What Is Sensitivity Analysis?

Sensitivity Analysis determines the impact of a change in an independent variable associated with a product.

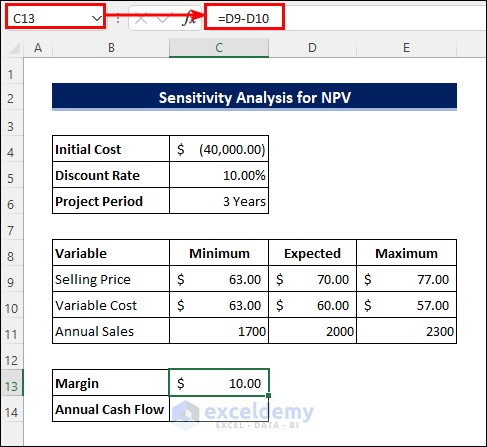

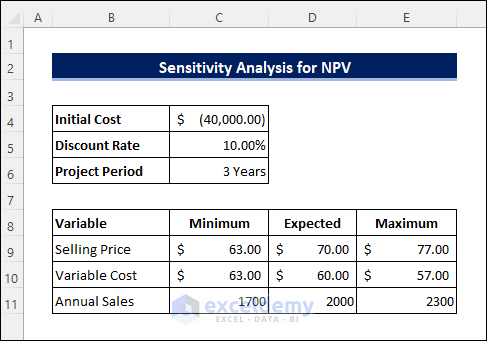

You have a three-year project. The revenue from the project depends on 3 variables: selling price, variable cost, and annual sales. To know how changes in these variables will affect the Net Present Value (NPV) of the project:

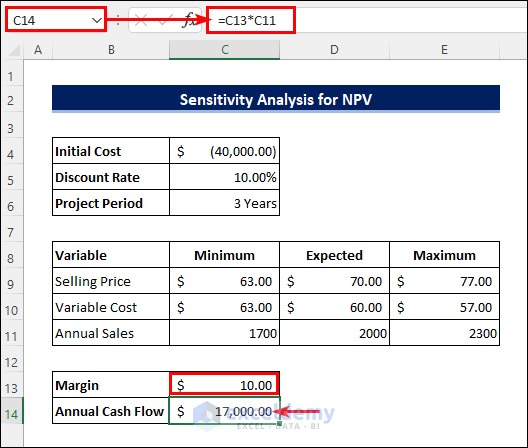

Steps 1 – Calculate the Profit Margin

- Enter the following formula in C13 to calculate the margin between cost and sales.

=D9-D10Steps 2 – Estimate the Annual Cash Flow

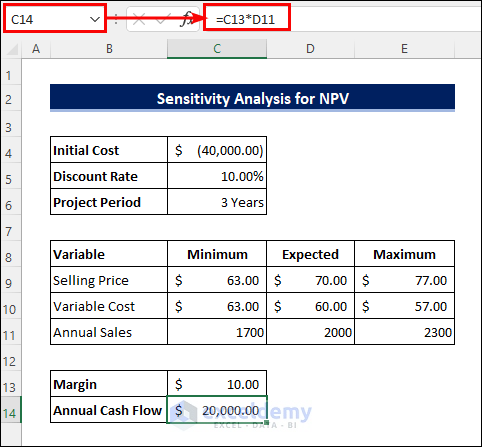

- Use the following formula in C14 to estimate the annual cash flow.

=C13*D11Read More: How to Use What If Analysis in Excel

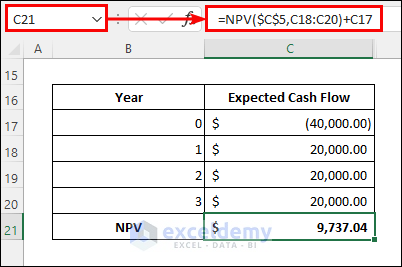

Steps 3 – Create a NPV Table

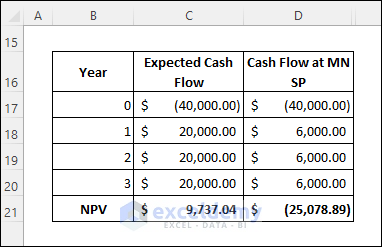

- Create a table showing yearly cash flows (the numbers in brackets are negative):

- Enter the following formula in C21 to get the NPV based on the expected cash flow.

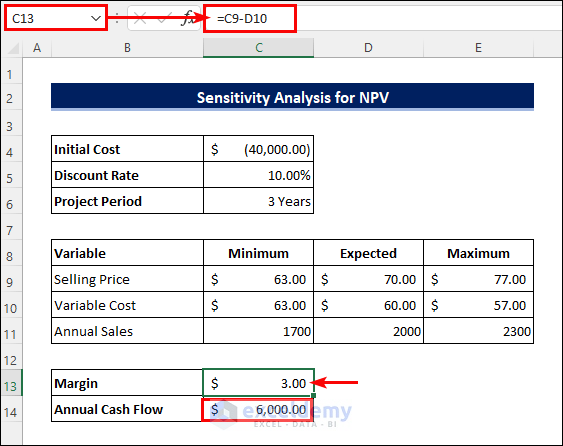

=NPV($C$5,C18:C20)+C17- To forecast how the NPV will change if the selling price falls to a defined minimum, change the formula in C13:

=C9-D10You can change only one variable at a time and keep the others as expected.

- Extend the NPV table to get the NPV at the minimum selling price.

-

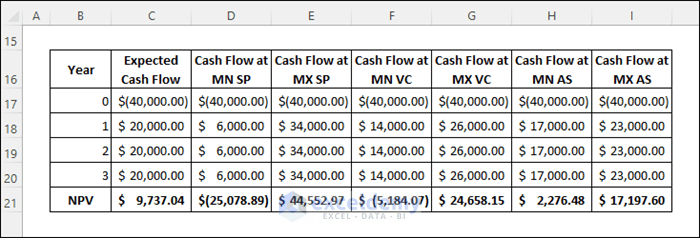

- Change the formula in C14 to know what will happen if the annual sales drop to a minimum. Calculate the margin from the expected values.

=C13*C11- Change the formulas for a different variable one by one to complete the following table.

Read More: What-If Analysis in Excel with Example

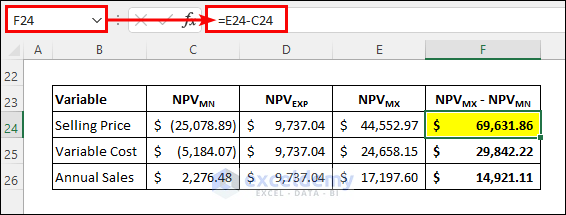

Steps 4 – Perform a Sensitivity Analysis for NPV

- Create another table to compare the changes in the NPV with the changes in the variables. Use the following formula in F24 to see the change in the NPV.

=E24-C24Remarks:

The selling price is the most sensitive variable. You can also calculate that a 20% increase in the selling price may increase the NPV by more than 700%.

Read More: How to Build a Sensitivity Analysis Table in Excel

Download Sample Workbook

Download the free template.

Related Articles

- How to Perform Sensitivity Analysis for Capital Budgeting in Excel

- How to Do IRR Sensitivity Analysis in Excel

- How to Get Sensitivity Report from Solver in Excel

- What If Analysis Data Table Not Working

- How to Delete What If Analysis in Excel

<< Go Back to What-If Analysis in Excel | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!