Excel payment calculator is one of the most common and essential calculators to track and plan various loan or savings payments.

In this free downloadable template, you will find all the required calculators to use according to your needs.

Download Excel Template

Download Excel TemplateFor: Excel 2007 or later

License: Private Use

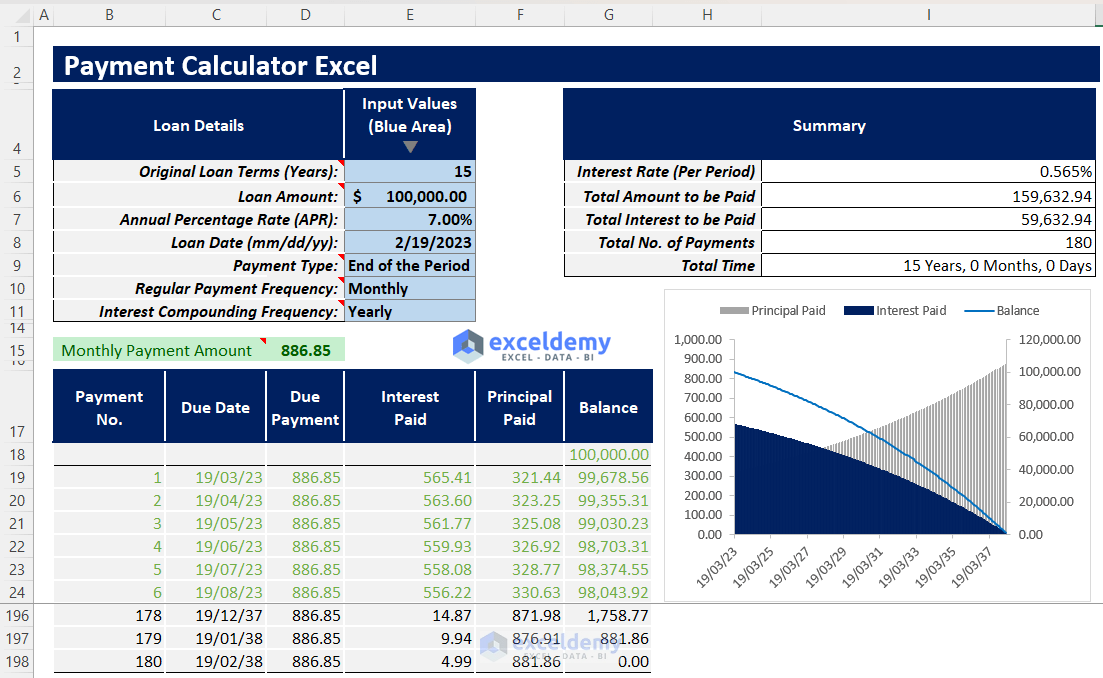

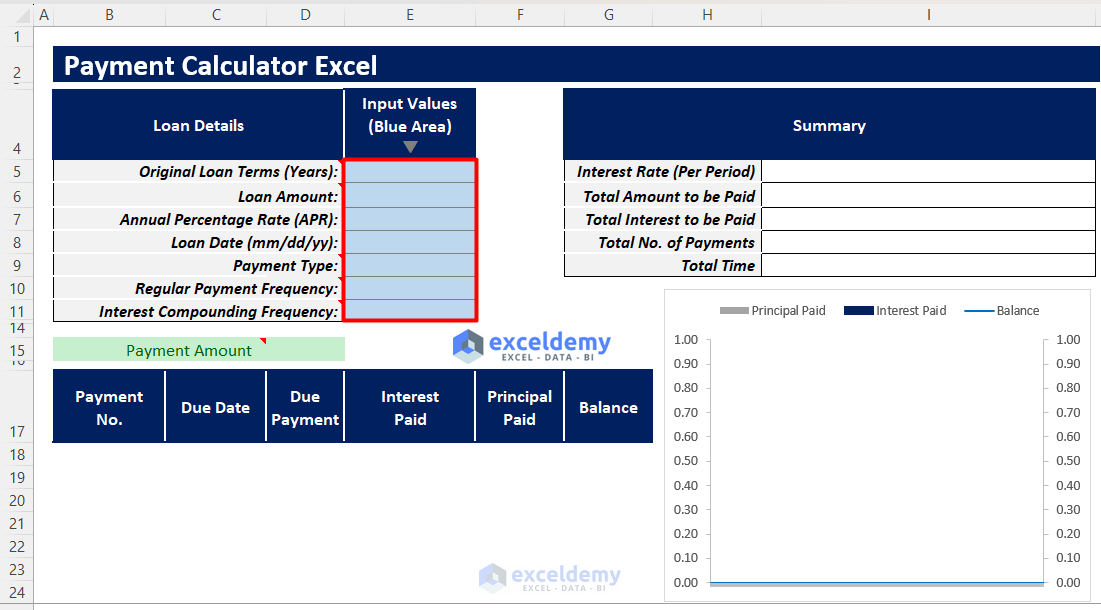

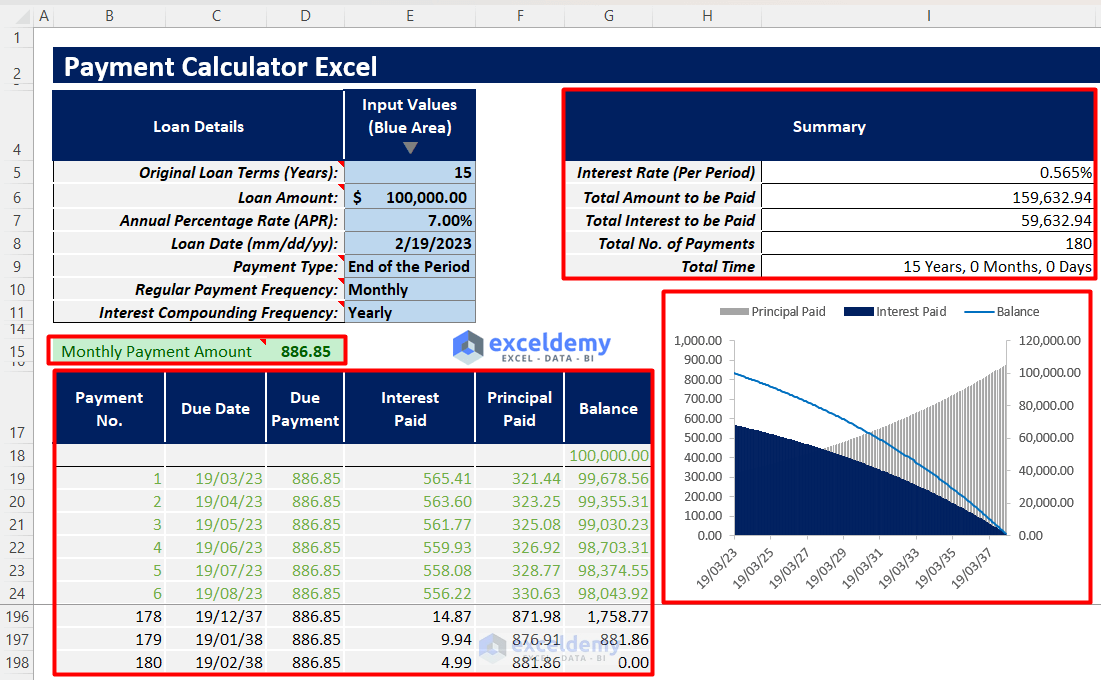

Find Payment to Repay Loan

In this template, you will be able to insert your loan parameters like Loan Terms, Loan Amount, Annual Percentage Rate, Regular Payment Frequency, Interest Compounding Frequency, etc. And, you will find your required regular payment amount along with a summary, amortization schedule, and a chart to calculate and visualize all your output data.

Instructions:

- Open the template Payment Calculator and insert your loan inputs in the blue shaded area based on the given loan parameters.

- You will find your regular payment amount, output summary, amortization schedule and a chart to show your loan repayment trend over the loan tenure.

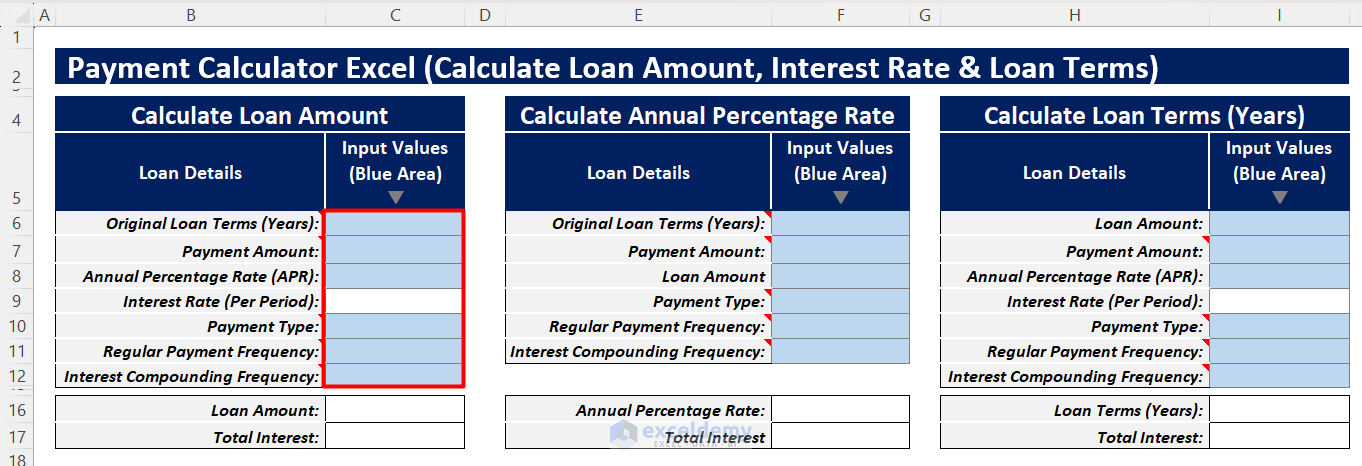

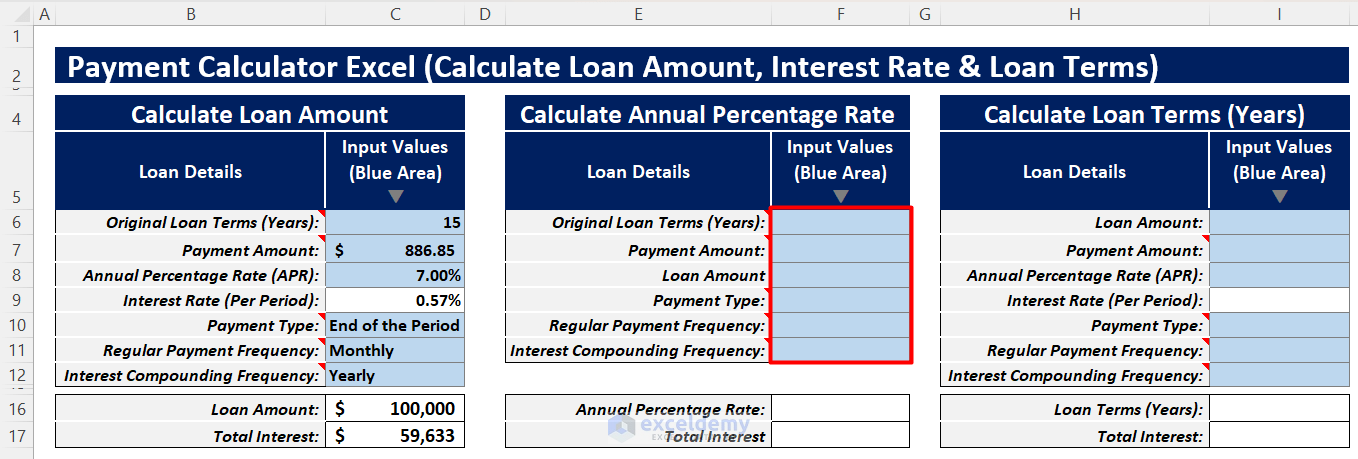

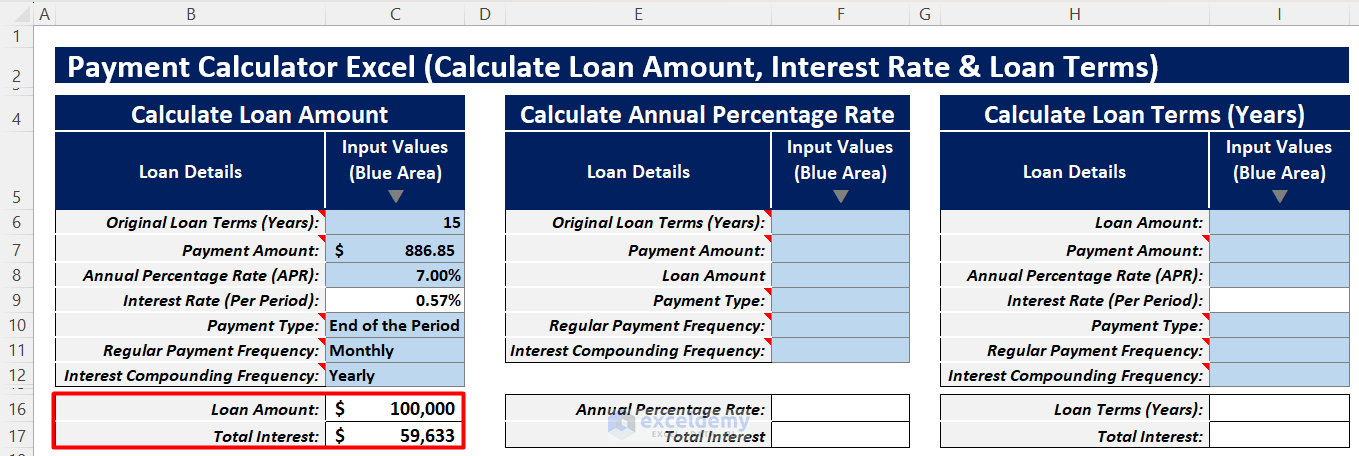

Find Loan Amount from Payment

Insert all the required inputs and choose all required dropdowns in the blue shaded area depending on the given loan details.

You will get the loan amount and total interest.

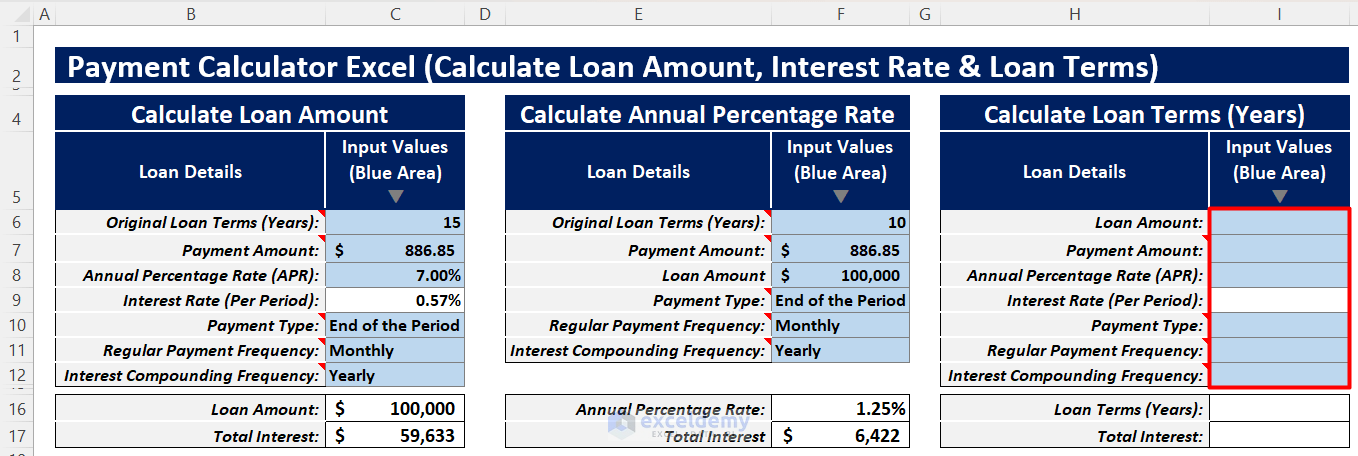

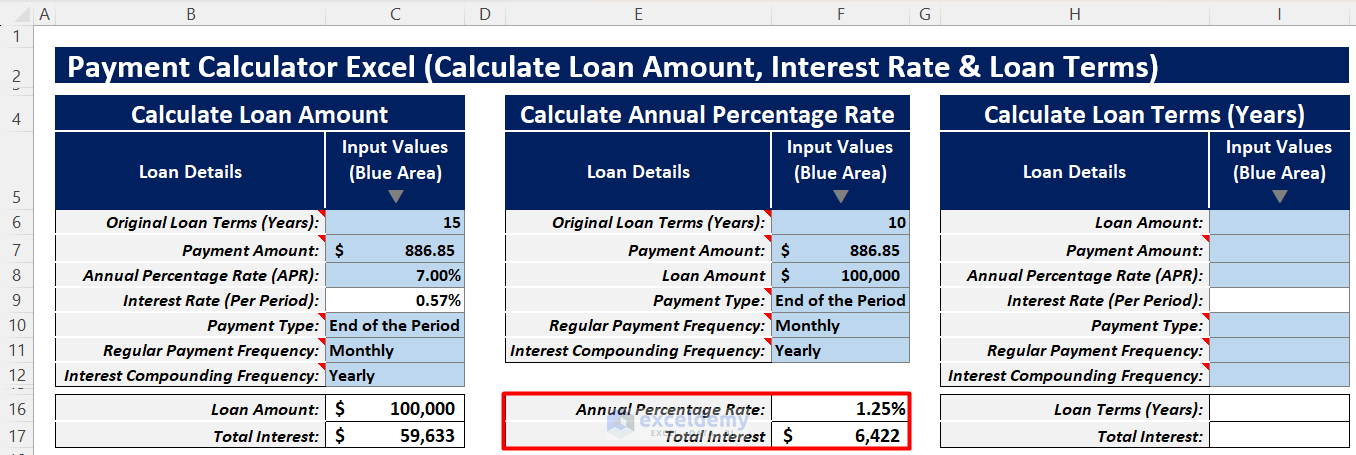

Find Interest Rate from Payment

Enter all required inputs in the blue shaded area of the template according to the loan parameters.

You will find the annual interest rate and total interest amount.

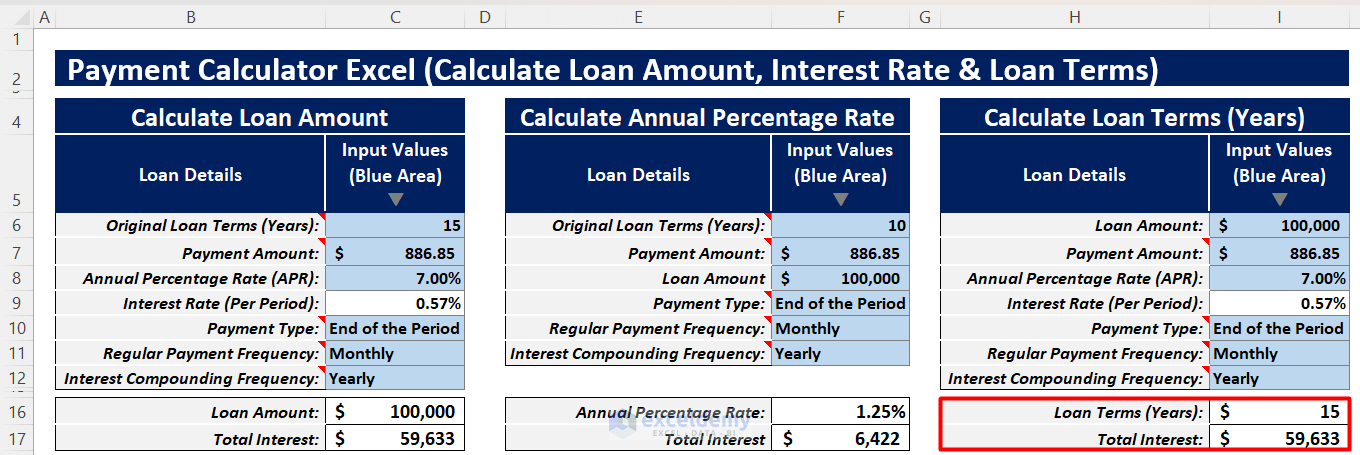

Find Loan Tenure from Payment

Enter all the required inputs in the blue shaded area of the template according to the loan details.

You will get the loan terms in years and the total interest amount to be paid according.

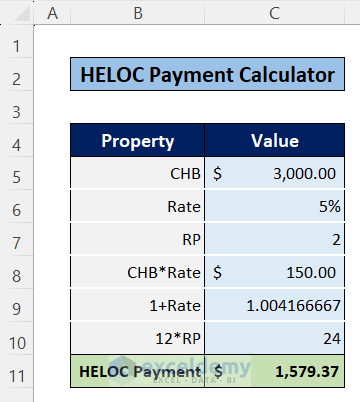

Excel HELOC Payment Calculator

HELOC stands for Home Equity Line of Credit. It is a different type of loan that is generally used to improve or repair a home.

The formula for calculating HELOC payment is:

You can use Excel HELOC Payment Calculator to calculate your HELOC payment. You can enter your loan inputs in the blue shaded area and will get the output of HELOC payment.

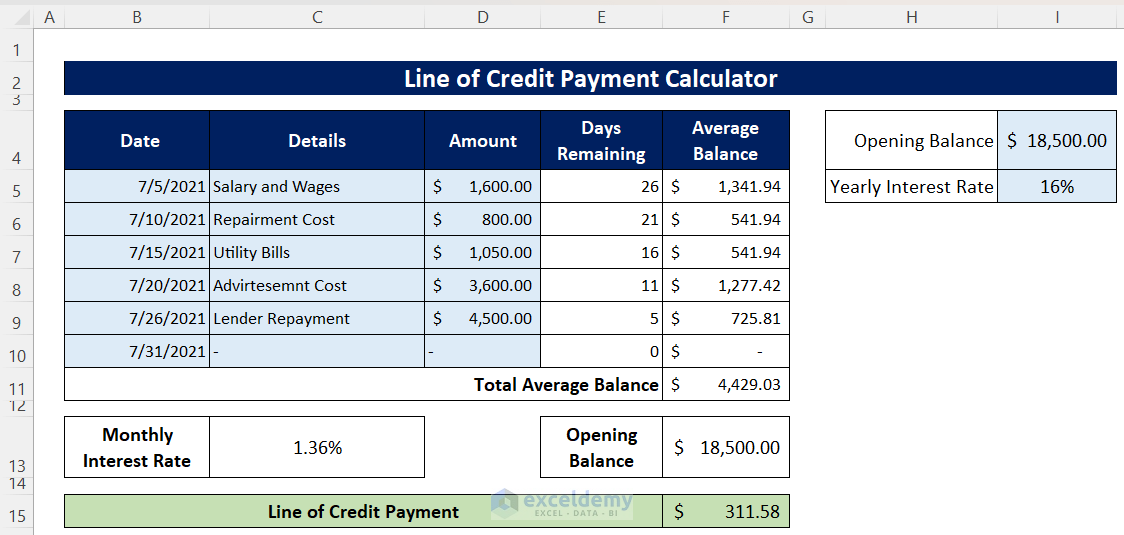

Excel Line of Credit Payment Calculator

A line of credit is a flexible loan that allows you to use money as much as you need up to a certain limit.

You can use Excel Line of Credit Payment Calculator to calculate your line of credit. As shown in the sample template below, you will have to insert inputs in the blue-shaded area.

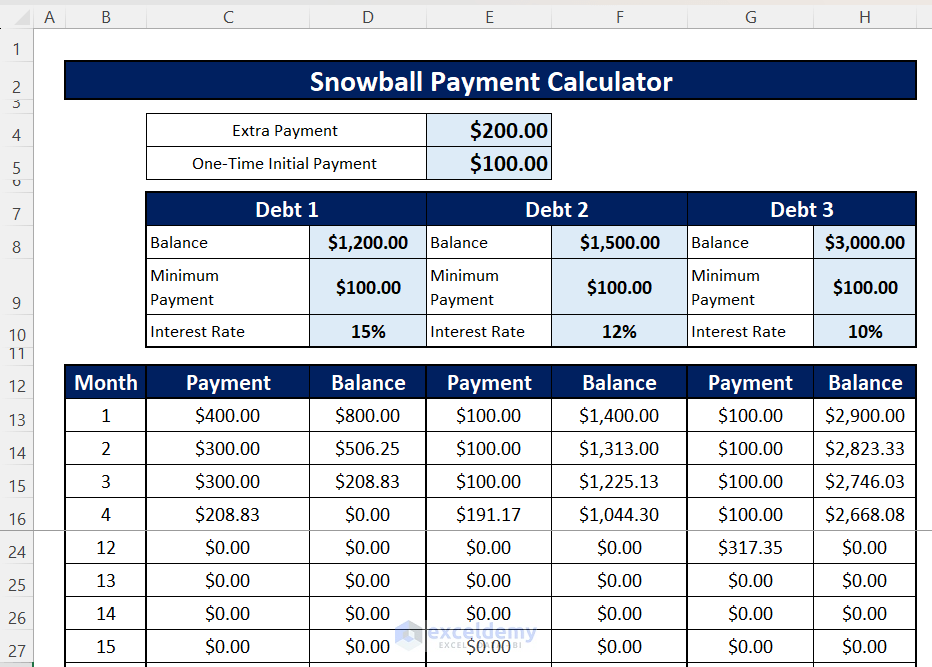

Excel Snowball Payment Calculator

Snowball payment is generally a loan repayment strategy applied to repay debts when someone is under multiple debts

You can use Excel Snowball Payment Calculator to calculate and visualize your snowball payment to repay your multiple debts. Enter your debt inputs in the blue-shaded area and you will get your debt repayment table.

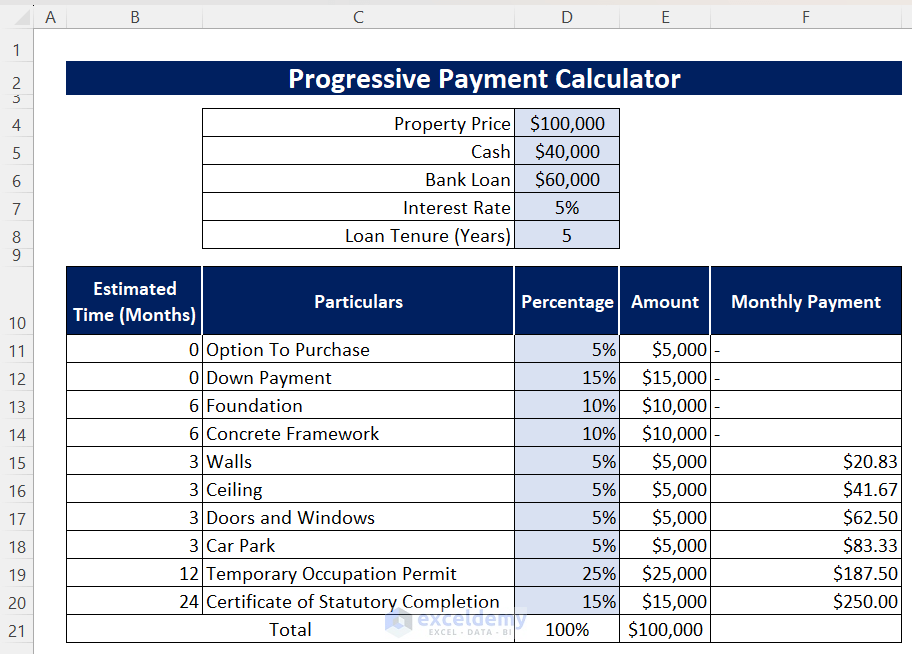

Excel Progressive Payment Calculator

Progressive payment is a different type of payment structure that is mainly used in large construction projects.

You can use Excel Progressive Payment Calculator to divide your projects into your chosen milestones and assign respective percentages. Enter your loan inputs and get your progressive payment calculator according to project terms and loan inputs.

Payment Calculator Excel: Knowledge Hub

<< Go Back to Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!