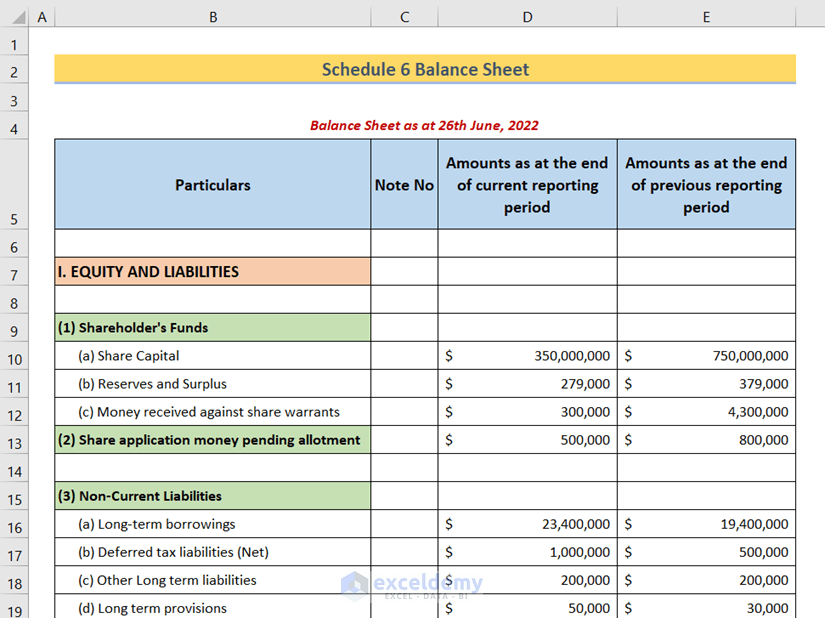

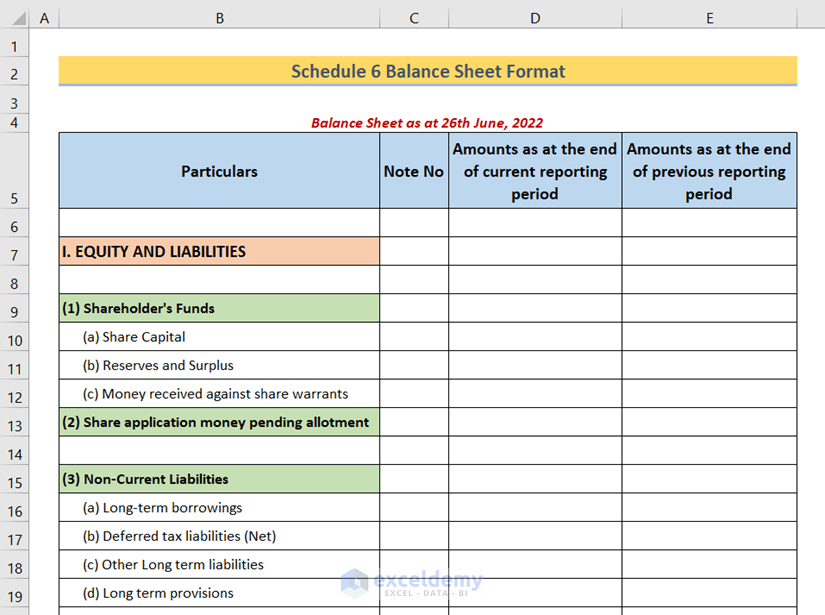

To monitor a company’s financial growth, the Schedule 6 format of the balance sheet is used. It consists of a company’s financial statements for the current year as well as previous years. Just like any other balance sheet, a Schedule 6 balance sheet also has an Equity and Liabilities section and an Assets section. In this article, I will discuss the Schedule 6 balance sheet format in Excel.

What Is Schedule 6 Balance Sheet?

The Schedule 6 balance sheet is a balance sheet format that describes a company’s financial state at a particular time. It helps to determine a company’s gross liabilities as well as assets at any schedule of a financial year. Thus, the Schedule 6 balance sheet format helps track a company’s financial state at any time.

Schedule 6 Balance Sheet Format

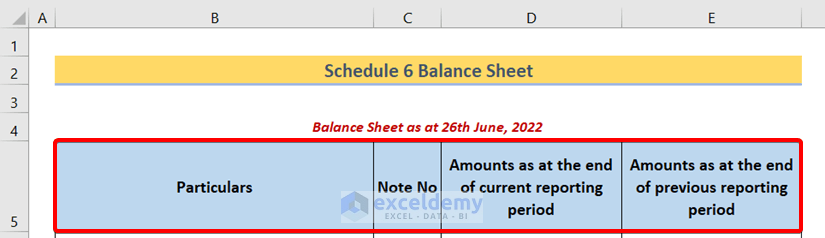

I used 4 columns to create a Schedule 6 balance sheet. The columns are,

- Particulars

This column consists of various financial statements.

- Note No

You can use this column to keep any short notes.

- Amounts as of the end of the current reporting period

Here, you will insert the current financial statements of your company.

- Amounts as of the end of the previous reporting period

In the column, you will insert the previous financial statements of your company.

1. Equity and Liabilities

The first primary section of a balance sheet is the Equity and Liabilities section. Under this section, the following categories remain.

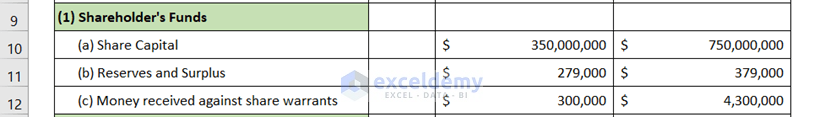

1.1. Shareholder’s Funds

If your company collected any funds by launching IPOs, those amounts should be mentioned here. The sectors under Shareholder’s Funds are:

- Share Capital

- Reserves and Surplus

- Money received against share warrants

The sections are self-descriptive, so a detailed explanation is not written, if you have any problem understanding the terms please leave a comment, will try to provide you with an answer.

1.2. Share Application Money Pending Allotment

Your company might receive application fees, but maybe the allotment has not been made yet. Those application fees fall under the Share application money pending allotment category.

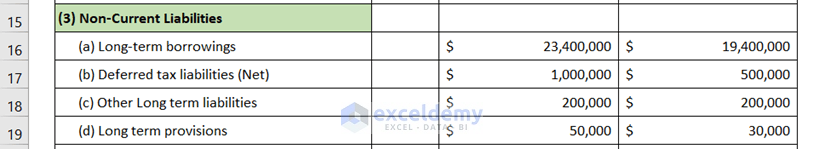

1.3. Non-Current Liabilities

Here, you should include a company’s past money-borrowing statements. It has the following sectors:

- Long-term borrowings

- Deferred tax liabilities (Net)

- Other Long term liabilities

- Long term provisions

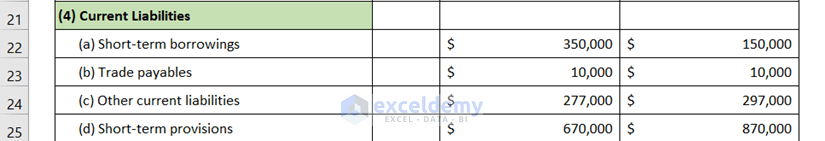

1.4. Current Liabilities

Here, a company’s present borrowings are recorded. It includes,

- Short-term borrowings

- Trade payables

- Other current liabilities

- Short-term provisions

Read More: How to Create Tally Debit Note Format in Excel

2. Assets

The second essential part of a balance sheet is the Assets section. It consists of a company’s tangible and intangible assets, investments, etc. Now let’s dive deeper into this section.

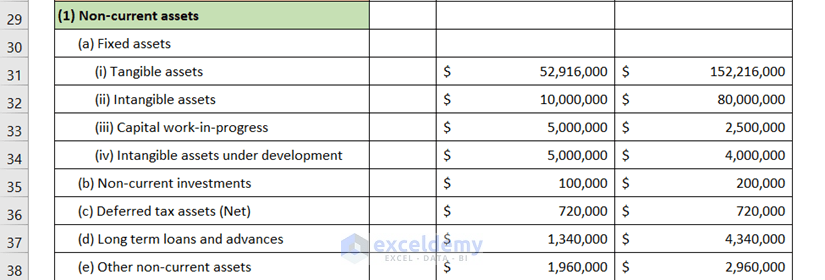

2.1. Non-Current Assets

Here, a company’s non-recent assets are recorded. It consists of the following sectors:

- Fixed assets

- Tangible assets

- Intangible assets

- Capital work-in-progress

- Intangible assets under development

- Non-current investments

- Deferred tax assets (Net)

- Long-term loans and advances

- Other non-current assets

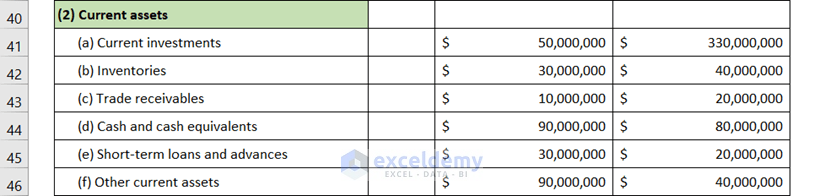

2.2. Current Assets

Here, you will insert a company’s present assets statements. It consists of the following sectors:

- Current investments

- Inventories

- Trade receivables

- Cash and cash equivalents

- Short-term loans and advances

- Other current assets

Read More: Revised Schedule 3 Balance Sheet Format in Excel with Formula

Practice Section

You will get an Excel sheet like the following screenshot, at the end of the provided Excel file. You can practice all the topics in that blank dataset discussed in this article.

Download Schedule 6 Balance Sheet Template

You can download the Excel file from the following link. You can use the file as a Schedule 6 balance sheet template.

Conclusion

To sum up, I have discussed the format of a Schedule 6 balance sheet in Excel. Please don’t hesitate to ask any questions in the comment section below. We will try to respond to all the relevant queries ASAP.

Related Articles

- How to Create Vertical Balance Sheet Format in Excel

- How to Make Hotel Balance Sheet Format in Excel

- Create Horizontal Balance Sheet Format in Excel

- How to Perform Balance Sheet Ratio Analysis in Excel

- How to Add Balance Sheet Graph in Excel

<< Go Back to Balance Sheet | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!