Excel is the most widely used tool for dealing with massive datasets. We can perform myriads of tasks of multiple dimensions in Excel. When it comes to creating a rental invoice, Excel can be helpful. One can easily create a rental invoice format using Excel. In this article, I will show you how to create GST rental invoice format in Excel in easy steps.

Introduction to Rental Invoice

When a landlord or property management receives payment for a rental property, they will deliver or mail a rent invoice to the tenant (whether they are renting a single, multi-family, or commercial property). To ensure accurate payment records, the property manager or landlord should keep copies of all relevant paperwork.

GST stands for Goods & Service Tax. It is crucial to remember that the GST is only charged on the rental of commercial property; it is not charged on the rental of residential property.

How to Create GST Rental Invoice Format in Excel: 5 Quick Steps

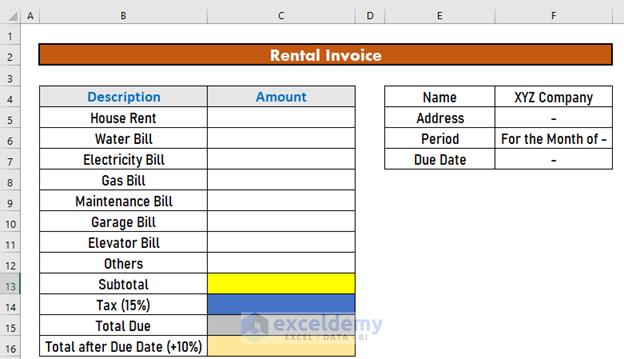

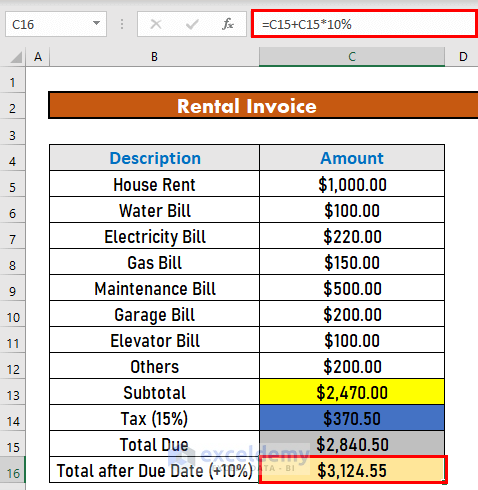

This is the dataset for today’s article. We have XYZ company. This is a simple format for a rental invoice prepared for this company.

I will show how to create the invoice using this format.

Step 1: Write Down Details of Invoice

The first step is to fill up the amount for different bills. You just have to manually fill up them in.

Read More: How to Create a Tally VAT Invoice Format in Excel

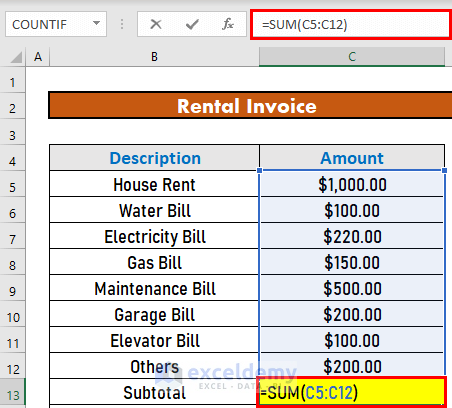

Step 2: Calculate Subtotal from Given Data

The next step is to calculate the subtotal. We will use the SUM function to calculate the subtotal. To do so,

- Go to C13 and write down the following formula

=SUM(C5:C12)- Then, press ENTER. Excel will return the output.

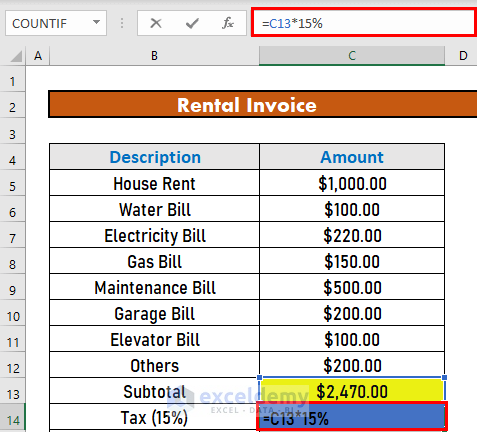

Step 3: Calculate Tax Amount from Given Amount

Now, I will calculate the tax amount. In this example, I am considering the tax to be 15%. So, let’s calculate the tax.

- Go to C14 and write down the formula

=C13*15%- Then, press ENTER to get the output.

Read More: Tally Sales Invoice Format in Excel

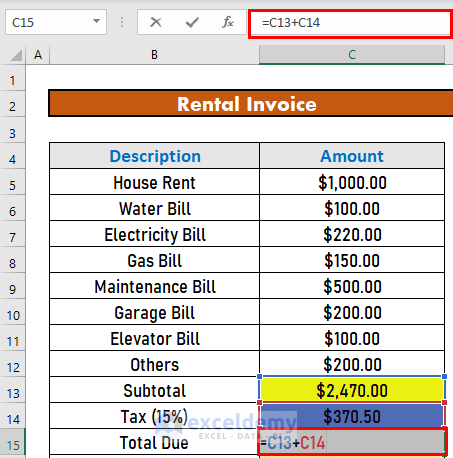

Step 4: Determine Total Due

Now, I will show how to calculate the total due. This is the summation of the subtotal and the tax levied on the subtotal. To calculate it,

- Go to C15 and write down the following formula

=C13+C14- Then, press ENTER.

Step 5: Calculate Total Due After Due Date

We are almost done with the steps. Our last step is to consider the late payment. If the tenant does not repay the rent within a certain time, he or she will have to give a penalty. We are considering this amount to be 10%. So, let’s calculate it.

- Go to C16 and write down the following formula

=C15+C15*10%- Now, press ENTER to get the output.

Read More: How to Create Proforma Invoice for Advance Payment in Excel

Things to Remember

- GST is only charged only on the rental of commercial property, not on the rental of residential property.

- Format the invoice as you wish.

Download Practice Workbook

Download this workbook and practice while going through the article.

Conclusion

In this article, I have explained how to create GST rental invoice format in Excel in easy steps. I hope it helps everyone. If you have any suggestions, ideas, or feedback, please feel free to comment below.

Related Articles

- Proforma Invoice Format in Excel with GST

- Create Non GST Invoice Format in Excel

- How to Make GST Export Invoice Format in Excel

- How to Create a Tally GST Invoice Format in Excel

- How to Create GST Bill Format in Excel with Formula

<< Go Back to Excel Invoice Templates | Accounting Templates | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!