While working with Microsoft Excel, sometimes, users have to make a payroll accrual calculator. Payroll accrual refers to money that is due to your employees but has not yet been paid. In this article, I will show you how to make a payroll accrual calculator in Excel.

Make a Payroll Accrual Calculator in Excel: 4 Easy Steps

In this article, you will see four easy steps to make a payroll accrual calculator in Excel. The process for making this calculator is quite simple and easy. By giving proper information and doing some simple calculations, you can make this calculator.

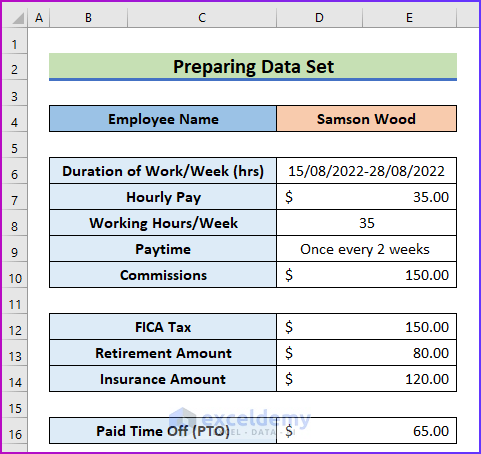

Step 1: Prepare Data Set with Additional Information

The first step of this procedure is to prepare the data set that will help you make the calculator. For that,

- First of all, look at the following data set where I have entered all the necessary information to make the calculator.

- Here, I want to calculate the payroll for Samson Wood for his two weeks of work.

- Also, the values of working hours, hourly pay, commissions, and the benefits received from the organization are given.

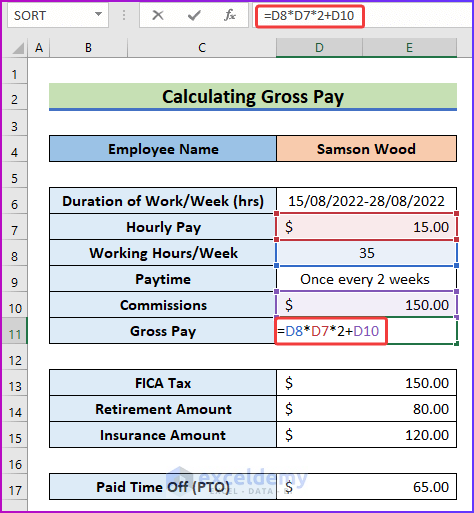

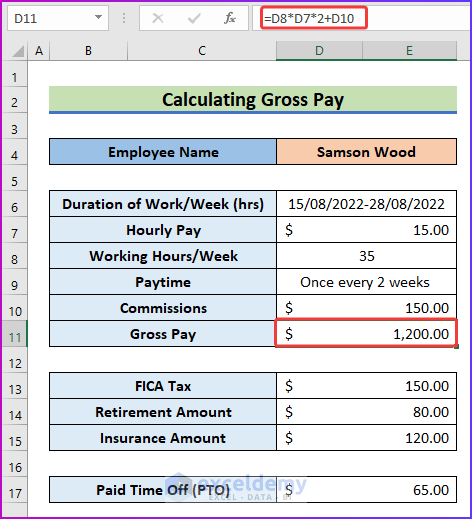

Step 2: Calculate Gross Pay

In the second step, I will calculate gross pay of Samson using the information from the previous step. To do that,

- Firstly, insert the following formula in cell D11.

=D8*D7*2+D10- Here, the employee has served the organization for one month and the organization will pay the employee once every 2 weeks.

- So, you have to multiply the weekly pay by 2 to get the actual payment, and then add the commission to the result from the multiplication.

- Secondly, to see the desired gross pay, press Enter.

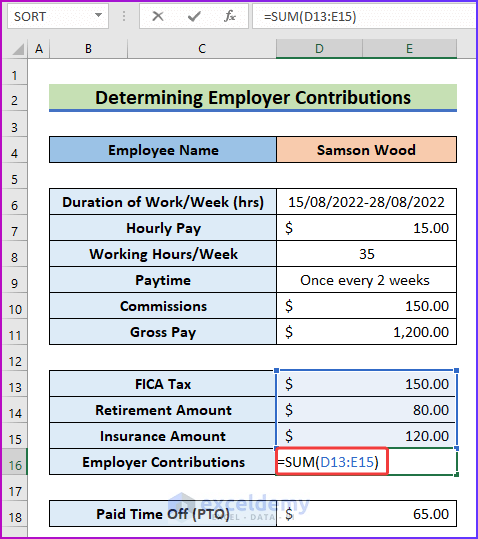

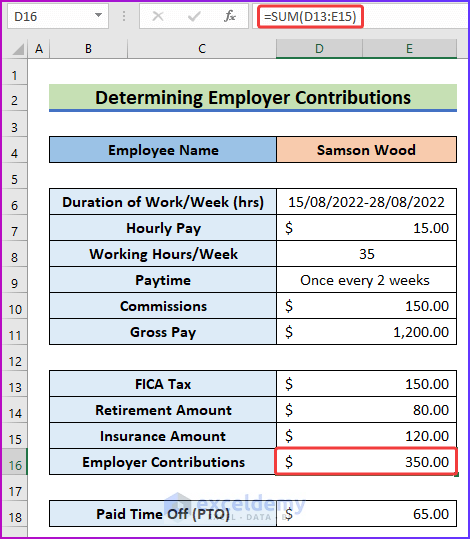

Step 3: Determine Employer Contributions

Now, every organization provides some facilities to their employees, like FICA taxes, retirement, insurance amounts, etc. They are known as employer contributions. In this step, I will determine the employer contributions from the given information. To do that,

- First of all, use the following formula of the SUM function to determine the total employer contributions in cell D16.

=SUM(D13:E15)- Secondly, press Enter to get the total contribution as the result.

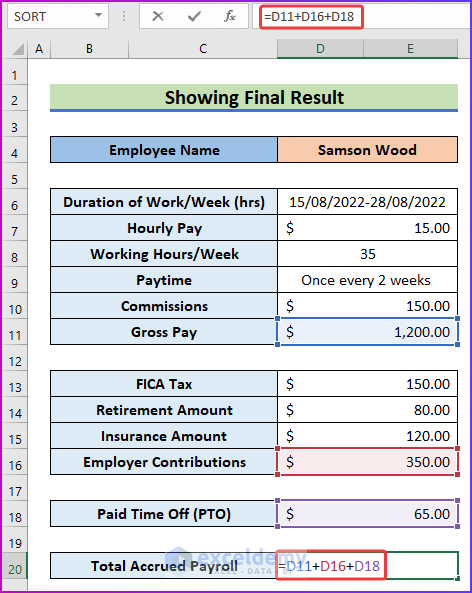

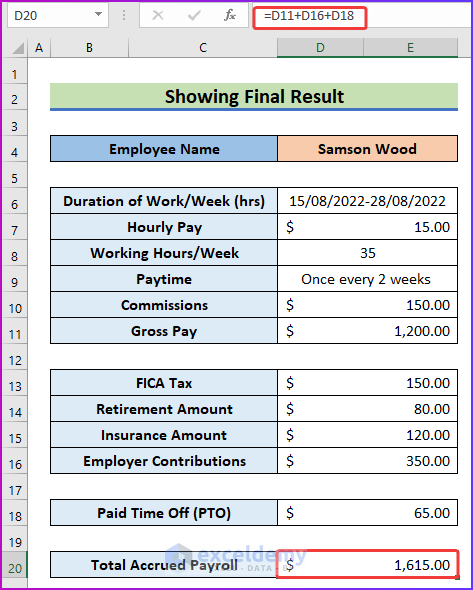

Step 4: Show Final Result

This is the final step of this procedure. By analyzing and going through all the previous steps, it is time to show the final result. To do that,

- Firstly, use the following formula in cell D20 to add up all the values calculated in steps 2 and 3, plus the extra paid time off.

=D11+D16+D18- Finally, hit Enter and you will get the total accrued payroll.

Things to Remember

- While inserting formulas remember to provide the correct cell references to get the desired result.

- If your organization’s employee performs over time then you have to add it to the gross pay. Also, the contributions of the organization may vary from one another.

Download Practice Workbook

You can download the free Excel workbook here and practice on your own.

Conclusion

That’s the end of this article. I hope you find this article helpful. After reading the above description, you will be able to make a payroll accrual calculator in Excel. Please share any further queries or recommendations with us in the comments section below.

Our team is always concerned about your preferences. Therefore, after commenting, please give us some moments to solve your issues, and we will reply to your queries with the best possible solutions.

Related Articles

<< Go Back to Excel Payroll Templates | Excel HR Templates | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!