Most of the students have to go through various types of spending in contrast to a small window of income opportunities. so they need a budget planner to ease the process of planning out their budget. If you are curious to know how you can make a budget planner in Excel, this article may come in handy for you. In this article, we are going to show how you can make a budget planner in Excel for college students with elaborate explanations.

Make a Budget in Excel for College Students: Step-by-Step Procedure

In this, you will make a budget in Excel step by step. You can not only able to track your earnings and expenditure, but you can compare them with the help of a pie chart also. You can also create personal monthly budget in Excel.

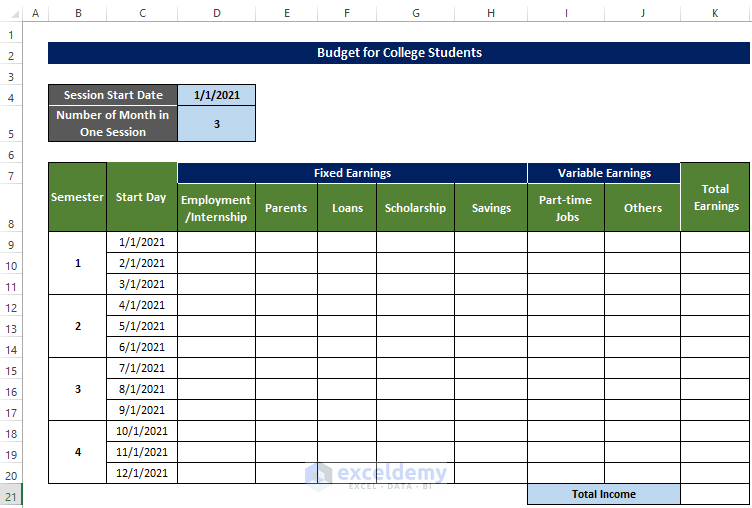

Step 1: Create Primary Outline

Before we delve into preparing the Budget, we first need to prepare the initial structure. That structure can be altered as users need.

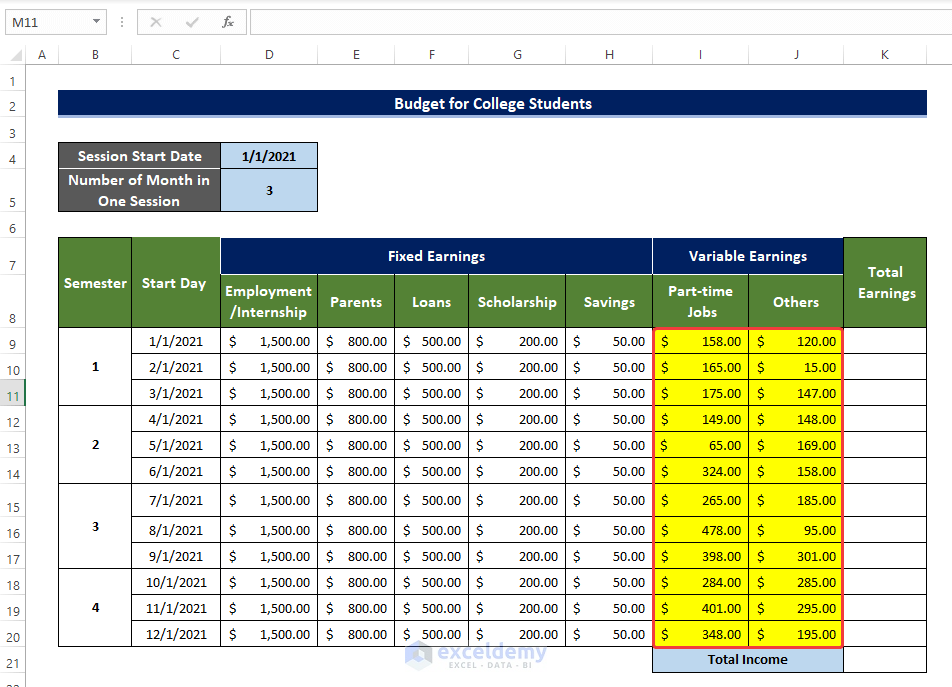

- In order to create the budget, we need to create a sample template for inputting the data and organization.

- The template must consist of sections of Fixed Earnings and Variable Earnings.

- And then there should be expenses in both the Variable fields and Fixed fields.

- Then finally we add several charts to visualize our income and expenses.

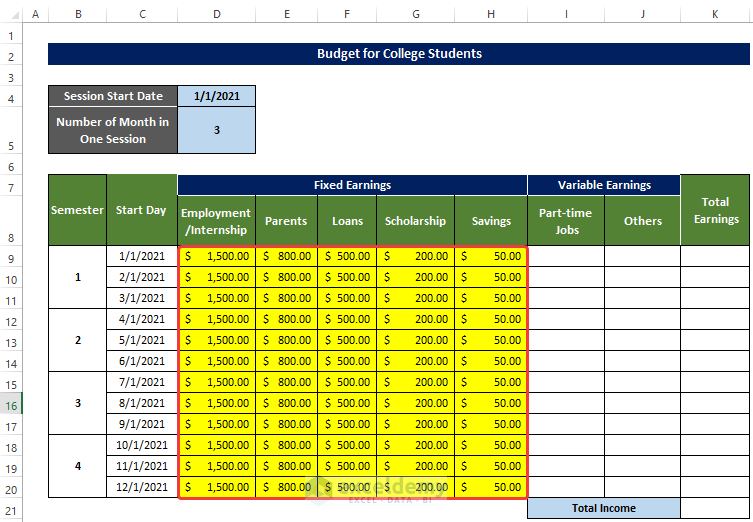

Step 2: Input All Fixed Earnings

Now, we have all the fixed earnings listed, we now put them one by one as the column header.

- The fixed earnings are subjective. So it will vary from person to person.

- For example, here we have internships or similar types of employment that can be enlisted as the Fixed earnings.

- A constant stream of money from parents can also be enlisted as the Fixed earnings.

- Loans, such as student loans or any other type of loan taken can be considered as the money inflow. Although the loan can be taken all at once, we dispersed it throughout the 12 months in order to have a better insight into cash flow every month.

- Next, we will have the scholarship money.

- Next, we will enter savings amounts.

Step 3: List All Variable Earnings

After we enlisted the Fixed earnings, we are going to list the Variable earnings. These earnings are going to be varied from month to month.

- The most source of any kind of variable income is any kind of involvement of part-time jobs.

- We will list them manually each month, as the pay for a part-time job will vary month to month.

- There are myriads of sources of variable incomes. We will let users calculate them separately and input them into the Others columns.

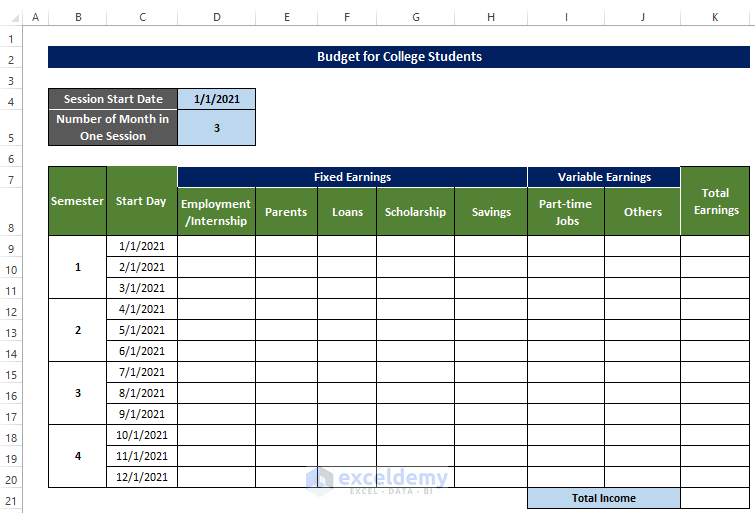

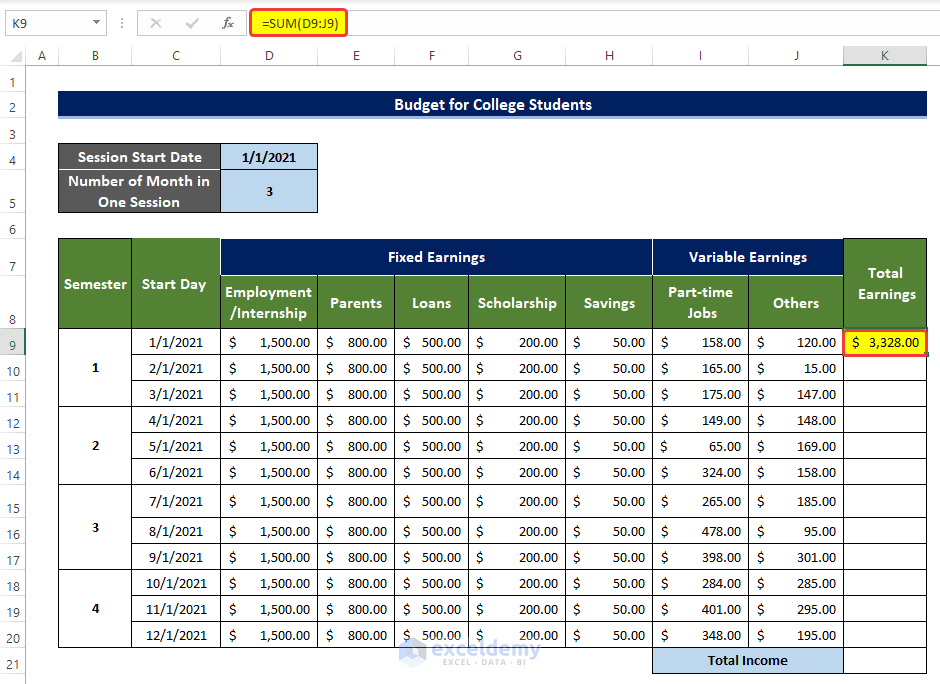

Step 4: Evaluate Total Income

As we have both the Fixed and the Variable earnings, we can calculate the Total earnings now, using the SUM function.

- Now select cell K9 and enter the following formula:

=SUM(D9:J9)

Entering this formula will evaluate the sum of All the earnings from the sources mentioned in the range of cells K9:K20 for the first month of the first semester.

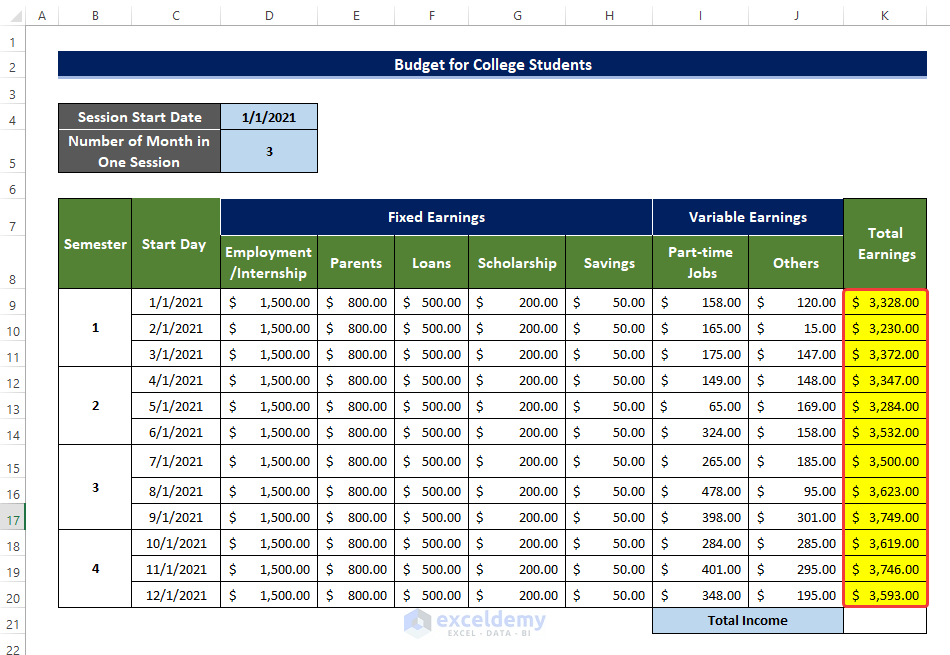

- Drag the fill handle to cell K20, to repeat the above process for the rest of the months.

- We now have the total earnings for each month.

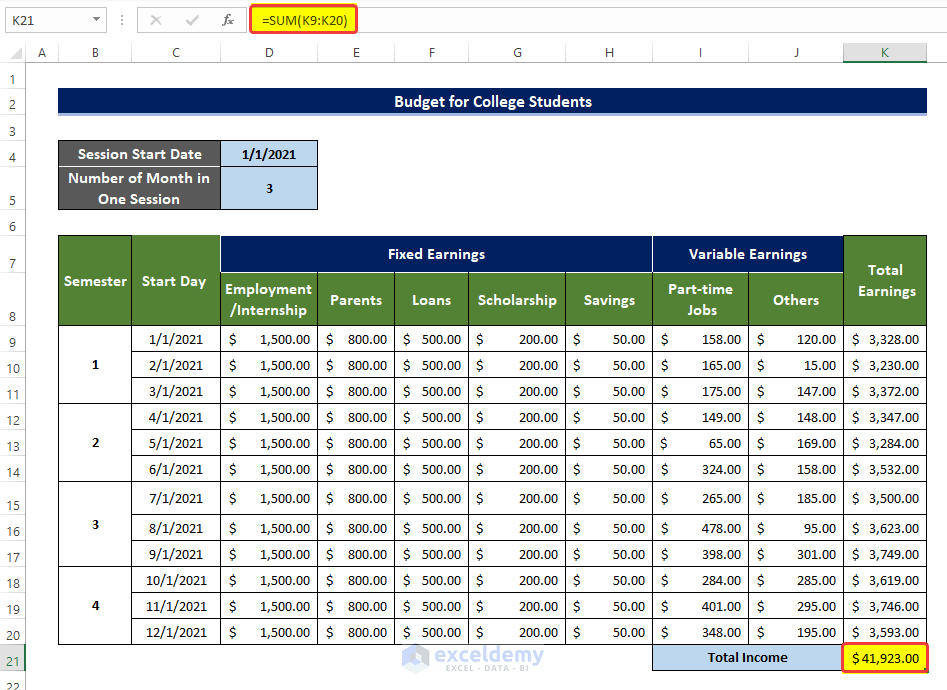

- Then select the cell K21 and enter the following formula:

=SUM(K9:K20)

Doing this will calculate the summation of all the earnings in a single year.

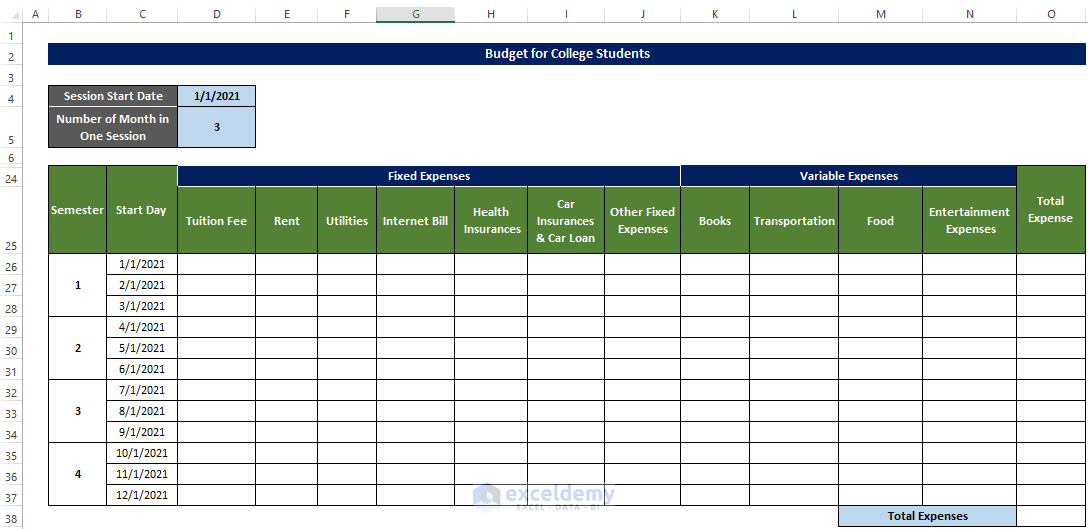

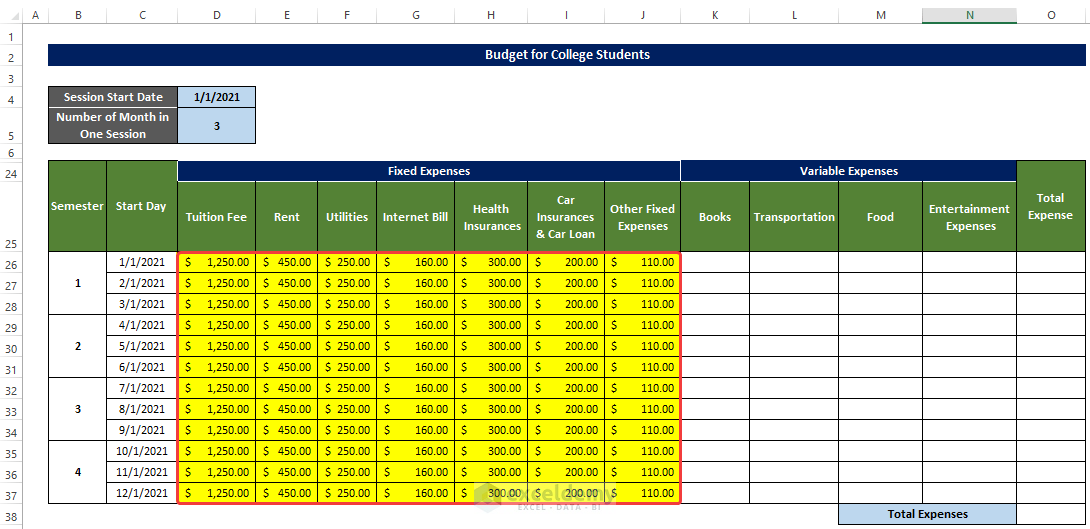

Step 5: Input All Fixed Expenses

In this step, we are going to determine all kinds of Fixed expenses.

- First, e need to input all fixed expenses that a student needs to pay every month.

- From D26:J37, we got all the fixed expenses listed.

- Among them are the most common ones, Tuition Fees, Rent Utility, Internet Bill, Health Insurance, Car Insurance, and Others.

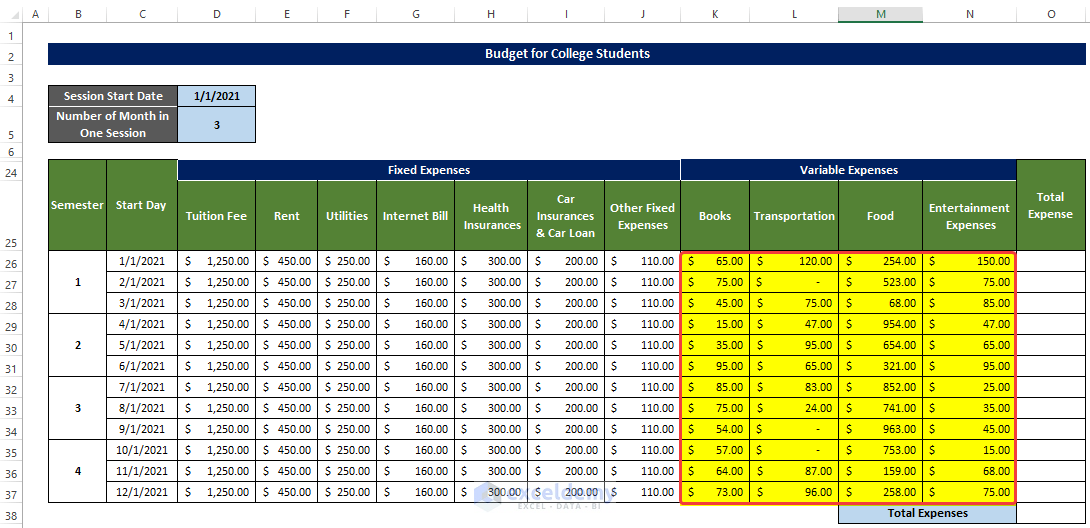

Step 6: List All Variable Expenses

After we got all the Fixed expenses, we now enlist the Variable expenses now, they normally need to update every month.

- The most common types of Variable Expenses for students are Books.

- Other types of variable expenses could be Food, Entertainment, transportation, etc.

- They all need manual updates on the sheets every month.

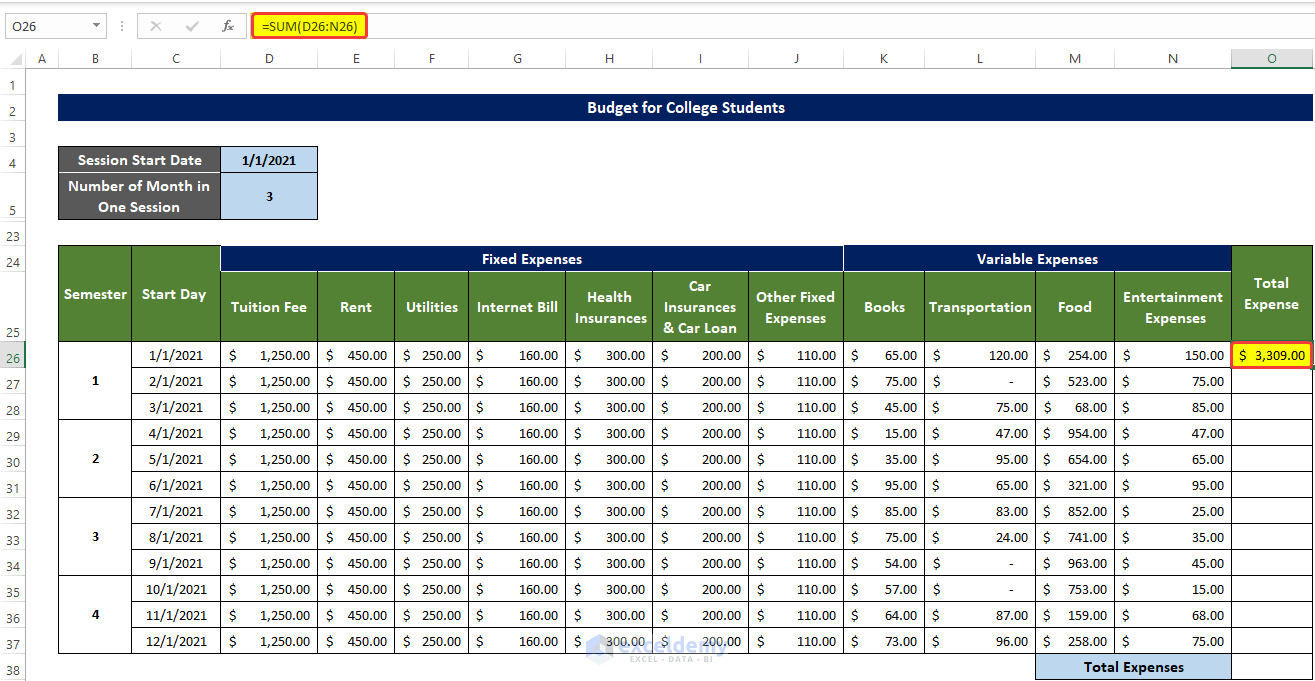

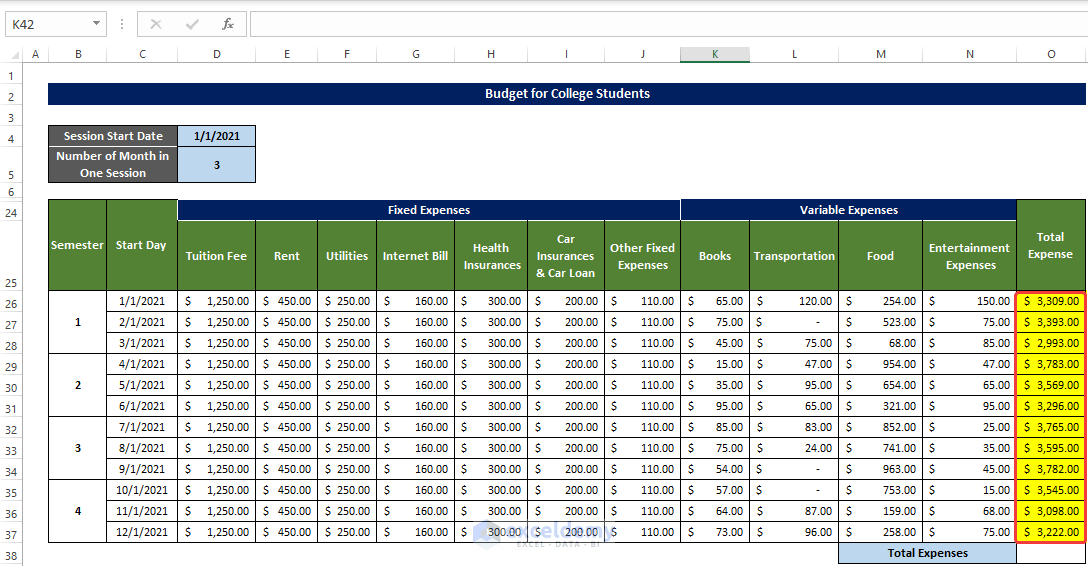

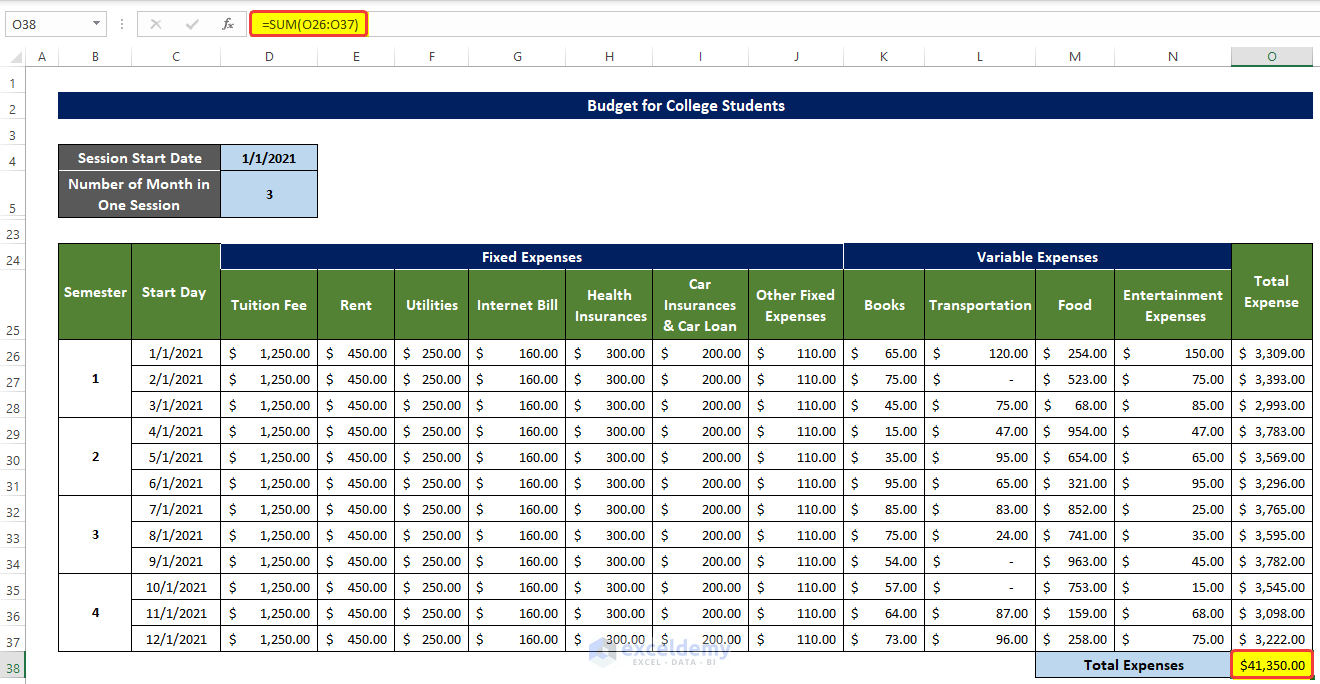

Step 7: Evaluate Total Expenses

As we have both the Variable expense and the Fixed expense, we can calculate the Total Expense, using the SUM function.

- Select the cell O26, and enter the following formula:

=SUM(D26:N26)

Entering this formula will estimate the summation of Toal Expenses that occurred in the span of one single month.

- Then drag the fill handle to the cell O37.

- A Total Expense per month will be calculated in the range of cells O26:O37.

- Then select cell O38 and enter the following formula:

=SUM(O26:O37)

- In this way, all expenses will be summed up over the span of 12 months.

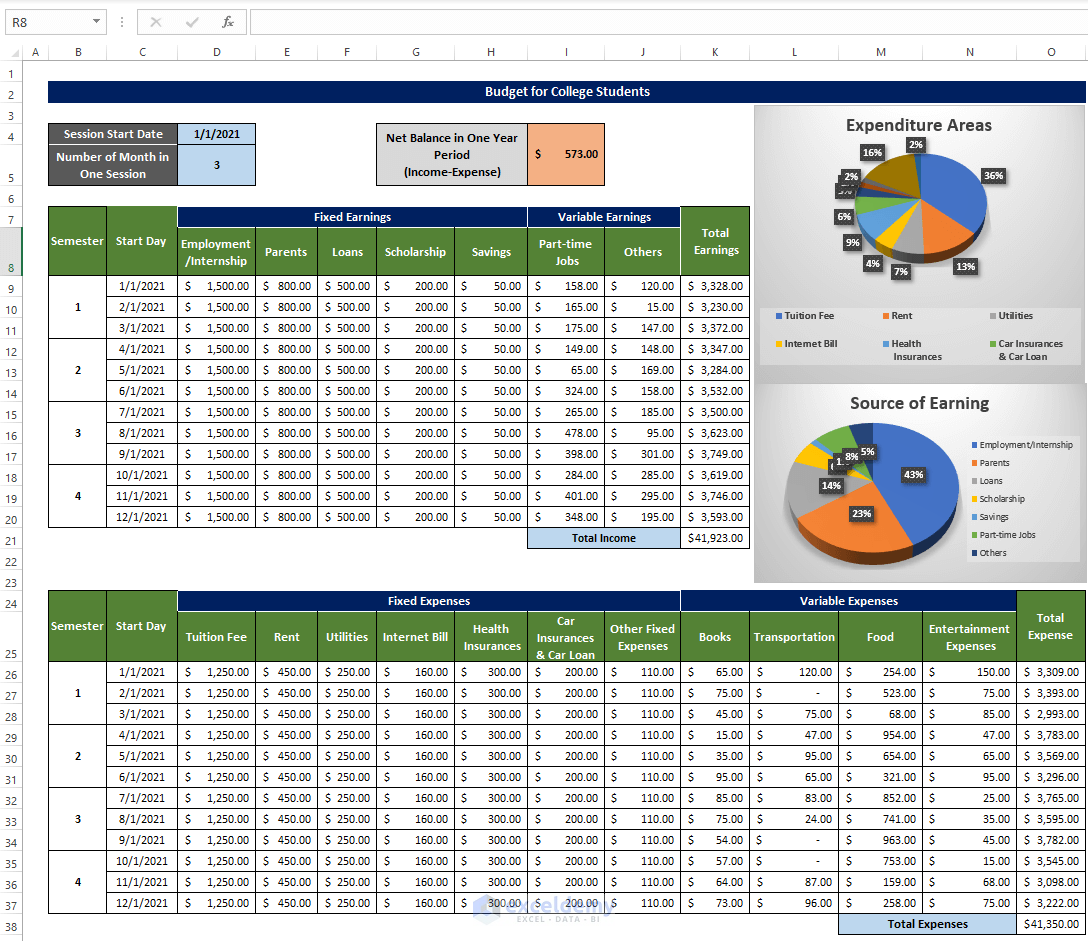

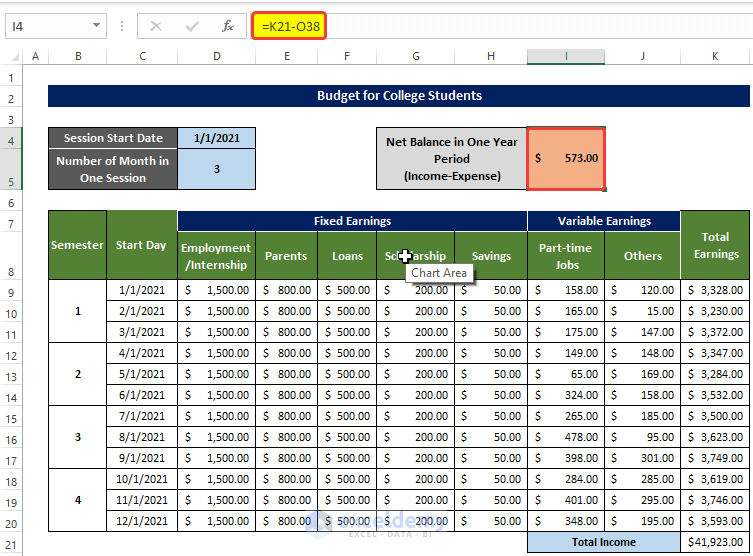

Step 8: Calculate Net Balance

Now, as we got both the expenses and the earnings, we could calculate the total net balance for the entire year.

- We selected te cell I4 and enter the following formula:

=K21-O38

- Entering this formula will calculate the net balance that would remain after one year on the hand of the student.

- This formula basically Subtracts all of the Expenditure from the Total Earnings.

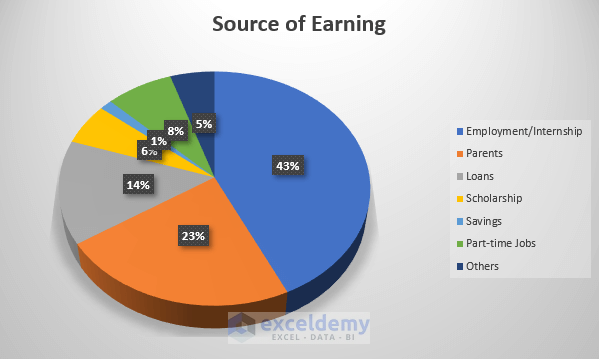

Step 9: Generate Final Budget with Charts

In the final Stage, a Pie chart will be there to compare all the expenditures and earnings.

- In the PIe chart below, we presented the incomes of the students from various sources.

- We can compare the earnings among themselves.

- It is quite evident that the Employment or the internship plays the biggest part in the earnings of the student.

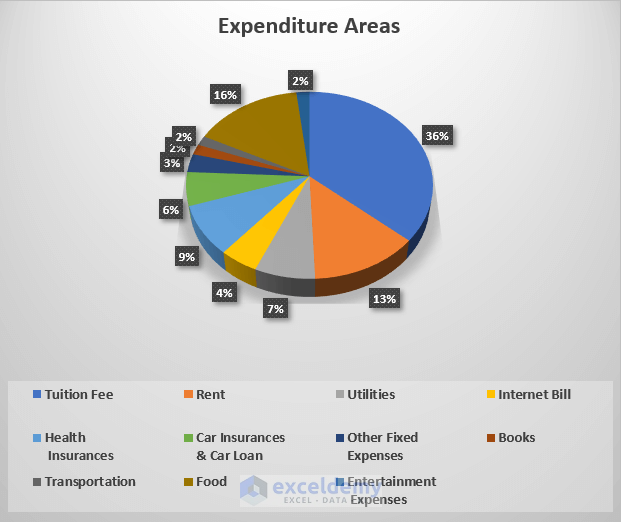

- Now as we got the source of earnings, we will plot the pie chart demonstrating the areas of expenditure.

- The pie chart below shows that the biggest field in which student spend their money is the Tuition fees(36%), followed by the Rent, Utilities, etc.

The final form of the budget planner will look like this altogether.

Read More:How to Create a Personal Budget in Excel

Download this practice workbook below.

Conclusion

To sum it up, the question “how to make a budget in excel for college students” in 9 separate steps with elaborate explanations.

For this problem, a workbook is available for download where you can practice these methods.

Feel free to ask any questions or feedback through the comment section.

Related Articles

- How to Make a Household Budget in Excel

- How to Make a Wedding Budget in Excel

- How to Make a Family Budget in Excel

- How to Create a Department Budget in Excel

<< Go Back To How to Create a Budget in Excel | Excel For Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!