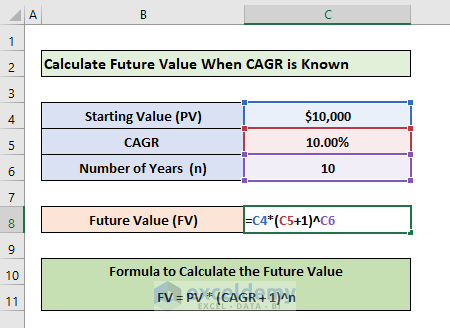

Method 1 – Calculate the Future Value When the CAGR Is Known in Excel Using a Basic Formula

Using the following formula, we can easily calculate the Future Value for a certain investment period when the CAGR value is known.

FV = PV * (CAGR + 1)n

In this formula,

FV – the future value which is the final amount of an investment after the investment period ends.

PV – the starting or present value of the investment money.

CAGR – known as Compound Annual Growth Rate in percentage.

n – the number of years for which we’ll invest the money.

For the sample dataset:

C4 – initial investment/present value (PV)

C5 – compound annual growth rate (CAGR)

C6 – no of investment periods in years (n)

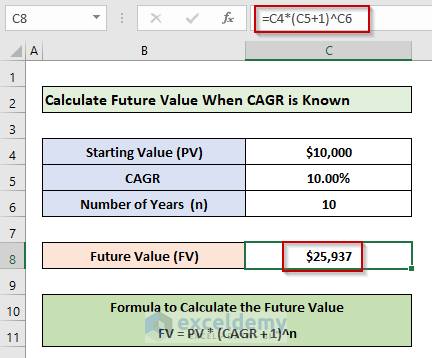

- In cell C8, put the following formula: =C4*(C5+1)^C6

- Press Enter to get the result.

Read More: CAGR Formula in Excel

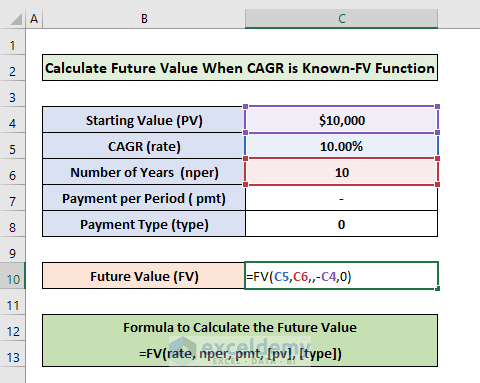

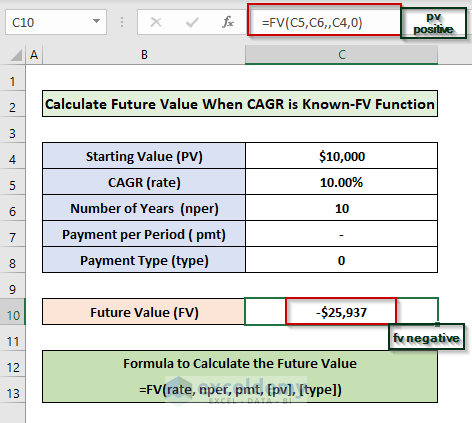

Method 2 – Use the FV Function to Estimate the Future Value When the CAGR Is Known

The syntax for the FV function is- FV(rate, nper, pmt, [pv], [type])

The function takes several arguments:

rate (required)- the annual growth rate of the investment, CAGR.

nper (required) – number of payment periods in years.

pmt (required) – payment amount per period which is blank in this calculation.

pv (optional) – present value or initial investment amount.

type (optional)- 0 for payment due at the end of the payment period and 1 for payment due at the start of the period.

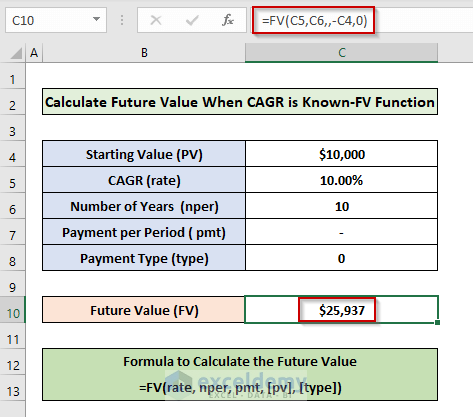

- In cell C10, we configured the following formula- =FV(C5,C6,,-C4,0)

C4 – initial investment/present value (PV)

C5 – compound annual growth rate (CAGR)

C6 – no of investment periods in years (n).

C7 – payment per period which is empty in this calculation.

C8 – payment is due at the end of the period i.e., 0.

- Here’s the output.

Note

- If we use the pv argument without the negative sign, it’ll calculate the future value as negative.

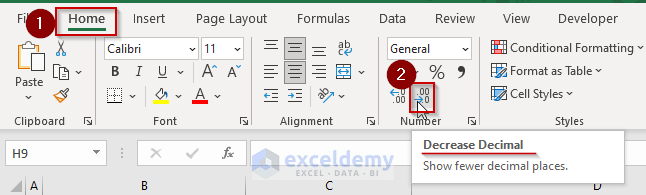

- By default, the result shows as a number with decimal places. You can remove decimal places by following the steps below:

- Go to the Home Tab.

- Navigate to the Number panel.

- Choose the Decrease Decimal.

Read More: How to Calculate End Value from CAGR in Excel

Download the Practice Workbook

Related Articles

- Excel Formula to Calculate Average Annual Compound Growth Rate

- How to Calculate CAGR with Negative Number in Excel

- How to Calculate 3-Year CAGR with Formula in Excel

- How to Calculate 5 Year CAGR Using Excel Formula

- How to Create CAGR Graph in Excel

<< Go Back to Compound Interest in Excel | Excel for Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!