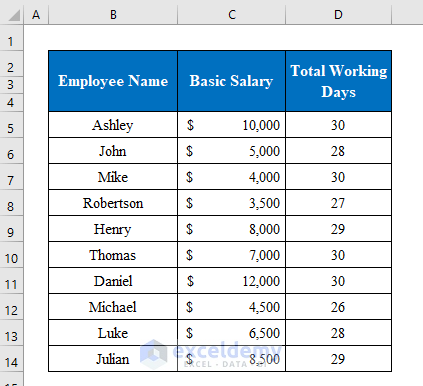

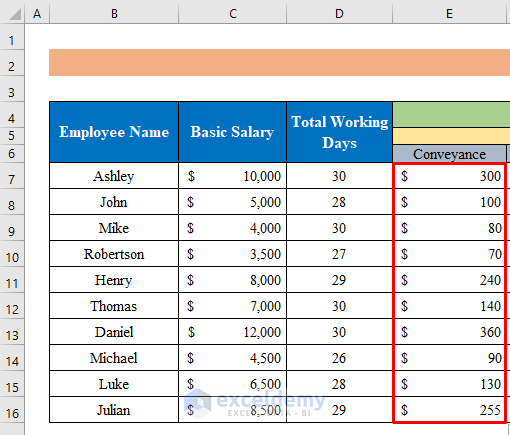

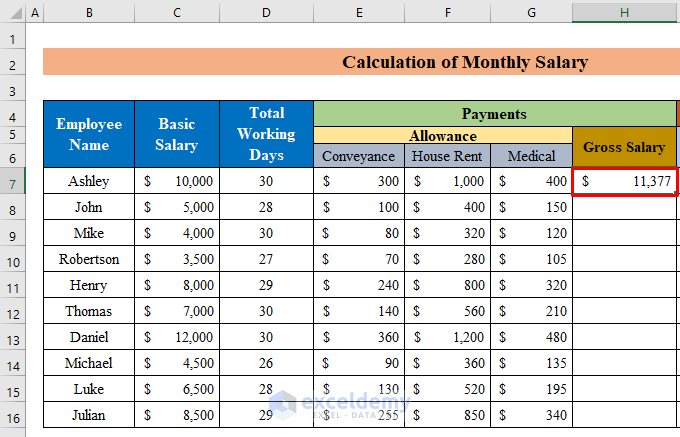

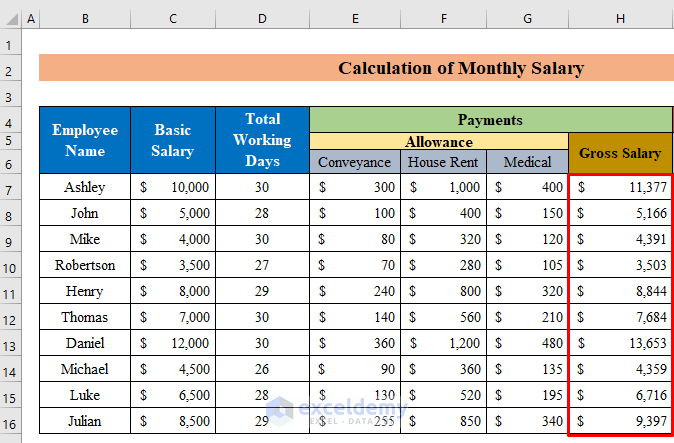

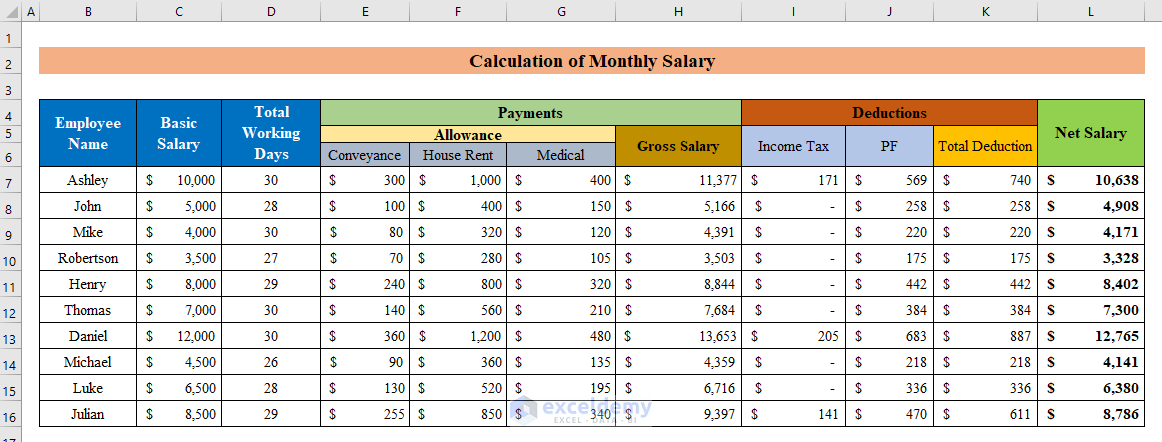

Suppose we have a dataset of some Employee Name, Basic Salary of employees, and Total Working Days. We’ll use this data to calculate the full salary for the employees.

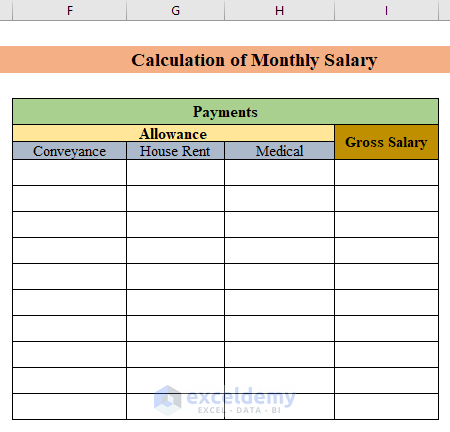

Step 1 – Determine the Gross Salary for Each Employee

- We’ll extend the dataset with new columns where allowances such as Conveyance, House Rent, and Medical will be calculated according to the company’s terms and conditions.

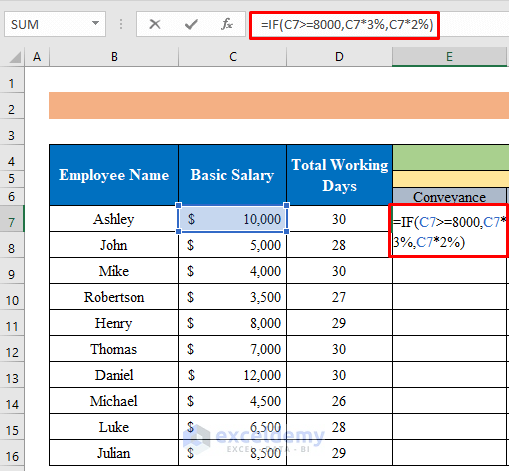

- Select a cell (E7) to calculate conveyance in the chosen cell.

- Apply the following formula:

=IF(C7>=8000,C7*3%,C7*2%)(C7>=8000,C7*3%,C7*2%) stands for the company’s requirements. The term is if an employee’s salary is equal to or more than $8,000, they will get 3% of conveyance or will get 2%.

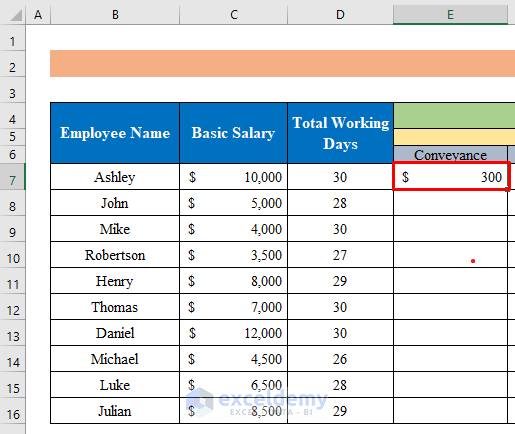

- Press Enter and drag down the “fill handle” to fill.

- We have calculated the conveyance payments for all employees.

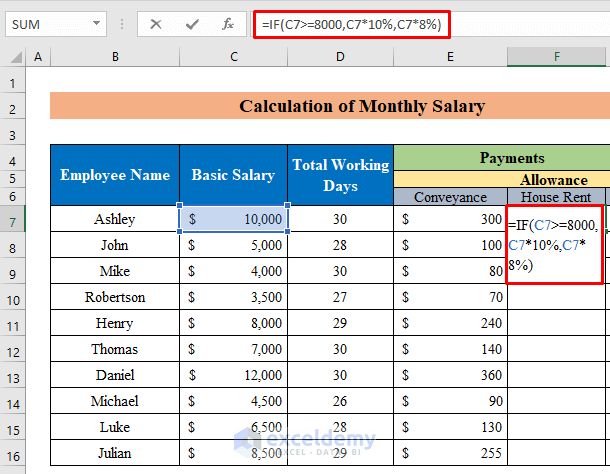

- Choose a cell for the house rent allowance. We have selected cell (F7):

- Insert the following formula into the cell:

=IF(C7>=8000,C7*10%,C7*8%)

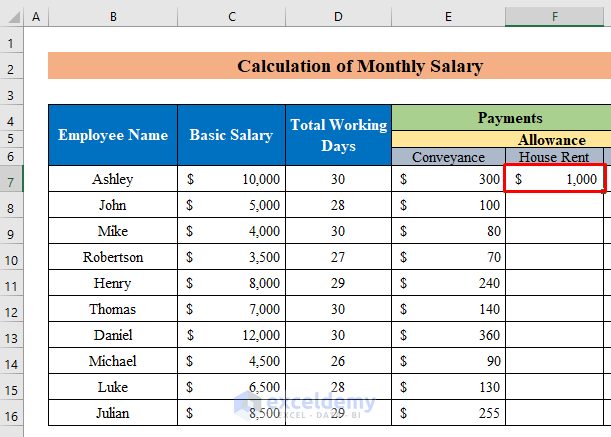

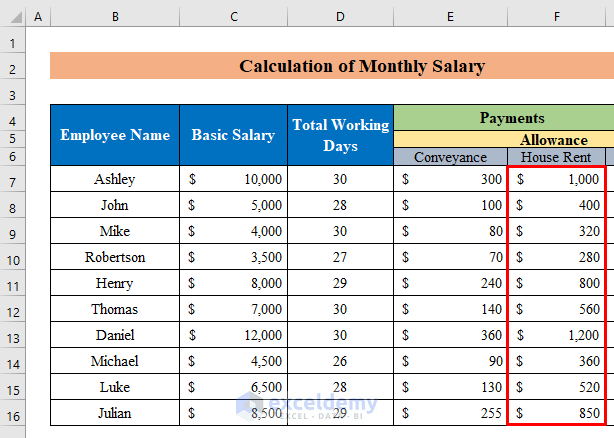

- Hit the Enter button and then drag the Fill Handle down to fill all the cells.

- We have the house rent calculated for all the employees.

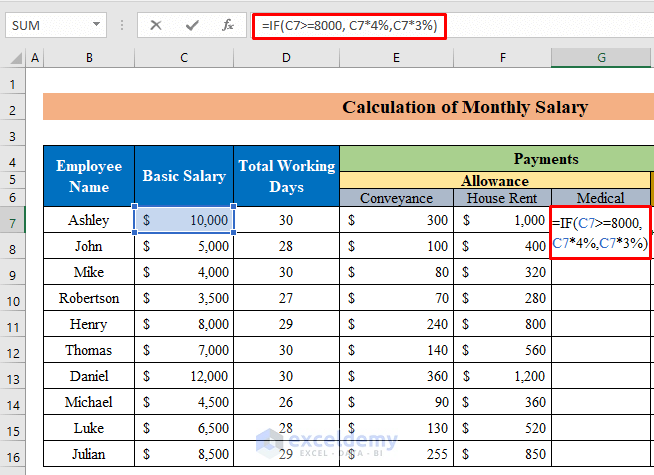

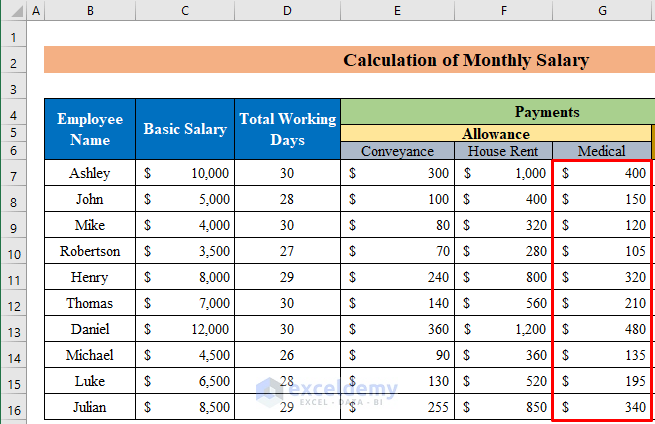

- Choose cell G7.

- Copy the following formula into it:

=IF(C7>=8000, C7*4%,C7*3%)

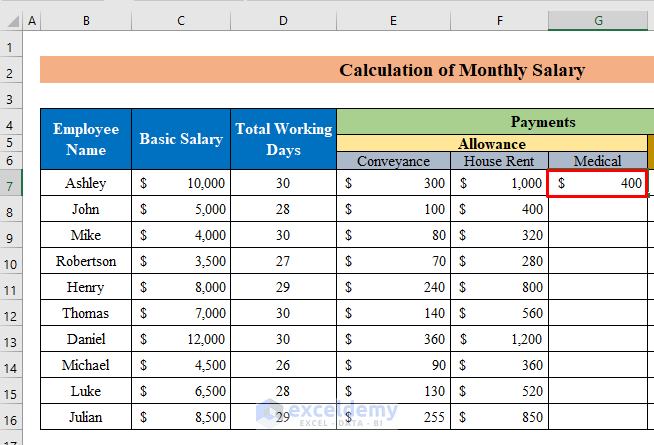

- Press the Enter key.

- Pull the “fill handle” down to get the output.

- We have calculated the output of medical allowances.

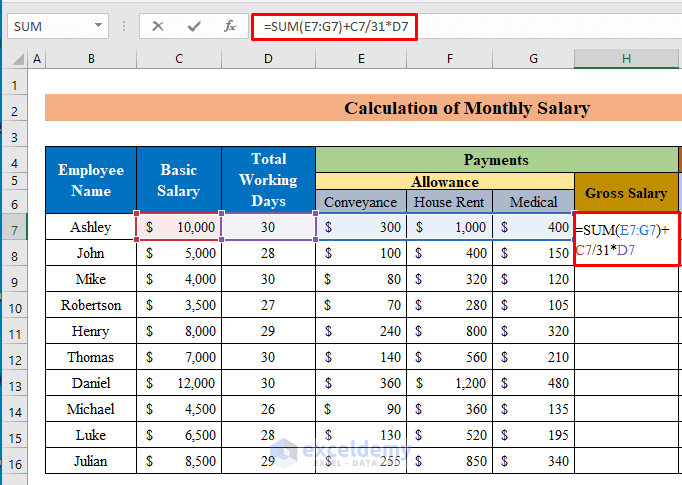

- Choose cell H7 and apply the following formula:

=SUM(E7:G7)+C7/31*D7

- Hit the Enter button and drag the Fill Handle down to get all the employee’s gross salary.

- We have all the values in the gross salary column.

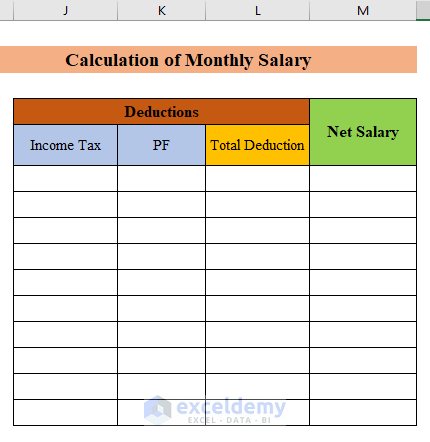

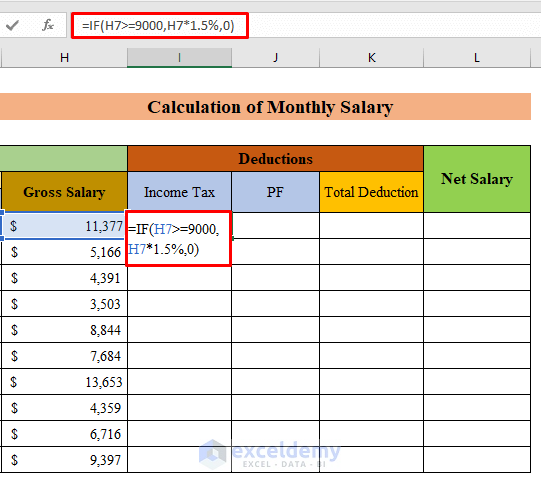

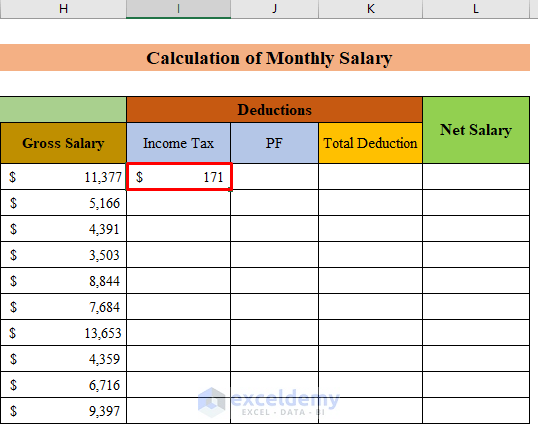

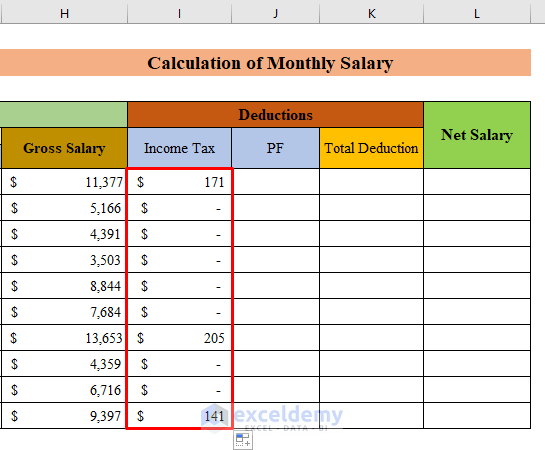

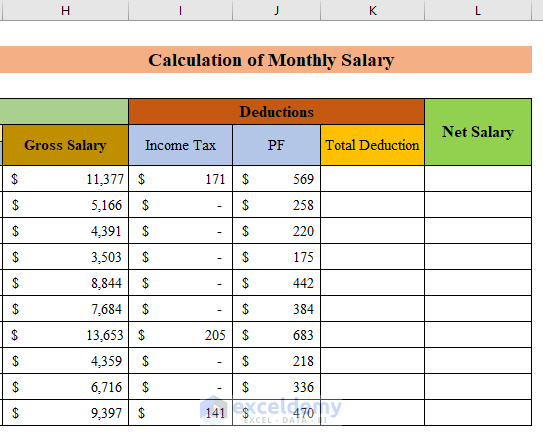

Step 2 – Perform Necessary Deductions from the Gross Salary

- Add new columns which will represent Income Tax, Provident Fund (PF), and Total Deduction.

- Let’s say the income tax is 5% for a salary equal to or above $9,000.

- Choose cell I7.

- Copy the following formula into it:

=IF(H7>=9000,H7*1.5%,0)

- Press Enter and pull the fill handle down.

- We have income tax values in the dataset.

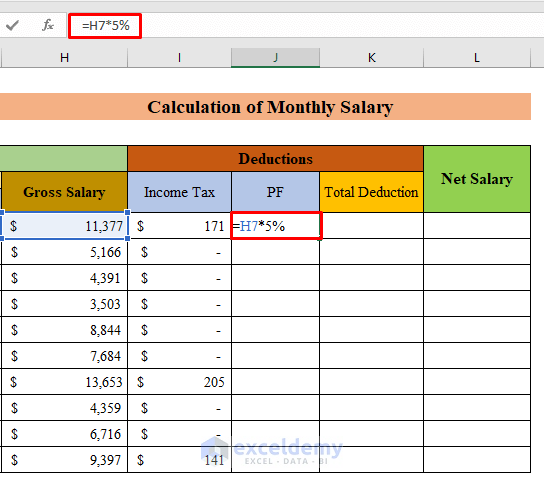

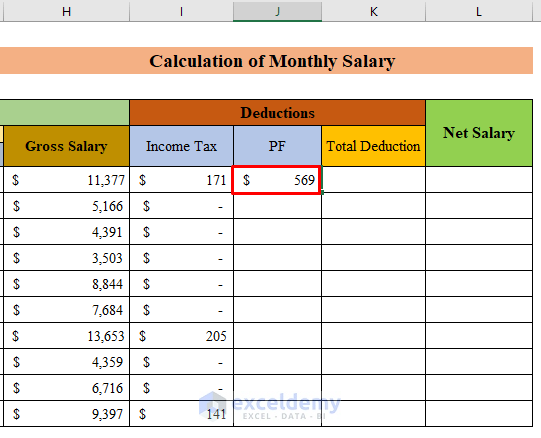

- Select J7 and insert the following:

=H7*5%

- Hit Enter and drag down the fill handle to fill the column.

- We have calculated the provident fund values for all the employees.

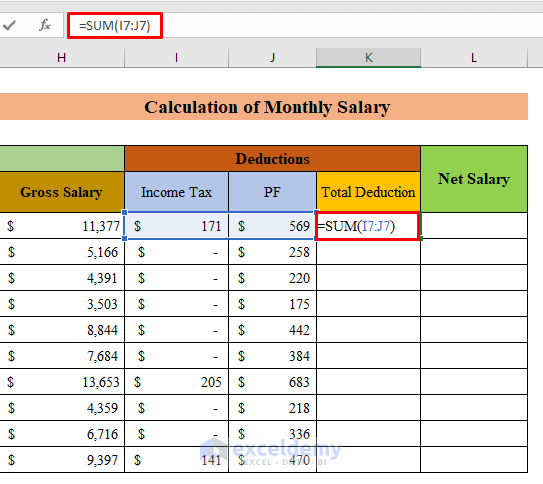

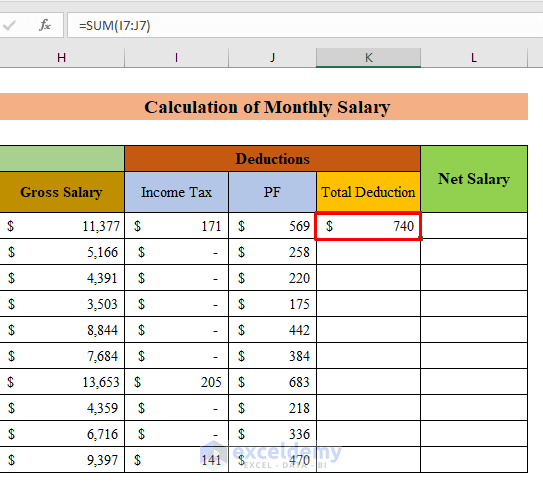

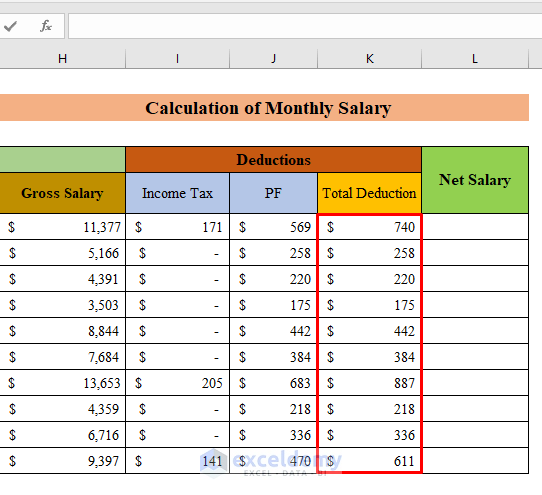

- Choose the cell K7.

- Apply the following formula:

=SUM(I7:J7)

- Press Enter and fill the cells by dragging the “fill handle” down.

- Here we have total deduction values.

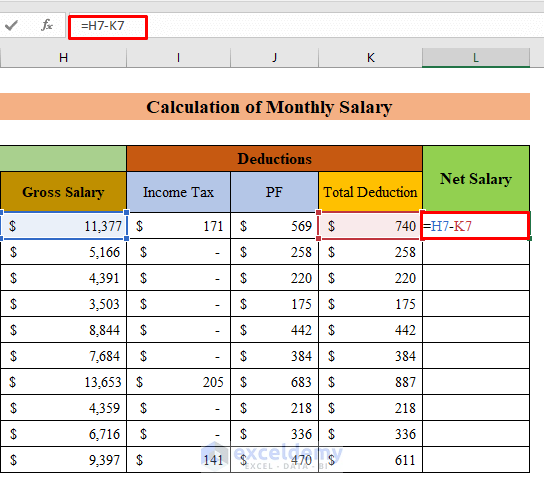

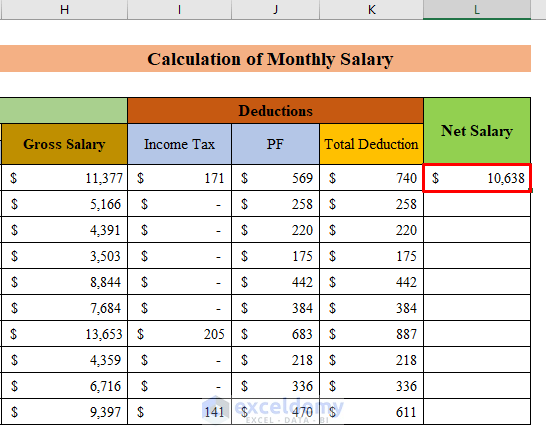

Step 3 – Calculate the Monthly Net Salary

- Select cell L7 and insert the following formula:

=H7-K7

- Hit the Enter button and drag the “fill handle” down.

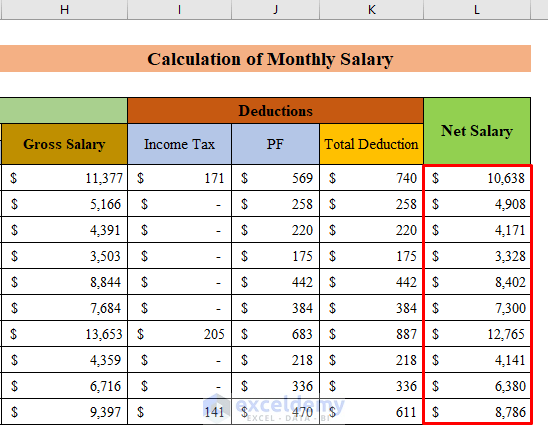

- We have our desired output where we got the output by subtracting the deduction amount from the gross salary.

- Our final table will look like this.

Download Practice Workbook

Download this practice workbook to exercise while you are reading this article or use it as a template.

<< Go Back to Salary | Formula List | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!