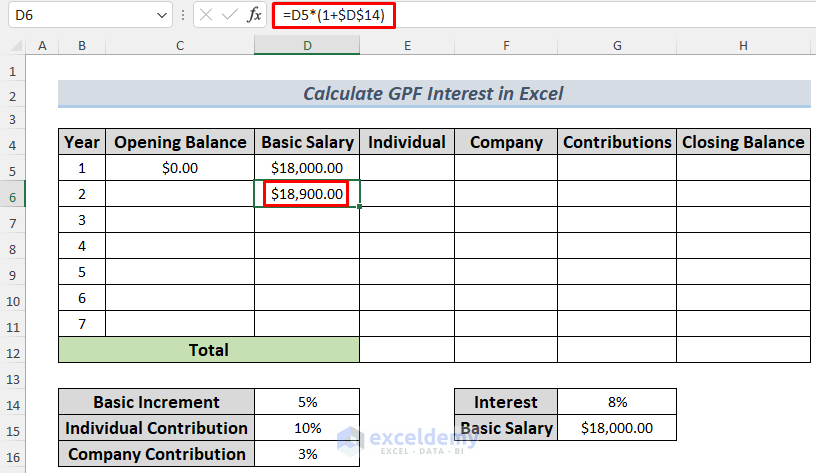

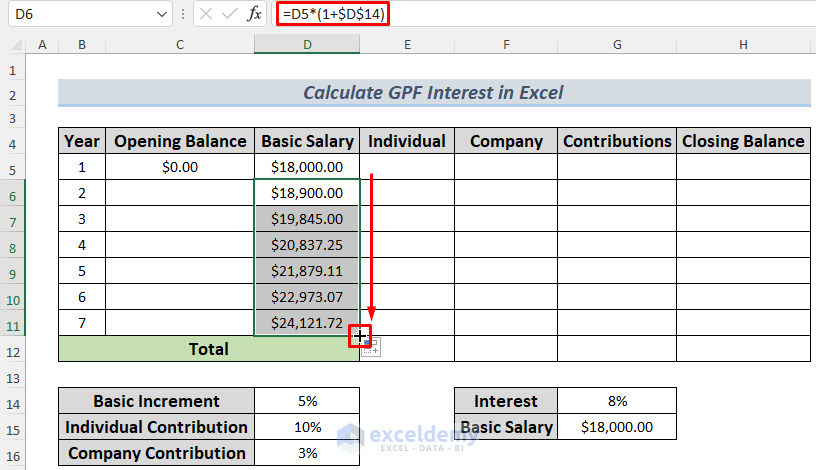

- To calculate the Basic Salaries for the upcoming years, enter the formula in D6 and press ENTER.

=D5*(1+$D$14)

- Use the Fill Handle to AutoFill the rest of the cells.

Step 3: Determining Individual and Company Contributions

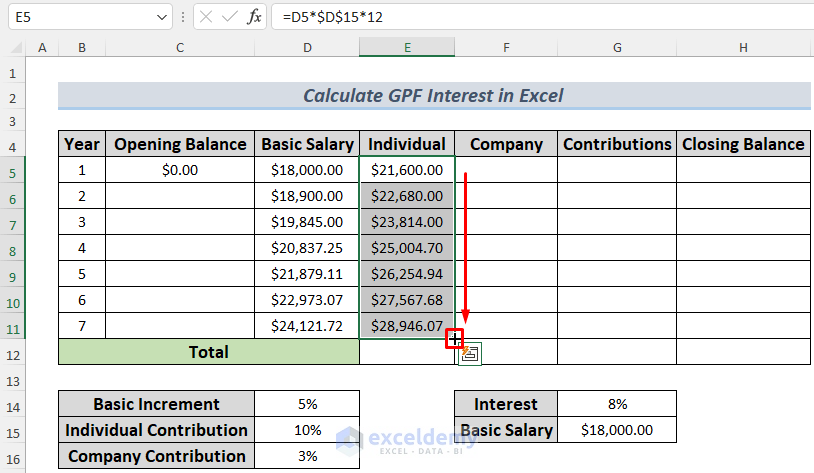

- Use the following formula to calculate the Individual Contribution for the first year.

=D5*$D$15*12

- Drag down the Fill Handle to determine Individual Contributions for the upcoming years.

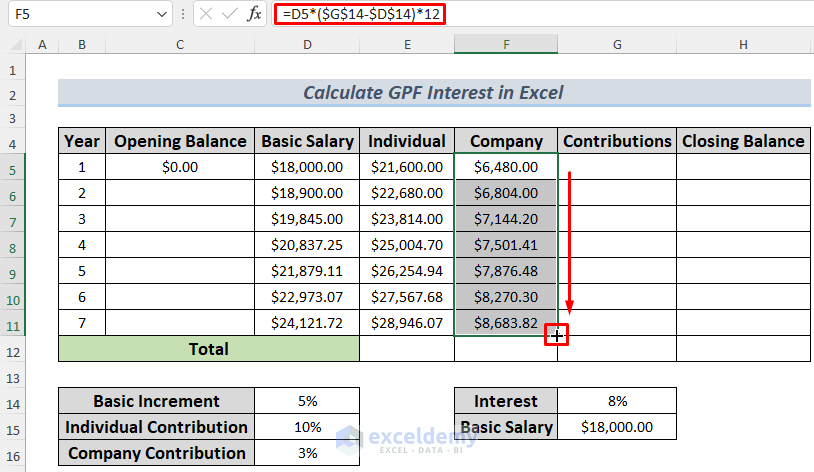

- Enter the following formula to calculate the Company Contributions.

=D5*($G$14-$D$14)*12

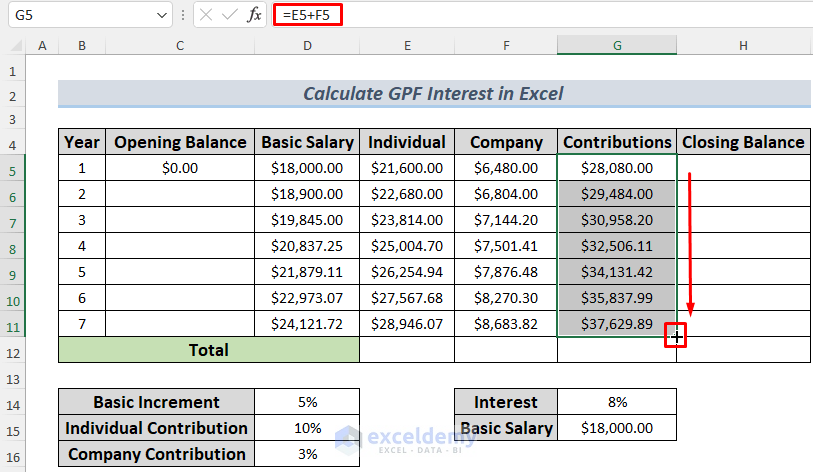

- To store the total Contributions, enter the following formula.

=E5+F5

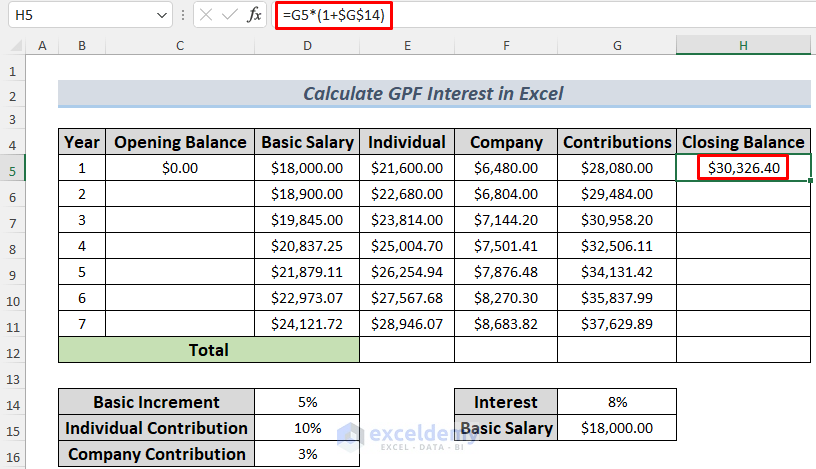

Step 4: Calculating Closing Balance

- Enter the formula below in H5. It will return the Closing Balance amount of the first year.

=G5*(1+$G$14)

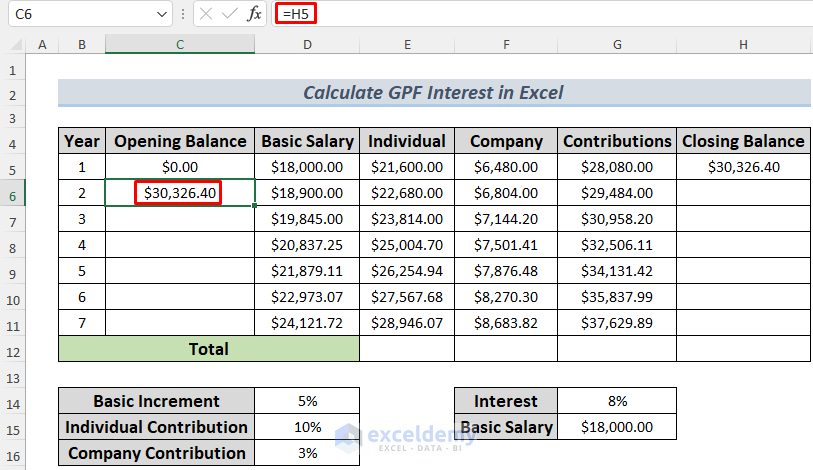

- Store this value in C66 using the formula below.

=H5

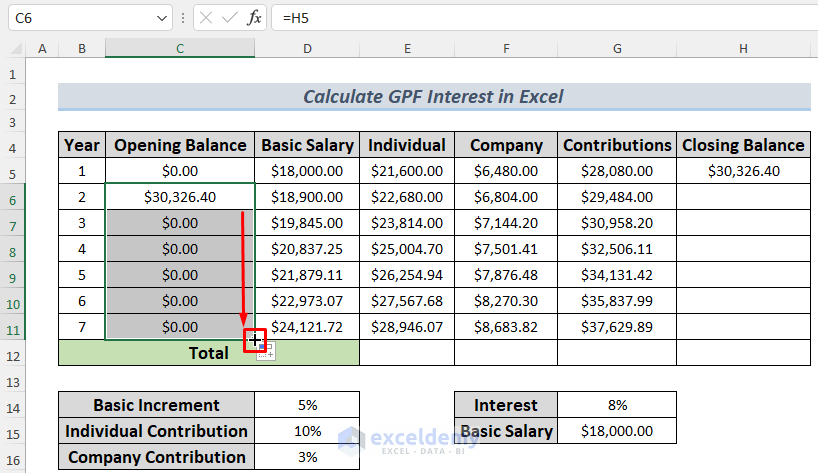

- After that, use the Fill Handle to AutoFill the rest of the cells.

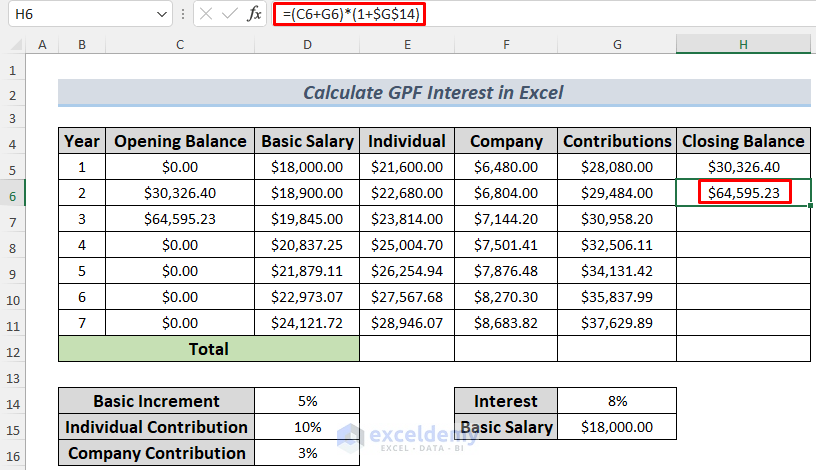

- Enter the following formula to calculate the Closing Balance for the second year.

=(C6+G6)*(1+$G$14)

- Dag the Fill to AutoFill therest of the cells. The Opening Balance column will fill automatically.

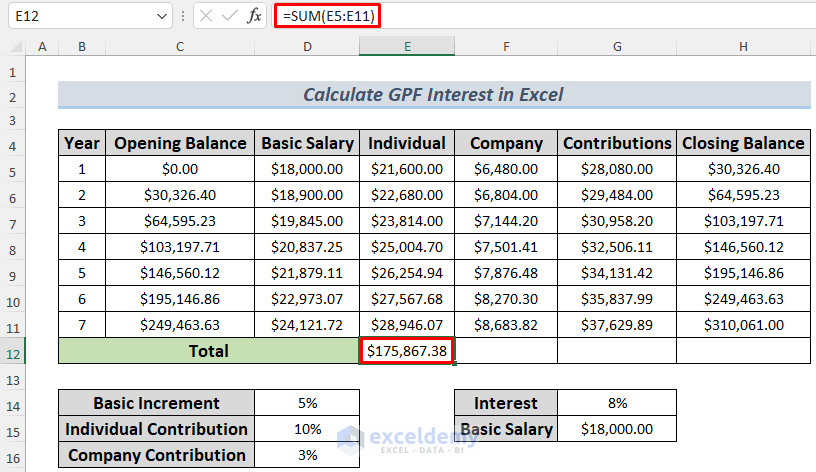

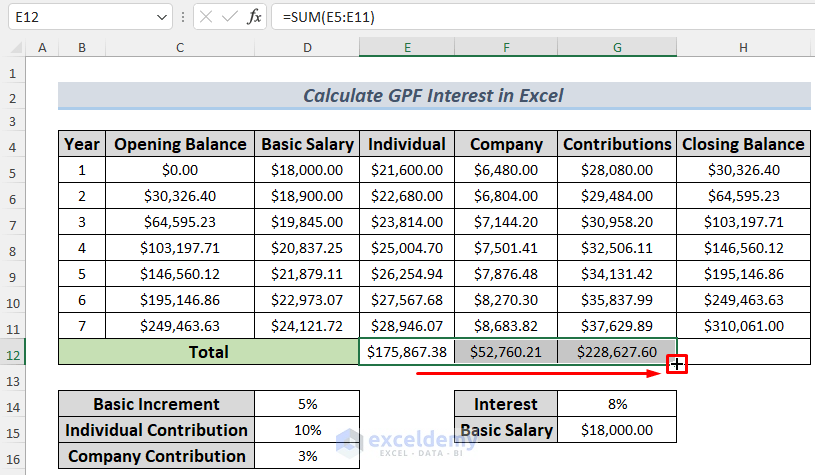

Step 5: Calculating the Gross Total

To calculate the total amount of Individual and Company Contributions and the Closing Balances:

- Enter the following formula in E12.

=SUM(E5:E11)

The formula uses the SUM function to return the total Individual Contribution.

- Drag the Fill Handle to the right to calculate the Company Contribution and Total Contributions.

- Store the final Closing Balance amount using the formula below.

=H11

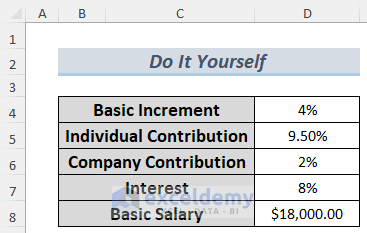

Practice Section

Practice here.

Download Practice Workbook

Related Articles

- How to Calculate Interest Between Two Dates in Excel

- Calculation of Interest During Construction in Excel

- How to Split Principal and Interest in EMI in Excel

- Perform Carried Interest Calculation in Excel

- How to Perform Actual 360 Interest Calculation in Excel

- How to Use Cumulative Interest Formula in Excel

- How to Calculate Daily Interest in Excel

<< Go Back to Excel for Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!