If you are looking for per day salary calculation formula in Excel, this article is for you. Here, we will walk you through 2 easy and suitable methods to do the task effortlessly.

Calculate Per Day Salary in Excel: 2 Formulas

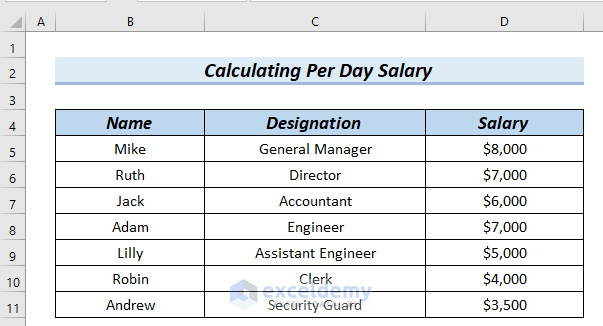

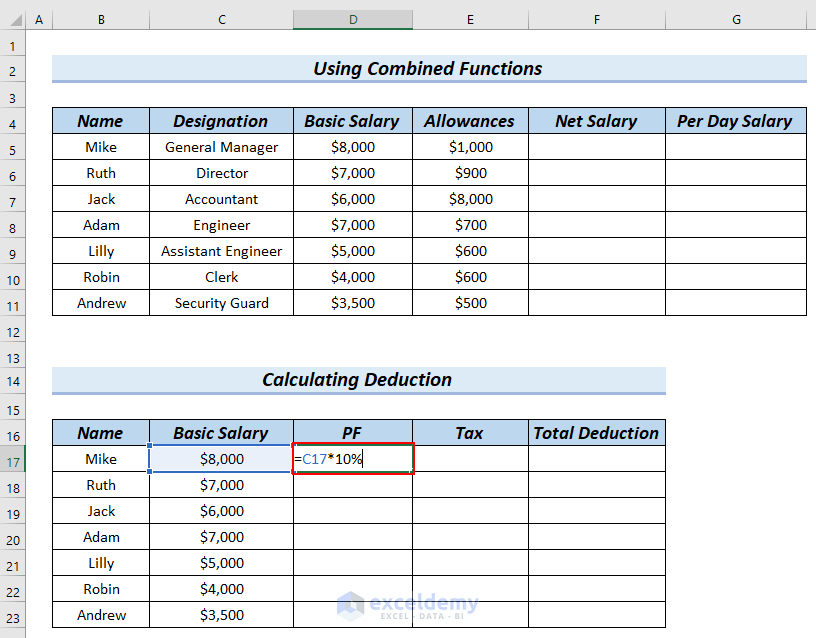

The following table has Name, Designation, and Salary columns.

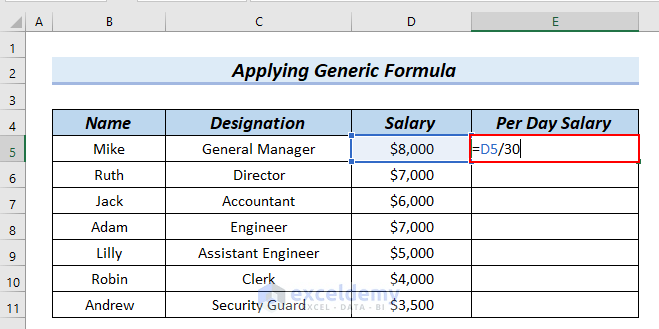

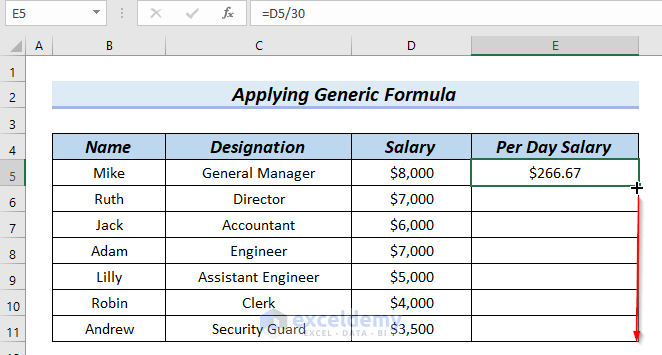

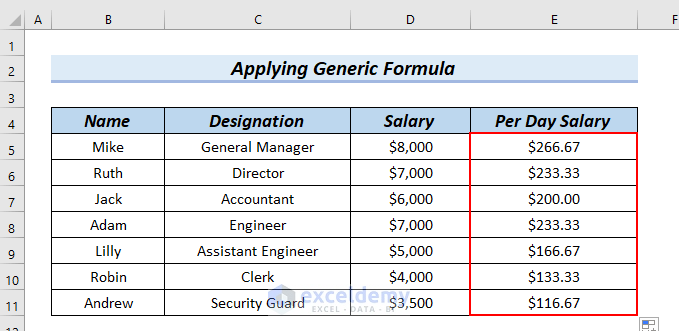

Formula 1 – Using a Generic Formula to Calculate Per Day Salary in Excel

Steps:

- Enter the following formula in E5.

=D5/30Formula Breakdown

- Divide D5 by 30.

- $8000/30 → becomes

- Output: $266.67

- Explanation: Here, $266.67 is the Per Day Salary.

- Press ENTER and see the result in E5.

- Drag down the formula across the cells you want to fill with the Fill Handle tool.

The calculated per day salary is displayed in the Per Day Salary column.

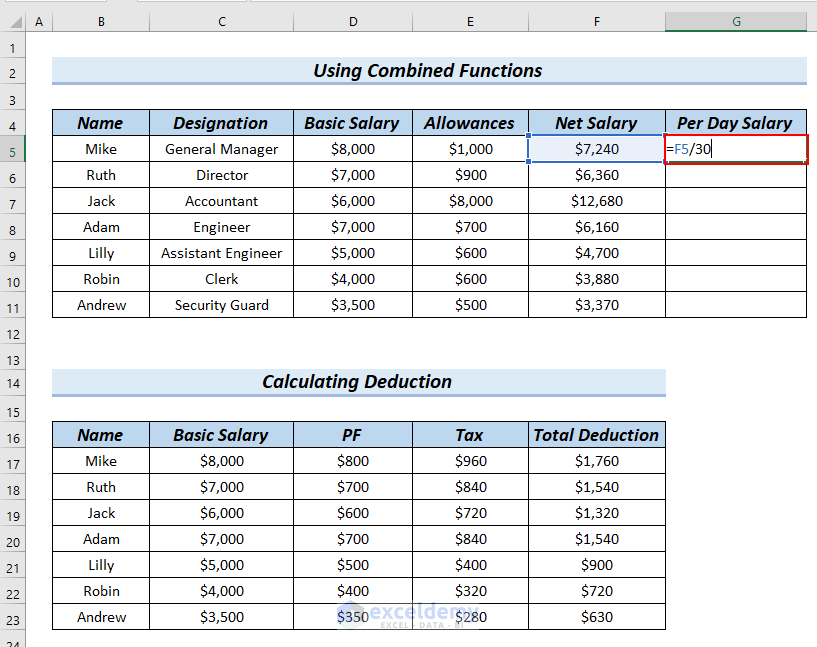

Formula 2 – Using a Combined Formula to Calculate Per Day Salary in Excel

Steps:

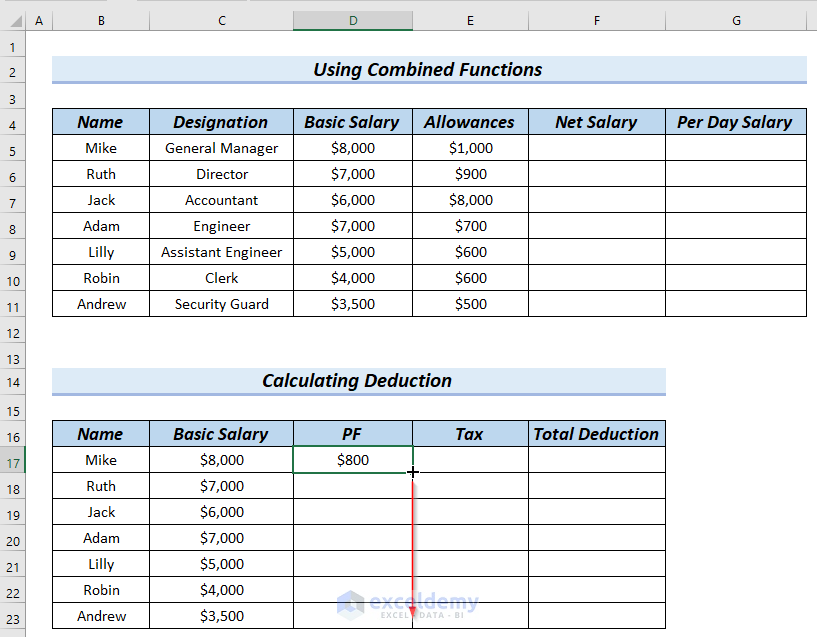

- Calculate PF (Provident Fund). PF for each employee is 10% of their Basic Salary, here.

Enter the following formula in D17.

=C17*10%Formula Breakdown

- C17*10% → multiplies cell C17 by 10%.

- $8000*10% → becomes

- Output: $800 is the PF of a particular employee.

- Press ENTER and see the result in D17.

- Drag down the formula across the cells you want to fill with the Fill Handle tool.

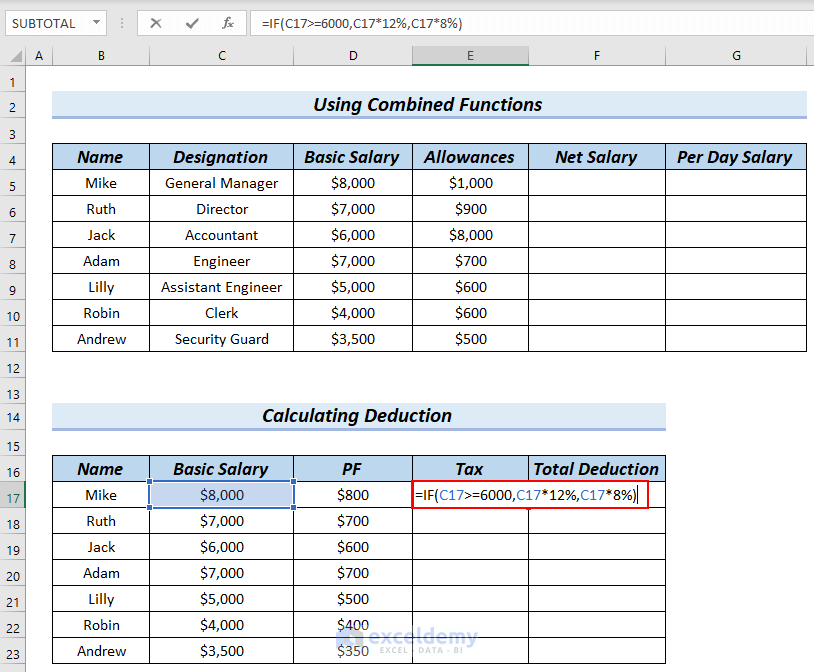

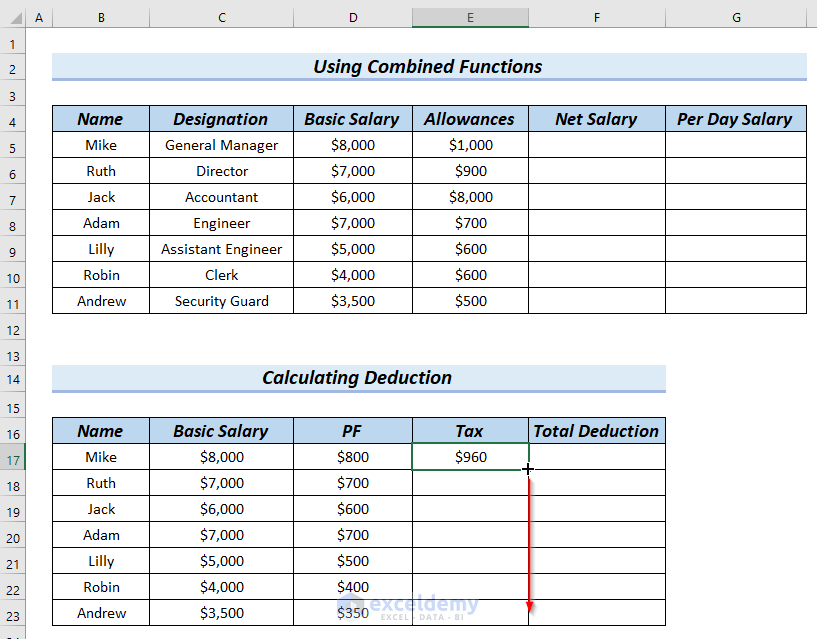

Calculate Tax by using the IF function.

- Enter the following formula in E17.

=IF(C17>=6000,C17*12%,C17*8%)Formula Breakdown

- IF(C17>=6000,C17*12%,C17*8%) → the IF function returns C17*12% when C17>=6000 is TRUE, otherwise it returns C17*8%.

- IF(8000>=6000,8000*12%,8000*8%) → becomes

- Output: $960. As the logical_test is TRUE, the result becomes 8000*12% which is $960.

- Press ENTER and see the result in E17.

- Drag down the formula across the cells you want to fill with the Fill Handle tool.

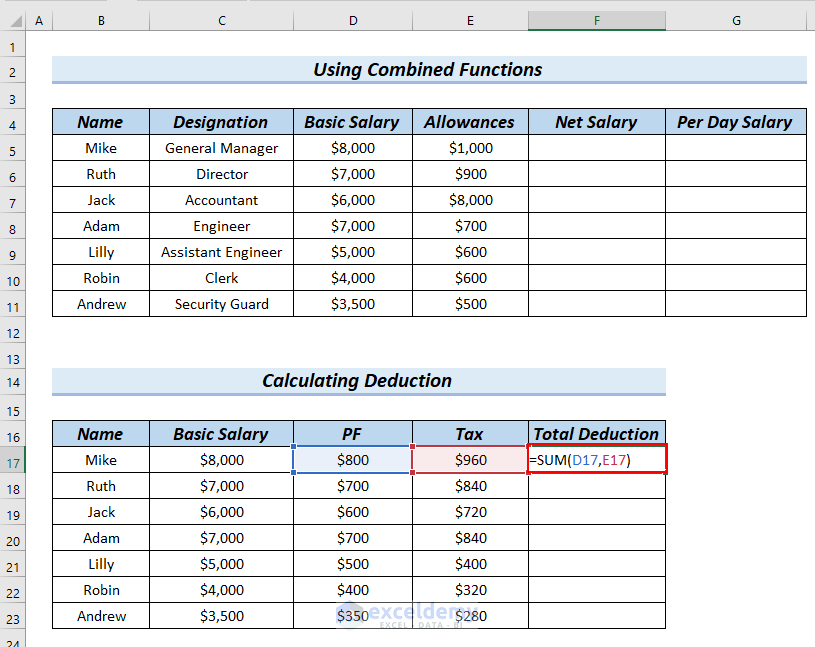

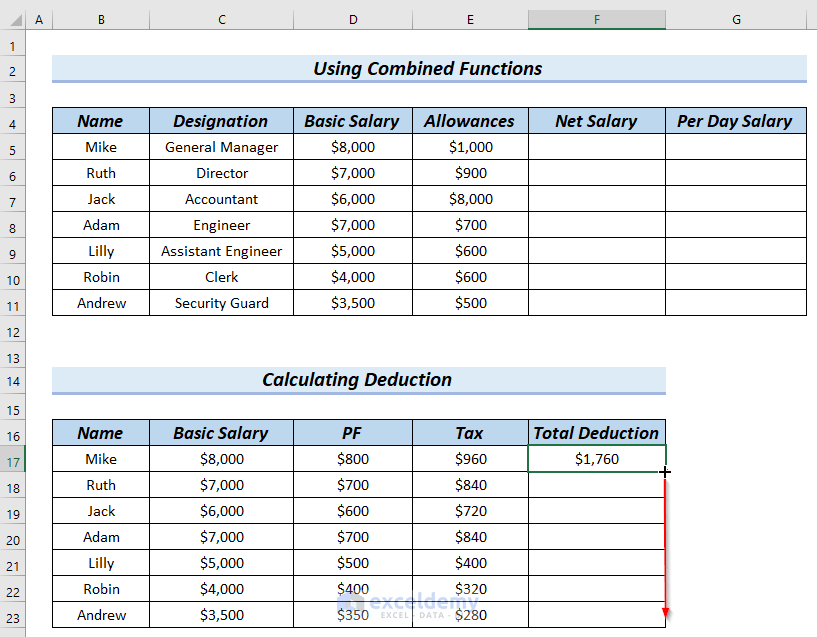

Calculate Total Deduction by using the SUM function.

- Enter the formula in F17.

=SUM(D17,E17)Formula Breakdown

- SUM(D17,E17) → adds cell D17 with cell E17.

- SUM(800,960) → becomes

- Output: $1760 is the Total Deduction of a particular employee.

- Press ENTER and see the result in F17.

- Drag down the formula across the cells you want to fill with the Fill Handle tool.

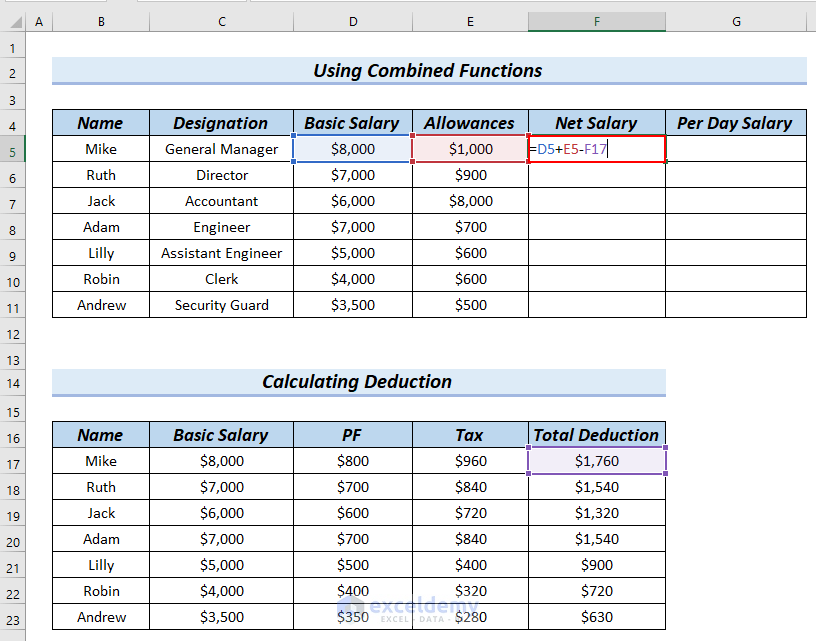

Calculate Net Salary.

- Enter the following formula in E5:

=D5+E5-F17Formula Breakdown

- D5+E5-F17 → adds cell D5 to cell E5 and subtracts F17.

- 8000+1000-1760 → becomes

- Output: $7240 is the Net Salary of a particular employee.

- Press ENTER and see the result in F5.

- Drag down the formula across the cells you want to fill with the Fill Handle tool.

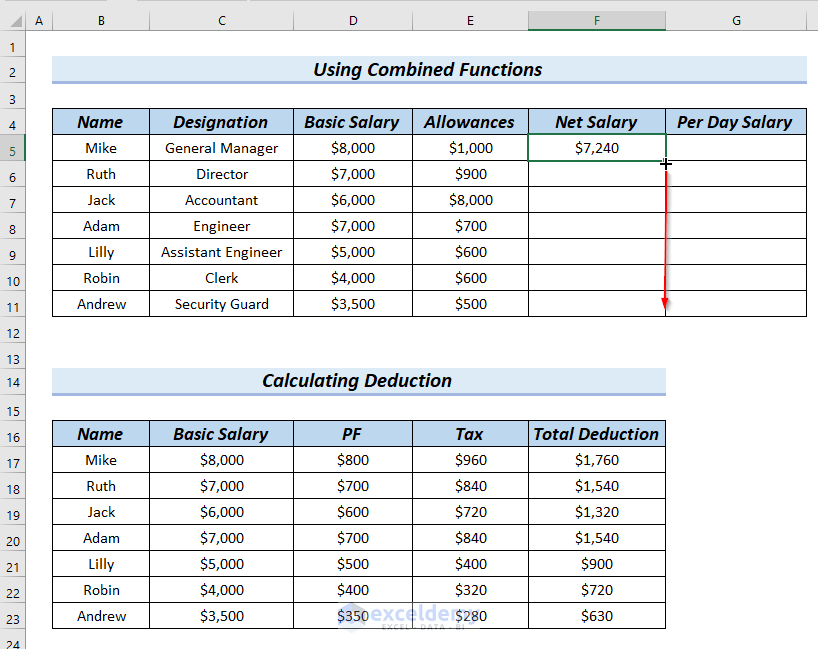

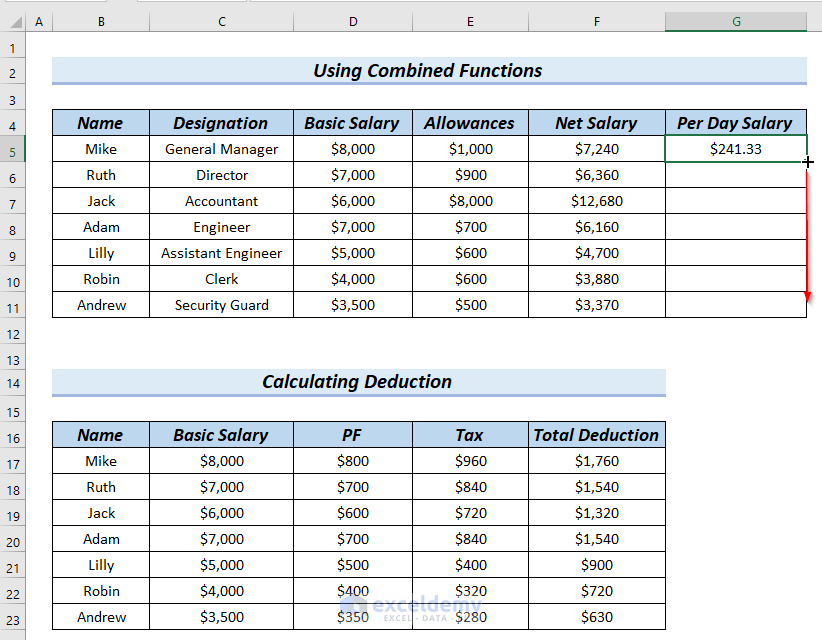

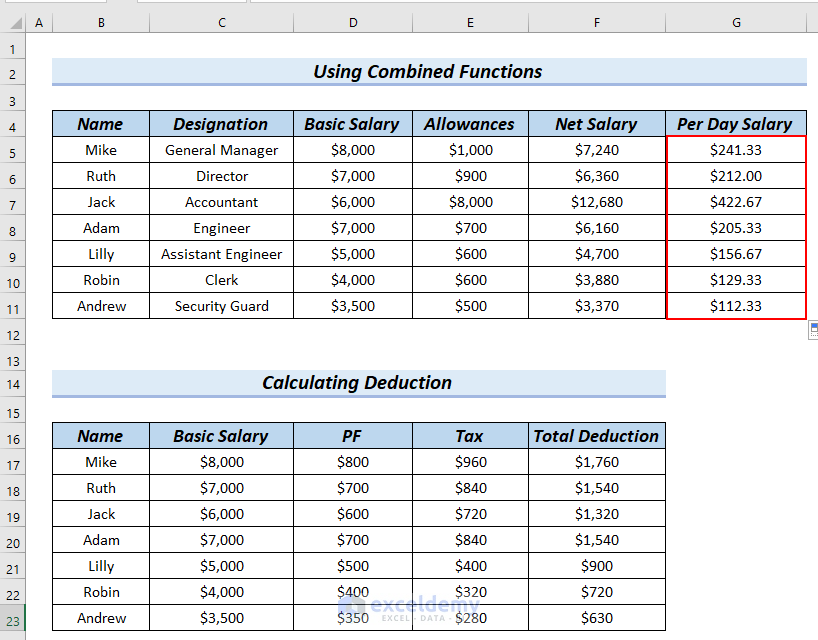

Calculate Per Day Salary by using a division formula.

- Enter the following formula in G5.

=F5/30Formula Breakdown

- Divide cell F5 by 30.

- $7240/30 → becomes

- Output: $241.33 is the Per Day Salary of a particular employee.

- Press ENTER and see the result in E5.

- Drag down the formula across the cells you want to fill with the Fill Handle tool.

The calculated per day salary is displayed in the Per Day Salary column.

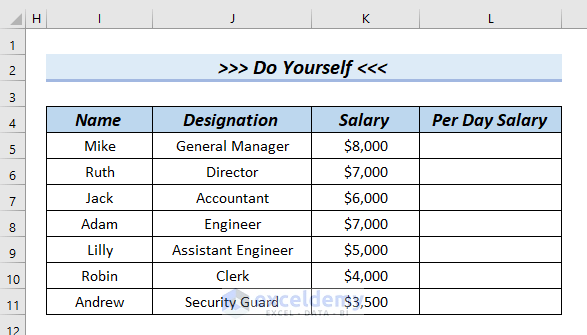

Practice Section

You can download the Excel sheet below for further practice.

Download Practice Workbook

<< Go Back to Salary | Formula List | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!