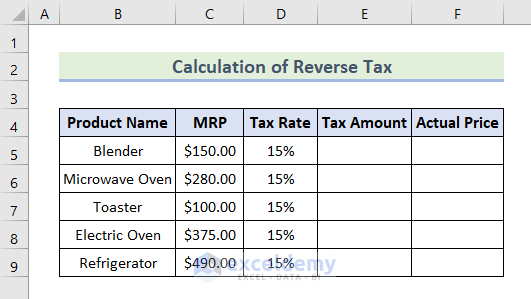

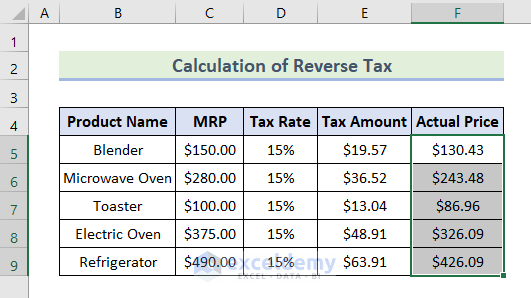

Here is a sample dataset to calculate the reverse tax calculation formula. The dataset comprises product names, MRP and Tax rates in cells B4:D9.

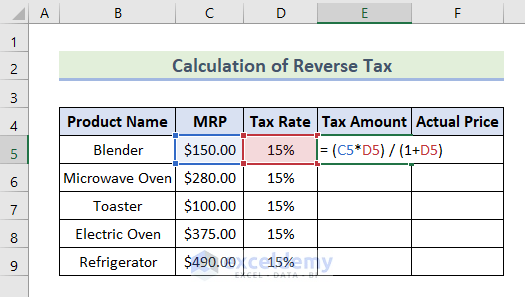

Step 1 – Tax Amount Calculation

Calculate the tax amount of each product with this formula:

=(MRP*Tax Rate)/(1+Tax Rate)- Insert the Tax Amount formula in cell E5 according to the dataset:

=(C5*D5)/(1+D5)

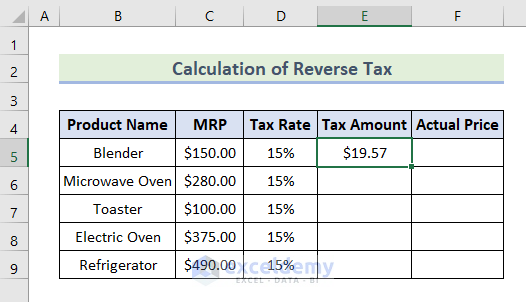

- Press Enter.

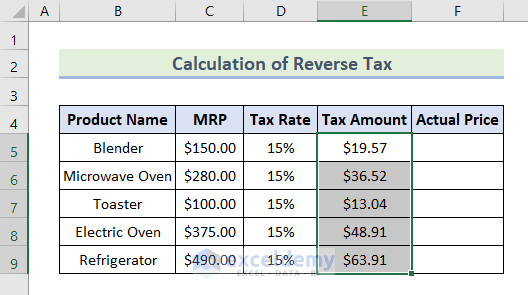

- Calculate the tax amount of other products as well. You can insert the formula in cells E6:E9 or just drag the bottom right corner of cell E5 up to cell E9.

Read More: Formula for Calculating Withholding Tax in Excel

Read More: Formula for Calculating Withholding Tax in Excel

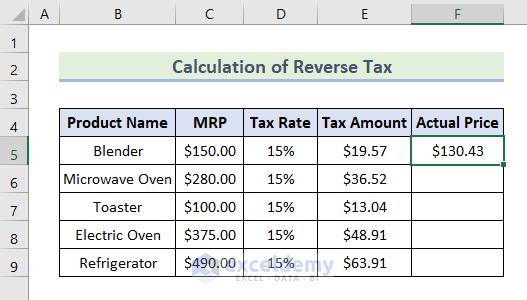

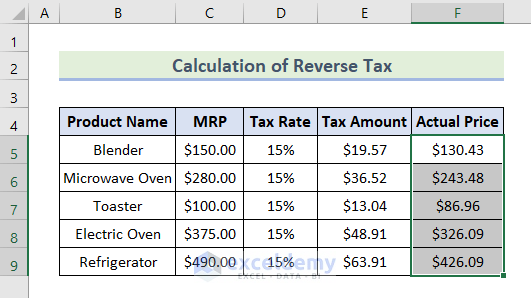

Step 2 – Calculation of Actual Prices

Let’s calculate the actual price of each product with this formula:

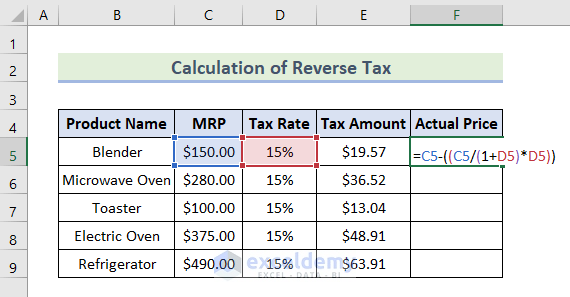

=MRP-((MRP*Tax Rate)/(1+Tax Rate))- Insert this formula in cell F5.

=C5-((C5/(1+D5)*D5))

- Press Enter.

- Insert the same formula in cells F6:F9 or just drag the bottom corner of cell F6 up to cell F9.

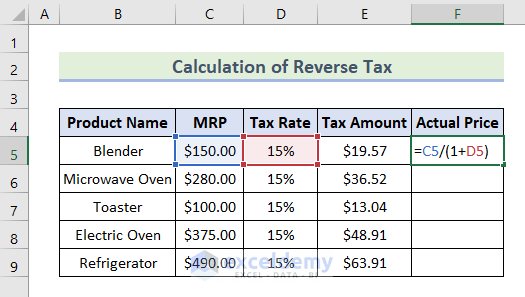

Another formula can be used to calculate the actual price which states below:

=MRP/(1+Tax rate)- You can insert this formula in cell F5, for example.

=C5/(1+D5)

- Use the Fill Handle tool to autofill the next cells.

Practice Workbook

Related Articles

- How to Calculate Marginal Tax Rate in Excel

- How to Calculate Income Tax in Excel Using IF Function

- How to Calculate Social Security Tax in Excel

- How to Calculate Federal Tax Rate in Excel

- How to Calculate Income Tax on Salary with Example in Excel

- How to Calculate Sales Tax in Excel

<< Go Back to Excel Formulas for Finance | Excel for Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!