Download Excel Template

EXCEL (.XLSX)

For: Excel 2007 or later

License: Private Use

What Is Bi-Weekly Mortgage Calculator with Extra Payments?

A Bi-weekly Mortgage Calculator is a tool that uses an amortization schedule where the mortgage payment is done bi-weekly, i.e. every two weeks. A borrower will pay 26 times in a year when repaying their loan.

If someone takes a loan for 30 years in bi-weekly payment frequency, they have to pay their mortgage payment for (26*30)=780 times to repay the loan where both principal and accrued interest will be deducted accordingly every time.

If the borrower’s income increases during the loan repayment period, they might consider an early payoff of the loan, like closing the loan within 25 years by making some extra payments.

What Is Accelerated Bi-weekly Payment?

An accelerated bi-weekly payment is similar to a regular bi-weekly payment as it is also done every two weeks. Here, we assume each month has four weeks. So, to calculate accelerated biweekly payment, monthly payment is calculated with monthly interest rate and all necessary calculations based on monthly payment frequency. The monthly mortgage payment is then divided by two to get the accelerated bi-weekly payment.

Template 1 – Biweekly Mortgage Calculator with Extra payments

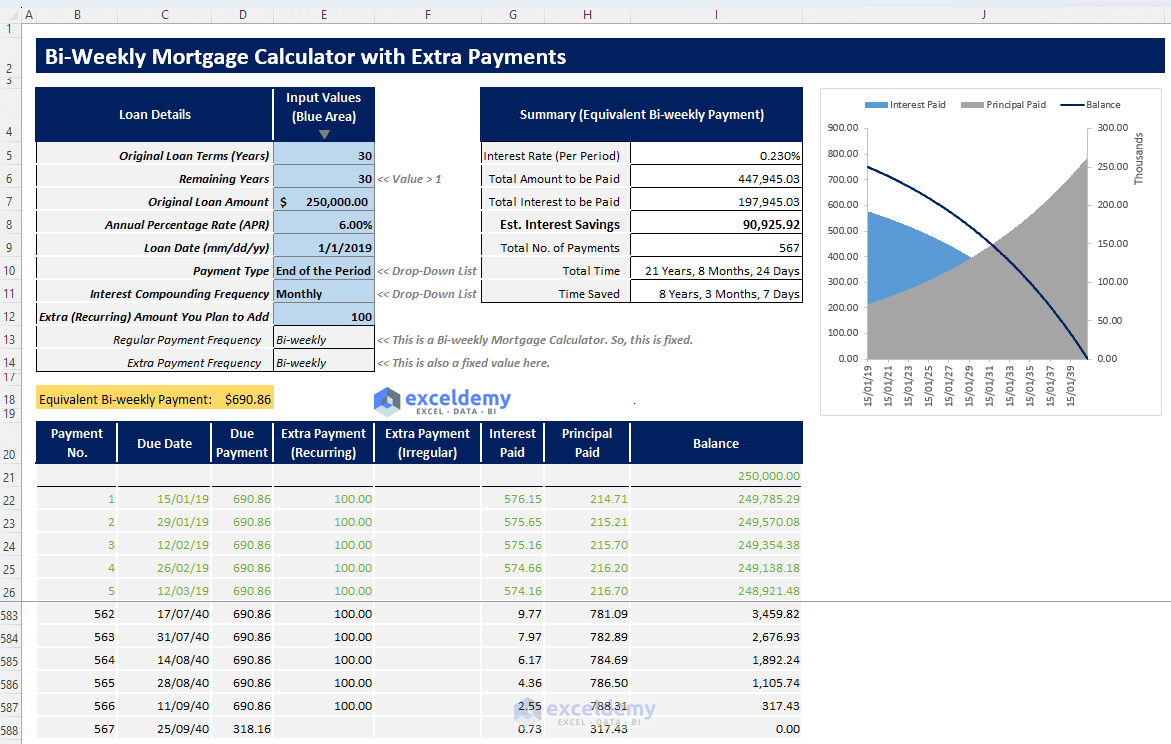

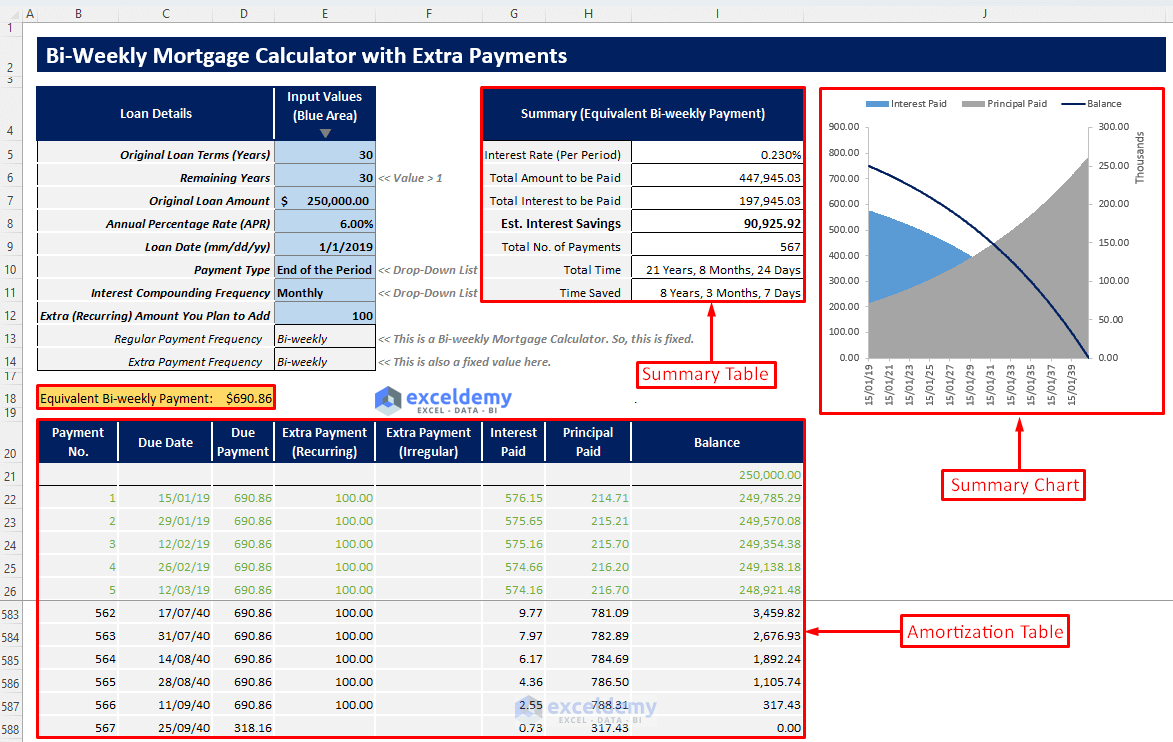

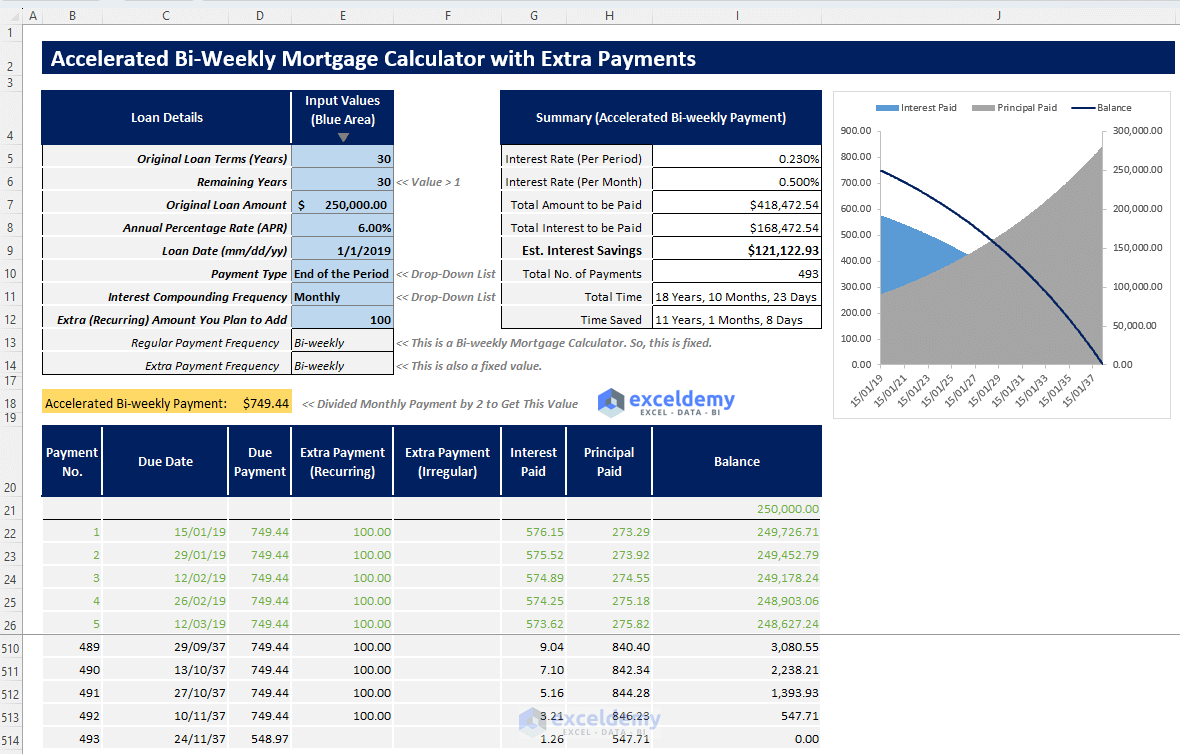

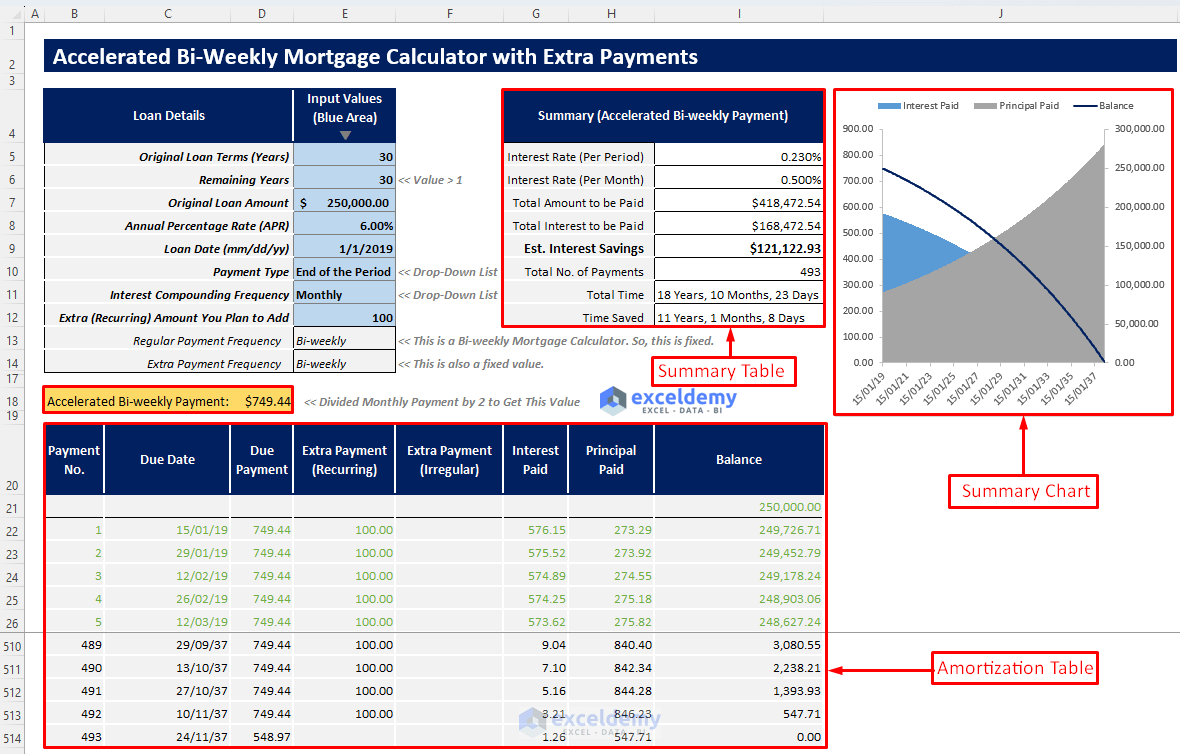

This template allows you to input loan details and generate an automated bi-weekly mortgage payment amount with extra payment options. The calculator provides a summary table, amortization table, and a summary chart. These will help you visualize the entire loan repayment process and find all the key output values. It also calculates the potential time and interest savings you can achieve with bi-weekly payments and extra payments compared to a standard bi-weekly payment plan.

How to Use This Template

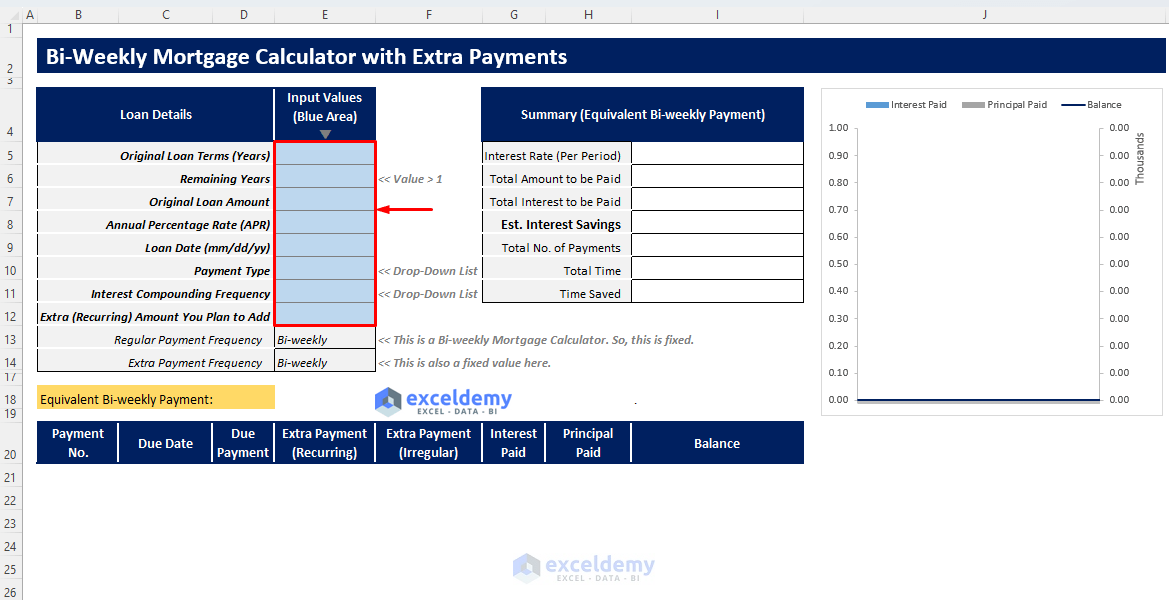

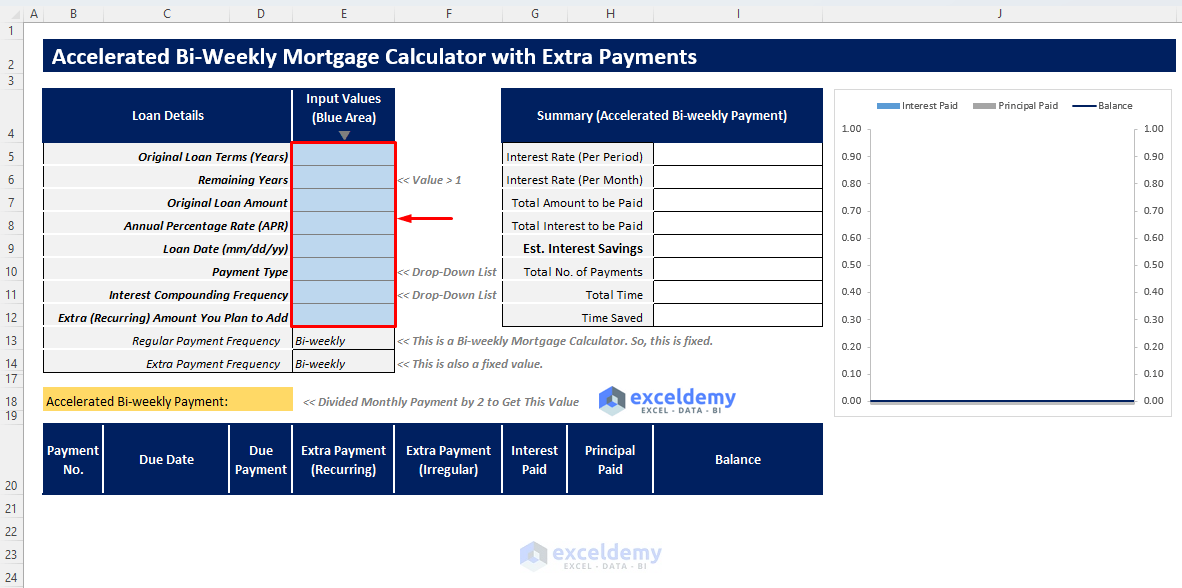

- Open your desired template and insert all necessary inputs in the blue shaded area according to the Loan Details column.

- Since this template is a bi-weekly mortgage calculator, the Regular Payment Frequency is automatically set to bi-weekly. For consistency, the Extra Payment Frequency is also assumed to be bi-weekly.

- After entering your loan details, you will see the calculated bi-weekly payment and the following amortization table.

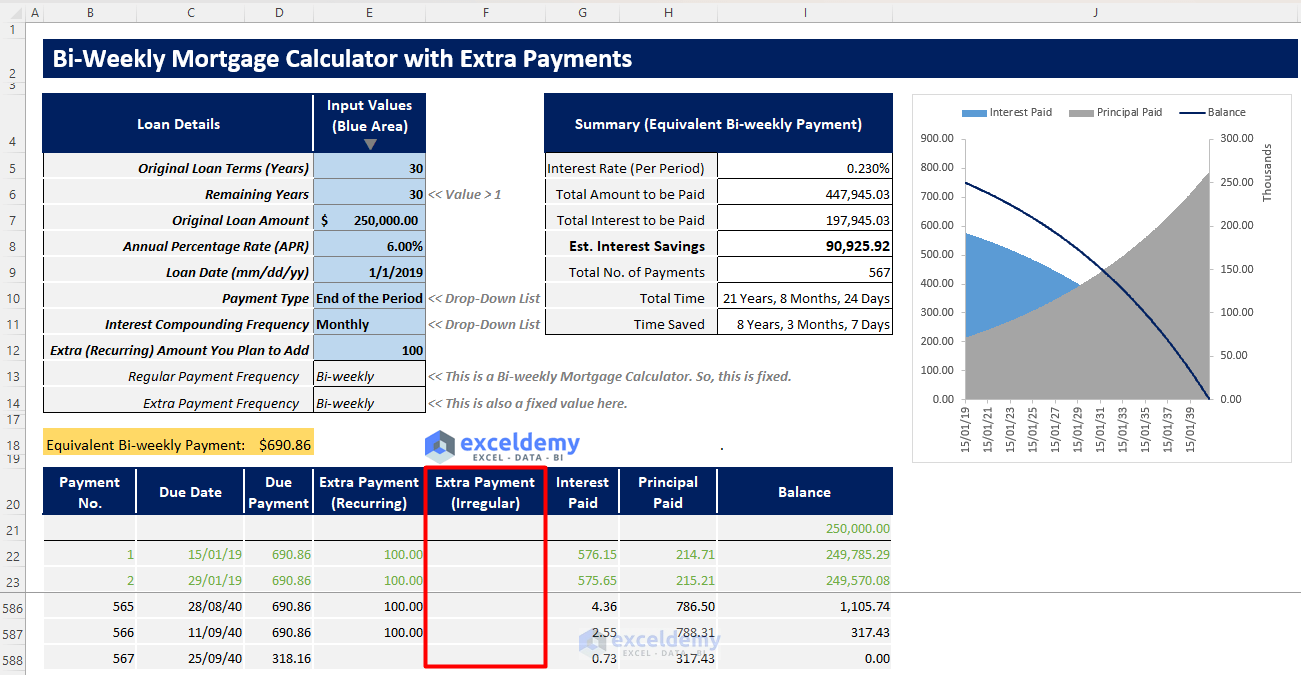

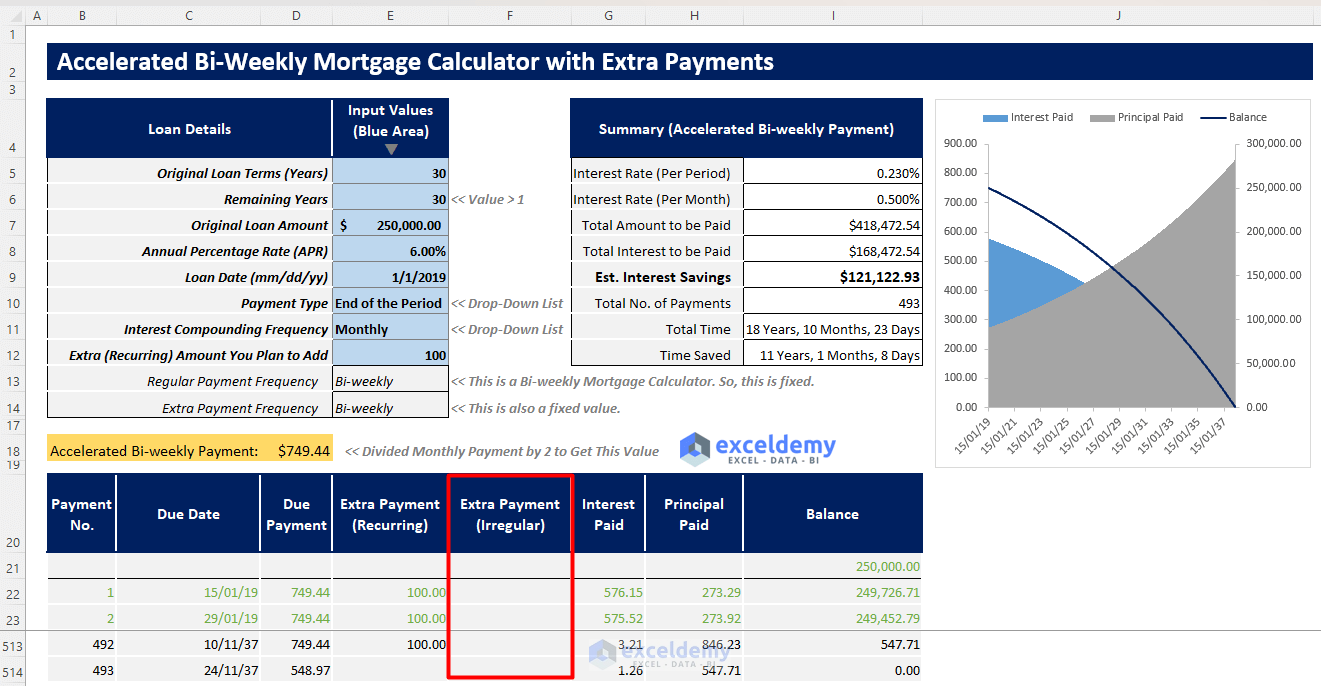

- For unscheduled extra payments, insert them manually in the Extra Payment (Irregular) column of the Amortization table.

- Once you’ve entered all the information, a summary table will appear. This table displays all the key outputs, including the time and potential interest savings you can achieve with extra payments. You’ll also get the full amortization table, which provides a detailed breakdown of each payment, allowing you to track every transaction throughout the loan term. Additionally, a summary chart offers a visual representation of the mortgage repayment process.

Read More: Mortgage Calculator with Extra Payments and Lump Sum in Excel

Template 2 – Accelerated Biweekly Payment Mortgage Calculator with Extra Payments

This template will calculate your accelerated bi-weekly payment and will generate an automated accelerated bi-weekly mortgage calculator with extra payments depending on your loan parameters.

Instructions:

- Open the template and enter the input values in the blue shaded area according to the loan parameters.

- After entering your loan details, you will find your accelerated bi-weekly payment and a summary table along with an amortization table and a summary chart.

- As this is a bi-weekly mortgage calculator, the Regular Payment Frequency is fixed as a bi-weekly payment. The Extra Payment Frequency is also assumed as a bi-weekly payment frequency here.

- If you have any extra unscheduled payments made or to make, insert them manually in the Extra Payment (Irregular) column of the amortization table.

- You will get your summary table containing all necessary outputs along with time saved and estimated interest savings.

- You will also get an amortization table to track your loan repayment and a summary chart to visualize the whole loan repayment process.

Read More: Mortgage Repayment Calculator with Offset Account and Extra Payments in Excel

Related Excel Templates

- How to Make Chattel Mortgage Calculator in Excel

- How to Create Reverse Mortgage Calculator in Excel

- Creation of a Mortgage Calculator with Taxes and Insurance in Excel

- Interest Only Mortgage Calculator with Excel Formula

- How to Create Fixed Rate Mortgage Calculator in Excel

- How to Create Offset Mortgage Calculator in Excel

- Early Mortgage Payoff Calculator in Excel

- Calculator for Effective Interest Method of Amortization

<< Go Back to Mortgage Calculator | Finance Template | Excel Templates

can’t open file in Office 365. Error message states; “This file is corrupted.”

Hi Denny,

I am using Microsoft 365 (Home) and it is working on my side perfectly. Please try again.

Thanks.

How can you adjust for missed payments?

This is not completely automatic, Lea!

How do you revise for missed payments?

This is not completely automatic, Lea!

Kawser, how do I contact you directly?

Hello, Kim! You can contact him through this email address:

[email protected]

Hi – I love what you built here…. thank you. Ive been trying to use your calculator and can never get the math quite right and I realized why. Its because in your formula, I am literally paying every 2 weeks, however Im with Chase, and they just hold my first payment, and dont apply it till they receive my second payment. Ive tried hacking what you build but I break it every time. Any chance you can show me a version where the bank only receives my money every 4 weeks, not every 2. Thanks in advance. -Jon

Hey there, Thanks for sharing your problem here. Try the following excel worksheet in the article

https://www.exceldemy.com/mortgage-calculator-with-extra-payments-and-lump-sum-excel/

and try to solve the issue with this excel template. and make sure to follow the instructions mentioned in the article.

If you have any queries regarding excel, feel free to share. Also, you can post your Excel-related problems in the ExcelDemy Forum (https://exceldemy.com/forum/) with images or Excel workbooks.

Regards

Exceldemy Team

Thank you this was very helpful and user friendly!!!

Hello Jennifer,

You are most welcome.

Regards

ExcelDemy