We use so many factors at the industry level to calculate the condition. Sharpe Ratio is just a factor of that kind. It will help to analyze the condition of the company based on the previous records. In this article, We’re going to elaborate on the procedure of how to calculate the Sharpe Ratio in Excel.

Basics of Sharpe Ratio

The Sharpe Ratio, also known as the Sharpe Index, is used to calculate the performance of an investment considering all the related risks. It compares investments of different risk profiles against each other.

In order to calculate the Sharpe Ratio, we follow the following formula:

Sharpe Ratio = (Rp - Rf) / ꝹWhere,

Rp = Expected Rate of Return

Rf = Risk-Free Rate of Return

Ꝺ = Standard Deviation

A higher value symbolizes a better investment. It means greater outcomes for the portfolio compared to the inherent risk.

How to Calculate Sharpe Ratio in Excel: 2 Common Cases

1. Formula to Calculate Sharpe Ratio for Known Values

When the values are known, we can simply calculate the Sharpe Ratio by putting the values in the equation.

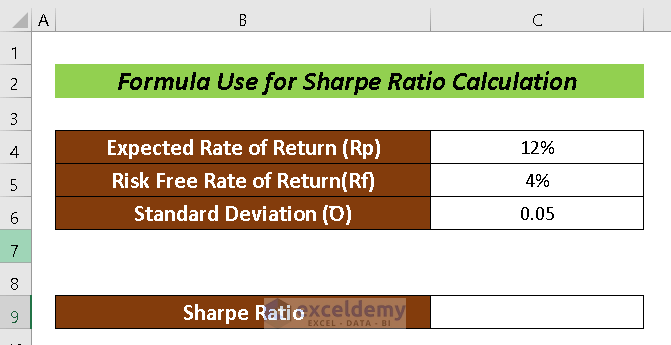

Here, we have a dataset with a given Expected Rate of Return, Risk Free Rate of Return, and Standard Deviation. Now, we can apply the formula to calculate the Shape Ratio.

Steps:

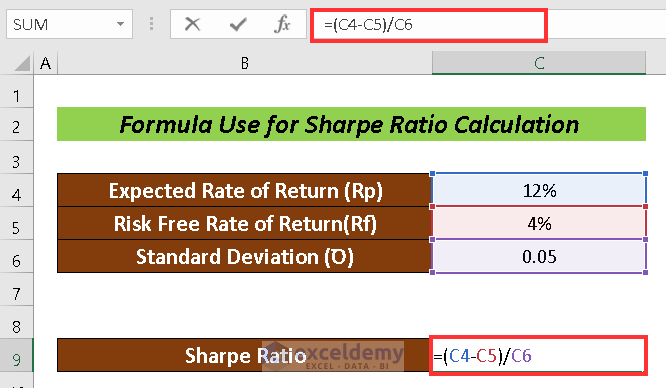

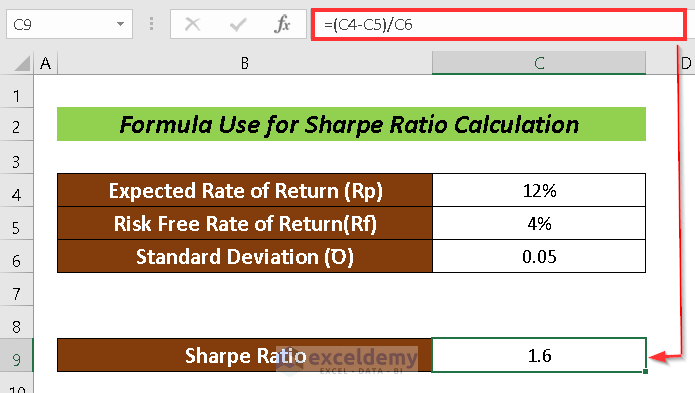

- First, select a cell for the output of the Sharpe Ratio (i.e. C9).

- Input the following formula in C9:

=(C4-C5)/C6Where,

C4 = Expected Rate of Return

C5 = Risk-Free Rate of Return

C6 = Standard Deviation

- Finally, press ENTER.

Thus, we can easily calculate the Sharpe Ratio.

Read More: How to Calculate Average Ratio in Excel

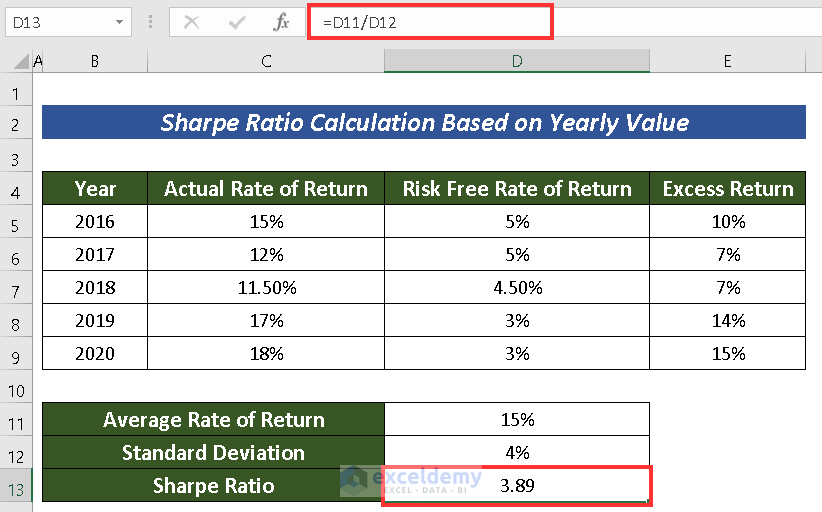

2. Sharpe Ratio Calculation in Excel Based on Yearly Returns

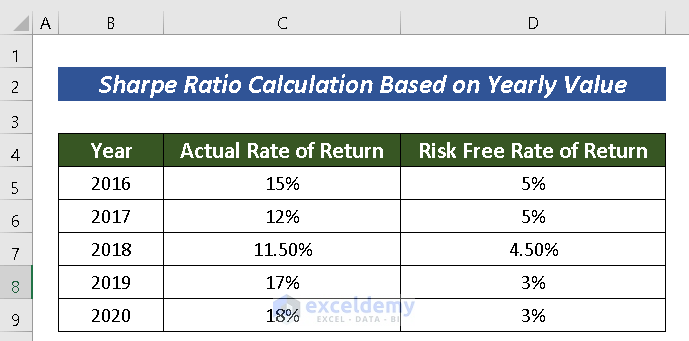

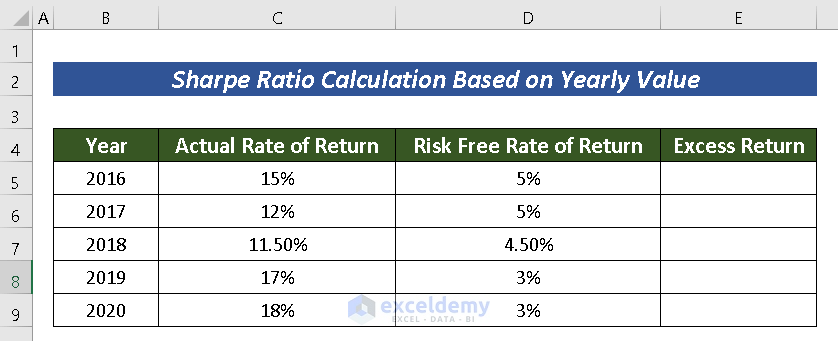

We can also calculate the Sharpe Ratio considering the previous years’ records. Generally, when you need to calculate the Sharpe Ratio based on years, you’ll be provided a dataset with an Actual Rate of Return, Risk Free Rate of Return.

Actual Rate of Return means the change in percentage of the actual investment and Risk Free Rate of Return means the hypothetical rate of return if there involves no risk.

Let’s assume, we have a dataset like the earlier now we’ll calculate the Sharpe Ratio from here.

Steps:

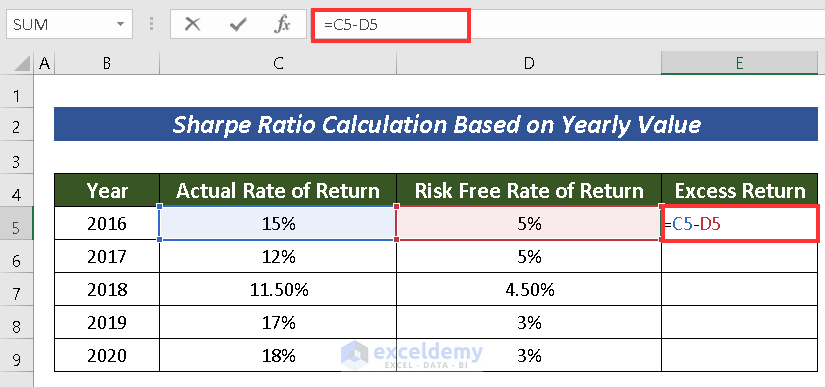

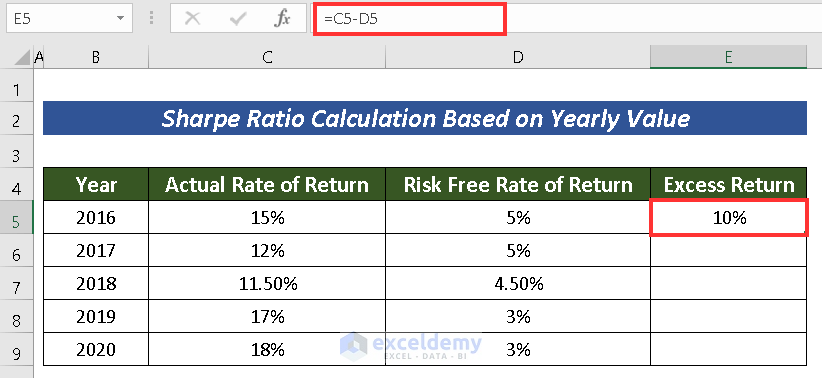

- Create an additional column named Excess Return.

- Use the following formula to calculate the Excess Return:

=C5-D5Where,

C5 = Actual Rate of Return

D5 = Risk-Free Rate of Return

- Now, press ENTER.

- Use Fill Handle to AutoFill the rests.

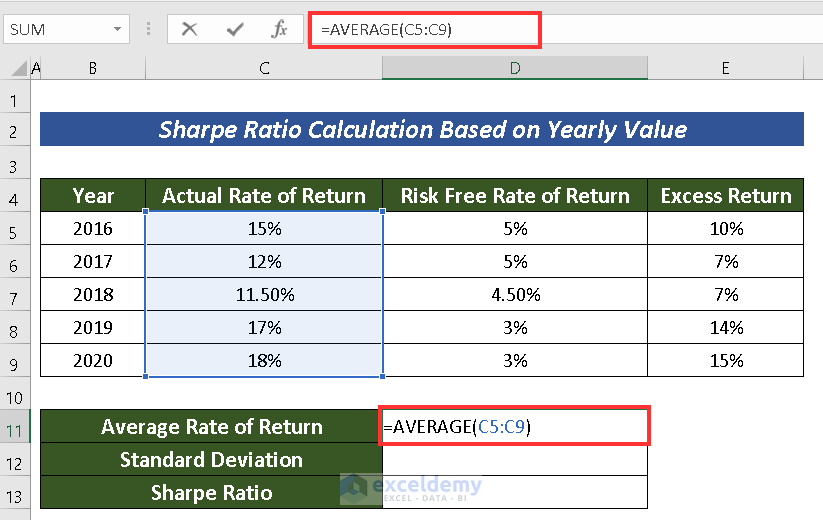

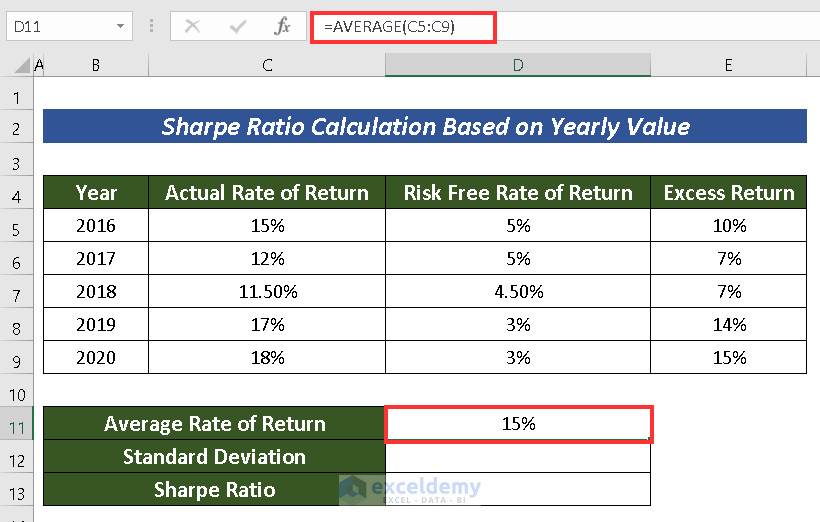

- Input the following formula to calculate the Average Rate of Return as it explains the cash flow of the investments generated over the years:

=AVERAGE(C5:C9)Where the mean value of the cells C5:C9 is calculated.

- Now, hit ENTER.

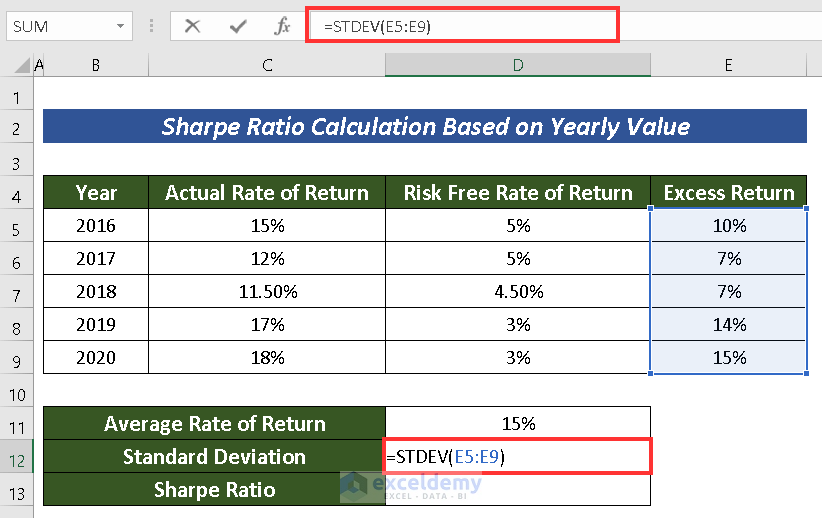

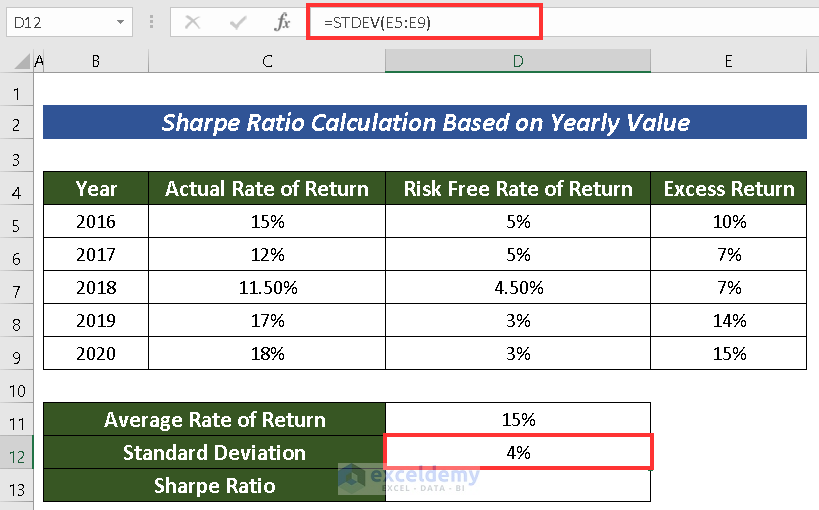

- Now, write down the following formula to calculate the Standard Deviation from the Excess Return as it symbolizes the dispersion of a dataset with its mean:

=STDEV(E5:E9)- Press ENTER.

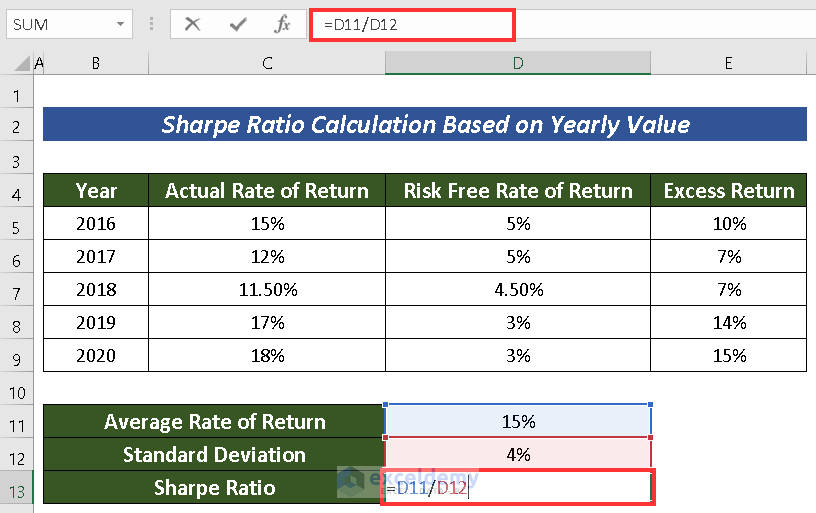

- Finally, use the following formula to calculate the Sharpe Ratio:

=D11/D12Where,

D11 = Average Rate of Return

D12 = Standard Deviation

- Lastly, press ENTER to have our desired output.

Read More: How to Calculate Ratio of 3 Numbers in Excel

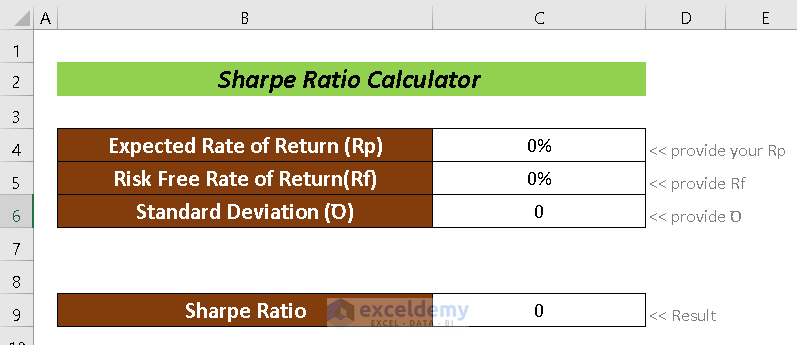

Sharpe Ratio Calculator

We have created a Sharpe Ratio Calculator. You will find this within the provided practice workbook. You just have to input the required variables to have the Sharpe Ratio.

Download Practice Workbook

Conclusion

We have tried to explain how to calculate the Sharpe Ratio in Excel with 2 detailed explanations. We hope it will help the Excel Users. For further queries, comment below.

Related Articles

- How to Calculate Male Female Ratio in Excel

- How to Calculate Sortino Ratio in Excel

- How to Calculate Odds Ratio in Excel

- How to Calculate Compa Ratio in Excel

- How to Calculate Current Ratio in Excel

<< Go Back to Ratio in Excel | Calculate in Excel | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!