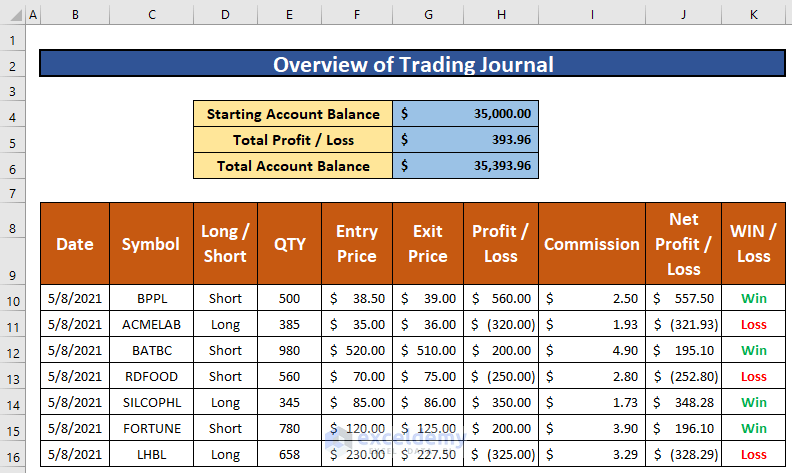

Let’s say we have a dataset that contains information about several Trades. We will make a trading journal in Excel using Mathematical formulas, the SUM function, and creating a waterfall chart.

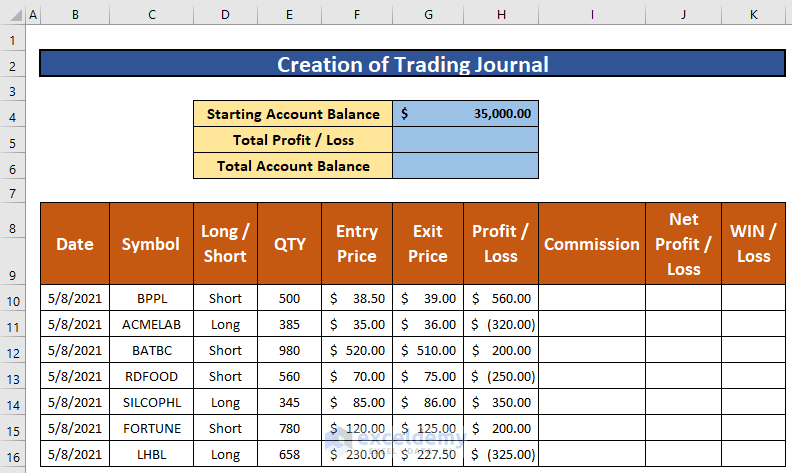

Step 1 – Create Dataset with Proper Parameters

Our dataset contains the trading company name, trade types, the quantity of trades, entry and exit price of trades for a day, profit and loss, commission, and so on.

Create a table and input the information according to the screenshot below.

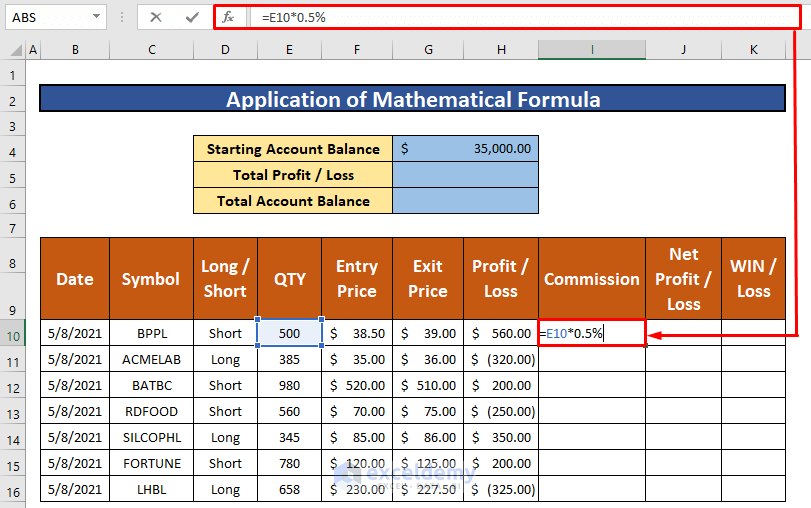

Step 2 – Calculate Individual Commission and Profit/Loss

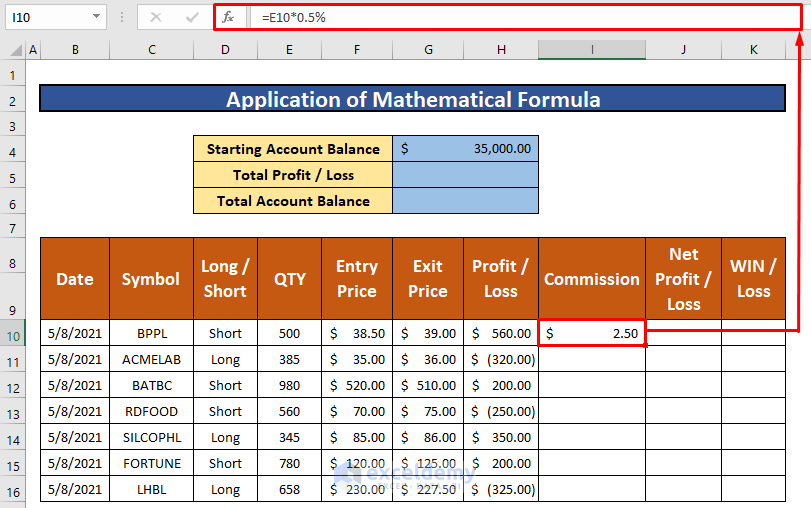

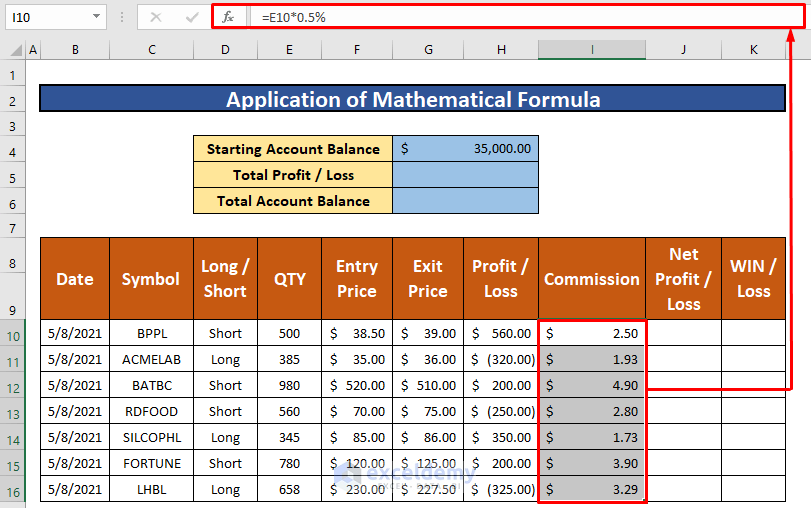

- Select cell I10.

- Enter the following formula:

=E10*0.5%E10 is the trade Quantity, and 0.5% is the commission.

- Press Enter on your keyboard. You will be able to get the return of the mathematical formula and the return is $2.50.

- AutoFill the mathematical formula to the rest of the cells in column I.

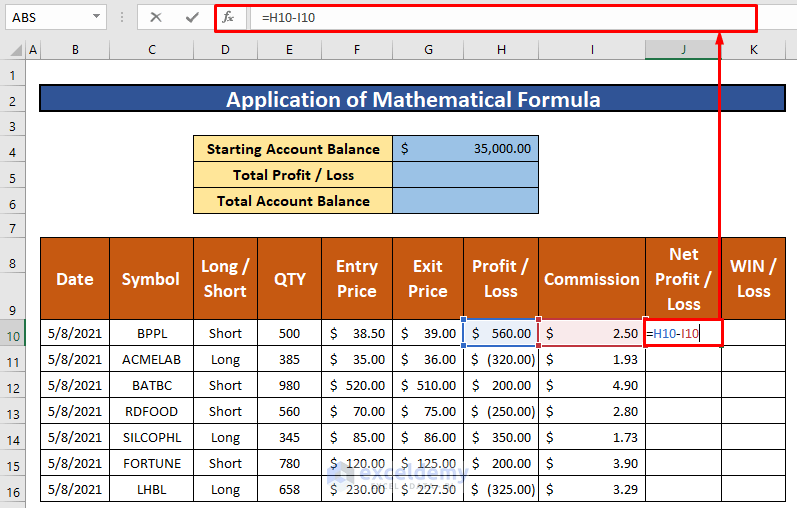

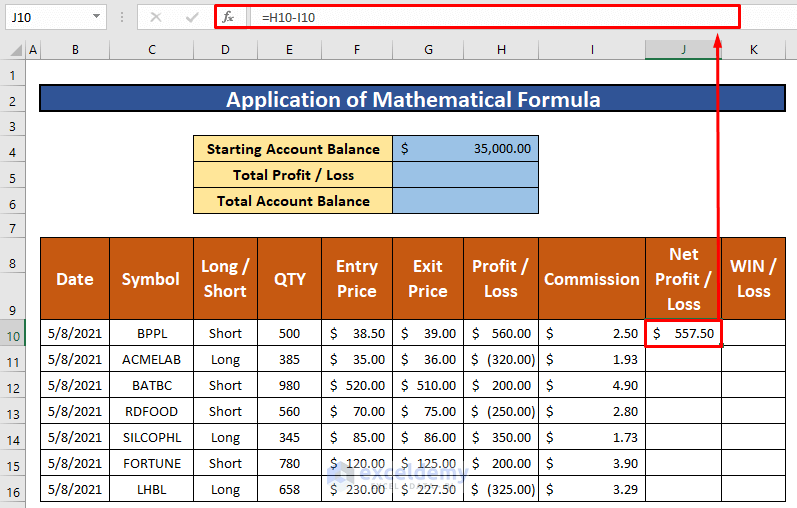

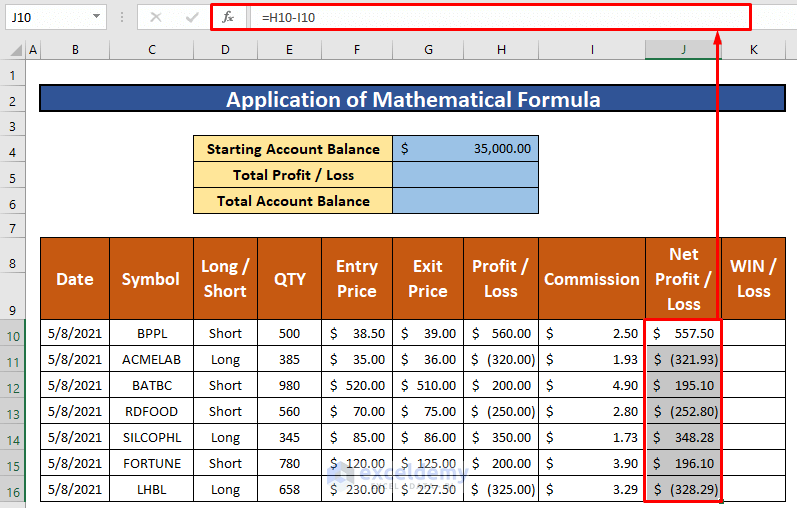

- Select cell J10.

- Copy the following formula into it:

=H10-I10H10 is the Profit or Loss, and I10 is the commission.

- Press Enter.

- AutoFill the mathematical formula to the rest of the cells in column J.

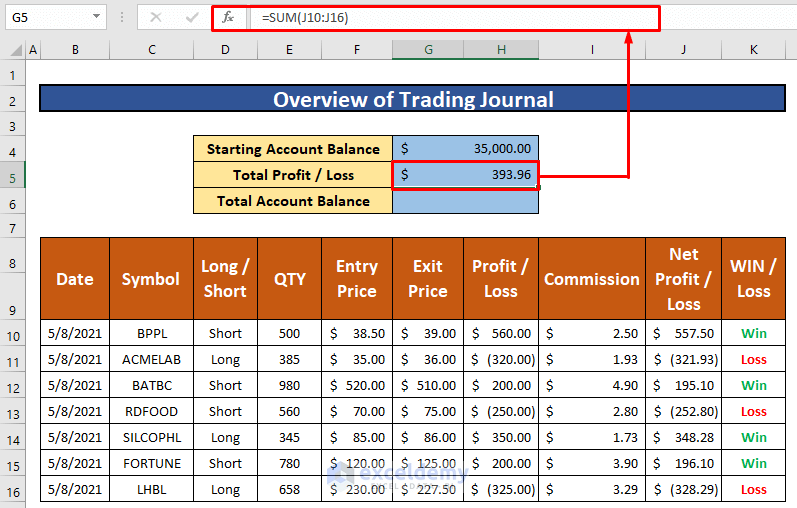

Step 3 – Calculate Total Profit

- Input the following formula in H5:

=SUM(J10:J16)- Press Enter.

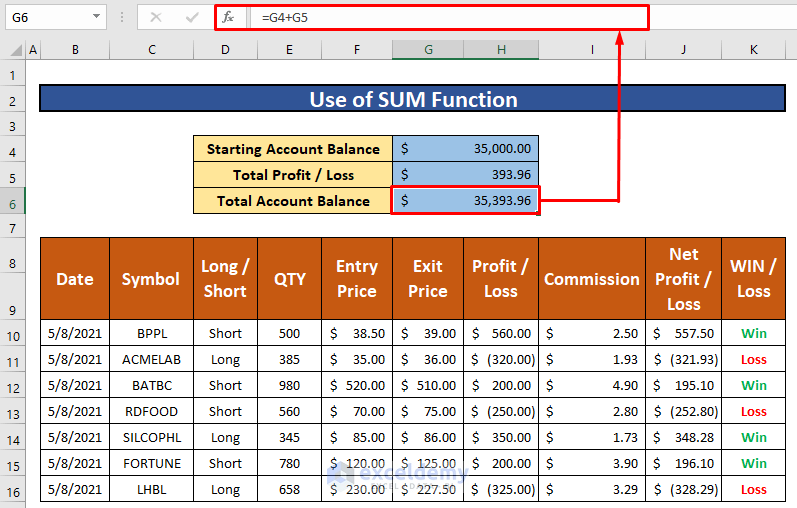

- Use the following formula in H6 for the total account balance:

=G4+G5G4 is the starting account balance, and G5 is the total profit or loss.

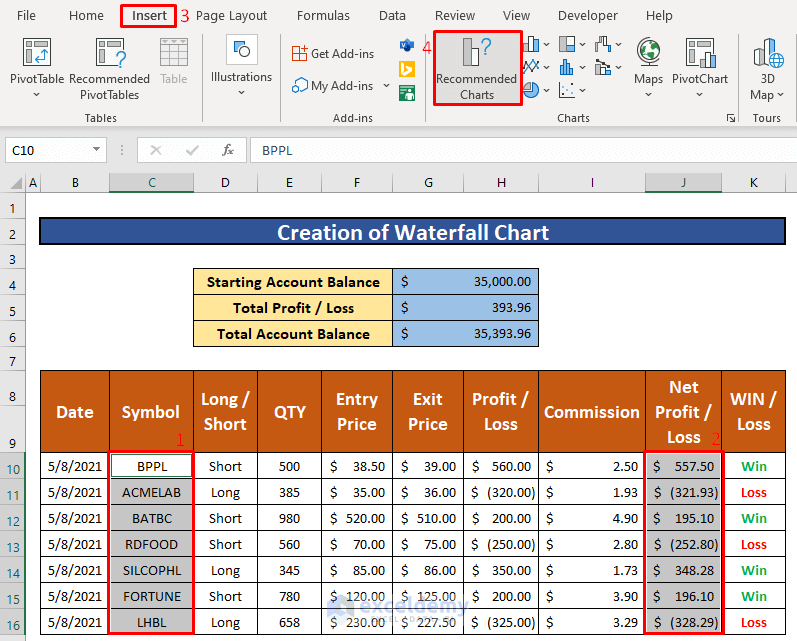

Step 4 – Create Waterfall Chart

- Select the range of data to draw a waterfall chart. We selected C10:C16 and J10:J16.

- From the Insert tab in the ribbon, go to Recommended Charts

- An Insert Chart dialog box will appear in front of you. Go to All Charts and select Waterfall.

- Click on OK.

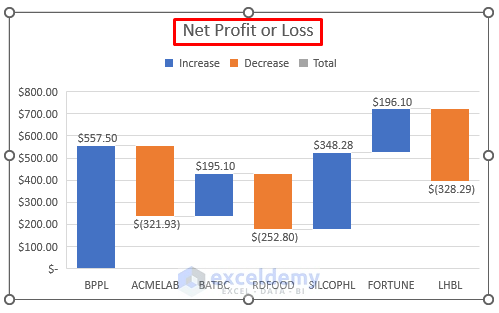

- Excel will create a Waterfall chart.

Things to Remember

#N/A! error arises when the formula or a function in the formula fails to find the referenced data.

#DIV/0! error happens when a value is divided by zero(0) or the cell reference is blank.

Download Practice Workbook

Download this practice workbook you can use as a template.

Related Articles

- How to Make Journal Entries in Excel

- How to Create a Forex Trading Journal in Excel

- How to Create a Bullet Journal in Excel

<< Go Back to Journal Entries in Excel | Excel for Accounting | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!

Thank you for your journal!