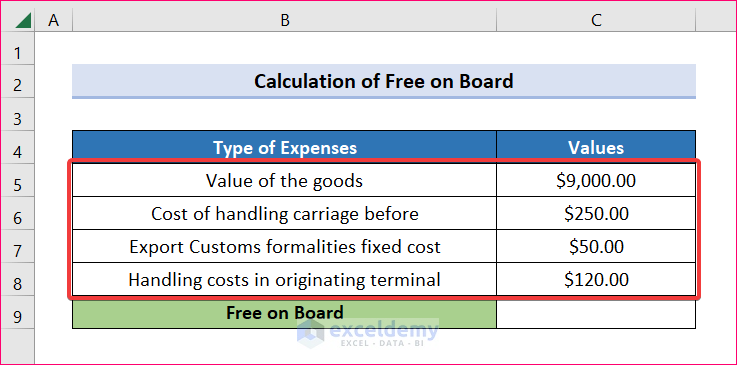

Method 1 – Calculate Free on Board

- Insert the price of the following four types of expenses.

- Value of the goods

- Cost of handling carriage before

- Export Customs formalities fixed cost

- Handling costs in the originating terminal

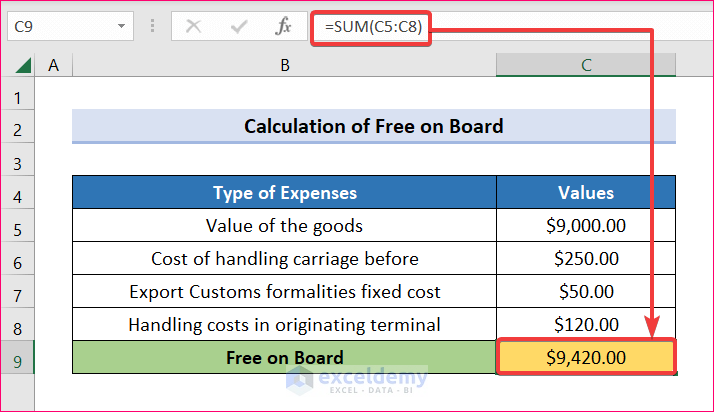

- To calculate the Free on Board expenses, select cell C9 and write the following formula with the SUM function.

=SUM(C5:C8)

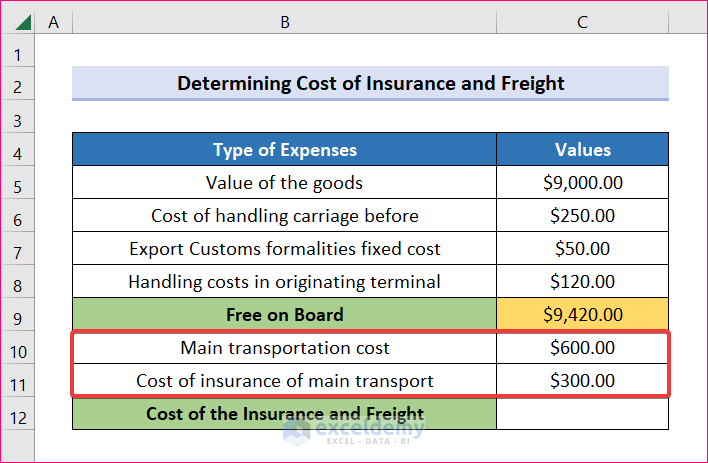

Method 2 – Determine Cost of Insurance and Freight

- Determine the Cost of the Insurance and Freight. Add the cost of main transportation.

- Input the cost of insurance of main transport.

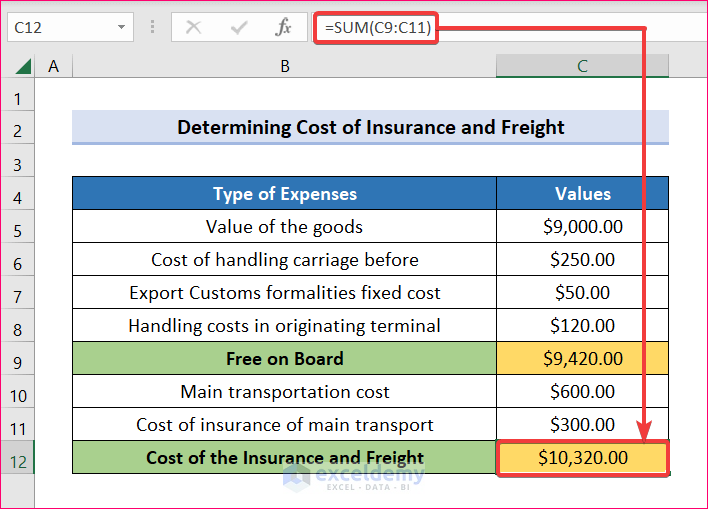

- Select cell C12 and type the formula given below.

=SUM(C9:C11)- Press Enter to get the Cost of the Insurance and Freight.

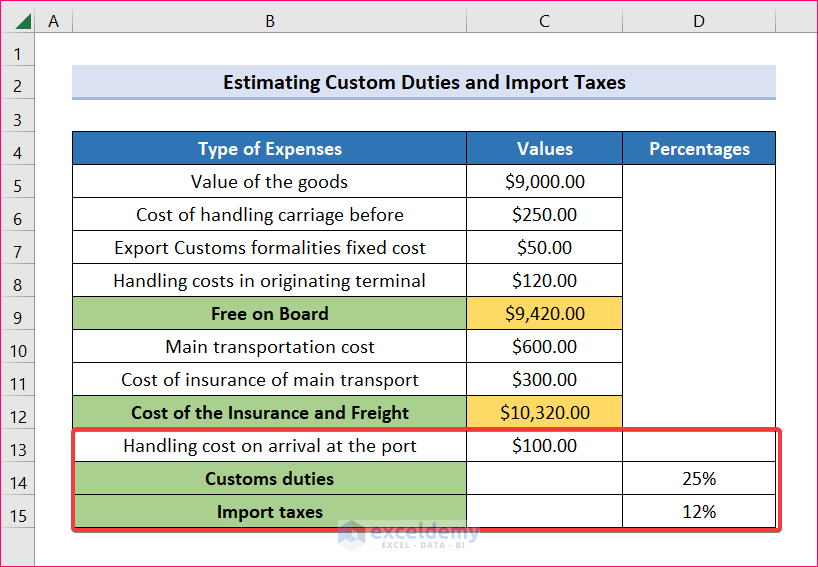

Method 3 – Estimate Custom Duties and Import Taxes

- We will estimate the taxes. Insert the handling cost on arrival at the port.

- Insert the percentages of Custom duties and Import taxes.

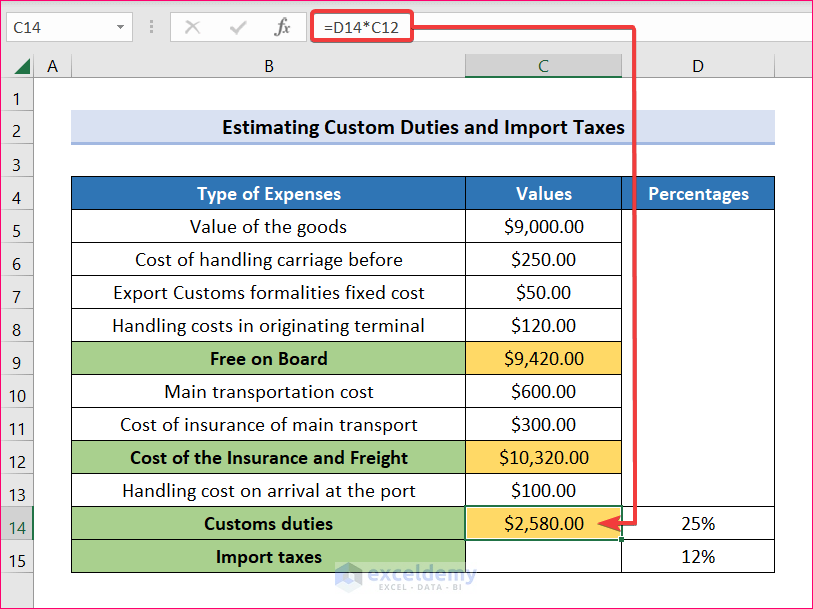

- Calculate the value of custom duties, click cell C14 and insert the following formula.

=D14*C12- Hit Enter to get the result.

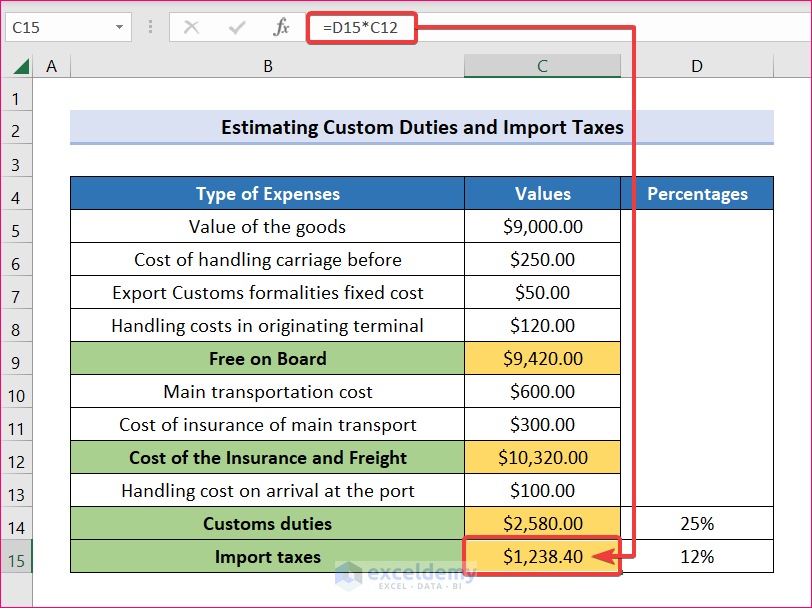

- Use the following formula to calculate Import taxes.

=D15*C12

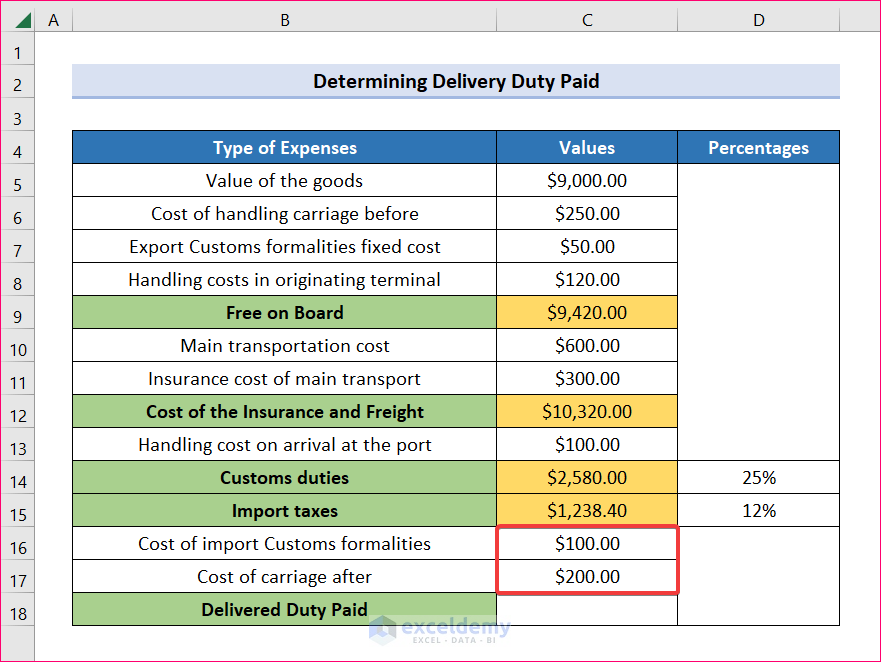

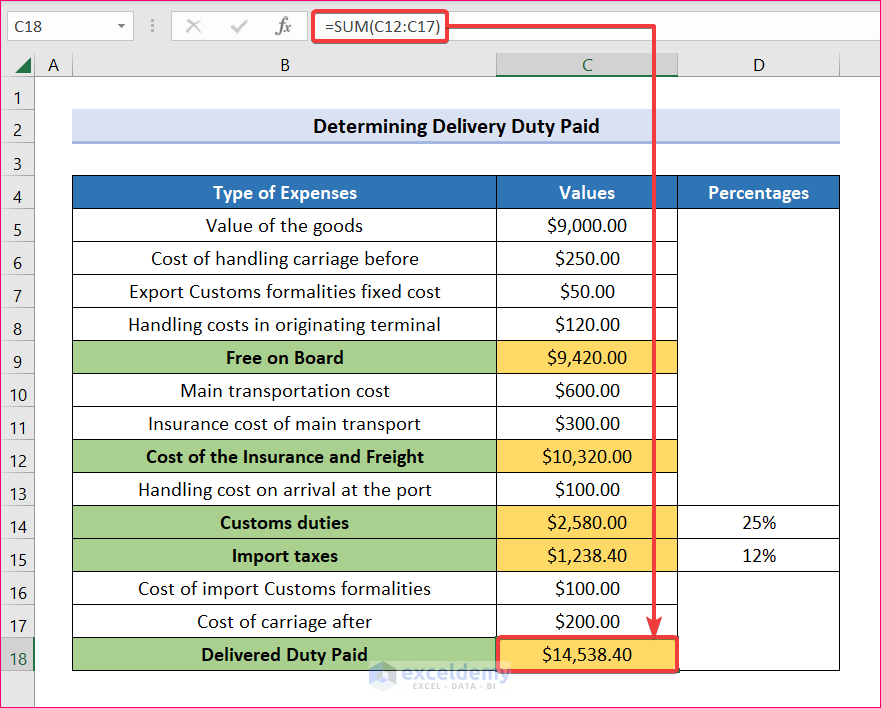

Method 4 – Determine Delivered Duty Paid

- Determine the Delivered Duty Paid. Insert two types of expenses.

- Cost of import Customs formalities

- Cost of carriage after

- Select cell C18 and write the formula given below.

=SUM(C12:C17)- Press Enter on your keyboard, and you will get the value of Delivered Duty Paid.

Download Practice Workbook

Download this practice workbook to exercise while reading this article.

Related Articles

- How to Create Fuel Cost Calculator Using Excel Formula

- How to Create Electricity Cost Calculator in Excel

- How to Create Shipping Cost Calculator in Excel

- Truck Operating Cost Calculator in Excel

- How to Make Vehicle Life Cycle Cost Analysis Spreadsheet in Excel

<< Go Back to Cost Calculator | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!