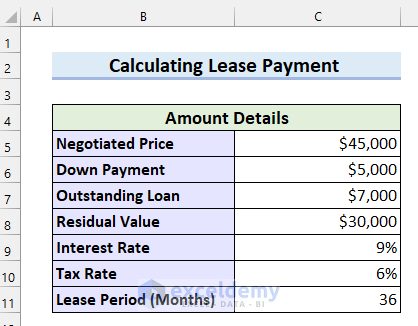

This dataset showcases the Amount Details.

Read More: How to Calculate Monthly Payment in Excel

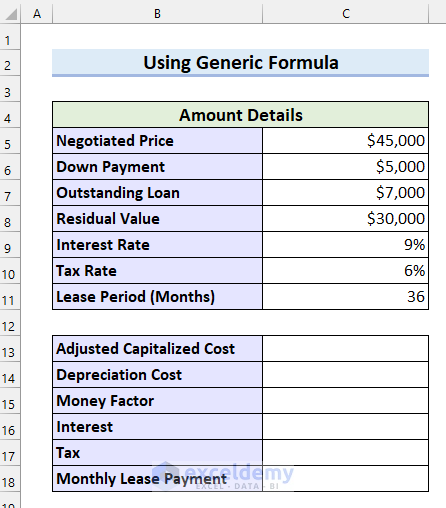

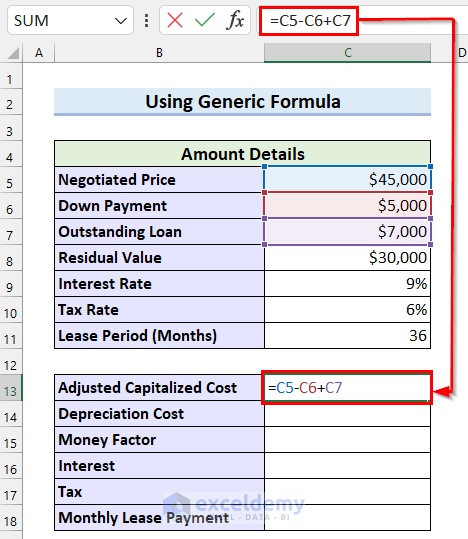

Method 1 – Using a Generic Formula to Calculate Lease Payments in Excel

Example 1 – Calculating Lease Payment When Residual Value Is Given

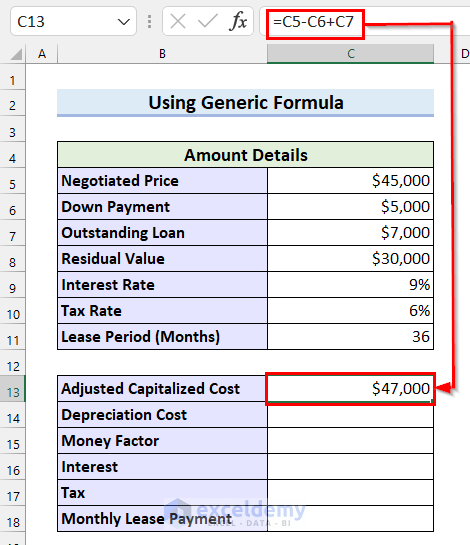

This is the dataset:

Steps:

Calculate the Adjustable Capitalized Cost

- Select the cell where you want to calculate your Adjustable Capitalized Cost. Here, C13.

- In C13 enter the following formula.

=C5-C6+C7 - Press ENTER to see the result.

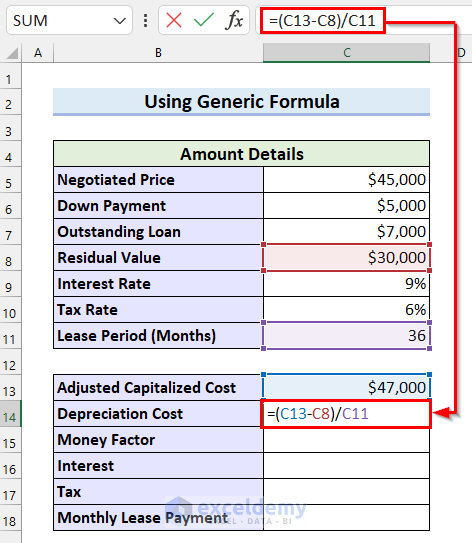

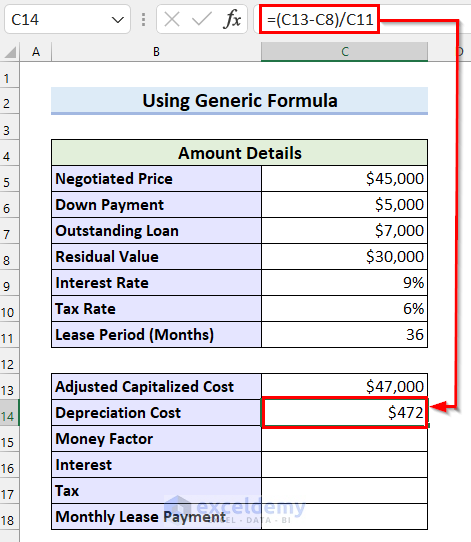

Calculate the Depreciation Cost

- Select the cell where you want to calculate your Depreciation Cost. Here, C14.

- Enter the following formula in C14.

=(C13-C8)/C11- Press ENTER to see the Depreciation Cost.

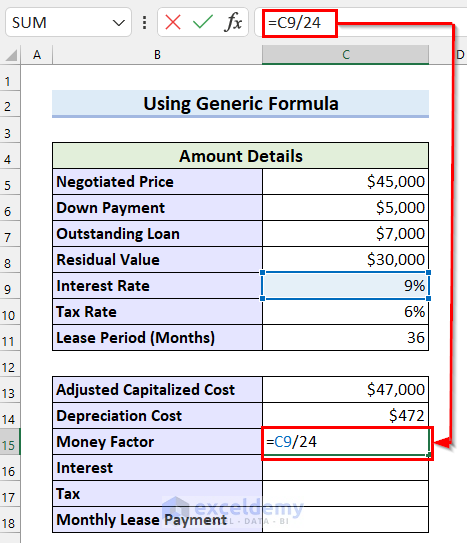

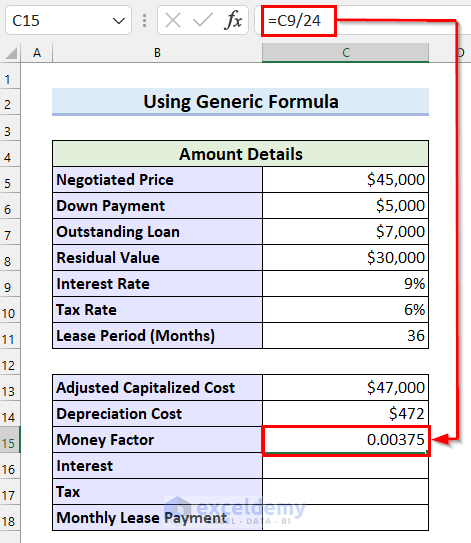

Calculate the Money Factor

- Select the cell where you want the Money Factor. Here, C15.

- Enter the following formula in C15.

=C9/24

- Press ENTER to see the Money Factor.

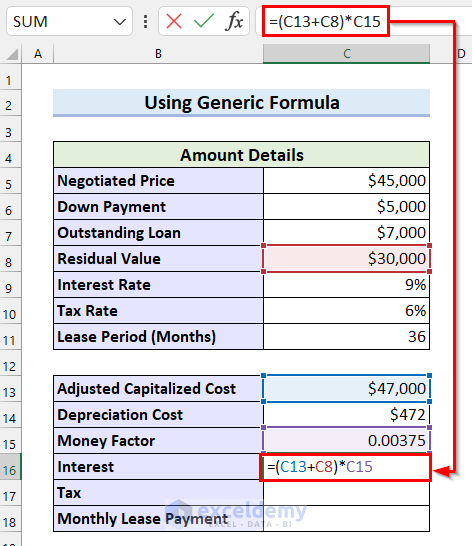

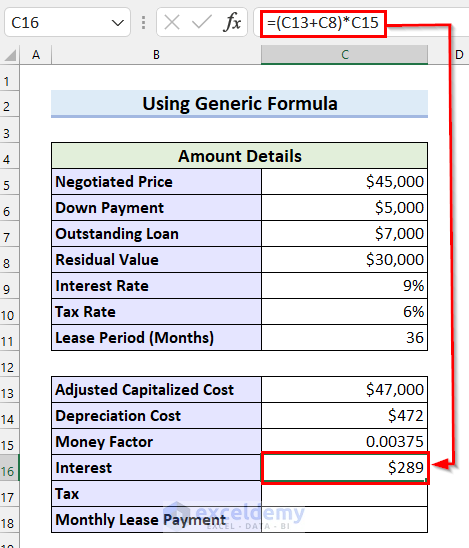

Calculate the Interest

- Select the cell where you want the Interest. Here, C16.

- Enter the following formula in cell C16.

=(C13+C8)*C15- Press ENTER to see the Interest.

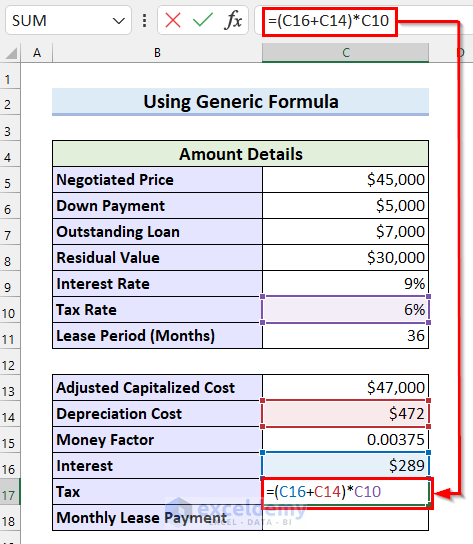

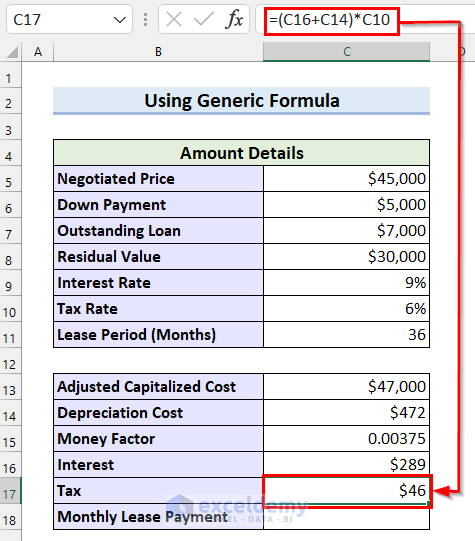

Calculate the Tax

- Select the cell where you want the Tax. Here, C17.

- Enter the following formula in cell C17.

=(C16+C14)*C10- Press ENTER to see the result.

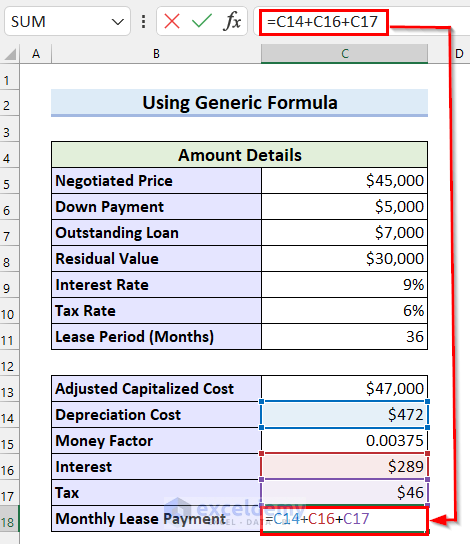

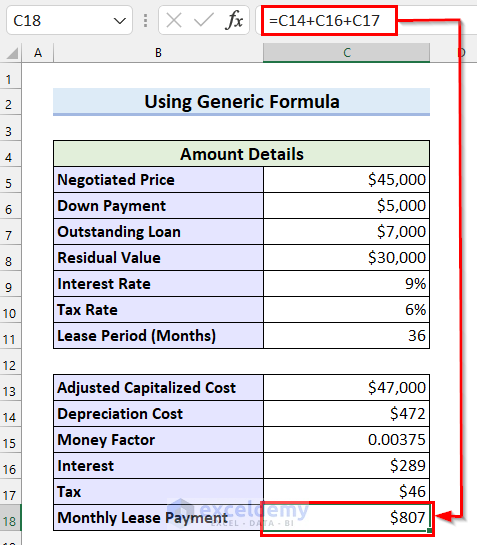

Calculate the Monthly Lease Payment.

- Select the cell where you want the Monthly Lease Payment. Here, C18.

- Enter the following formula in C18.

=C14+C16+C17- Press ENTER to see the Monthly Lease Payment.

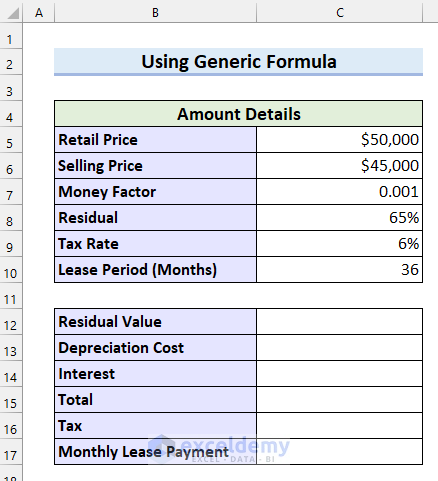

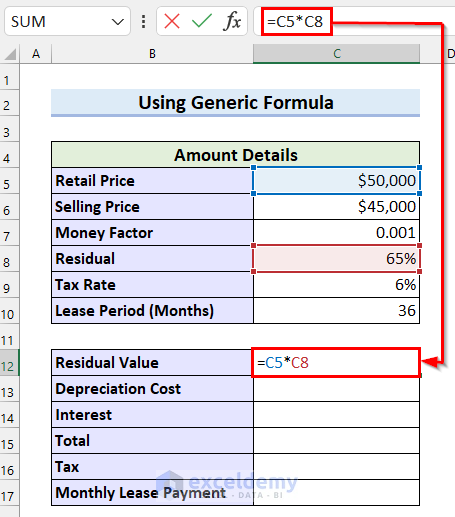

Example 2 – Calculating the Monthly Lease Payment When Residual Value Is Not Given

This is the dataset:

Steps:

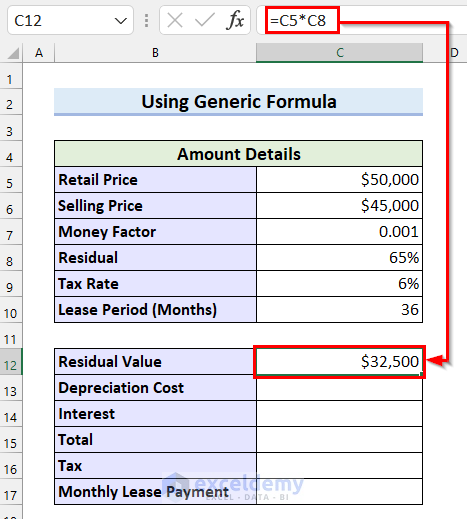

Calculate the Residual Value

- Select the cell where you want to calculate your Residual Value. Here, C12.

- Enter the following formula in C12.

=C5*C8- Press ENTER to see the Residual Value.

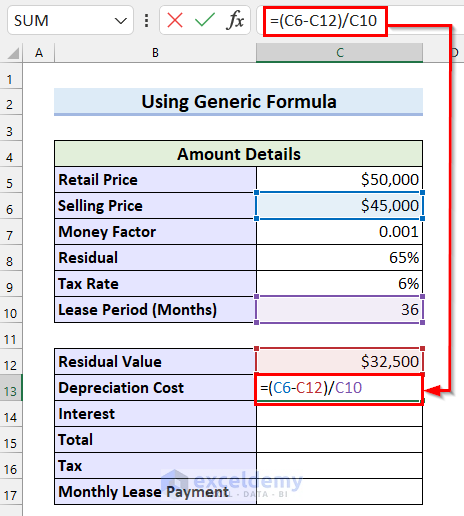

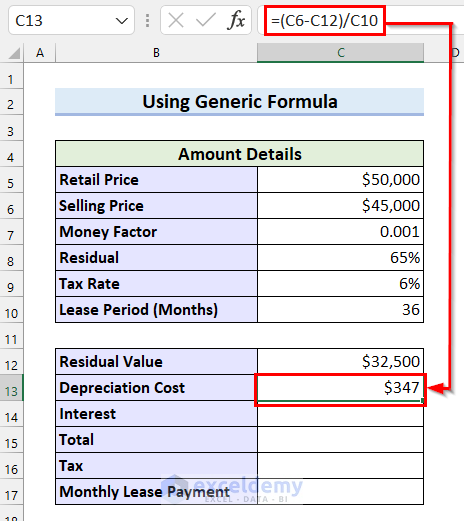

Calculate the Depreciation Cost.

- Select the cell where you want to calculate the Depreciation Cost. Here, C13.

- Enter the following formula in C13.

=(C6-C12)/C10 - Press ENTER to see the Depreciation Cost.

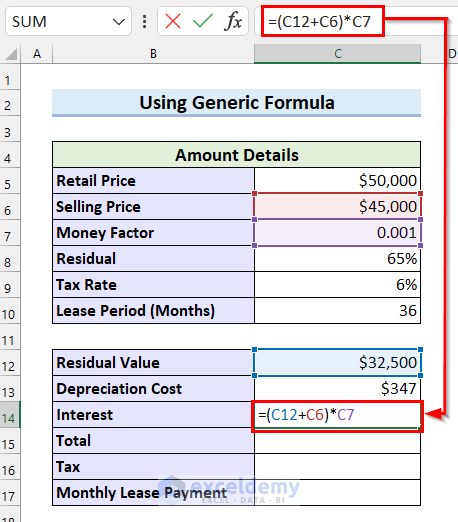

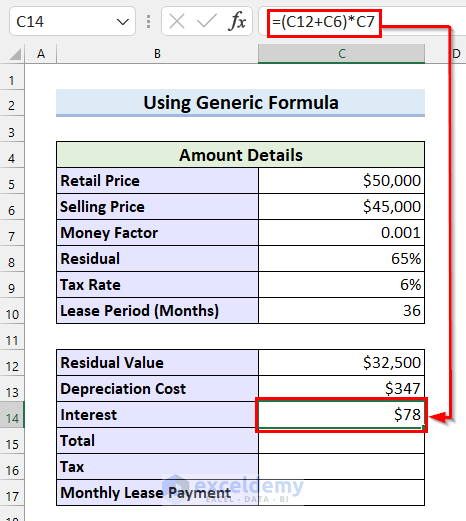

Calculate the Interest

- Select the cell where you want to calculate the Interest. Here, C14.

- Enter the following formula in C14 .

=(C12+C6)*C7- Press ENTER to see the Interest.

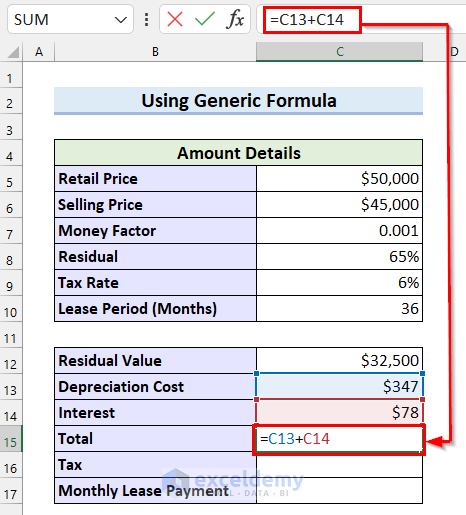

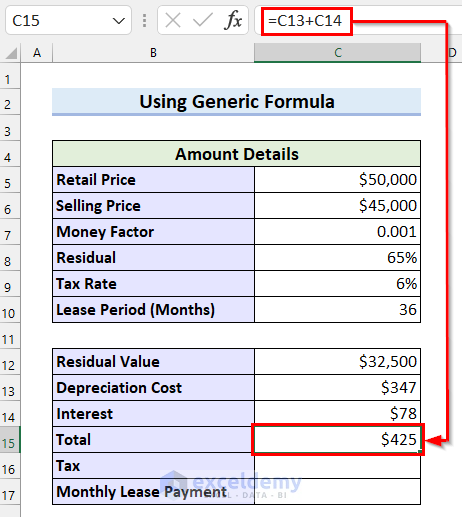

Calculate the Total

- Select the cell where you want the Total. Here, C15.

- Enter the following formula in C15.

=C13+C14- Press ENTER to see the result.

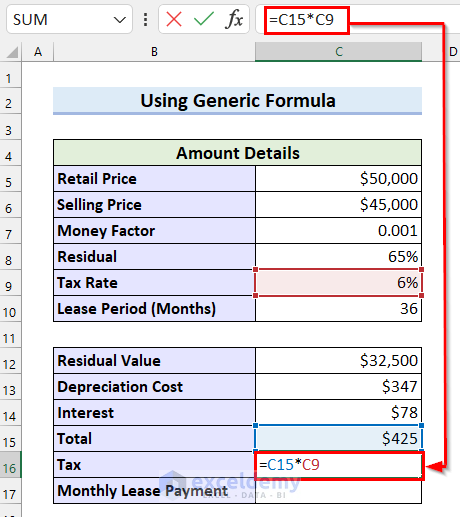

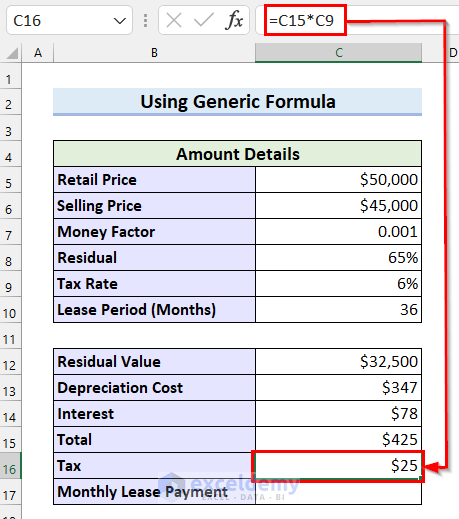

Calculate the Tax

- Select the cell where you want to calculate the Tax. Here, C16.

- Enter the following formula in C16.

=C15*C9- Press ENTER.

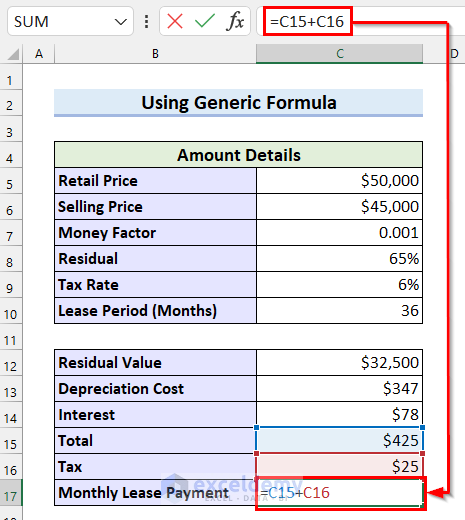

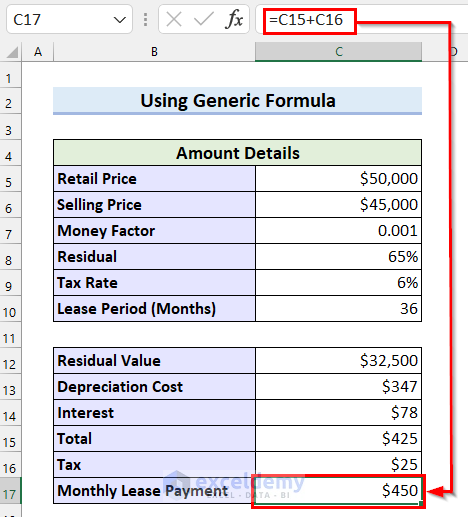

Calculate the Lease Payment

- Select the cell where you want the Monthly Lease Payment. Here, C17.

- Enter the following formula in C17.

=C15+C16- Press ENTER and see the Monthly Lease Payment.

Read More: How to Calculate Monthly Payment on a Loan in Excel

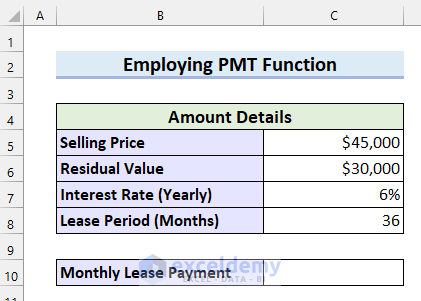

Method 2 – Using the PMT Function to Calculate Lease Payments in Excel

This is the dataset:

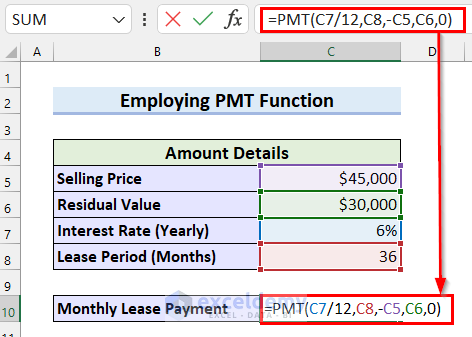

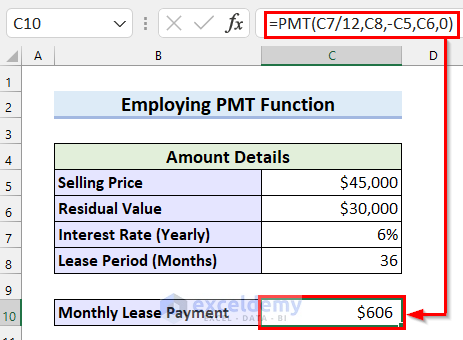

Steps:

- Select the cell where you want the Monthly Lease Payment. Here, C10.

- Enter the following formula in C10.

=PMT(C7/12,C8,-C5,C6,0)- Press ENTER and see the Monthly Lease Payment.

Read More: How to Calculate Loan Payment in Excel

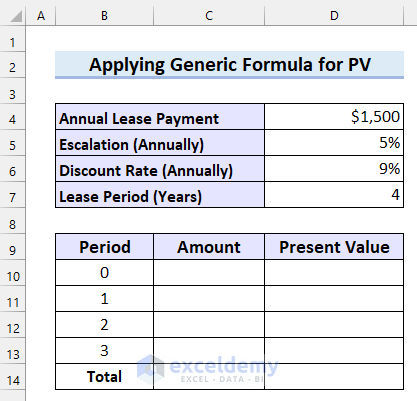

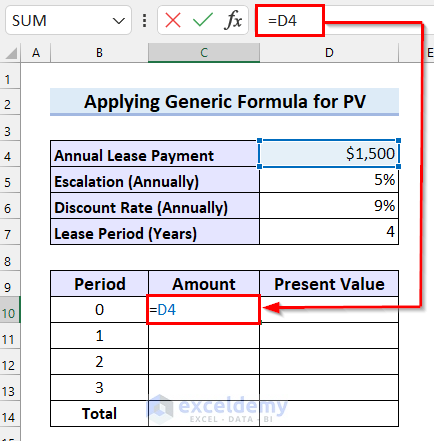

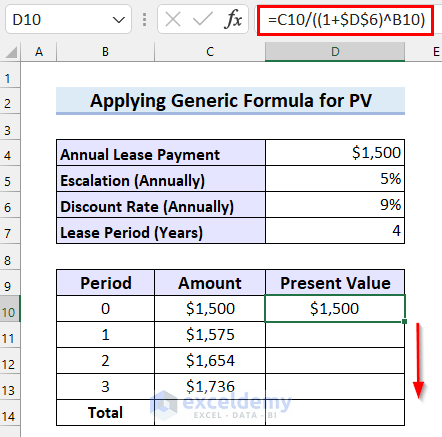

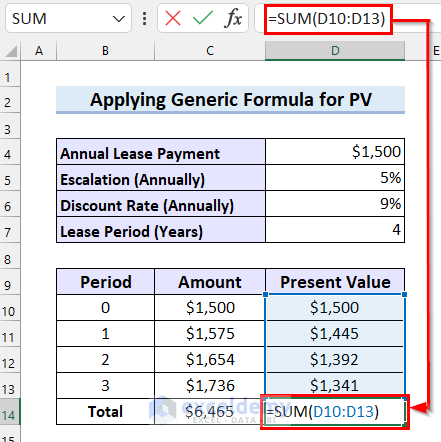

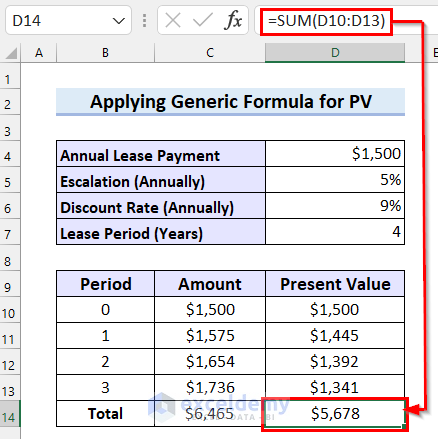

Method 3 – Applying a Generic Formula to Calculate the Present Value of Lease Payments

This is the dataset:

Calculate the lease Amount after each period

Steps:

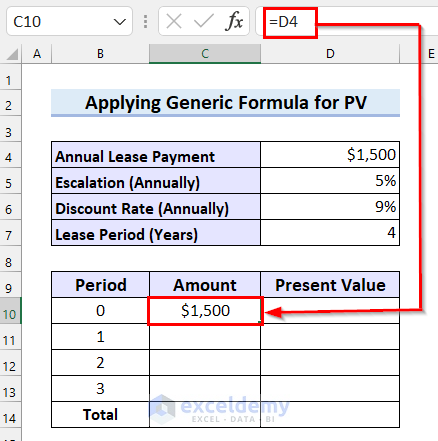

- Select the cell where you want to calculate the lease Amount after each period. Here, C10.

- Enter the following formula in C10 .

=D4- Press ENTER and see the result.

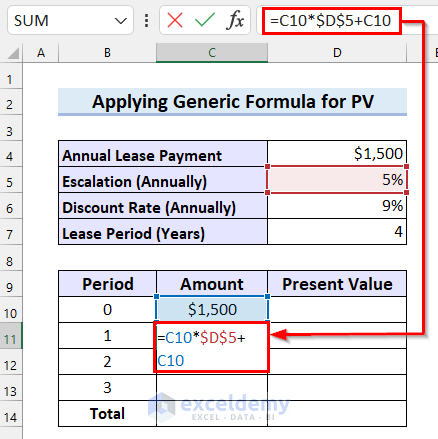

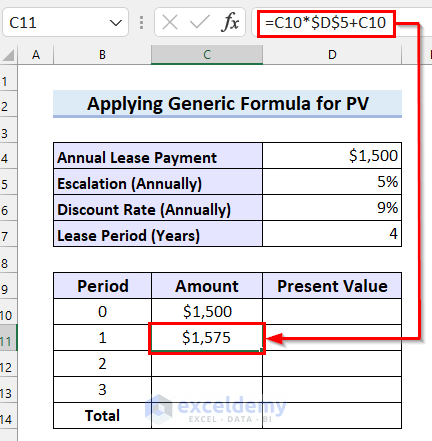

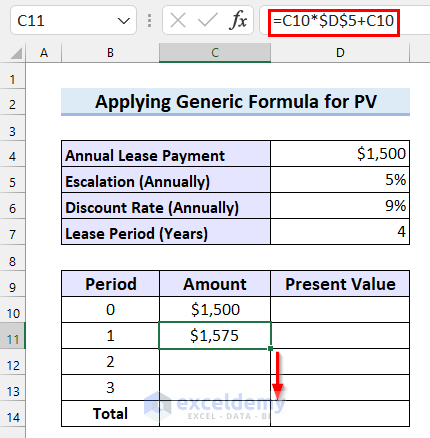

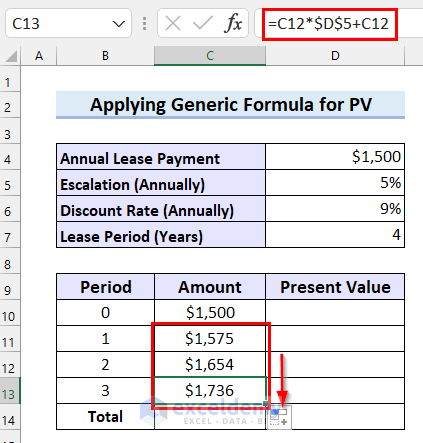

Calculate the lease Amount after period 1

- Select the cell where you want to calculate the lease Amount after period 1. Here, C11.

- Enter the following formula in C11 .

=C10*$D$5+C10- Press ENTER.

- Drag the Fill Handle to copy the formula.

The lease Amount after each Period is displayed.

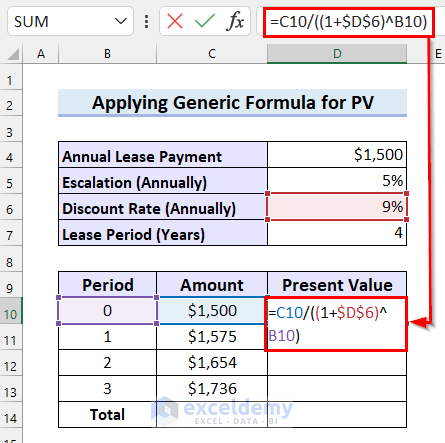

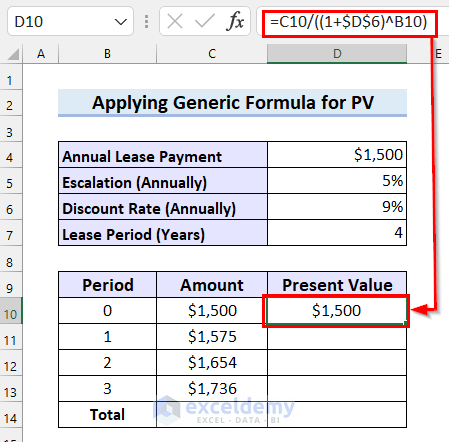

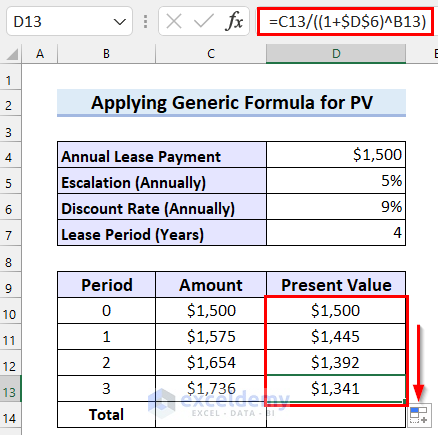

Calculate the Present Value.

- Select the cell where you want the Present Value. Here, D10.

- Enter the following formula in D10 .

=C10/((1+$D$6)^B10)- Press ENTER.

- Drag the Fill Handle to copy the formula.

The formula is copied to the other cells.

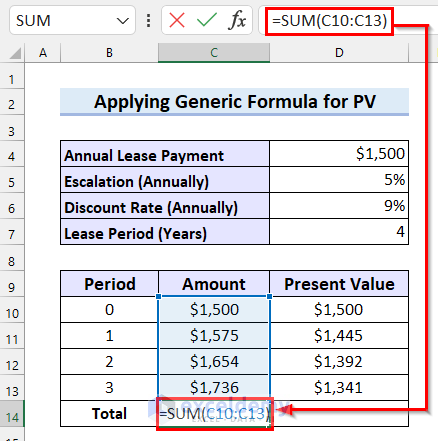

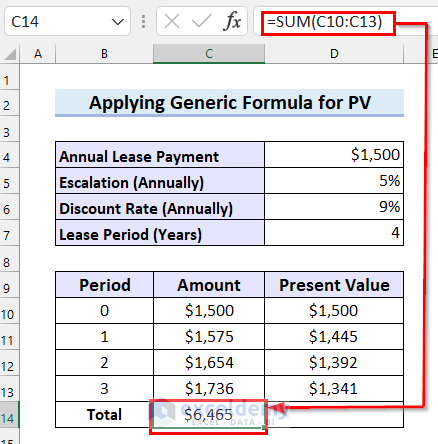

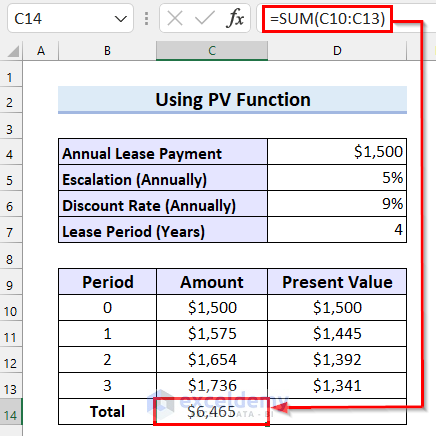

Calculate the Total Lease Amount.

- Select the cell where you want to calculate the Total.

- Enter the following formula in the selected cell.

=SUM(C10:C13)- Press ENTER to see the Total.

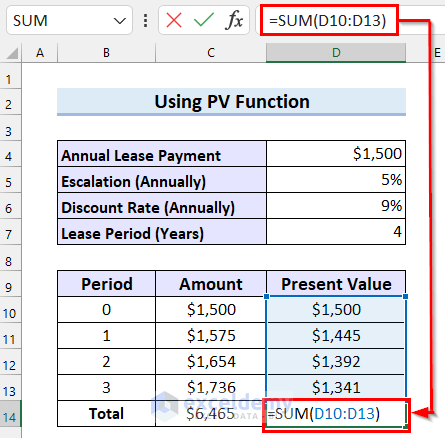

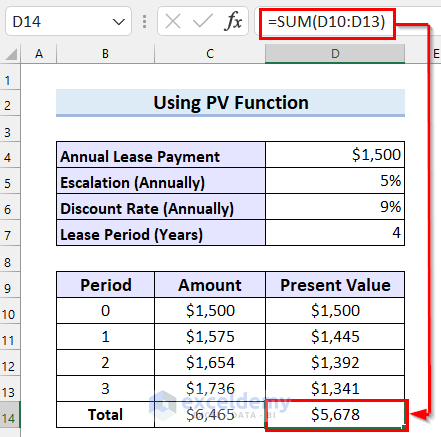

Calculate the Total Present Value.

- Select the cell where you want the Total. Here, D14.

- Enter the following formula in D14 .

=SUM(D10:D13)- Press ENTER.

Read More: How to Calculate Auto Loan Payment in Excel

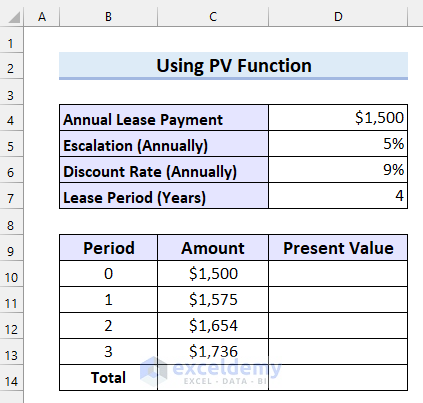

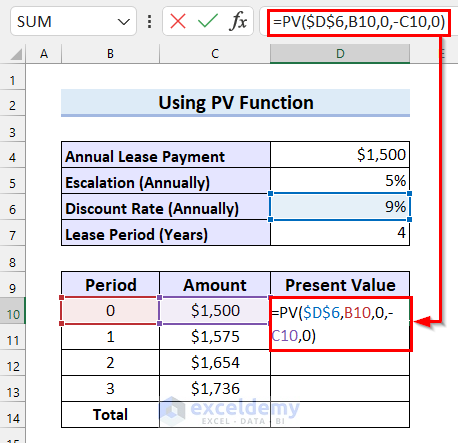

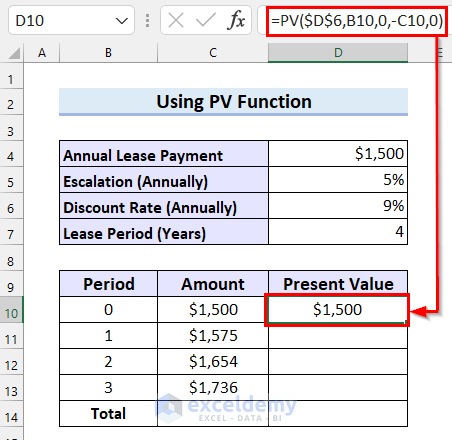

Method 4 – Using the PV Function to Calculate the Present Value of Lease Payments

Steps:

- Insert the lease Amount as shown in Method-03.

Calculate the Present Value of the Lease Payment.

- Select the cell where you want the Present Value. Here, D10.

- Enter the following formula in D10.

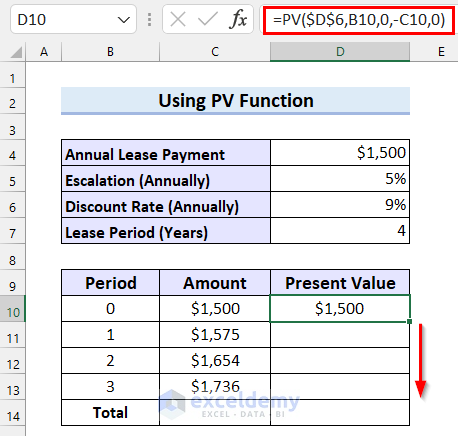

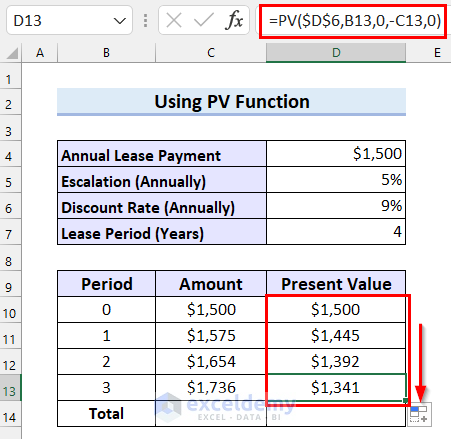

=PV($D$6,B10,0,-C10,0)- Press ENTER to see the Present Value.

- Drag the Fill Handle to copy the formula.

The formula returns the Present Value after each Period.

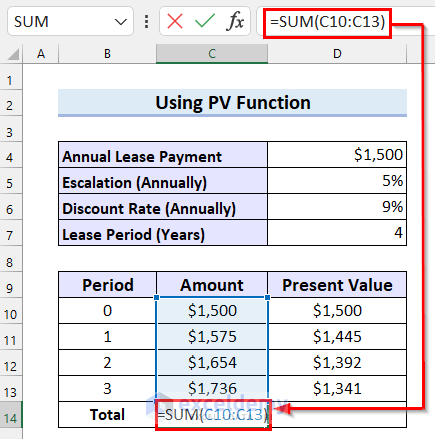

Calculate the Total lease Amount

- Select the cell where you want to calculate the Total.

- Enter the following formula in the selected cell.

=SUM(C10:C13)- Press ENTER to see the Total.

Calculate the Total Present Value.

- Select the cell where you want the Total. Here, D14.

- Enter the following formula in D14.

=SUM(D10:D13)- Press ENTER.

Read More: How to Calculate Car Payment in Excel

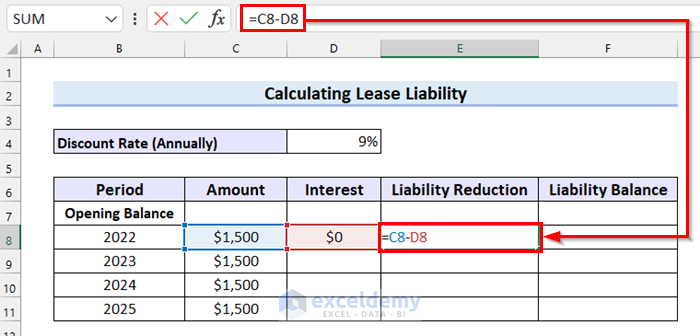

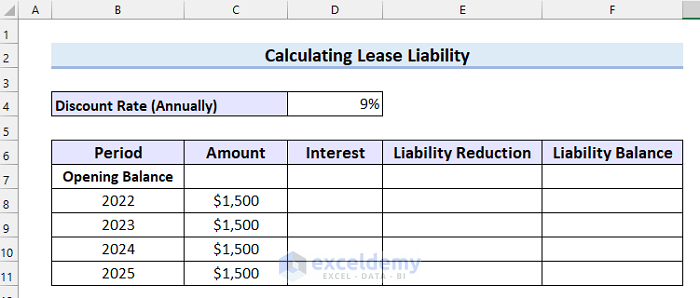

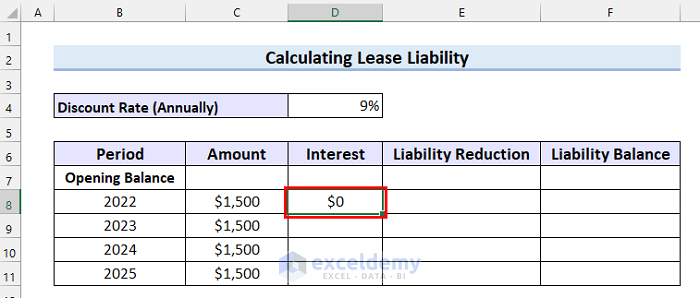

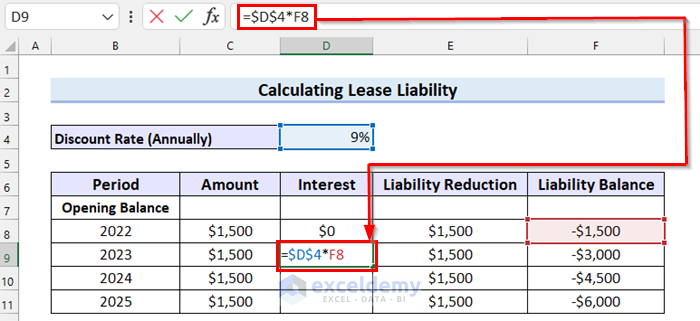

Calculate Lease Liability in Excel

This is the dataset:

Calculate the Liability Reduction

Steps:

- Insert 0 as Interest for the first year.

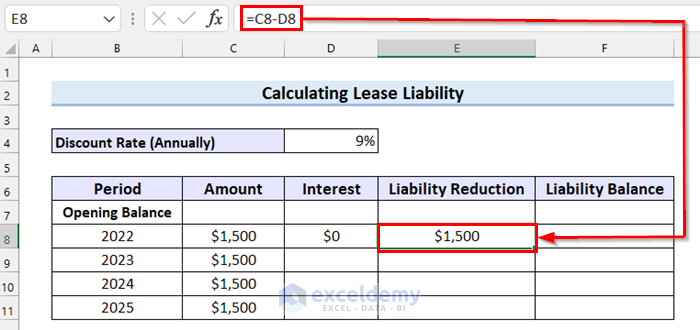

- Select the cell where you want the Liability Reduction. Here, E8.

- Enter the following formula in E8.

=C8-D8

- Press ENTER to see the Liability Reduction.

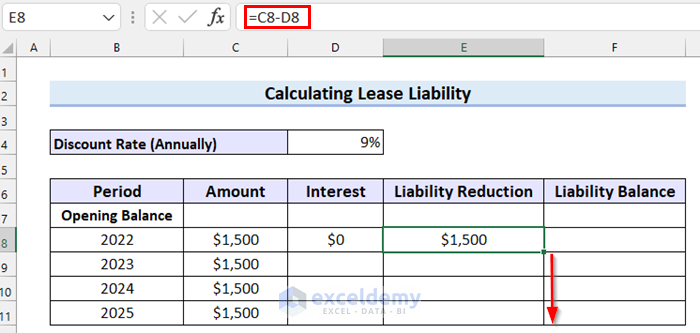

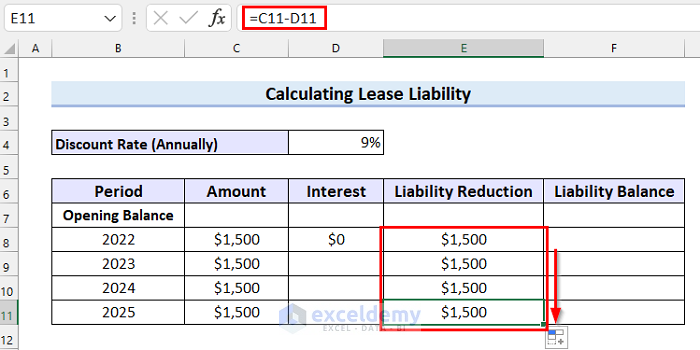

- Drag the Fill handle to copy the formula.

The formula is copied to the other cells.

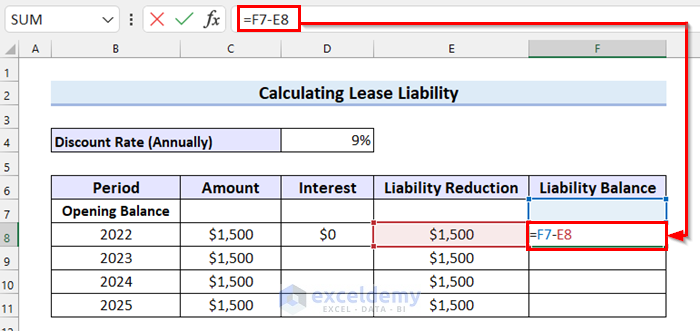

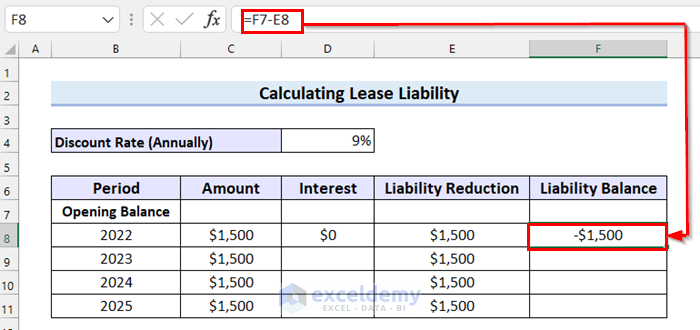

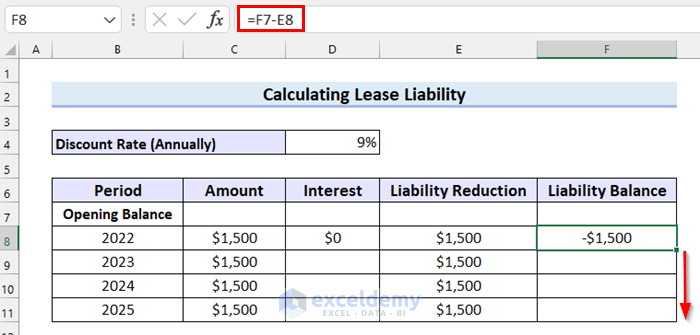

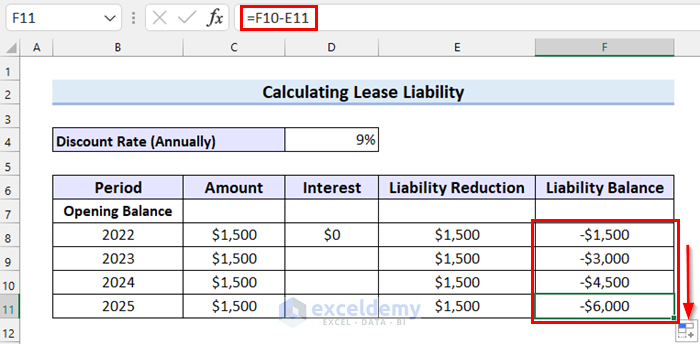

Calculate the Liability Balance

- Select the cell where you want to calculate the Liability Balance.

- Enter the following formula in the selected cell.

=F7-E8- Press ENTER.

- Drag the Fill Handle to copy the formula.

The formula is copied to the other cells.

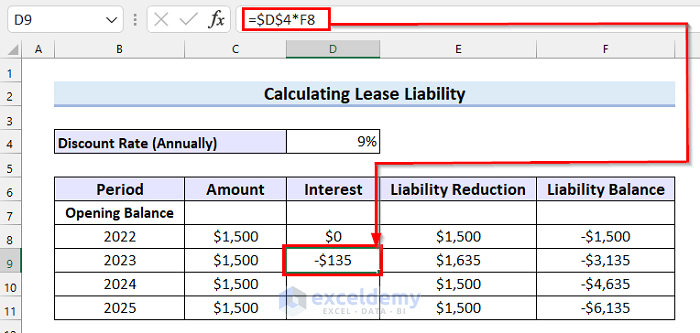

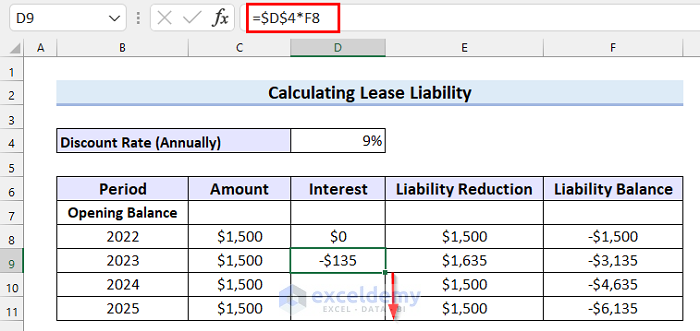

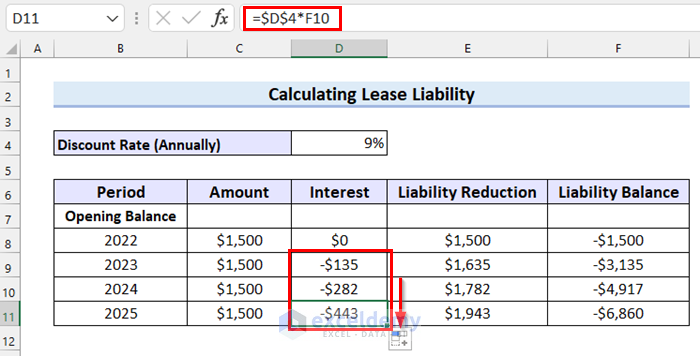

Calculate the Interest.

- Select the cell where you want to calculate the Interest. Here, D9.

- Enter the following formula in D9.

=F8*$D$4- Press ENTER and you will see the Interest.

- Drag the Fill Handle to copy the formula.

The formula is copied to the other cells.

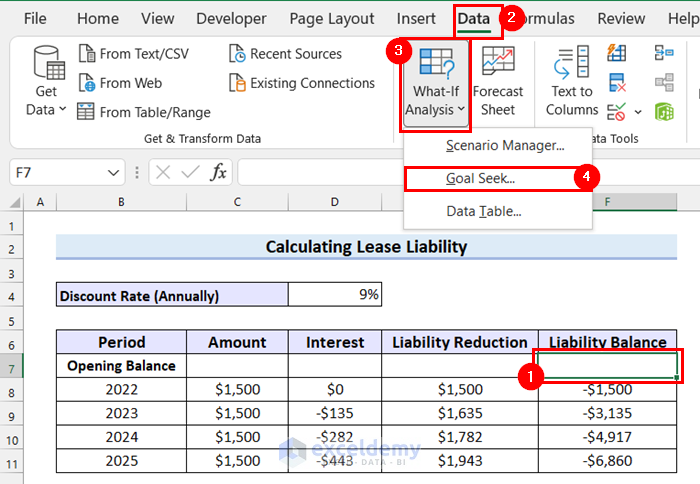

Calculate the Opening Liability Balance

- Select the cell where you want the Opening Liability Balance. Here, F7.

- Go to the Data tab.

- Select What-If Analysis.

- Select Goal Seek from the drop-down menu.

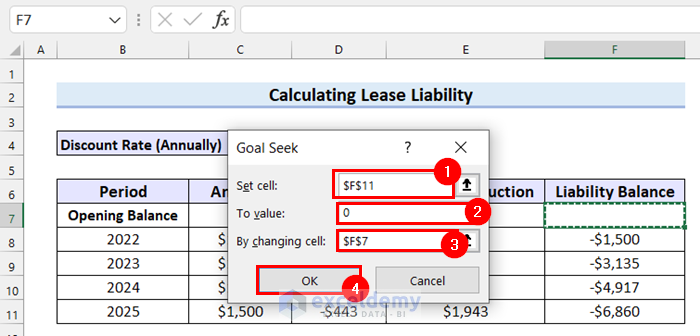

- In the dialog box select the last cell of Liability Balance as Set cell.

- Enter 0 as To value.

- Select the first cell as By changing cell.

- Click OK.

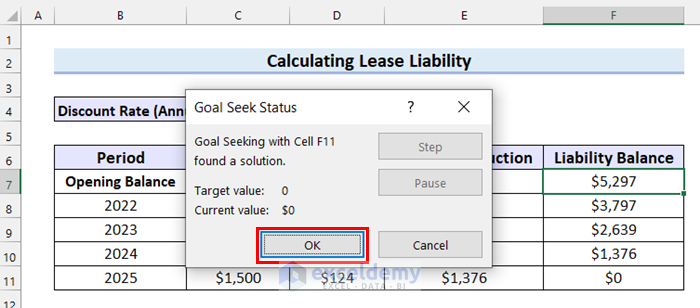

- Click OK in the Goal Seek Status in the dialog box .

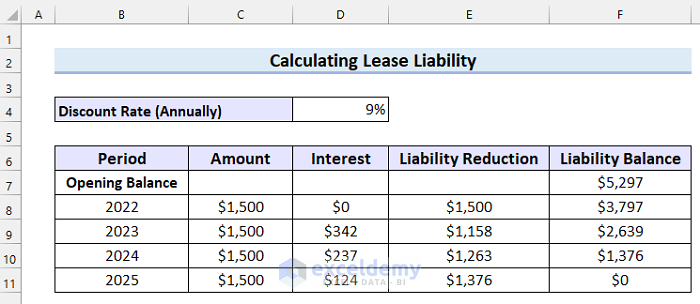

Lease Liability was correctly calculated.

Download Practice Workbook

Related Articles

- How to Calculate Coupon Payment in Excel

- How to Calculate Monthly Mortgage Payment in Excel

- How to Calculate Balloon Payment in Excel

- How to Calculate Monthly Payment with APR in Excel

<< Go Back to Calculate Payment in Excel | Excel for Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!

Calculate the monthly lease payment with following information – Selling Price Rs 28440, Maintainence and repair for 36 months- 4500 (To be Included in Lease payment 28440+4500), Residual Value 7.5%, interest rate at 20% the lease period of 36 months. how do we calculate the monthly payment in excel?

To calculate the monthly lease payment in Excel, you can use the following formula:

=PMT(rate/12,nper,-PV,FV)where:

rate = the interest rate per period (in this case, 20% divided by 12 for monthly payments)

nper = the total number of periods (in this case, 36 months)

PV = the present value of the lease (in this case, the selling price plus maintenance and repair costs, or Rs 28440 + Rs 4500 = Rs 32940)

FV = the future value of the lease (in this case, the residual value, or 7.5% of the selling price, or Rs 2133)

In our dataset, in Cell C11 we entered the below formula.

=PMT(C9/12,C8,(-C6),C7,0)See the image for better visualization.

Hope you are able to calculate the monthly lease payment now. Have a nice day. Keep supporting us.

Regards,

Fahim Shahriyar Dipto

Excel and VBA Content Developer