Useful Common Terms for Salary Calculations

Basic Salary

Basic Salary is the base part of the total salary that doesn’t include any other allowances. Overtime, bonuses, medical allowances, etc. are not part of the basic salary. Adding all other allowances to the basic salary comes out to the total salary received by an employee. So, the basic salary is a fixed amount for a company employee.

CTC

CTC stands for ” Cost to Company,” which indicates the total amount of expenses a company spends on an employee, including the Gross Salary and all other benefits the employee receives during the service period.

PF

PF (Provident Fund) refers to the amount deducted from the salary and put away in a PF account. It is designed to ensure enough funds are saved to adequately get an employee through retirement.

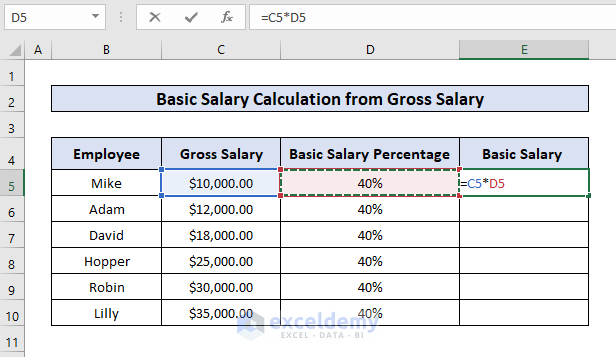

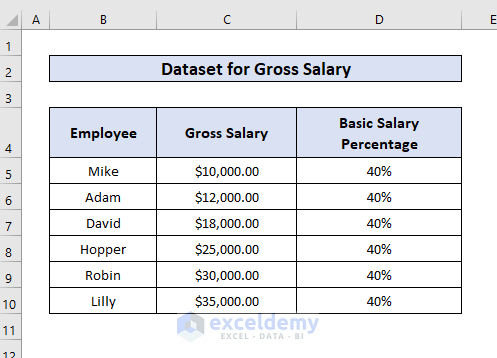

Method 1 – Calculate the Basic Salary Using the Gross Salary

Below, we have a dataset of the gross salaries of a company’s employers and the percentage of gross salaries that will denote the basic salary of the employees.

- Add a column where you want the Basic Salary of the employers.

- Enter the following formula to the cell where you want to get the result:

=C5*D5Here,

- C5= Gross Salary

- D5= Basic Salary Percentage

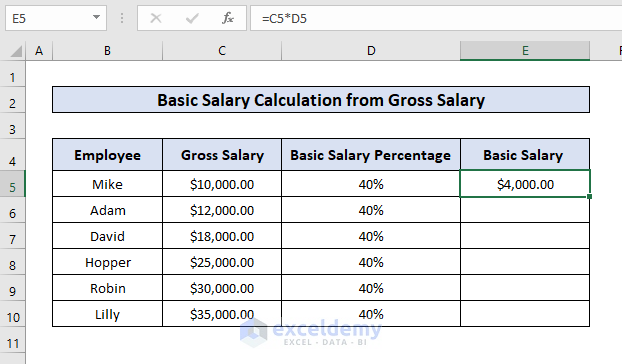

- Click ENTER.

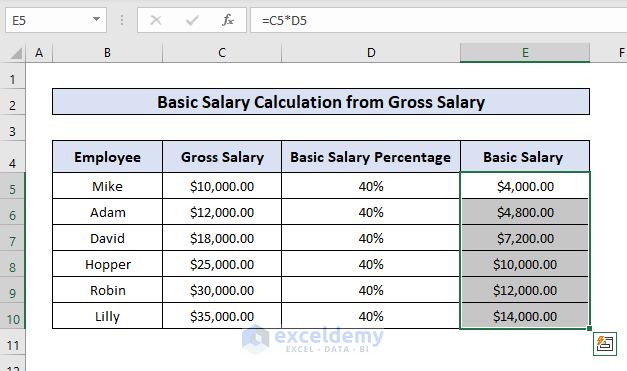

- Use Autofill to drag the formula to every cell you want to output, and you will get the basic salary of every employee.

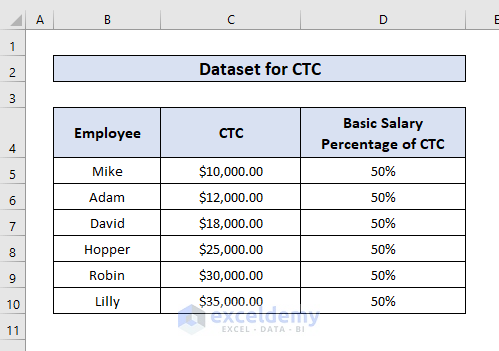

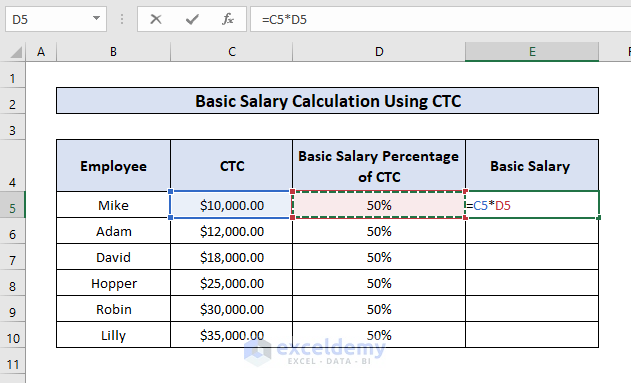

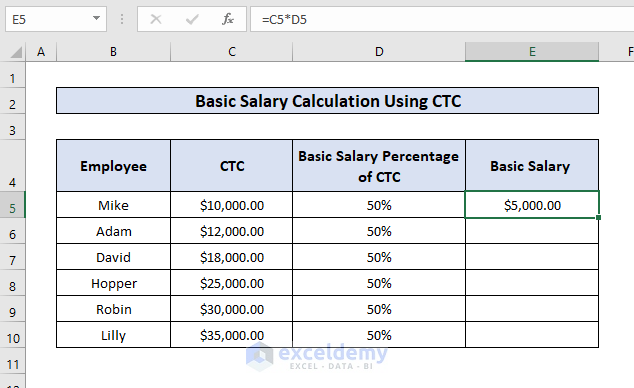

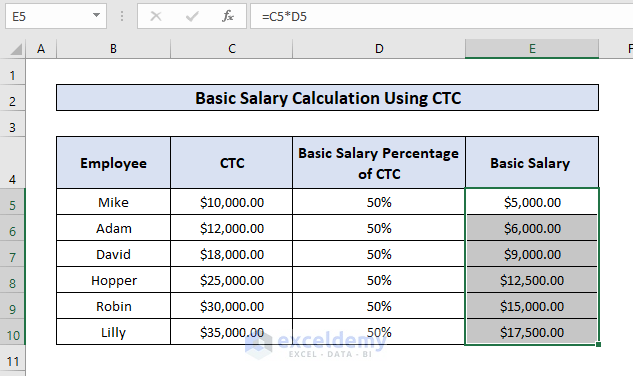

Method 2 – Calculation of Basic Salary Using CTC

We have a dataset of CTC for the employees and the Basic Salary percentage of CTC. We want to calculate the Basic Salary from this percentage.

Steps:

- Enter the following formula to the cell where you want to get your desired output:

=C5*D5Here,

- C5= CTC

- D5= Basic Salary Percentage of CTC

- Press ENTER.

- Use Autofill to drag the formula to every cell you want to get the output.

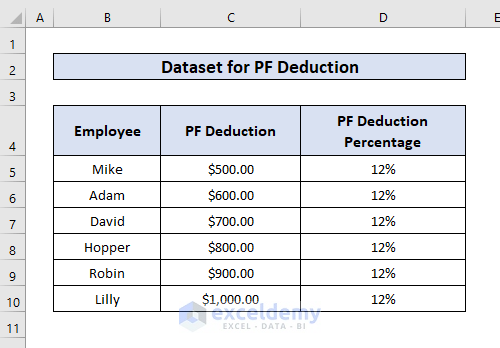

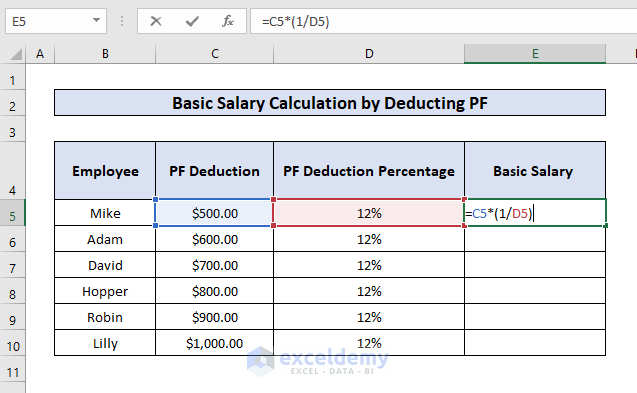

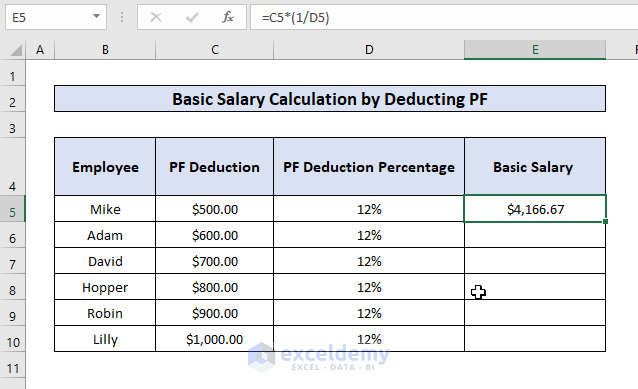

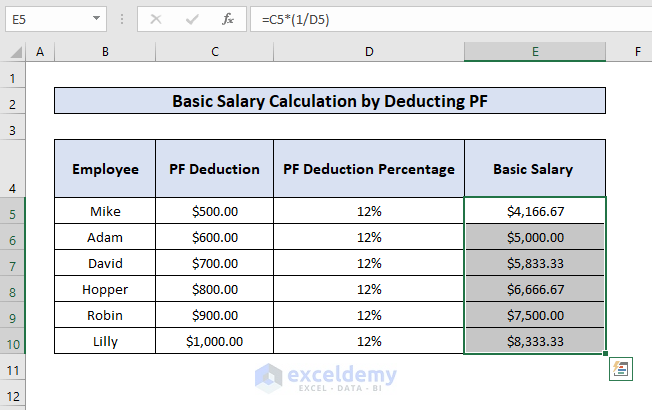

Method 3 – Deducting PF to Calculate the Basic Salary

We have a dataset of the PF (Provident Fund) which is deducted from the employees’ salary every month.

Steps:

- Go to the cell you want to get the result and enter the following formula:

=C5*(1/D5)Here,

- C5 = PF Deduction

- D5 = PF Deduction percentage

- Press ENTER.

- Use Autofill to drag the formula to every cell you want.

Download the Practice Workbook

<< Go Back to Salary | Formula List | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!