Method 1 – Use of PV Function to Calculate Present Value of Future Cash Flows

Steps:

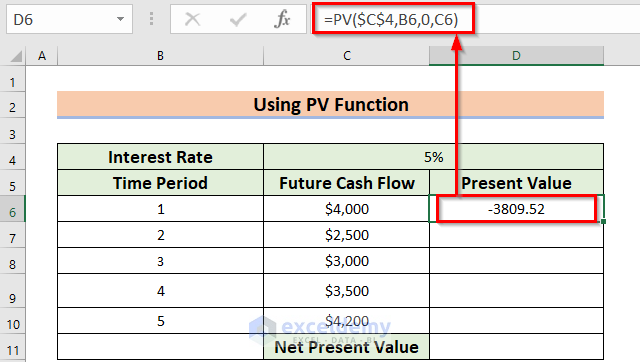

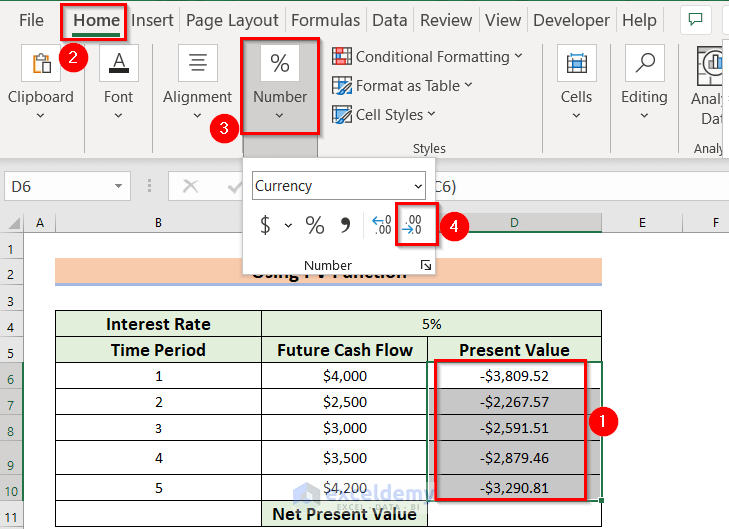

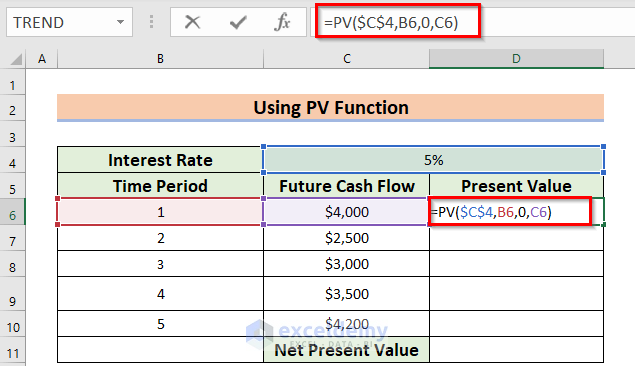

- Select a different cell, D6, where you want to calculate the present value.

- Use the corresponding formula in the D6 cell.

=PV($C$4,B6,0,C6)

Formula Breakdown

The PV function will return the present value of an investment.

- C4 denotes rate as the annual interest rate. The Dollar ($) sign denotes that the value of the C4 cell is fixed.

- B6 denotes NPER as the total period of time.

- As there is no Payment, so PMT will be 0.

- C6 denotes FV as the Future Cash Flow.

- Press ENTER to get the Present Value.

The Minus sign denotes that you must keep this amount at any monetary institute.

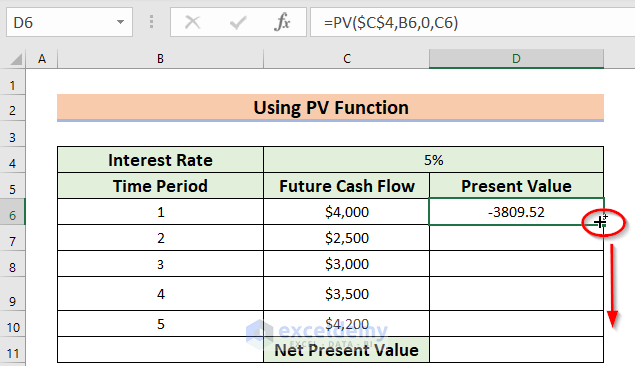

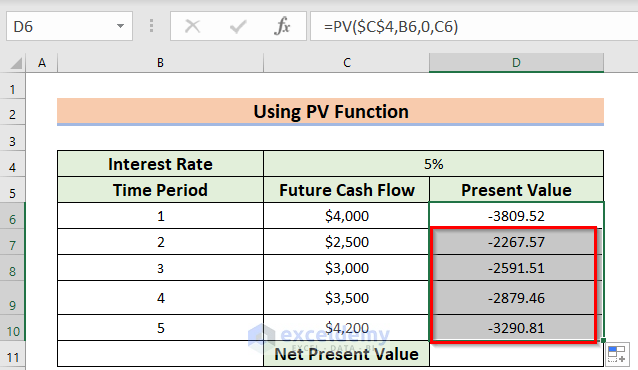

- You must drag the Fill Handle icon to AutoFill the corresponding data in the rest of the cells D7:D10.

At this time, you will see the following result.

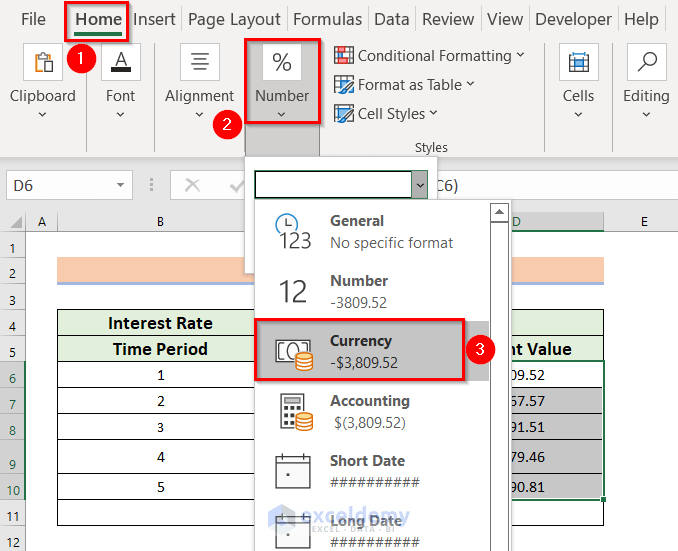

- Select the data range. Here, I have selected D5:D10.

- From the Home tab >> you should go to the Number feature.

- In the Number feature >> Click the Drop-Down Arrow >> Choose currency.

- From the Number feature >> you need to Click two times on decrease decimal to decrease the decimal.

- Press the CTRL+1 keys to open the Format Cells dialog box directly.

Use the Context Menu Bar or the Custom Ribbon to go to the Format Cells command.

- Select the data range >> right-click on the data >> choose the Format Cells option.

In the case of using Custom Ribbon,

- Select the data range >> from the Home tab >> go to the Format feature >> choose the Format Cells command.

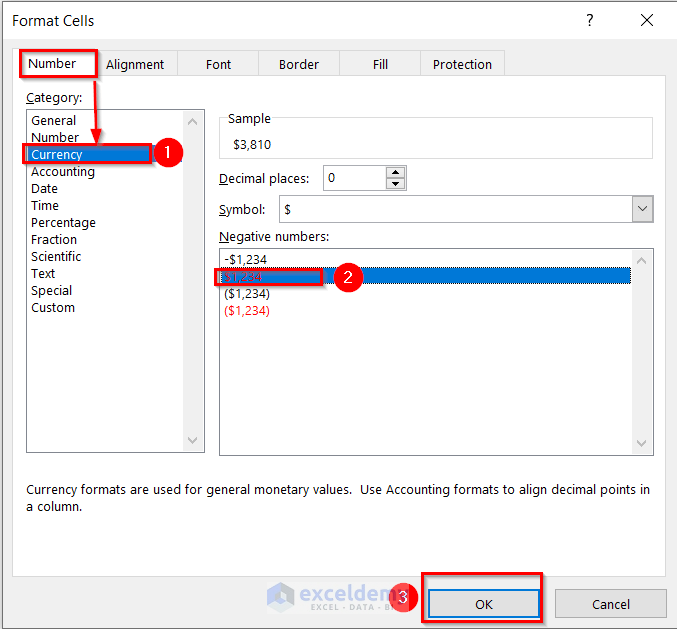

After that, a dialog box named Format Cells will appear.

- From that dialog box, you have to make sure that you are on the Number command.

- Go to the Currency option.

- Choose the second option from the Negative numbers option.

- Press OK.

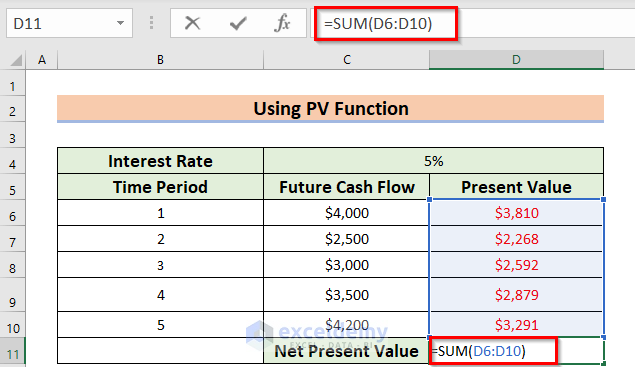

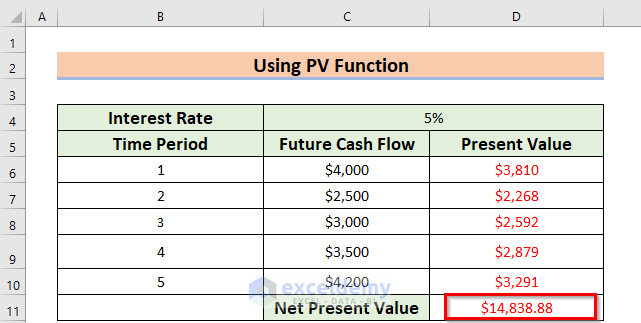

Get the total Present value, I will use the SUM function.

- Select a different cell, D11, where you want to calculate the total Present Value.

- Use the corresponding formula in the D11 cell.

=SUM(D6:D10)- Press ENTER.

The SUM function will return the summation of the data range D6:D10. Get the following present value.

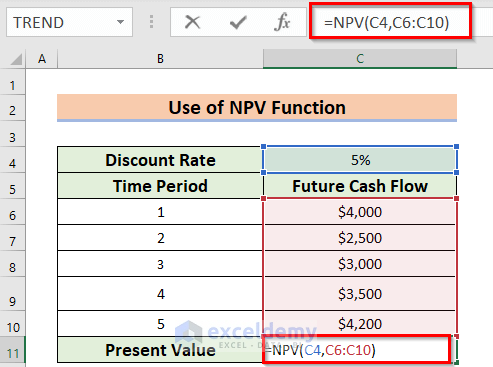

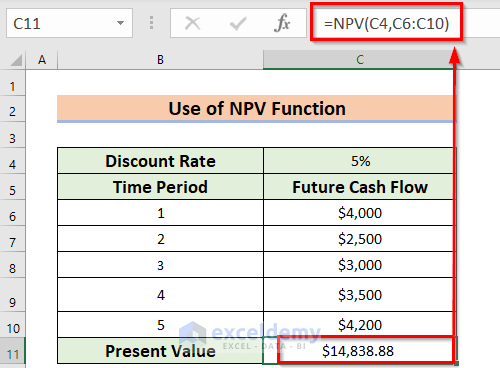

Method 2 – Applying NPV Function for Calculating Present Value

Steps:

- Select a different cell, C11, where you want to calculate the present value.

- Use the corresponding formula in the C11 cell.

=NPV(C4,C6:C10)Formula Breakdown

The NPV function will return the net present value of an investment.

- C4 denotes the discount rate. Which is 5%.

- C6:C10 denotes the series of FV as the Future Cash Flows.

- Press ENTER to get the Net Present Value.

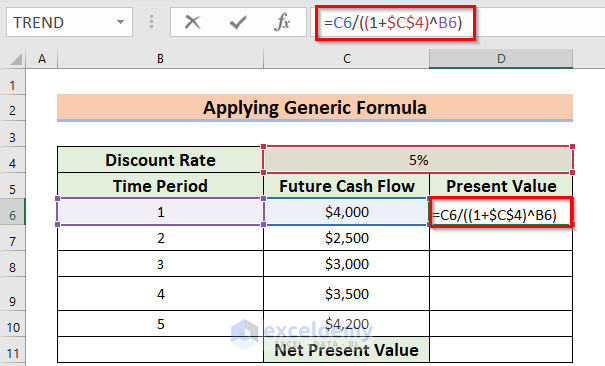

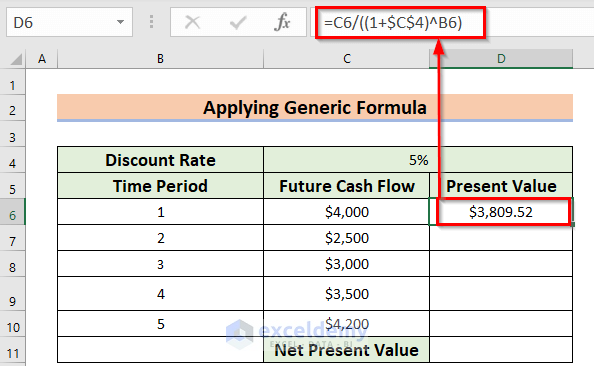

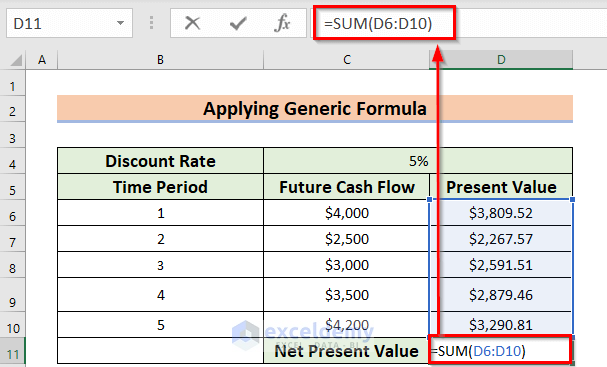

Method 3 – Employing Generic Formula to Calculate Present Value of Future Cash Flows

Steps:

- Select a different cell D6 where you want to calculate the Present Value.

- Use the corresponding formula in the D6 cell.

=C6/((1+$C$4)^B6)Formula Breakdown

- C4 denotes the rate as the annual discount rate. The Dollar ($) sign denotes that the value of the C4 cell is fixed.

- We added 1 with the discount rate.

- Output: 1.05.

- The Power (^) sign raises it to a fixed power which is the value of B6 cell. That is the time period.

- Output: 1.05.

- We divided the C6 cell value by 1.05.

- Output: $3,809.52.

- Press ENTER to get the present value.

- Drag the Fill Handle icon to AutoFill the corresponding data in the rest of the cells D7:D10.

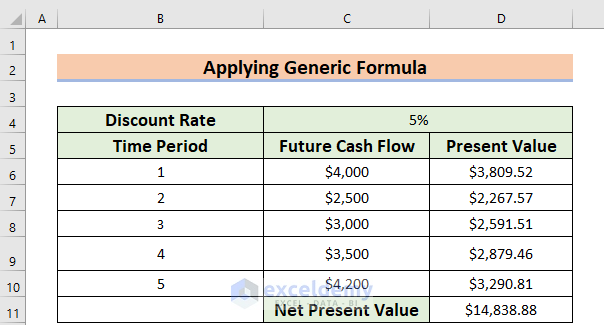

Get the total present value, I will use the SUM function.

- Select a different cell, D11, where you want to calculate the total present value.

- Use the corresponding formula in the D11 cell.

=SUM(D6:D10)- Press ENTER.

The SUM function will return the summation of the data range D6:D10. Lastly, you will get the following Present Value.

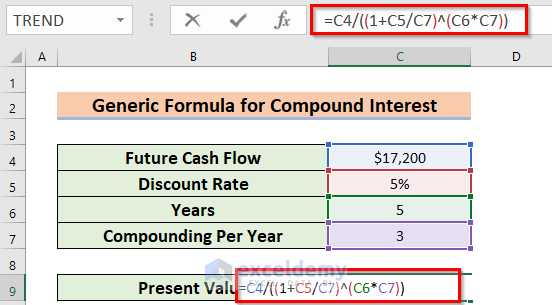

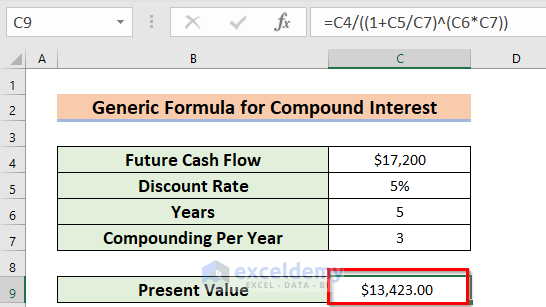

Method 4 – Using Generic Formula for Compound Interest

Steps:

- Select a different cell, C9, where you want to calculate the present value.

- Use the corresponding formula in the C9 cell.

=C4/((1+C5/C7)^(C6*C7))Formula Breakdown

- C5 denotes rate as the annual discount rate.

- We divided the cell value of C5 by Compounding year or C7 cell value.

- Output: 0.016666667.

- We added 1 with the result.

- Output: 1.016666667.

- We multiplied C6 with C7.

- Output: 15.

- The Power (^) sign raises it to a fixed power.

- Output: 1.281382444.

- We divided the C4 cell value by the output.

- Output:$13,423.00 .

- Press ENTER to get the present value.

Things to Remember

Try to avoid generic formulas as there are built-in functions to calculate the present value of future cash flows.

Download Practice Workbook

You can download the practice workbook from here:

Related Articles

- How to Calculate Future Value in Excel with Different Payments

- How to Apply Future Value of an Annuity Formula in Excel

- How to Calculate Future Value with Inflation in Excel

- How to Calculate Future Value of Growing Annuity in Excel

- How to Calculate Future Value of Uneven Cash Flows in Excel

- How to Calculate Present Value in Excel with Different Payments

<< Go Back to Time Value Of Money In Excel | Excel for Finance | Learn Excel