If you have any debts, you need to pay them back. When a borrower returns money by putting emphasis on the smallest amount, we call this technique the “snowball” method. This is applicable when we have more than one debt. This technique allows the repayment of the smaller debts faster. We will show you how to create a credit card payoff calculator in Excel using the snowball method.

Debt Snowball Method

We have already discussed the definition. Let us see an example of this method. If you have three outstanding debts of $10, $20, and $30, the minimum payment is $2 for each. Then, you will pay the total minimum amount of $6 and may choose to include additional money towards the $10 debt.

This additional $10 will be applied to the lowest debt. Whenever we finish paying the lowest debt, then this amount will be applied to the second-lowest debt. Thus, it creates a snowball effect to make the payment faster. Now, there is an opposite technique called the “avalanche” method, where we pay the debt in the largest amount first.

How to Create Credit Card Payoff Calculator Using Snowball Method in Excel: with Easy Steps

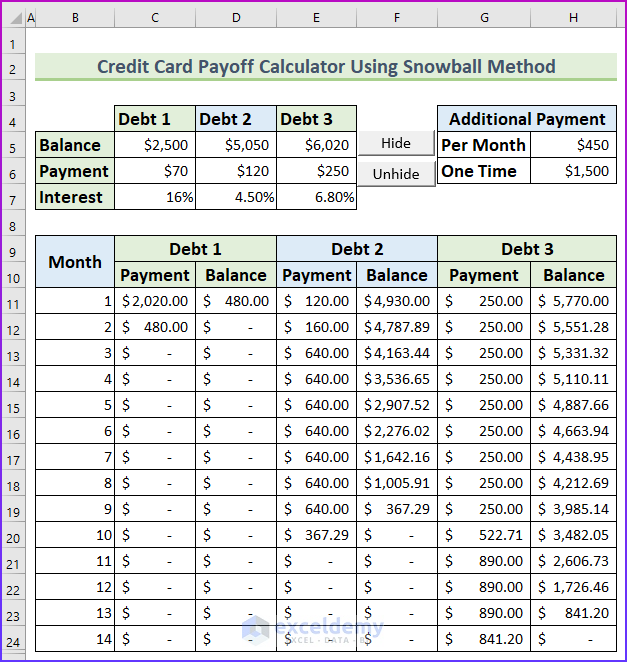

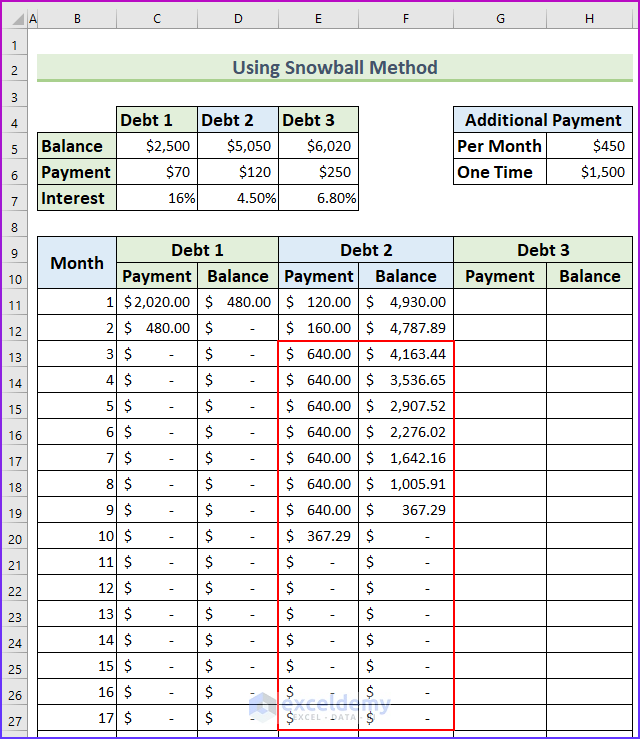

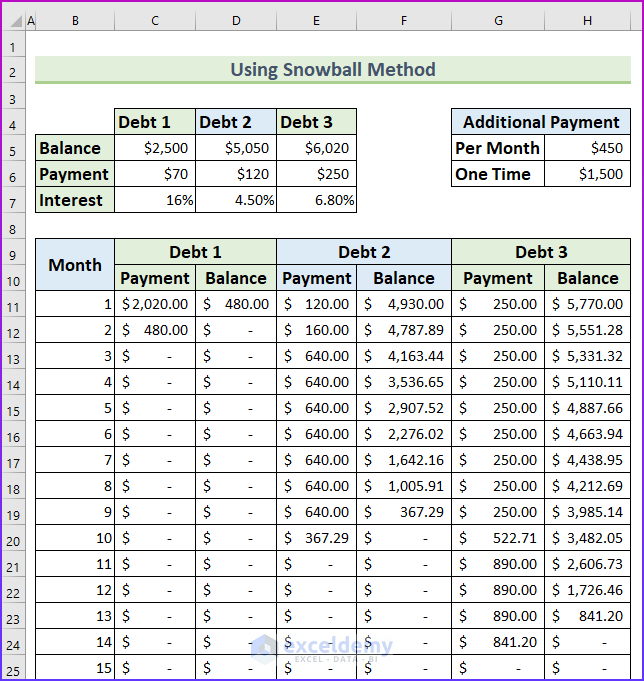

Here is a quick look at the credit card payoff calculator using the snowball method, which we will create by the end of this tutorial.

Step 1: Setting up the Essentials

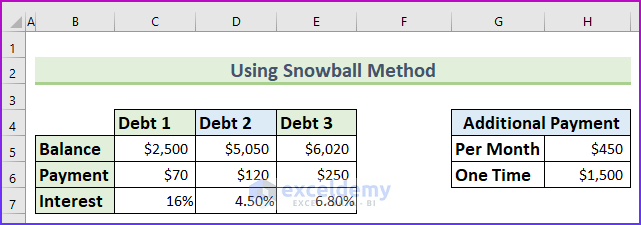

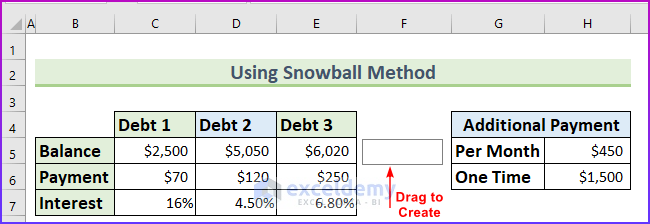

For the first method, we will input information about the debt. Then, we will pay an additional amount per month, and there will be a one-time payment for our credit card payoff calculator.

- Firstly, there will be three debts for us and the information related to our debts is as follows:

- Balance → Amount of outstanding debt.

- Payment → The minimum amount that needs to be paid off per month.

- Interest → Annual interest rate.

- Secondly, add another table for the additional payment:

- Per Month → The amount, we will pay on top of the minimum payment.

- One Time → If we pay an additional one-time payment we will input it here.

- Then, we will use these values to find the credit card payoff calculator in Excel using the snowball method.

Step 2: Finding First Debt Payoff

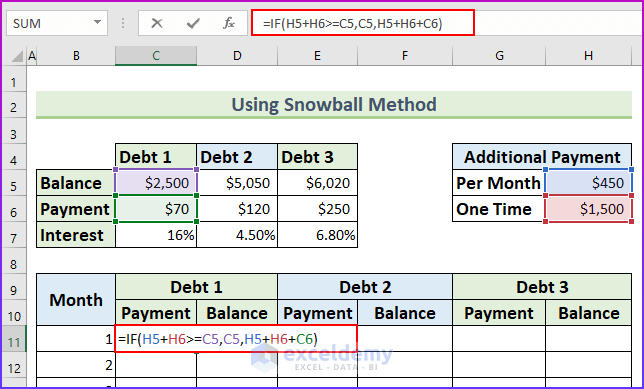

In this step, we will find the credit card payoff from the first debt. We will use the IF function to do so.

- To begin with, type the following formula in cell C11.

=IF(H5+H6>=C5,C5,H5+H6+C6)

- Here, if the total amount of the additional payment is more than that of the balance of the first debt, it will return the balance from debt 1. Else, it will add the values of the additional payment and the minimum payment for debt 1.

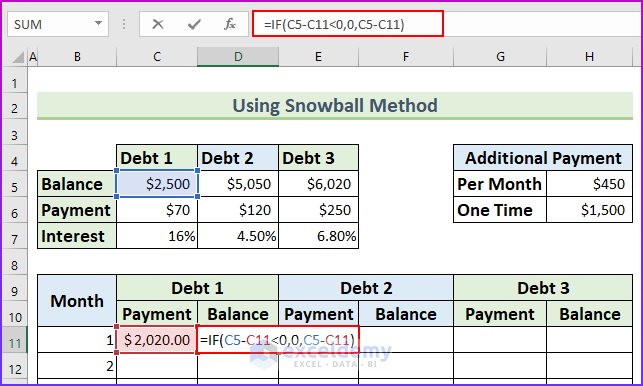

- Next, type another formula in cell D11 to find the balance.

=IF(C5-C11<0,0,C5-C11)

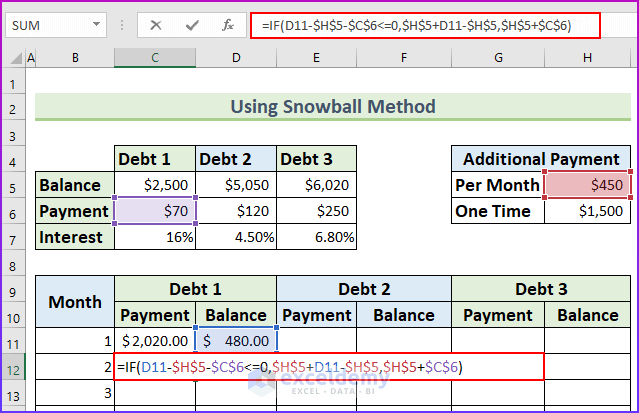

- Next, we will create a formula to find the payment values from the second month.

- So, type this formula in cell C12.

=IF(D11-$H$5-$C$6<=0,$H$5+D11-$H$5,$H$5+$C$6)

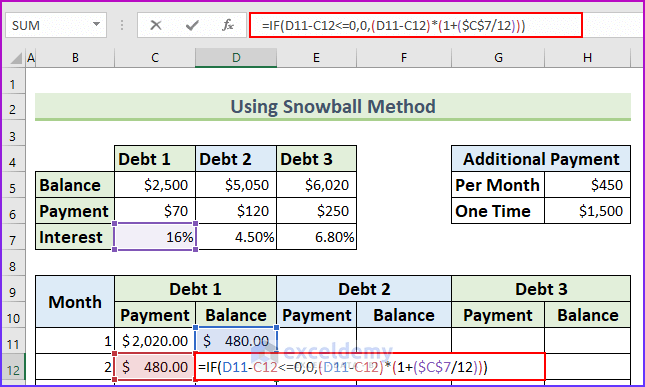

- Next, we will type this formula in cell D12 to find the values of balance from the second month. Moreover, we have divided the yearly interest rate by 12 to find the monthly interest rate.

=IF(D11-C12<=0,0,(D11-C12)*(1+($C$7/12)))

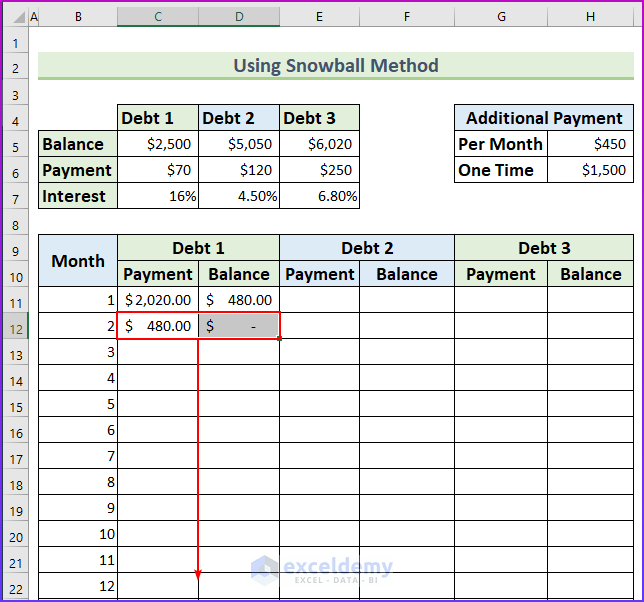

- Lastly, drag the cell range C12:D12 to AutoFill the formula into the rest of the cells.

Read More: How to Create a Credit Card Payoff Spreadsheet in Excel

Step 3: Calculating Second Debt Payoff

In this step, we will find the credit card payoff for the second debt.

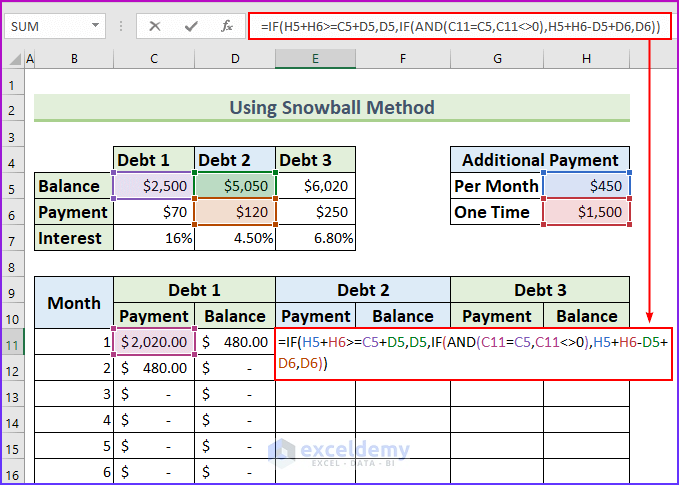

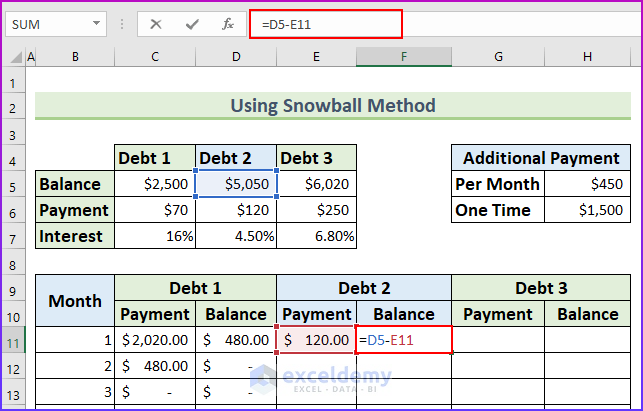

- Firstly, type this formula in cell E11.

=IF(H5+H6>=C5+D5,D5,IF(AND(C11=C5,C11<>0),H5+H6-D5+D6,D6))

- Next, type this formula in cell F11.

=D5-E11

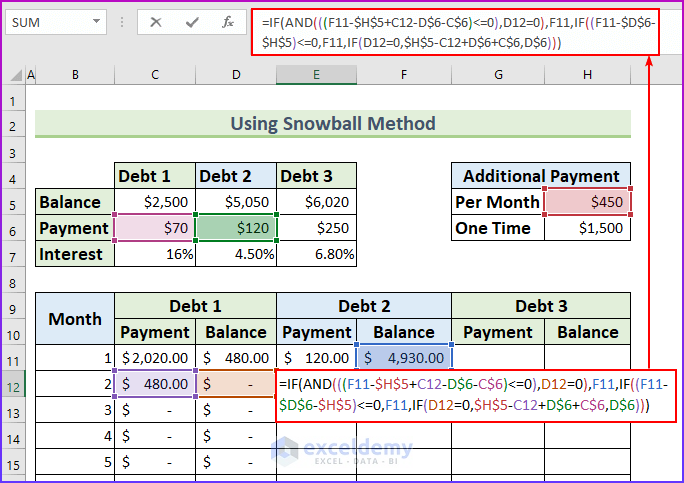

- Afterward, type this formula in cell E12.

=IF(AND(((F11-$H$5+C12-D$6-C$6)<=0),D12=0),F11,IF((F11-$D$6-$H$5)<=0,F11,IF(D12=0,$H$5-C12+D$6+C$6,D$6)))

Formula Breakdown

- AND(((F11-$H$5+C12-D$6-C$6)<=0),D12=0)

- Output: False.

- (F11-$D$6-$H$5)<=0

- Output: False.

- IF(D12=0,$H$5-C12+D$6+C$6,D$6)

- Output: 160.

- Formula reduces to → IF(FALSE,F11,IF((F11-$D$6-$H$5)<=0,F11,160))

- Output: 160.

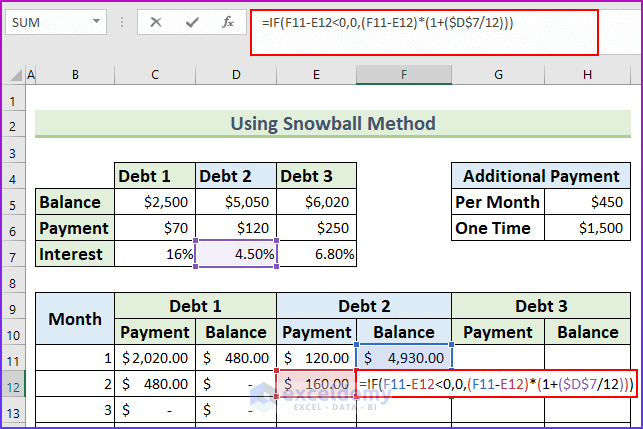

- Then, type another formula in cell F12.

=IF(F11-E12<0,0,(F11-E12)*(1+($D$7/12)))

- Finally, AutoFill the formula from the range E12:F12 to the other cells to find the values for debt 2.

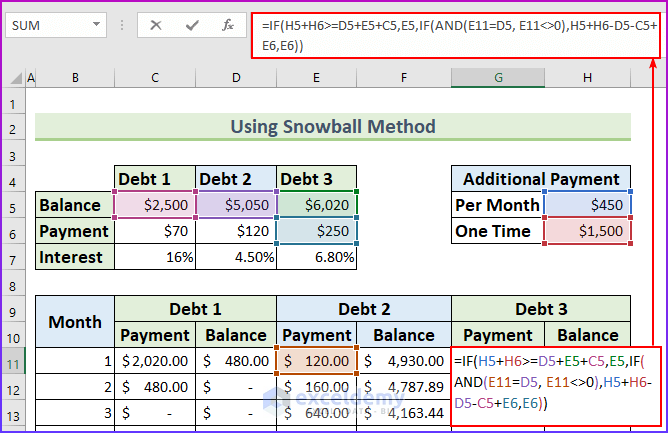

Step 4: Finding Third Debt Payoff

We will find the credit card payoff for the last debt using the snowball method in Excel.

- To begin with, type this formula in cell G11.

=IF(H5+H6>=D5+E5+C5,E5,IF(AND(E11=D5, E11<>0),H5+H6-D5-C5+E6,E6))

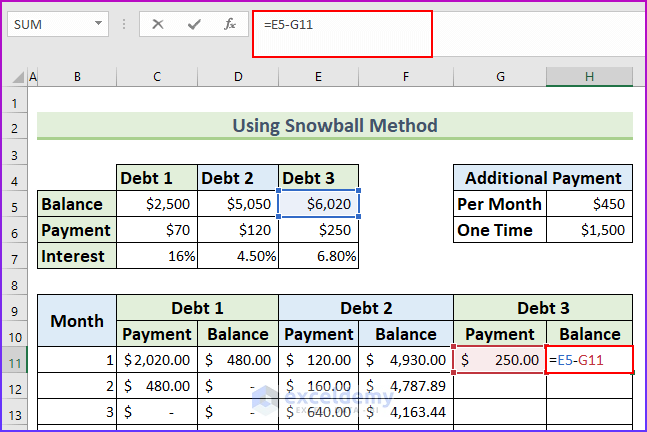

- Next, type another formula in cell H11 to find the first balance.

=E5-G11

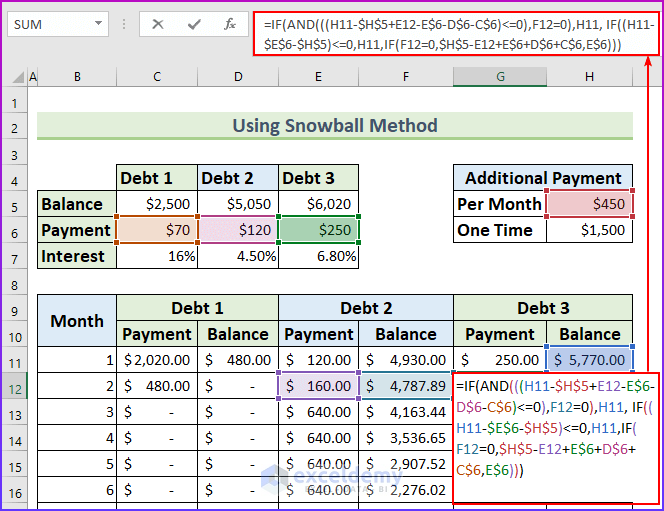

- After that, type another formula in cell G12.

=IF(AND(((H11-$H$5+E12-E$6-D$6-C$6)<=0),F12=0),H11, IF((H11-$E$6-$H$5)<=0,H11,IF(F12=0,$H$5-E12+E$6+D$6+C$6,E$6)))

Formula Breakdown

- AND(((H11-$H$5+E12-E$6-D$6-C$6)<=0),F12=0)

- Output: False.

- (H11-$E$6-$H$5)<=0

- Output: False.

- IF(F12=0,$H$5-E12+E$6+D$6+C$6,E$6)

- Output: 250.

- Formula reduces to → IF(FALSE,H11, IF(FALSE,H11,250))

- Output: 250.

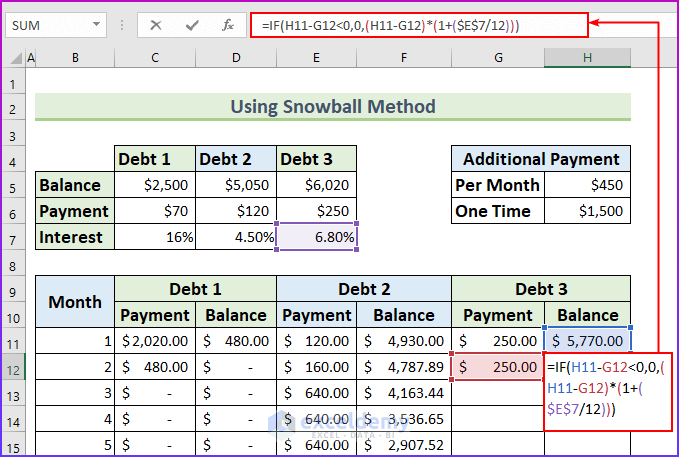

- Then, type this formula in cell H12.

=IF(H11-G12<0,0,(H11-G12)*(1+($E$7/12)))

- Then, AutoFill the formula from the cell range G12:H12 to the rest of the cells.

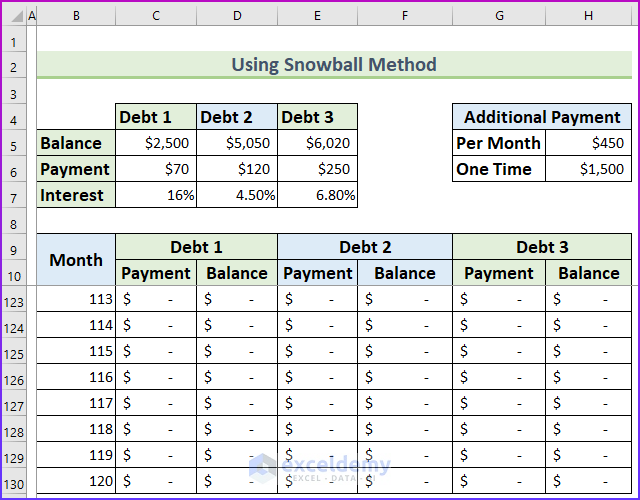

- Now, we have filled in the formulas up to month 120 (10 years).

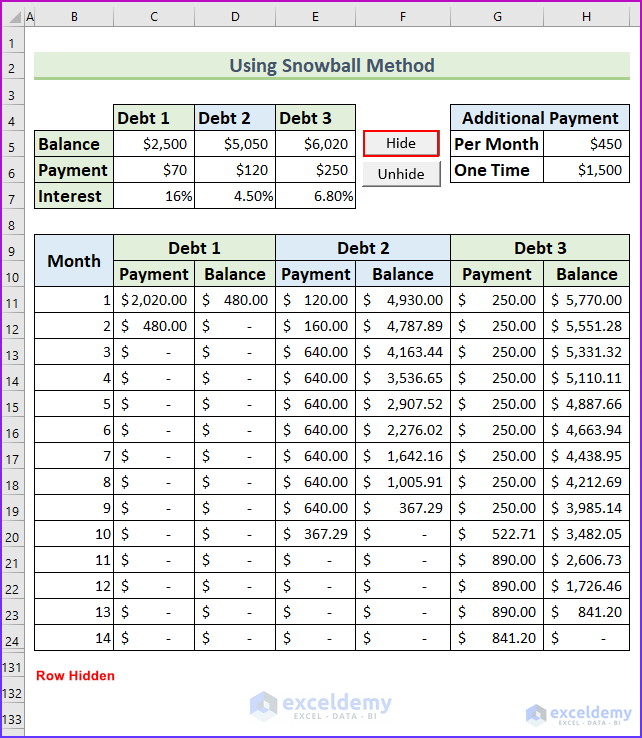

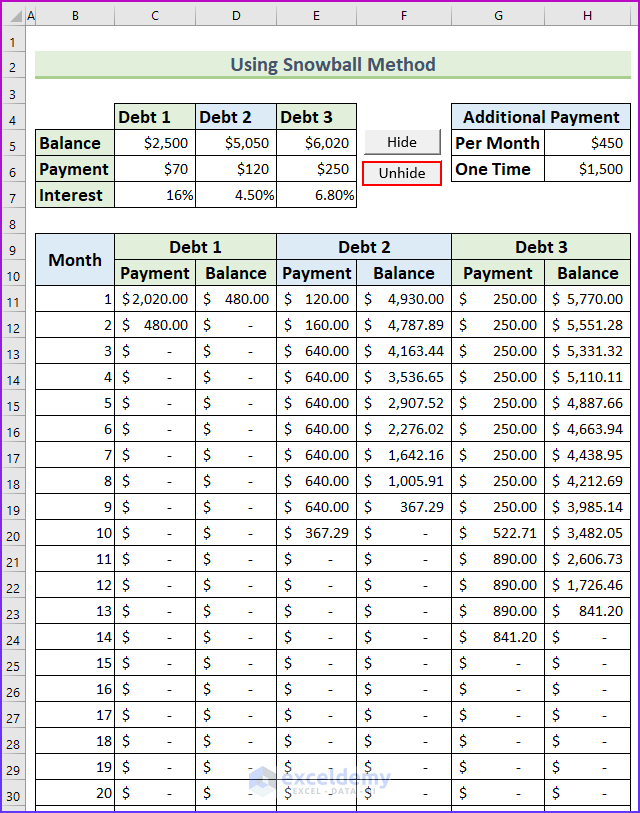

Step 5: Applying VBA to Hide Extra Rows

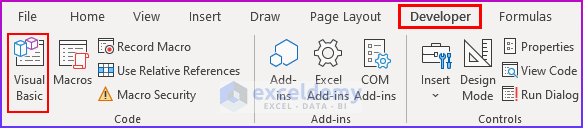

We can easily hide the extra rows using Excel VBA macros. After that, we will use another VBA code to unhide the rows.

- Firstly, from the Developer tab → select Visual Basic. Alternatively, you can press ALT+F11 to do so.

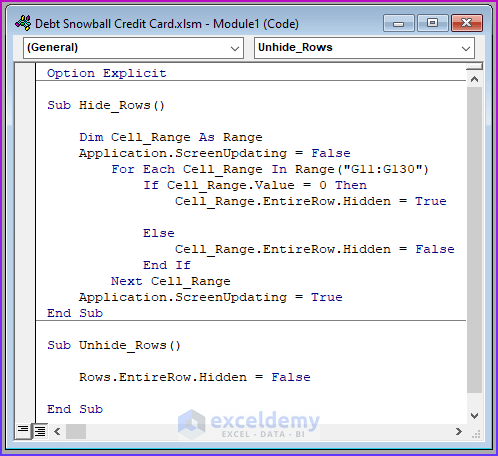

- Then, type the following code in the Module.

Option Explicit

Sub Hide_Rows()

Dim Cell_Range As Range

Application.ScreenUpdating = False

For Each Cell_Range In Range("G11:G130")

If Cell_Range.Value = 0 Then

Cell_Range.EntireRow.Hidden = True

Else

Cell_Range.EntireRow.Hidden = False

End If

Next Cell_Range

Application.ScreenUpdating = True

End Sub

Sub Unhide_Rows()

Rows.EntireRow.Hidden = False

End SubVBA Code Breakdown

- We have two Sub procedures in this VBA code. The first one is for hiding the rows that have 0 in the range G11:G130. We are using a For Each Next loop to go through all the cell ranges.

- The last one just unhides all the rows in the active sheet.

- Then, Save and Close the Module.

- After that, we will insert two buttons to execute the codes.

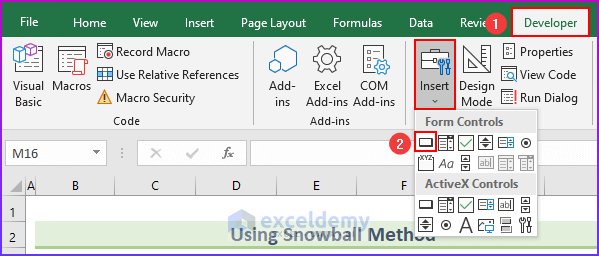

- So, from the Developer tab → Insert → select Button (Form Control).

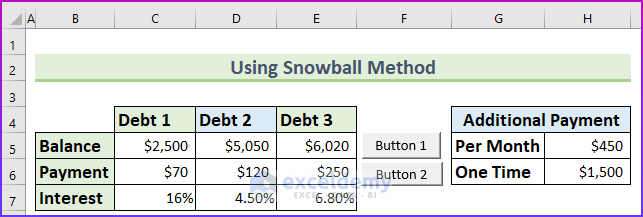

- It will change the cursor, then drag it to create a box. Afterward, repeat this process.

- There will be two buttons in the dataset.

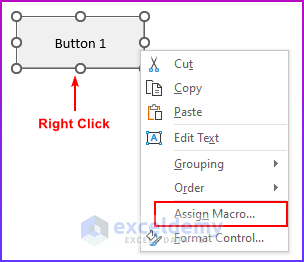

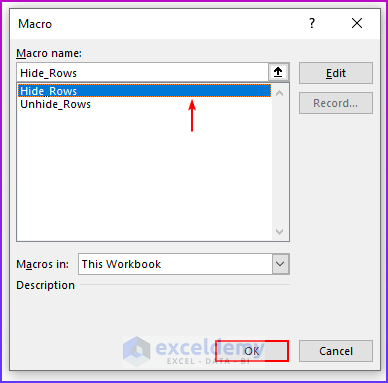

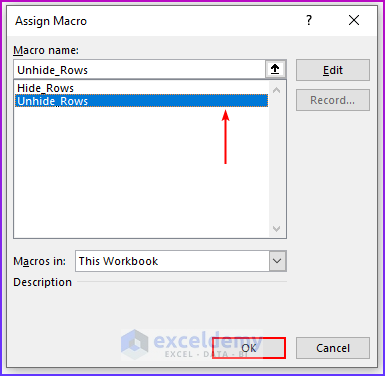

- Now, we will assign macros to the buttons. So, right-click on “Button 1” and select “Assign Macro”.

- Then, select “Hide_Rows” and press OK.

- After that, do so for the second button and select “Unhide_Rows” and press OK.

- Then, we will change the button labels to “Hide” and “Unhide” respectively.

- Now, if we press the “Hide” button, the extra rows will be hidden.

- Moreover, if we click on the “Unhide” button, it will unhide the rows.

Download Practice Workbook

Conclusion

We have shown you five quick steps to create a credit card payoff calculator in Excel using the snowball method. If you face any problems regarding these methods or have any feedback for me, feel free to comment below.

Related Articles

- Create Multiple Credit Card Payoff Calculator in Excel Spreadsheet

- Make Credit Card Payoff Calculator with Amortization in Excel

<< Go Back to Credit Card Payoff Calculator | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!