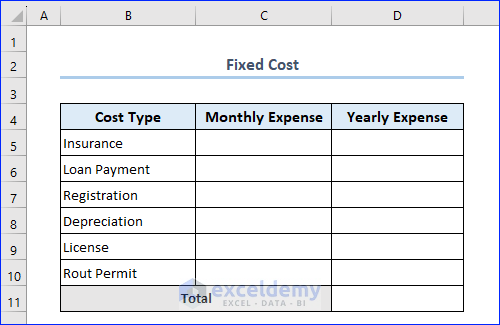

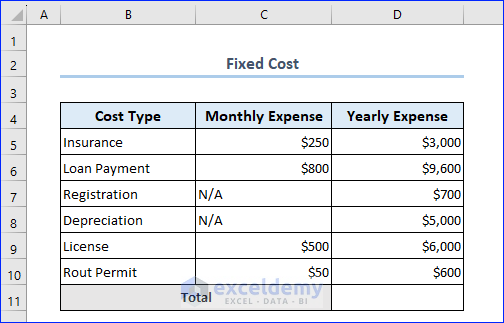

Method 1 – Calculate Fixed Costs

- The Cost Type column, give the names of various cost types like “Insurance”, “License” etc. We added only 6 types of fixed costs to our dataset. Include more if your truck has other types of fixed costs.

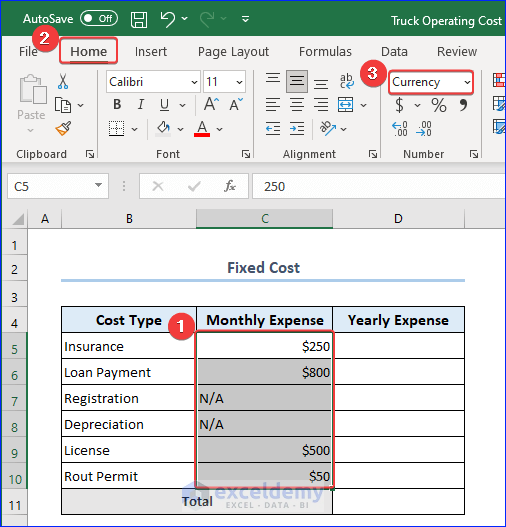

- Add values in the Monthly Expense column and change the data type of that column into the Currency format.

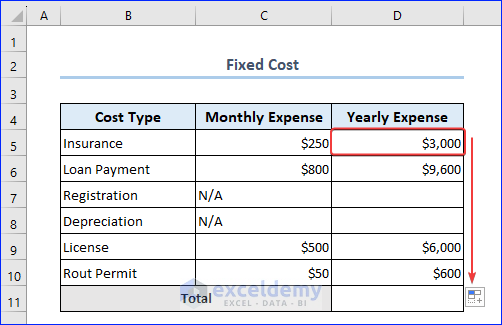

- Write down the following formula in the cell D5 and hit ENTER. Use Fill Handle to fill up the remaining cells as well.

=IFERROR(C5*12,"")

You will find that some of the cells in Column D are blank. We used the IFERROR function intentionally to keep it blank.

Overwrite the formula in those cells and assign exact values in those cells (we kept those blank because some values (e.g. depreciation) are exclusively calculated after the end of every year).

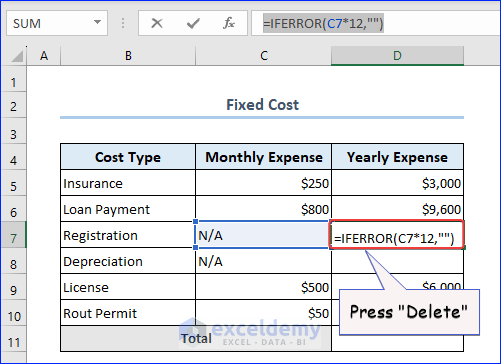

- Double-click on a cell and then press Delete button.

- Write down the value in the cell in the usual way.

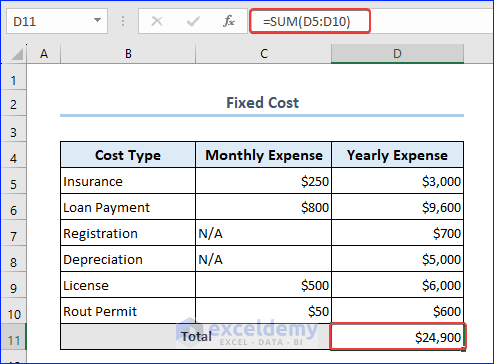

- Calculate the total fixed cost. In cell D11, write down the formula below to get the result.

=SUM(D5:D10)

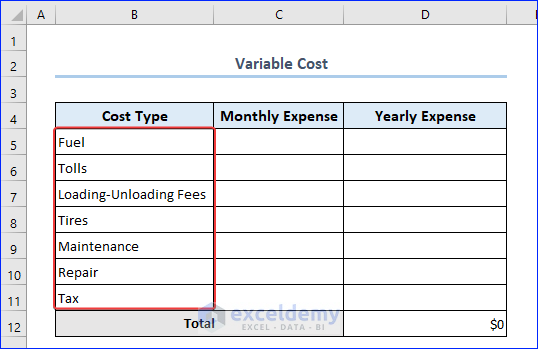

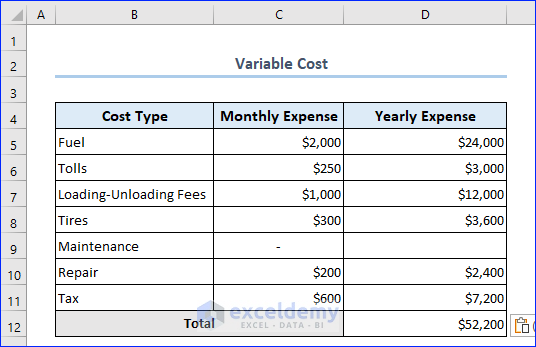

Method 2 – Determine Variable Costs

- Calculating variable costs is almost similar to calculating fixed costs. Just change the entries in the Cost Type column, like in the following image.

- The process of assigning values and formulas for the Monthly Expense and Yearly Expense columns is the same as the Fixed Cost calculation (Step 1). Repeat them and get the following result.

Method 3 – Find Total Costs

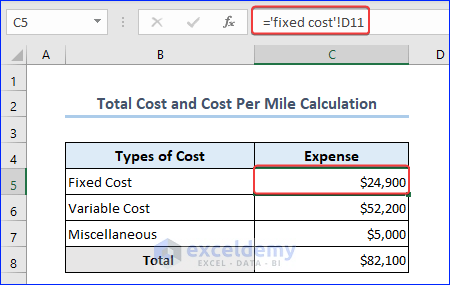

- Calculating total costs, we will give reference to those sheets, like in the following image.

- Do the same for variable costs as well.

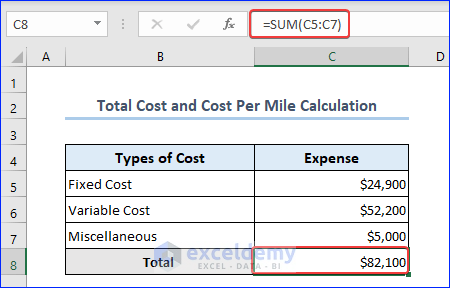

- Apply the simple formula in cell C8 to get the total costs.

=SUM(C5:C7)You will get the following result on your worksheet.

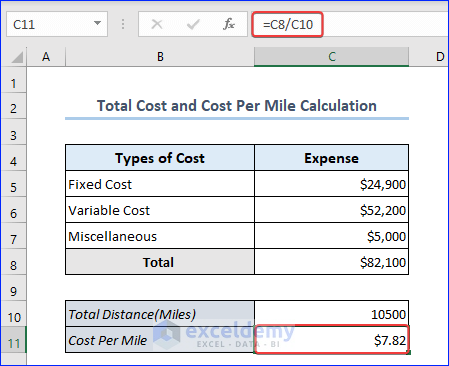

Method 4 – Calculate Total Costs and Cost Per Mile

- Write down the total distance the truck has traveled in cell C10.

- Apply the following formula in C11 to get the Cost Per Mile‘s value.

=C8/C10

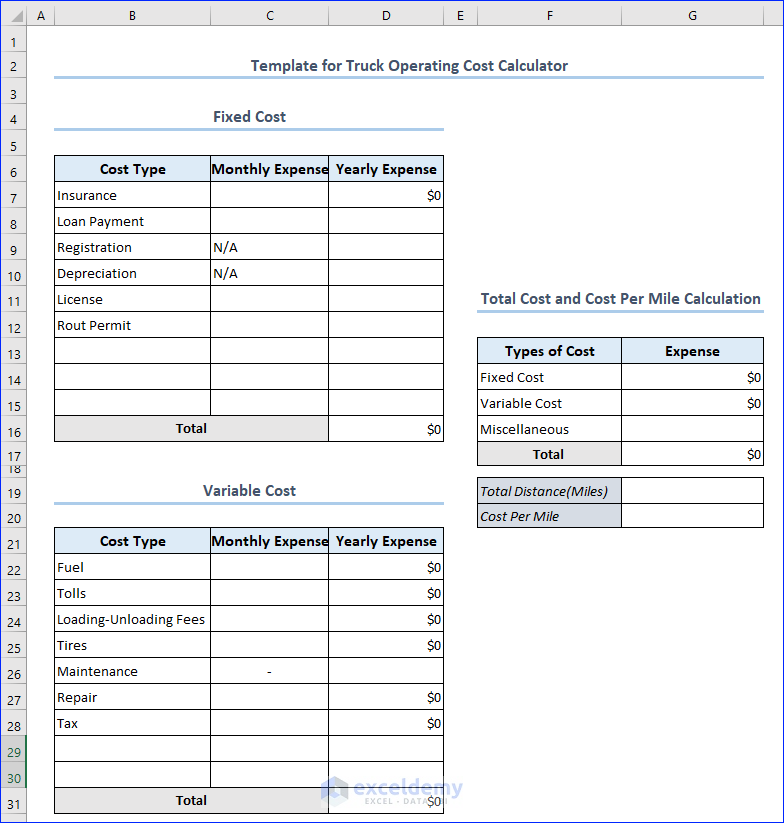

Bonus! Free Template for Truck Operating Cost Calculator

You will find an exclusive truck operating cost template in the Excel file of the download workbook section. Use it to make your business easier.

Things to Remember

- Over time, fixed costs remain the same, while variable costs continue to increase as long as you operate your truck.

- Truck operating costs will vary according to the truck’s service life. Two trucks with the same configuration but different service lives will have different operating costs.

- Some other factors that influence truck operating costs are fuel costs, fuel efficiency, driver wages, etc.

Frequently Asked Questions

1. What does the term Cost Per Mile mean?

Cost per mile (CPM) is a metric used to measure the cost of delivering a service over a given distance.

2. How do you calculate trucking profit?

Trucking profit is calculated by subtracting total direct expenses, including fuel, maintenance, and truck-related costs, as well as indirect expenses like insurance, permits, and administrative costs, from gross revenue, resulting in the net profit figure.

3. How do you calculate truck efficiency?

You measure your trucks’ efficiency by expressing the revenue for one truck as a fraction of the total revenue in one month divided by the number of trucks you have.

Download Practice Workbook

You may download the following workbook to practice yourself.

Related Articles

- How to Create Electricity Cost Calculator in Excel

- Opportunity Cost Calculator in Excel

- How to Create Shipping Cost Calculator in Excel

- How to Construct Cost Inflation Index Calculator in Excel

- How to Create Fuel Cost Calculator Using Excel Formula

- How to Make Vehicle Life Cycle Cost Analysis Spreadsheet in Excel

- How to Create an Export Price Calculator in Excel

<< Go Back to Cost Calculator | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!