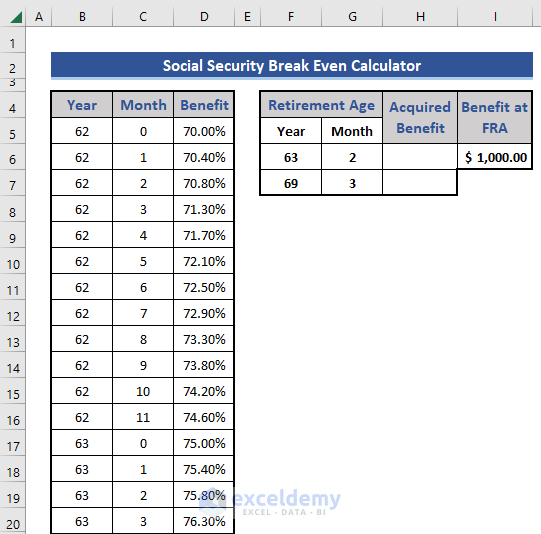

Method 1 – Insert Primary Information

- Insert basic information to compare two ages and 100% benefits in the dataset.

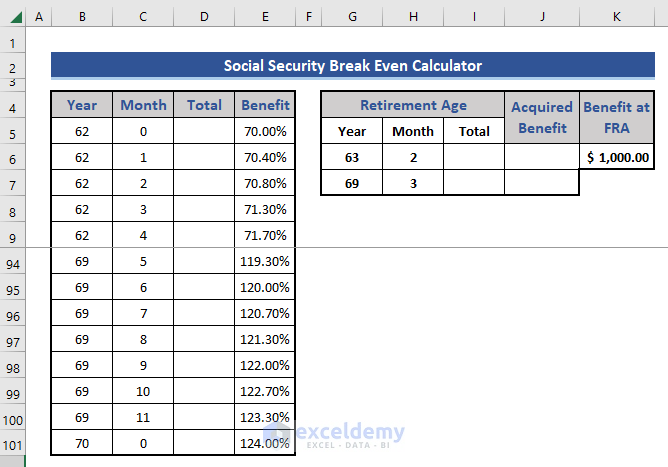

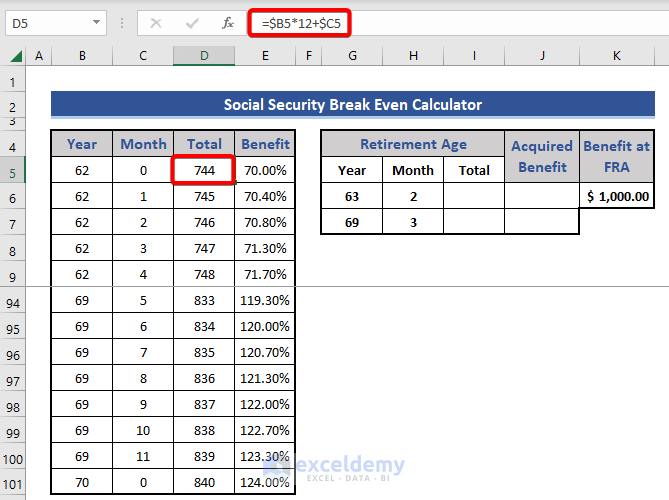

Method 2 – Calculate the Total Months

- Insert two new rows to calculate the total months in the dataset.

- Go to cell D5 and put in the following formula.

=$B5*12+$C5

This will help you find the benefit percentage based on the age at which you took retirement. Expand this formula to the end.

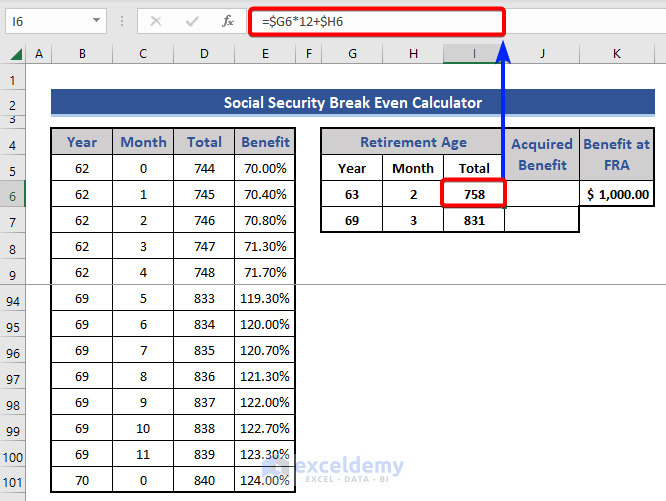

- Put another formula for cell I6 and I7.

=$G6*12+$H6

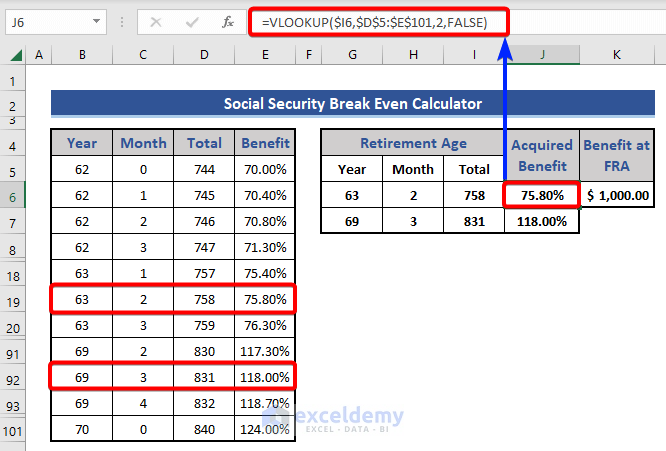

Method 3 – Find out Benefit Percentage

Use the VLOOKUP function to calculate the benefit percentage at different retirement ages.

- Put the following formula on cells J6 and J7.

For cell J6:

=VLOOKUP($I6,$D$5:$E$101,2,FALSE)

For cell J7:

=VLOOKUP($I7,$D$5:$E$101,2,FALSE)

We successfully find out the percentage from the list at different retirement ages.

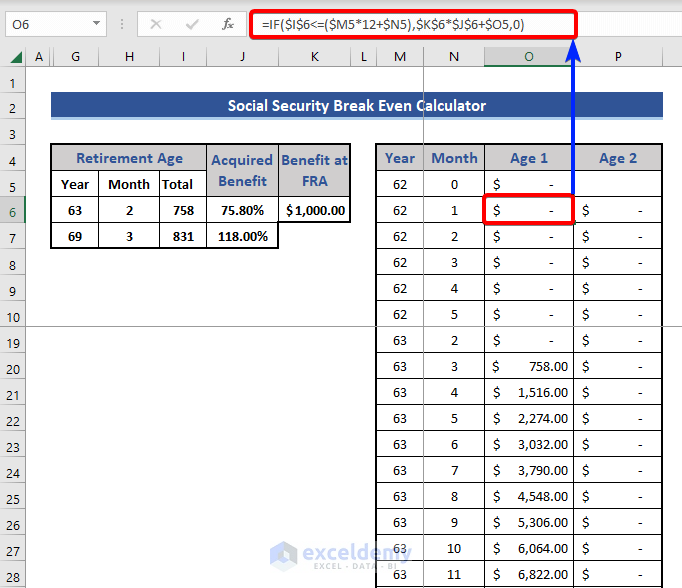

Method 4 – Calculate Cumulative Social Security Benefit

Here, the 1st retirement age is 63 years and 2 months. The person will benefit in the next month, which is 63 years and 3 months. After that, this will continue for a lifetime.

- Apply a formula on cell O6 to get the cumulative benefit for the 1st retirement age.

=IF($I$6<=($M5*12+$N5),$K$6*$J$6+$O5,0)

Expand this formula to the last. We used the IF function in this formula.

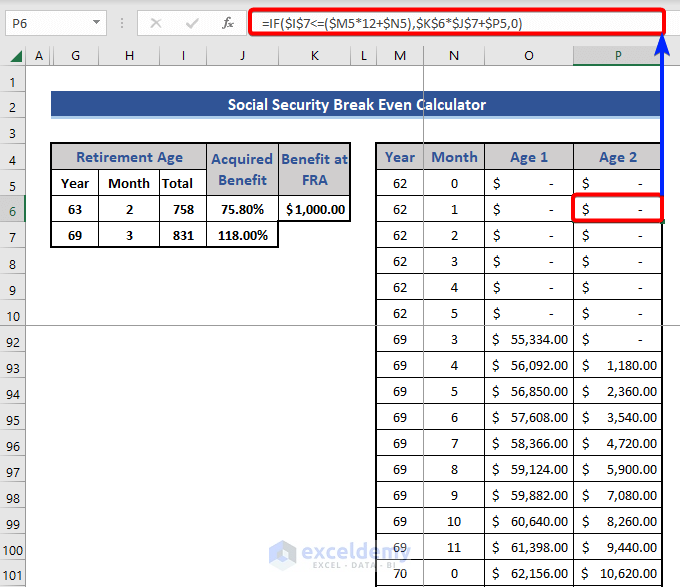

- Use another similar formula on cell P6 for the cumulative benefit at 2nd retirement age.

=IF($I$7<=($M5*12+$N5),$K$6*$J$7+$P5,0)

Expand this to the last cell.

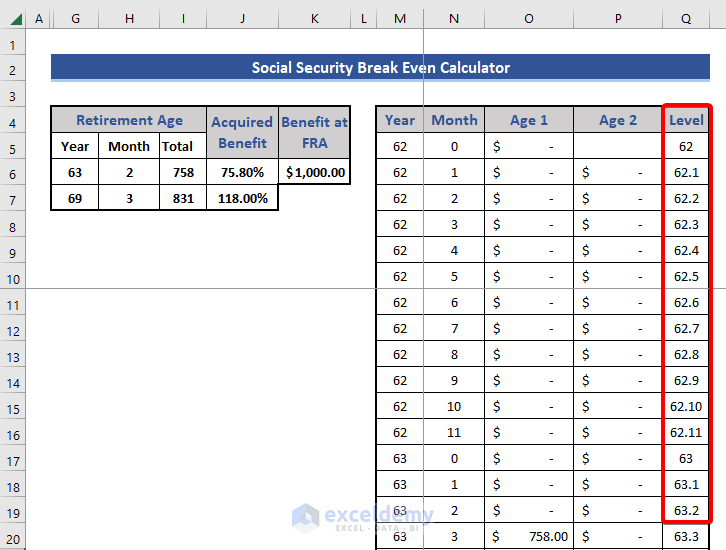

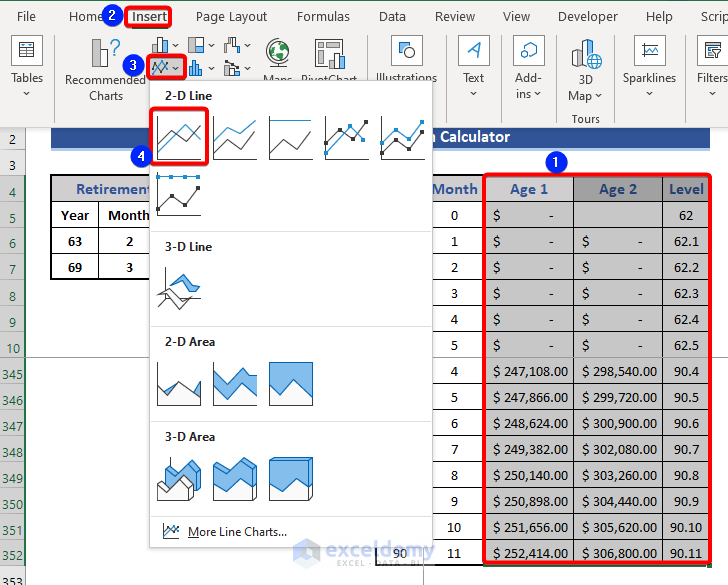

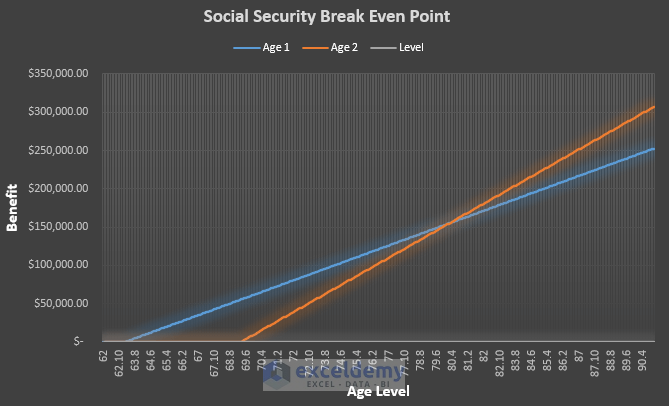

Method 5 – Insert Data in a Chart to Find the Break-Even Point

- Add a new column named Level for year-defining value.

- Select the whole data from the three columns Age 1, Age 2, and Level.

- Go to the Insert tab.

- Choose the Line option from the Charts group.

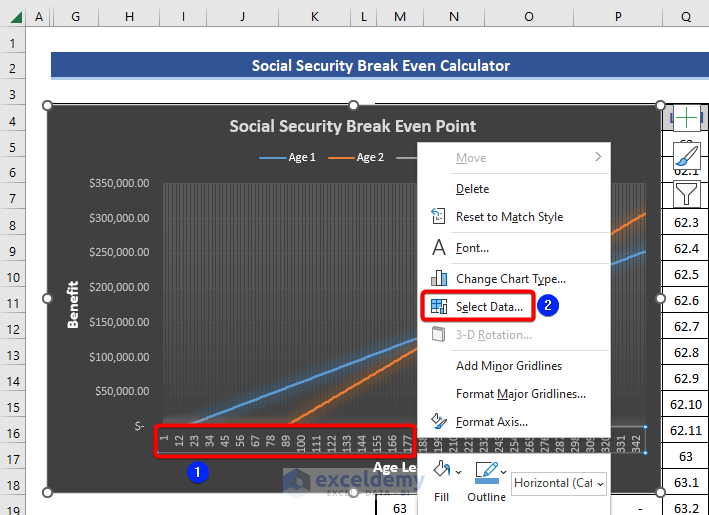

- Look at the following chart. Here, we will change the data of the horizontal axis.

- Choose the horizontal axis and press the right button of the mouse.

- Click the Select Data option from the menu.

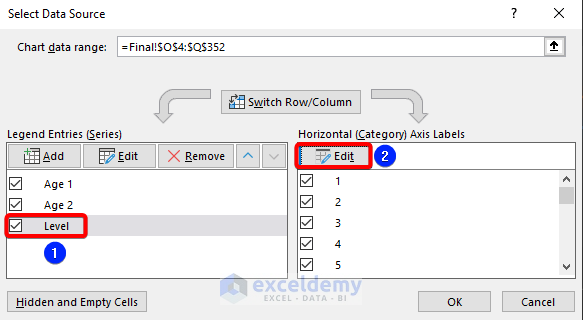

- Select Data Source window appears.

- Choose the Level option from the Legend Entries section.

- Choose the Edit option from the Horizontal Axis Labels section.

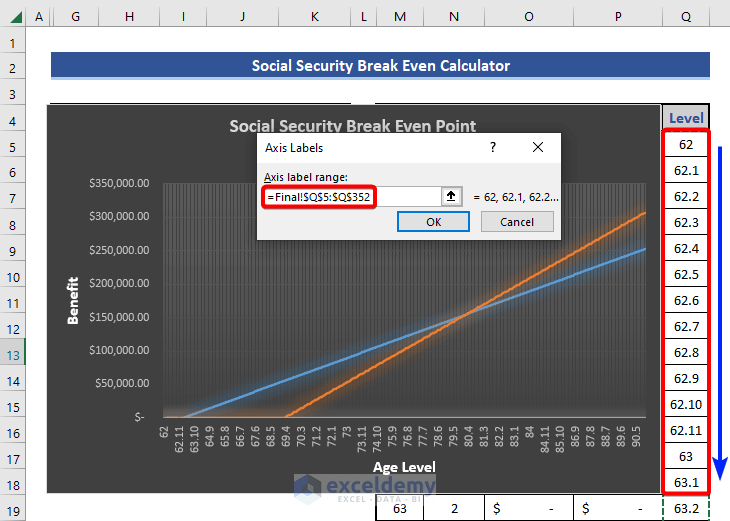

- Choose the Level column as the Axis label range.

- Press the OK button.

- Look at the chart now.

The chart will give us an idea of the break-even point, but we have to find it manually from the chart or the dataset.

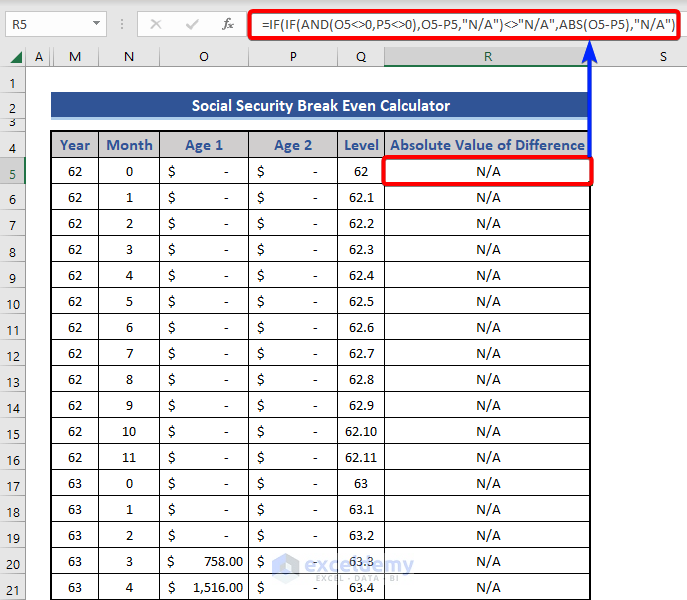

Method 6 – Find Out the Break-Even Point

- Add a new column in the dataset. Put a formula on cell R5.

=IF(IF(AND(O5<>0,P5<>0),O5-P5,"N/A")<>"N/A",ABS(O5-P5),"N/A")

This formula uses the nested IF function to find the absolute values of the difference between the benefits of age 1 and age 2. We added a condition that when Age 1 and Age 2 are both 0, the subtraction formula will not be applied.

Formula Breakdown:

- AND(O5<>0,P5<>0)

It follows two conditions. Check if O5 and P5 are not equal to 0.

Result: False.

- IF(AND(O5<>0,P5<>0),O5-P5,”N/A”)

IF function returns the difference between O5 and P5 when fulfilling the condition. Otherwise returns “N/A”

Result: N/A.

- IF(IF(AND(O5<>0,P5<>0),O5-P5,”N/A”)<>”N/A”,ABS(O5-P5),”N/A”)

IF function works based on the value of the previous section. If the value of the previous section is not equal to N/A, give the absolute value of the difference between cell O5 and P5, Otherwise, return N/A.

Result: N/A.

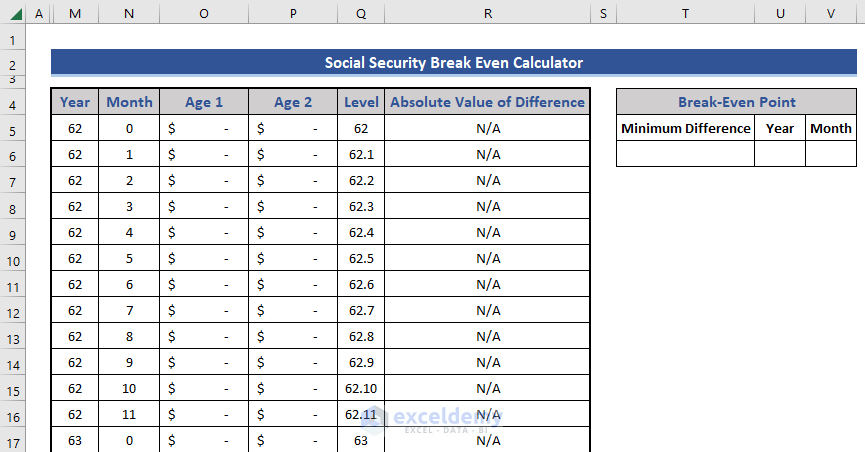

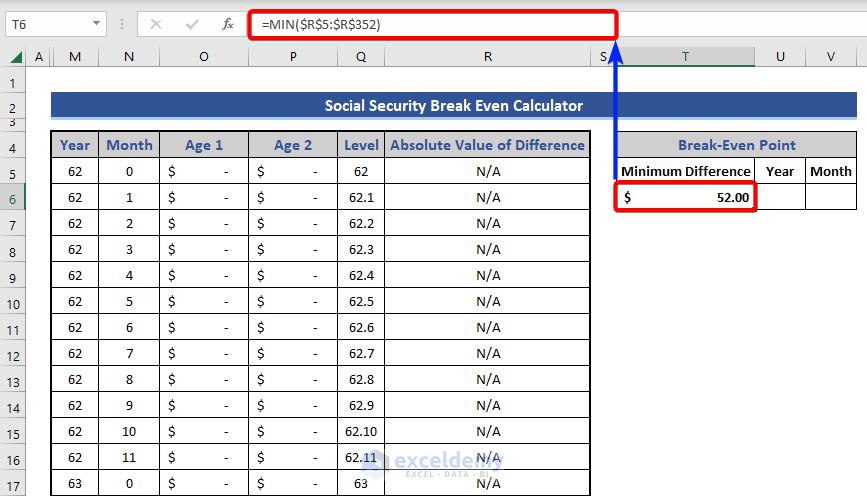

- Add a section in the dataset to find out the break-even point.

- Use the following formula based on the MIN function to get the minimum difference at cell T6.

=MIN($R$5:$R$352)

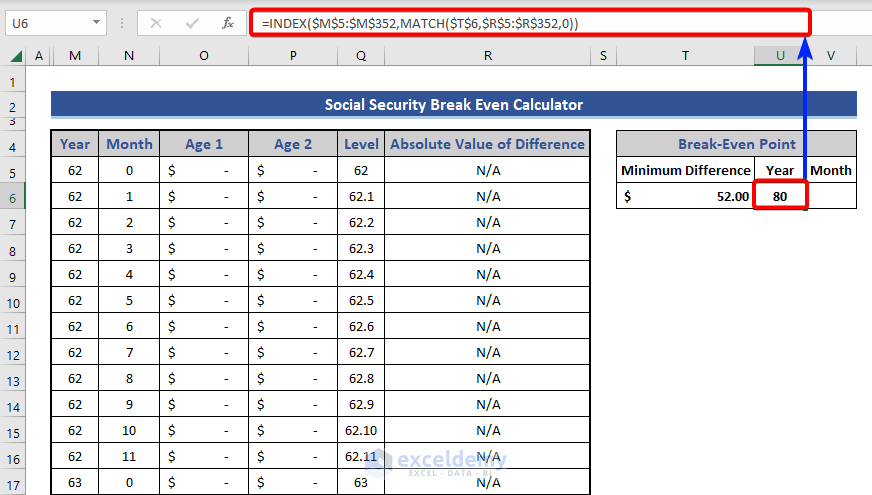

=INDEX($M$5:$M$352,MATCH($T$6,$R$5:$R$352,0))

This returns the Year value. The INDEX-MATCH formula works based on the minimum difference between two ages.

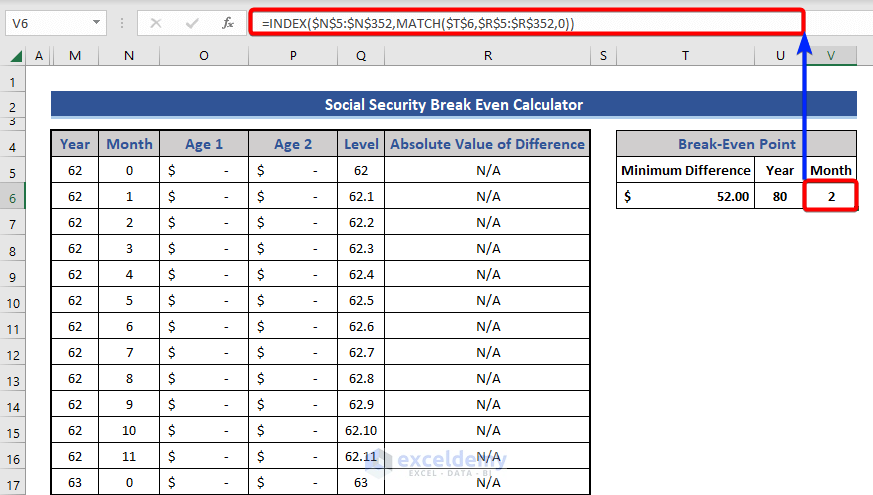

- Find out the Month value.

=INDEX($N$5:$N$352,MATCH($T$6,$R$5:$R$352,0))

Get the break-even point at age 80 years and 2 months.

Download Practice Workbook

Download this practice workbook to exercise while you are reading this article.

<< Go Back to Break-Even Analysis | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!