What Is the Future Value of Uneven Cash Flows?

Future Value is the total amount of the Present Value and Total Interest. To calculate the future value of uneven cash flows, the future value for each cash flow is calculated, then all values are added to get the total future value.

The formula for calculating the future value of uneven cash flow is given below.

FV = CF0 * (1+r)^ n + CF1 * (1+r)^ n-1+ CF2 * (1+r)^ n-2 + ……. +CFnCF represents the Cash Flow, r represents Interest Rate and n indicates the Total Number of Payment Periods.

How to Calculate the Future Value of Uneven Cash Flows in Excel: 3 Ways

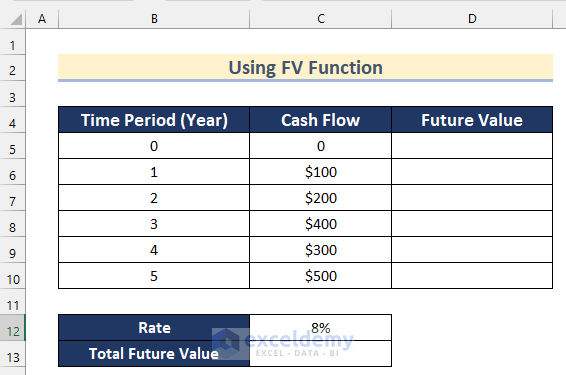

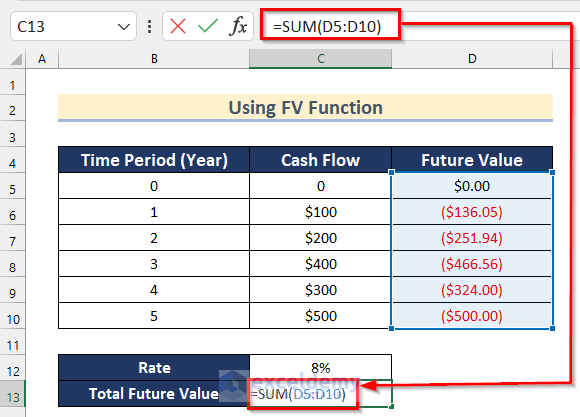

Method 1 – Using the FV Function to Calculate the Future Value of Uneven Cash Flows Excel

We have a dataset containing the Time Period (Year), Cash Flow, and the Rate of an investment. We will use this dataset to calculate the future value using the FV function.

Steps:

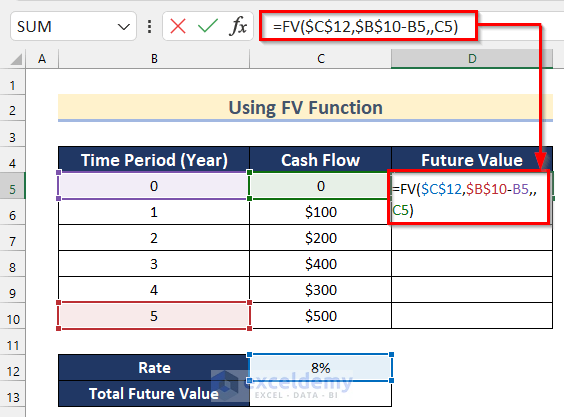

- Select cell D5.

- Insert the following formula.

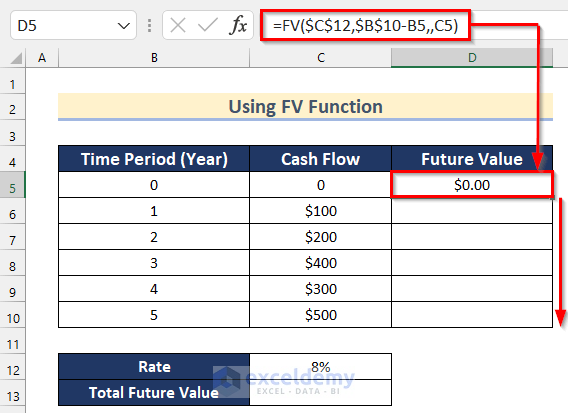

=FV($C$12,$B$10-B5,,C5)- Press Enter to get the Future Value.

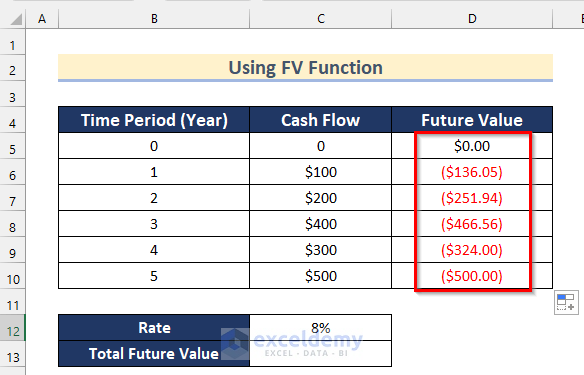

- Drag down the Fill Handle tool to AutoFill the formula for the rest of the cells.

- You will get all the values to the future value for each time period using the FV function.

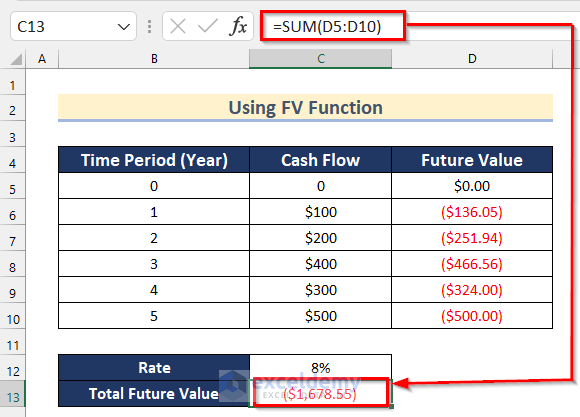

- Select cell C13.

- Insert the following formula.

=SUM(D5:D10)- You will get the Total Future Value which is in negative form.

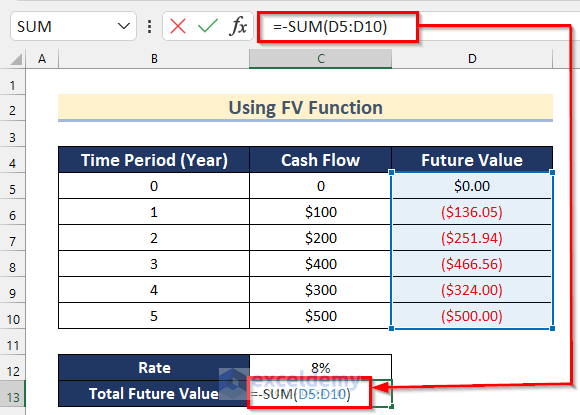

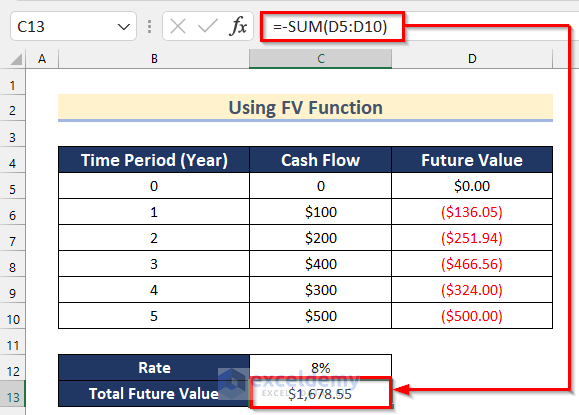

- To convert the value into a positive one, select cell C13 and insert the following formula.

=-SUM(D5:D10)- You will get your desired total future value in Excel.

Read More: How to Calculate Present Value of Future Cash Flows in Excel

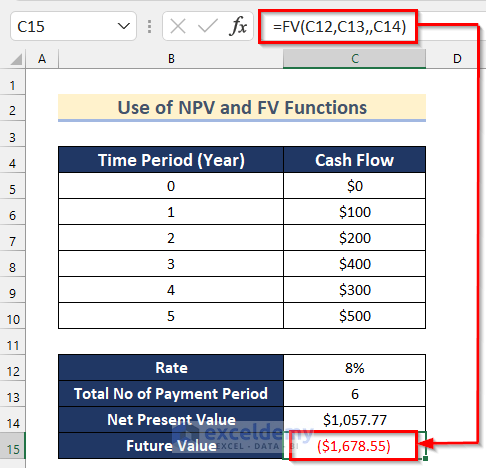

Method 2 – Use of NPV and FV Functions to Calculate the Future Value of Uneven Cash Flows

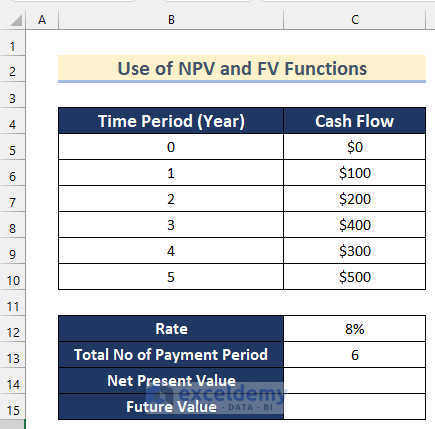

We have a dataset containing the Time Period (Year), Cash Flow, Rate, and Total No. of Payment Periods of an investment.

Steps:

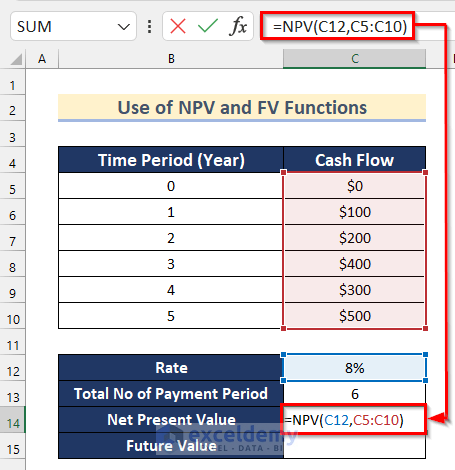

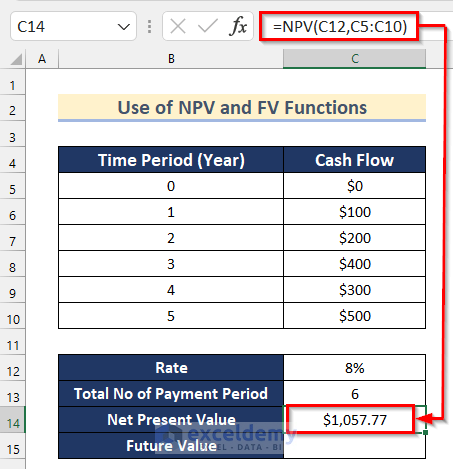

- Select cell C14.

- Insert the following formula.

=NPV(C12,C5:C10)- Press Enter to get the Future Value.

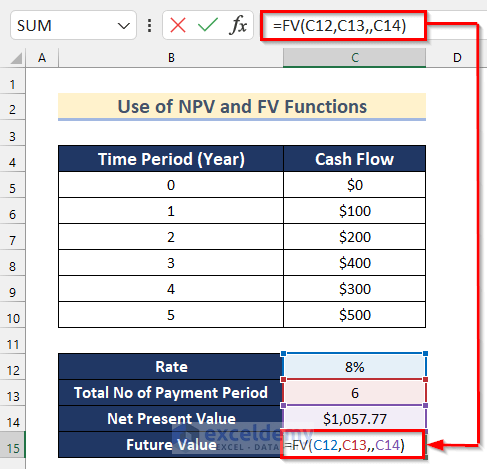

- Select cell C15.

- Insert the following formula.

=FV(C12,C13,,C14)- Press Enter to get the Future Value.

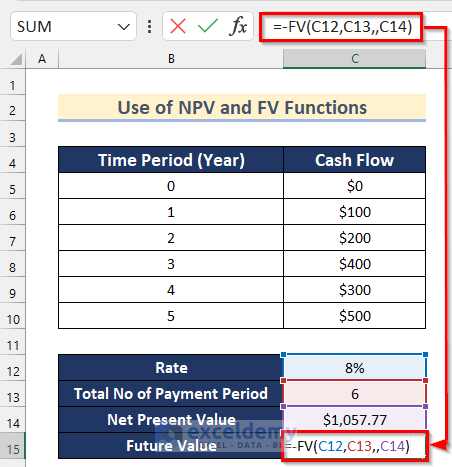

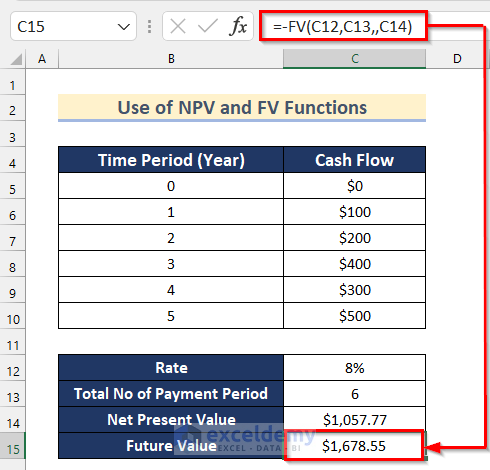

- Select cell C15.

- Insert the following formula.

=-FV(C12,C13,,C14)- You will get your desired future value in Excel.

Read More: Calculate NPV for Monthly Cash Flows with Formula in Excel

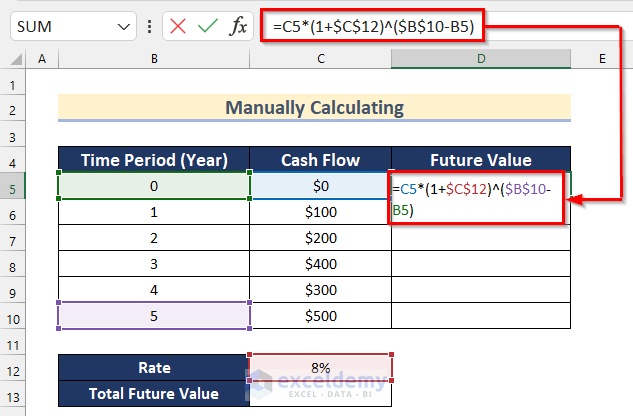

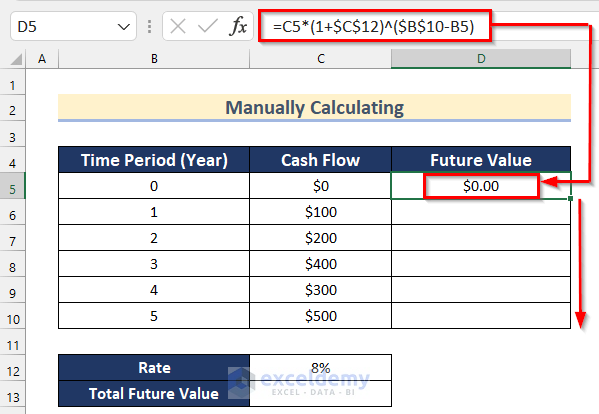

Method 3 – Manually Calculating the Future Value of Uneven Cash Flows in Excel

Steps:

- Select cell D5.

- Insert the following formula.

=C5*(1+$C$12)^($B$10-B5)- Press Enter to get the future value.

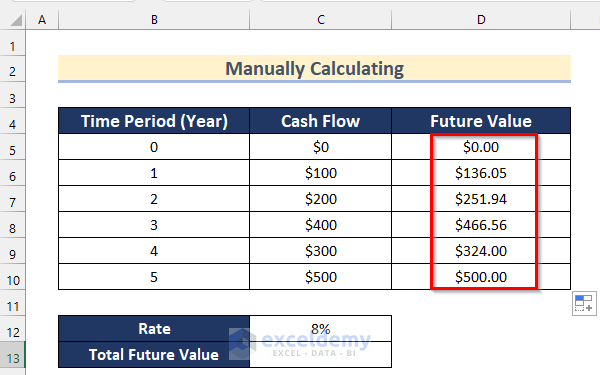

- Drag down the Fill Handle tool to AutoFill the formula for the rest of the cells.

- You will get all the future values for each time period.

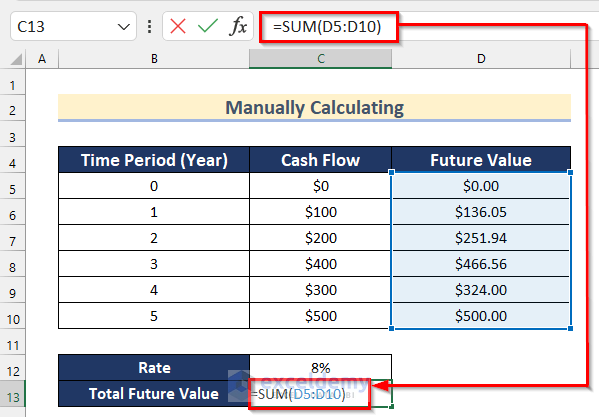

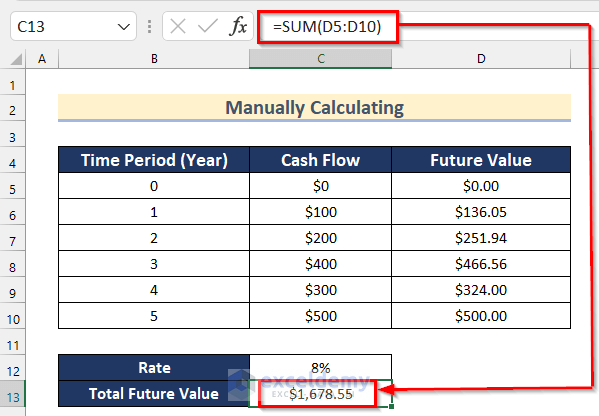

- Select cell C13.

- Insert the following formula.

=SUM(D5:D10)- You will get your desired Total Future Value of uneven cash flows.

Read More: How to Calculate Future Value in Excel with Different Payments

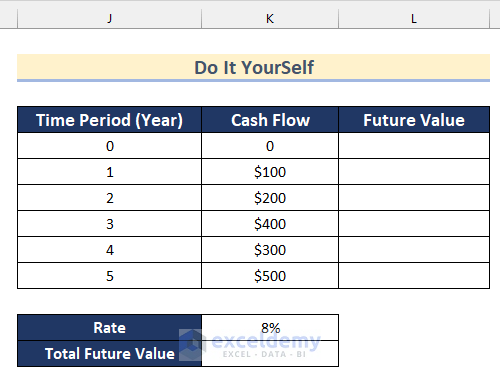

Practice Section

We’ve included a practice section in the file so you can test out these methods.

Download the Practice Workbook

Related Articles

- How to Calculate Present Value of Uneven Cash Flows in Excel

- How to Apply Present Value of Annuity Formula in Excel

- How to Calculate Future Value of Growing Annuity in Excel

- How to Calculate Future Value with Inflation in Excel

- How to Calculate Present Value of Lump Sum in Excel

- How to Calculate Present Value in Excel with Different Payments

- How to Apply Future Value of an Annuity Formula in Excel

<< Go Back to Time Value Of Money In Excel | Excel for Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!