A detailed breakdown of the allowances and deduced amounts is absent because they vary from country to country.

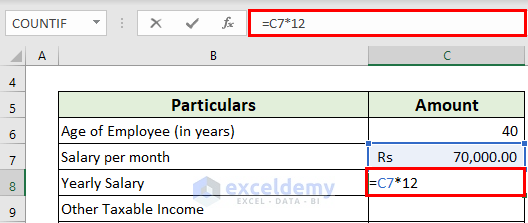

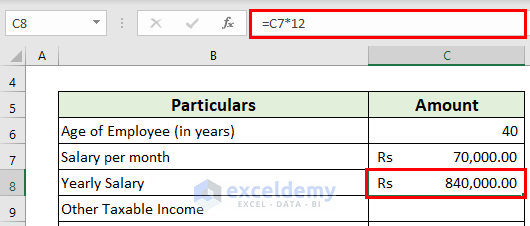

Step 1 – the Calculate Yearly Salary

Let’s assume that a person’s monthly salary is Rs 70,000 and the value is stored in C7. We will calculate the annual salary.

- Go to C8 and insert the following formula.

=C7*12

- Press Enter to get the output.

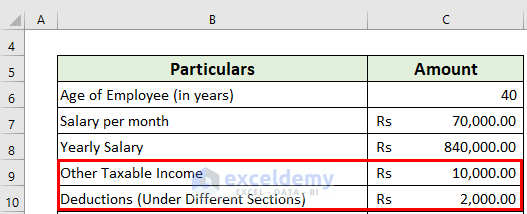

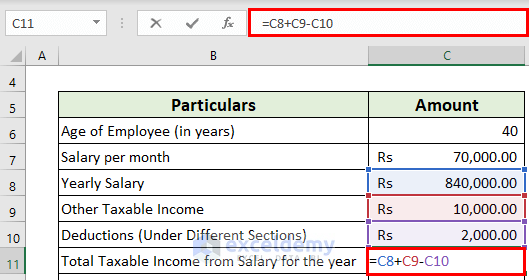

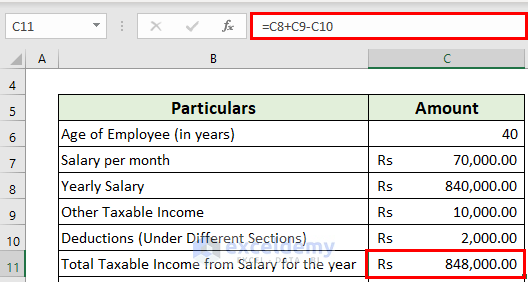

Step 2 – Measure the Total Taxable Income from Salary

Let’s assume that additional taxable income is Rs 10,000, and the deduction is Rs. 2,000.

- Go to C11 and use the following formula

=C8+C9-C10- Hit Enter.

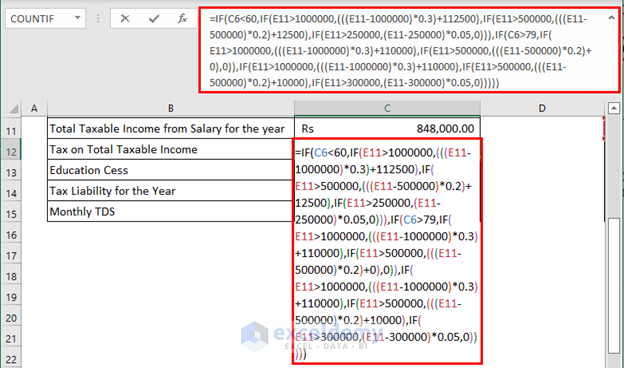

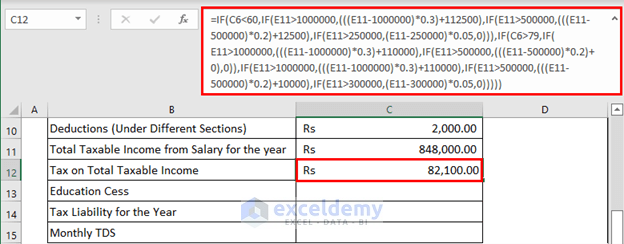

Step 3 – Calculate the Tax on Taxable Income

- Go to C12 and use the following formula

=IF(C6<60,IF(C11>1000000,(((C11-1000000)*0.3)+112500),IF(C11>500000,(((C11-500000)*0.2)+12500),IF(C11>250000,(C11-250000)*0.05,0))),IF(C6>79,IF(C11>1000000,(((C11-1000000)*0.3)+110000),IF(C11>500000,(((C11-500000)*0.2)+0),0)),IF(C11>1000000,(((C11-1000000)*0.3)+110000),IF(C11>500000,(((C11-500000)*0.2)+10000),IF(C11>300000,(C11-300000)*0.05,0)))))Formula Explanation

- The 1st logical test is C6<60 which is TRUE.

- So the corresponding output is IF(C11>1000000,(((C11-1000000)*0.3)+112500),IF(C11>500000,(((C11-500000)*0.2)+12500),IF(C11>250000,(C11-250000)*0.05,0)))

- The value of this output is 82100.

- Hit Enter.

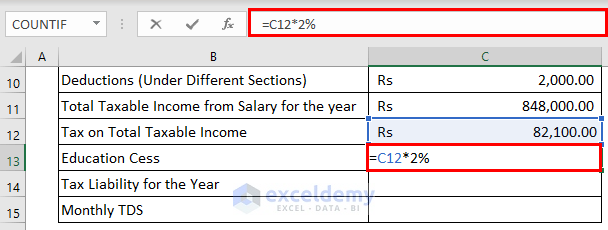

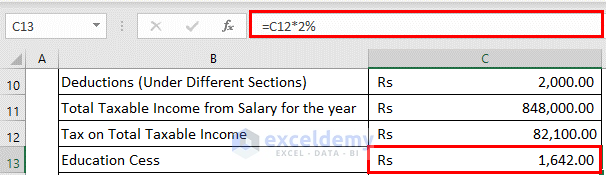

Step 4 – Measure the Education Cess

TThe assumption is that the education cess is 2% of the tax on total taxable income.

- Go to C13 and use the following formula

=C12*2%- Hit Enter.

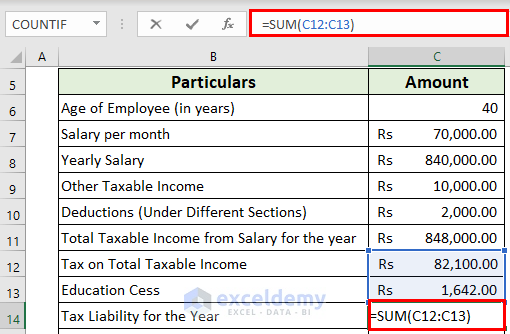

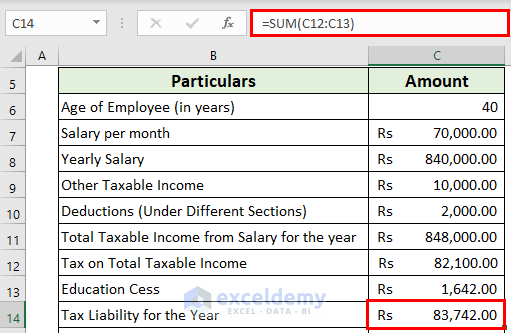

Step 5 – Calculate the Tax Liability for the Year

- Go to C14 and use the formula:

=SUM(C12:C13)- Hit Enter to get the output.

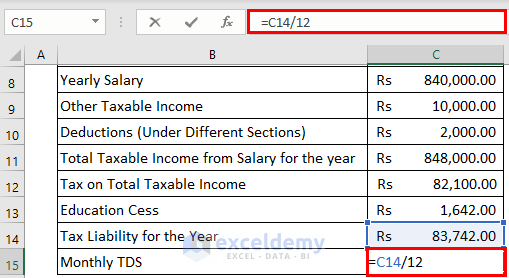

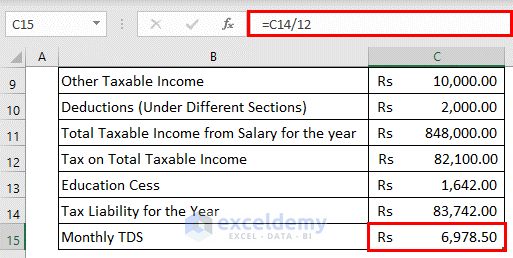

Step 6 – Measure the Monthly TDS

- Go to C15 and use the following formula

=C14/12- Hit Enter.

Things to Remember

- The tax is calculated based on different slabs.

- The breakdown of the allowances and deductions varies between countries, companies, industries, and years.

Download the Practice Workbook

<< Go Back to Salary | Formula List | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!

Why the amount of 1,12,500/- added in formula

Hello Nivedita,

Thanks for your comment. Here, “112500” represents the tax amount to be added to the calculated TDS when the annual salary income (C11) exceeds 1,000,000 (1 million) and falls within the highest tax slab.

To break it down further:

>> If the annual salary income (C11) is greater than 1,000,000, it means that the individual’s income falls into the highest income tax slab.

>> In this highest tax slab, the formula applies a tax rate of 30% to the portion of income above 1,000,000. It calculates the tax on this portion and adds 112,500 to the result.

Inform us in the comment if you have any more confusion.

Regards,

ExcelDemy Team

This calculation can use for old or new regime for 23/24

Hello, Sachin!

Thank you for your query. Regarding your query, this article was written based on the 2023 regime. But, the TDS calculator basics are the same for every regime. Only the variables, like tax deduction percentage, education cess percentage, etc. can change from year to year which would slightly affect the calculation. But, the basics are the same. So, it’s better if you check your current tax variable percentages for this regime in your region and use our file accordingly.

Hopefully, you will be able to use the file in your calculation properly.

With Regards,

Md. Tanjim Reza Tanim

Team Leader, Exceldemy