What Is Social Security Tax?

The Social Security tax is a dedicated payroll tax that funds Old-Age and Survivors Insurance and Disability Insurance. With each paycheck, a predetermined percentage is deducted to cover this tax. Introduced in 1937, the initial rate was 1% for employees, aiming to provide retirement benefits.

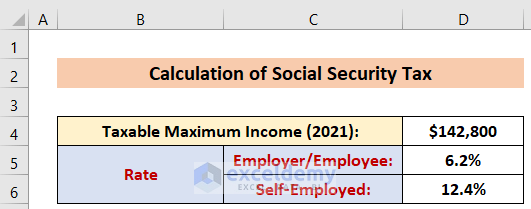

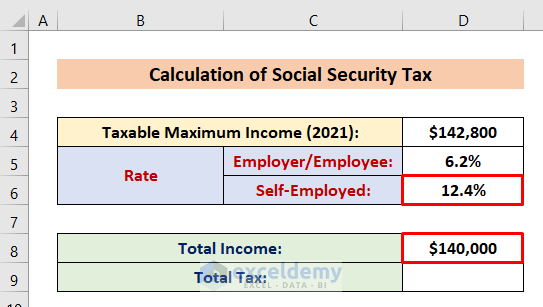

Both employees and employers are responsible for paying the Social Security tax. As of 2021, the individual contribution rate is 6.2% of wages for both parties. Self-employed individuals pay 12.4%. The maximum taxable amount for 2021 was $142,800, subject to annual adjustments.

As the tax rate is different, we’ll demonstrate the calculations in two sections:

- For an employer or employee

- For a self-employed individual

For Employers or Employees

- Tax Rate and Maximum Limit:

- In 2021, both employers and employees are required to pay 6.2% of their wages as Social Security Tax.

- The maximum taxable amount for 2021 was $142,800.

- Note that tax rates and limits may vary by region and change annually.

- Calculation Using the IF Function:

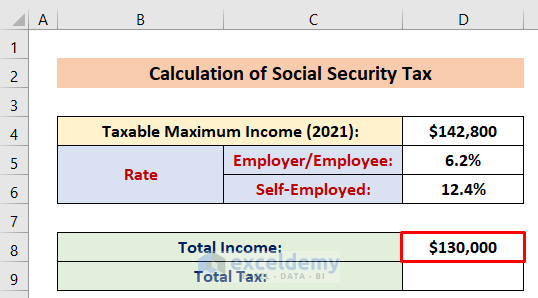

- Suppose your total income is $130,000.

-

- To calculate the Social Security Tax, follow these steps:

- Activate Cell D9.

- Insert the following formula:

- To calculate the Social Security Tax, follow these steps:

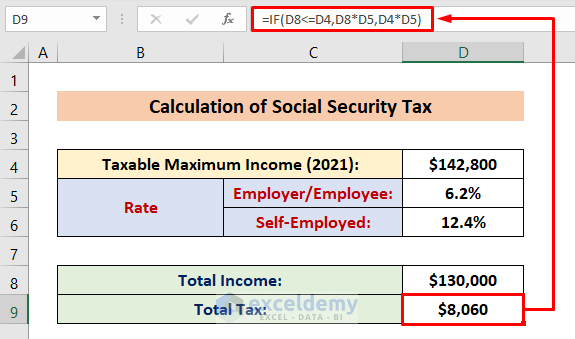

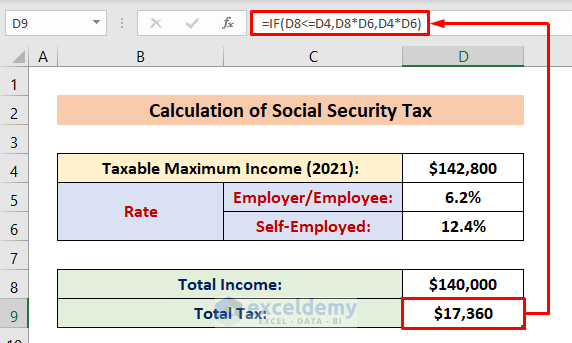

=IF(D8<=D4,D8*D5,D4*D5)- Press Enter.

-

- The formula checks if the income (D8) is less than or equal to the maximum limit (D4). If so, it calculates 6.2% of the income; otherwise, it uses the maximum limit.

- Example:

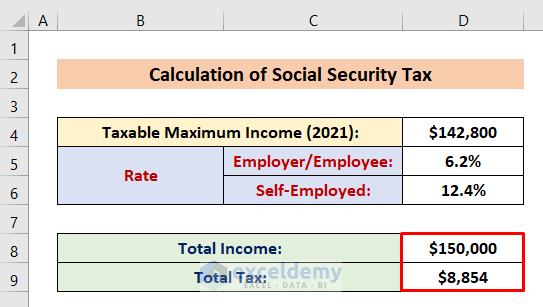

- If you input $150,000, the formula will return 6.2% of $142,800 (the maximum limit), which is $8,854.

- This happens because the income exceeds the maximum taxable limit.

For Self-Employed Individuals

- Total Tax Rate:

- Self-employed individuals need to pay both the employer’s tax (6.2%) and the employee’s tax (6.2%).

- The total tax rate for self-employment is 12.4% (6.2% + 6.2%).

- Calculation Using the IF Function:

- Let’s assume a self-employed person has a total income of $140,000.

- Follow these steps:

- Insert the following formula in Cell D9:

=IF(D8<=D4,D8*D6,D4*D6)-

-

- Press Enter.

-

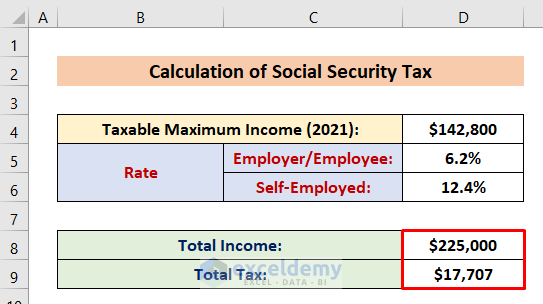

- Example:

- If you enter $225,000 (which exceeds the maximum limit), the formula will return the percentage of the maximum value ($142,800).

Read More: How to Calculate Marginal Tax Rate in Excel

Things to Remember

- Verify the correct tax rate for your specific fiscal year.

- Ensure accurate cell references in the IF function.

- Format cells containing rates as percentages to avoid decimal values.

Download Practice Workbook

You can download the practice workbook from here:

Related Articles

- Reverse Tax Calculation Formula in Excel

- How to Calculate Income Tax in Excel Using IF Function

- Formula for Calculating Withholding Tax in Excel

- How to Calculate Federal Tax Rate in Excel

- How to Calculate Income Tax on Salary with Example in Excel

- How to Calculate Sales Tax in Excel

<< Go Back to Excel Formulas for Finance | Excel for Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!