Overview of a Cash Flow Model

A cash flow model is a financial statement that describes the inflows and outflows of cash over a certain period for a specific organization or company. It usually shows how any change in the balance sheet affects the cash and cash equivalents.

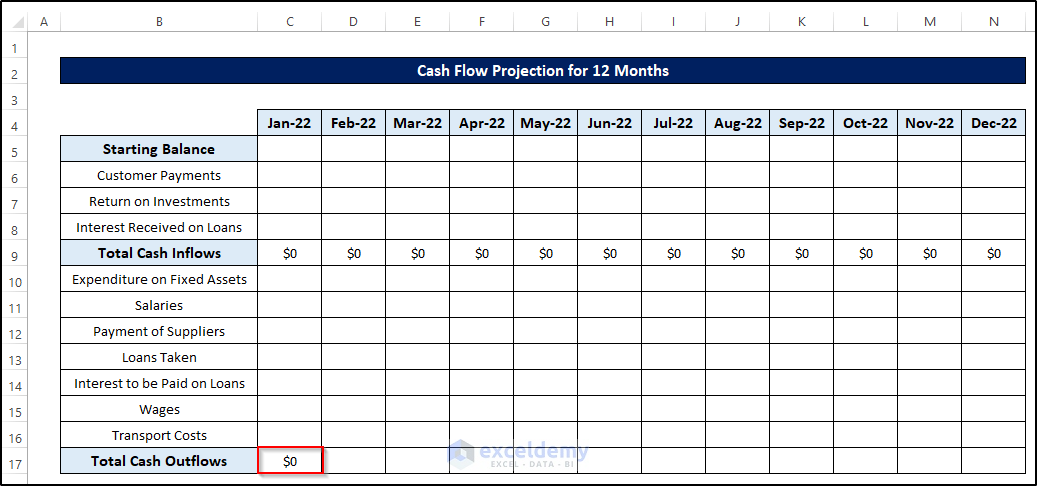

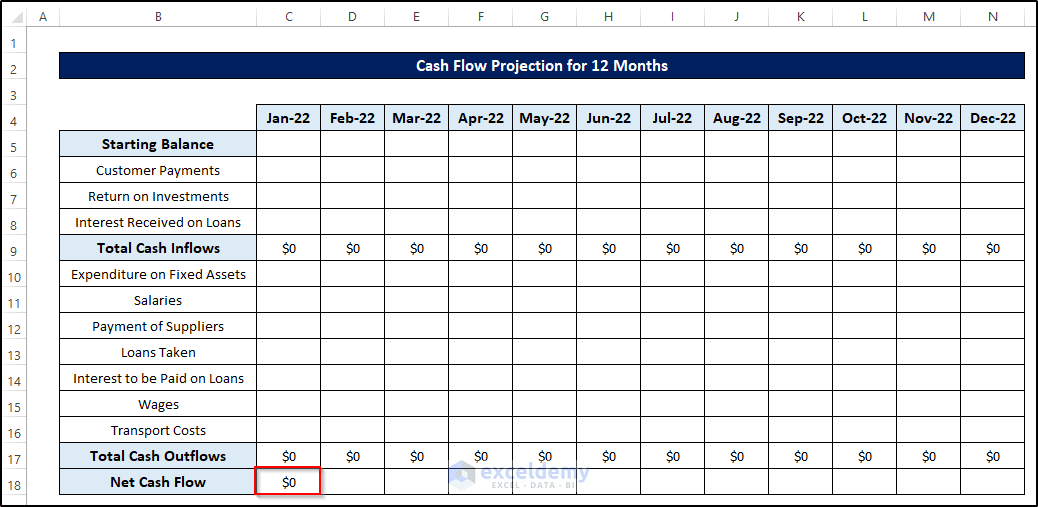

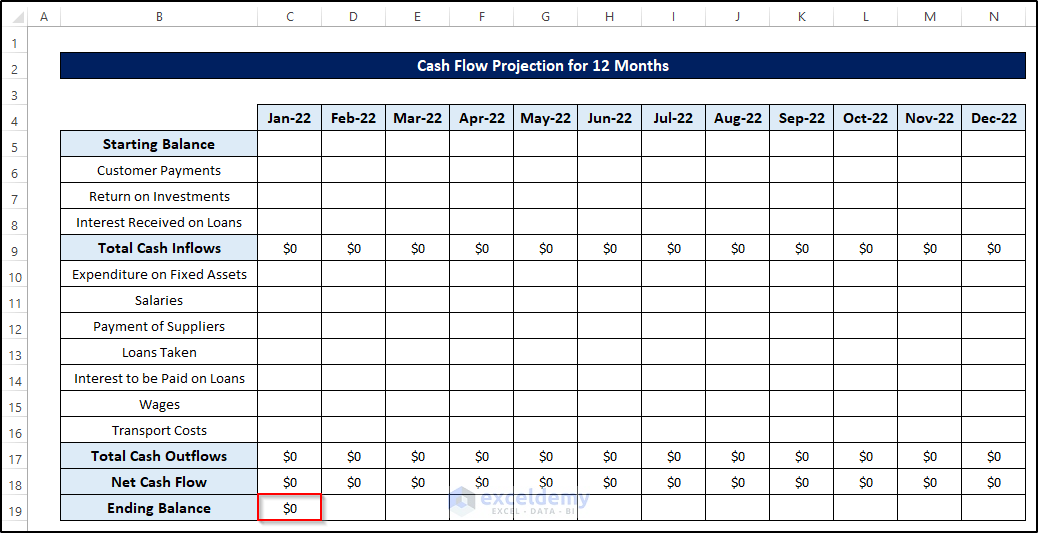

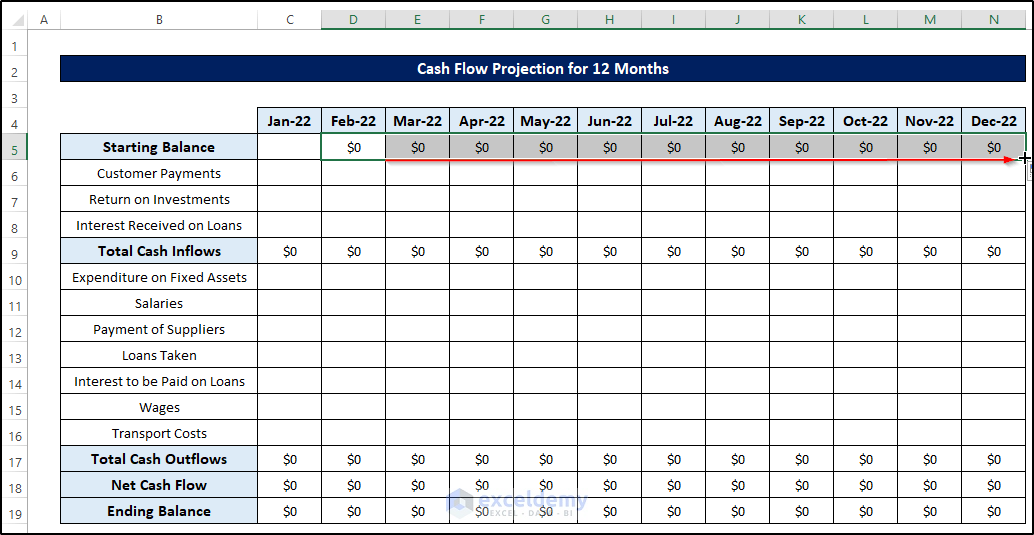

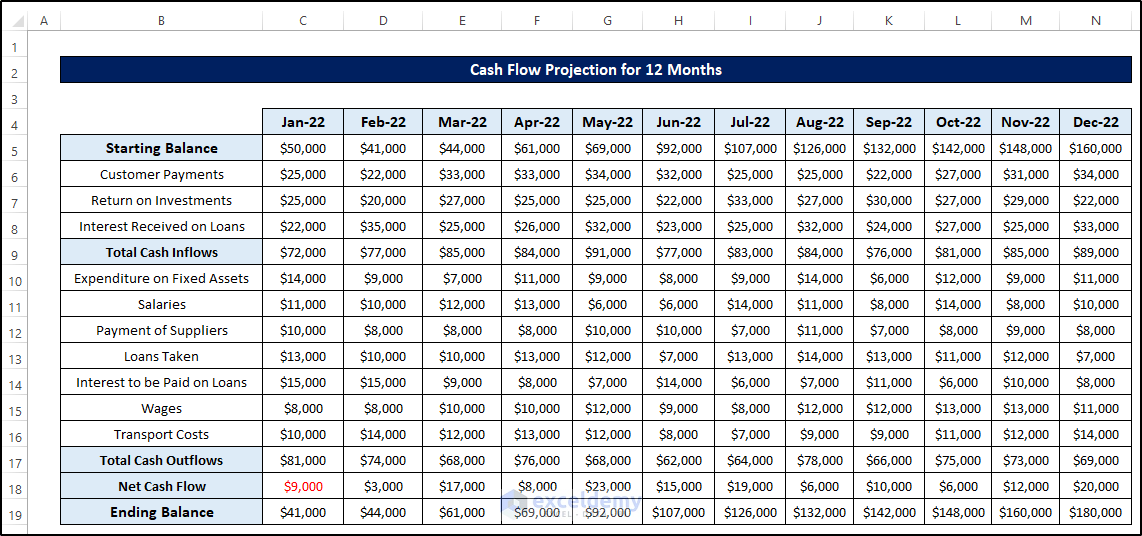

Create a cash flow projection format to calculate cash inflows and outflows.

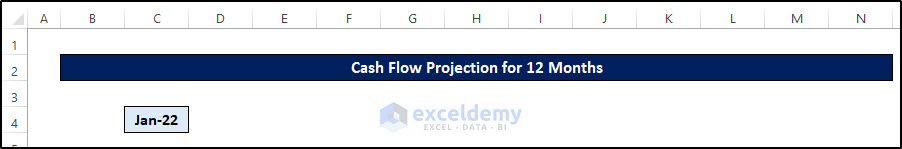

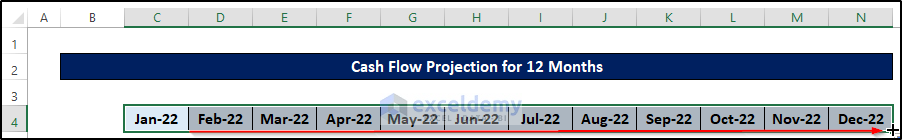

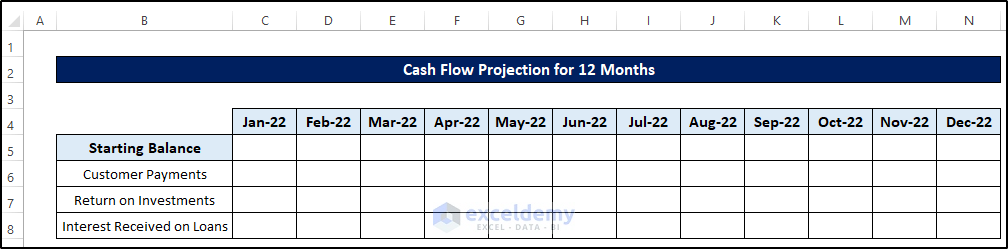

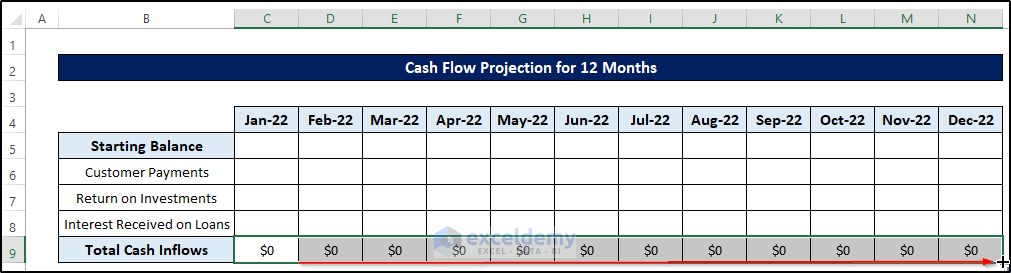

Step 1 – Record Time Intervals

Enter months as time intervals.

- Select C4 and enter “Jan-22”.

- Drag the Fill Handle to cell N4.

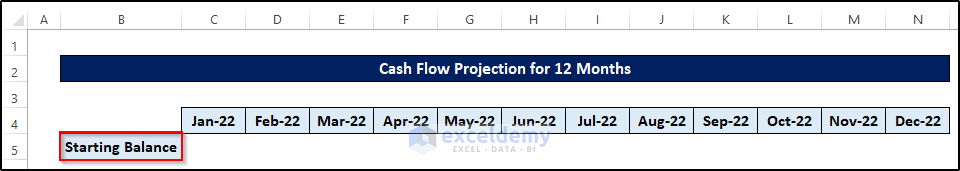

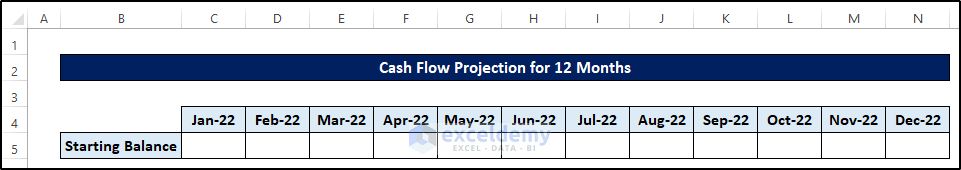

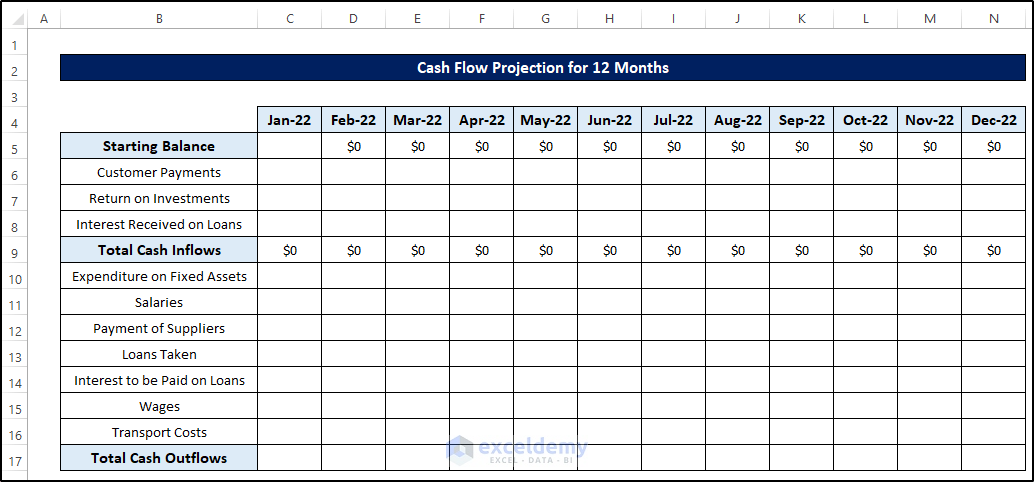

Step 2 – Create a Section for the Starting Balance

- Select B5 and enter the “Starting Balance”.

- Format the cells.

Step 3 – Input All Cash Inflows

Prepare cells for all cash inflows that you will provide later.

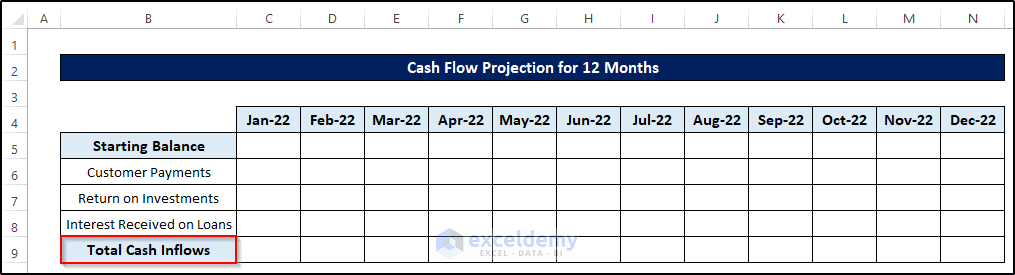

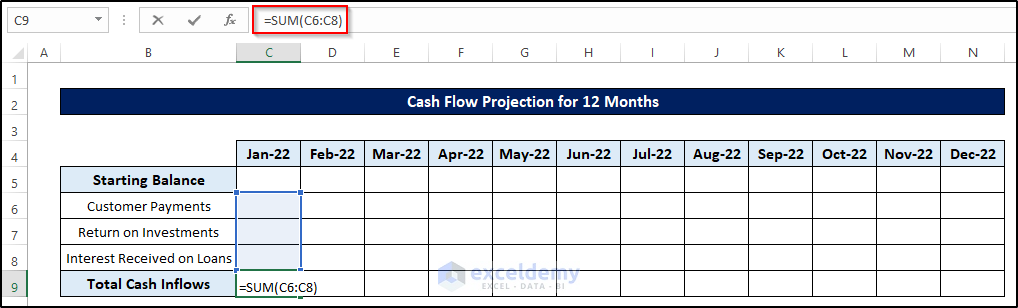

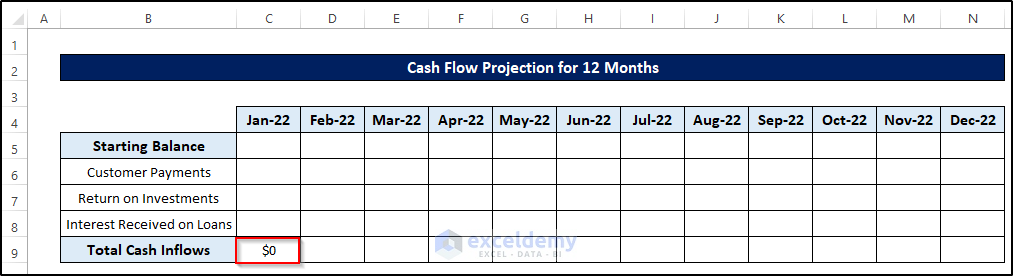

Step 4: Estimate the Total Cash Inflows

Add a section to store the values.

- Select C9.

- Enter the following formula.

=SUM(C6:C8)- Press Enter.

- Drag the Fill Handle to N9.

Read More: How to Create a Retirement Cash Flow Calculator in Excel

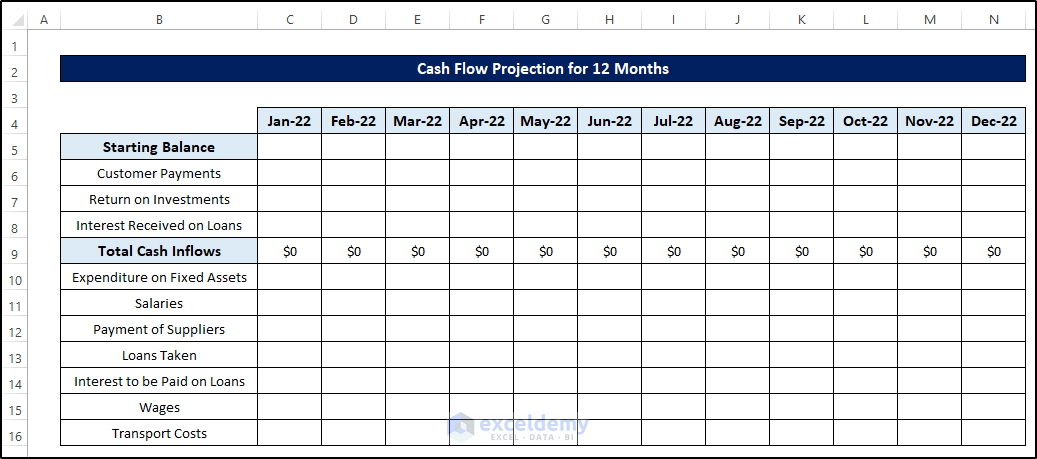

Step 5: Input All Cash Outflows

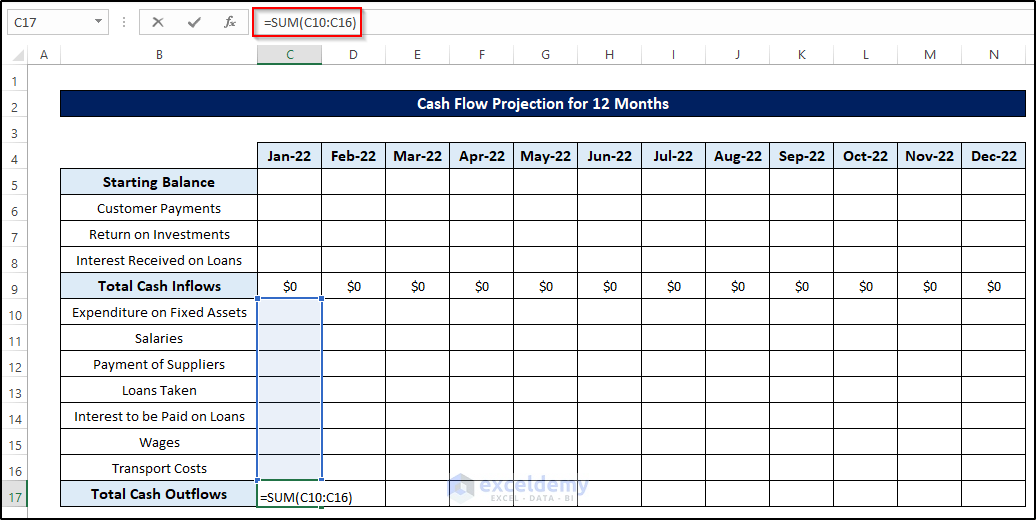

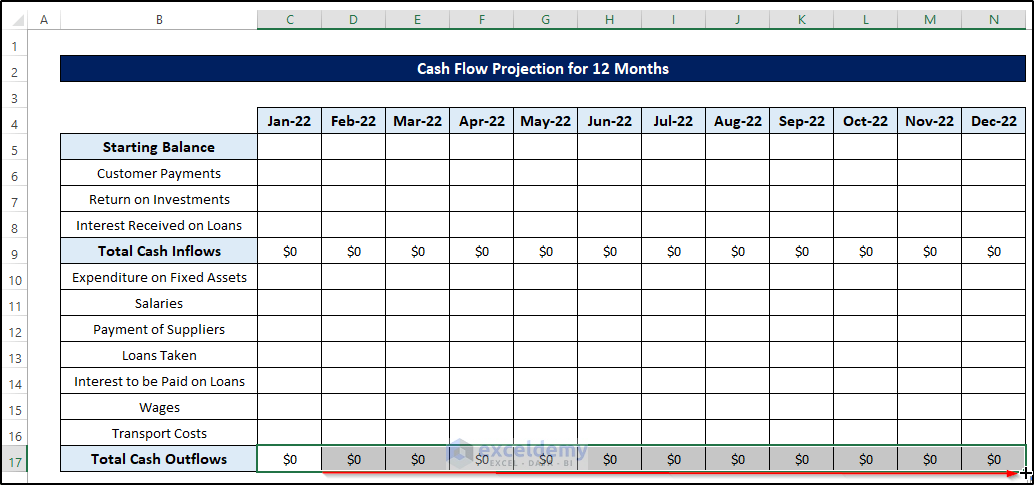

Step 6 – Calculate Total Cash Outflows

Estimate the total cash outflows. Add a section to store the values.

- Select C17.

- Enter the following formula.

=SUM(C10:C16)- Press Enter.

- Drag the Fill Handle to N17.

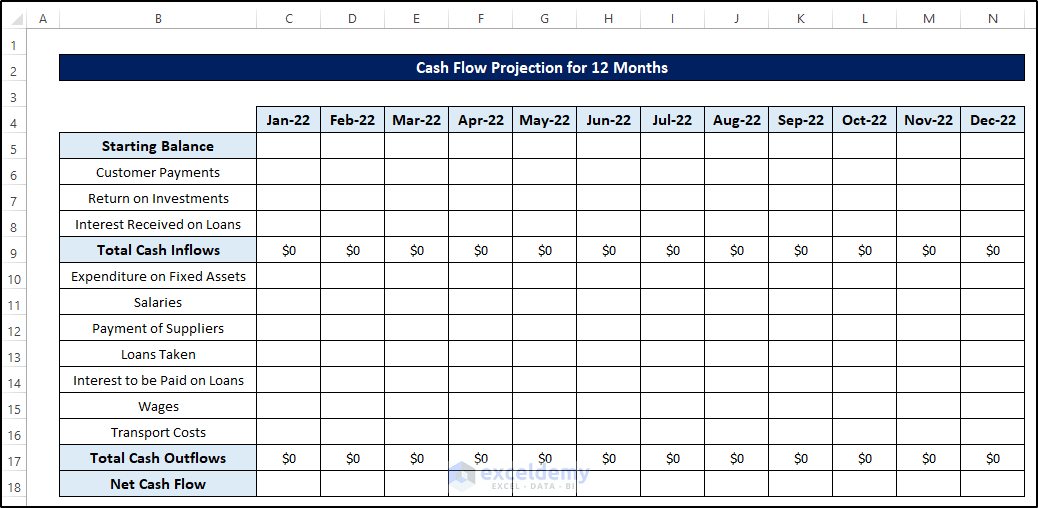

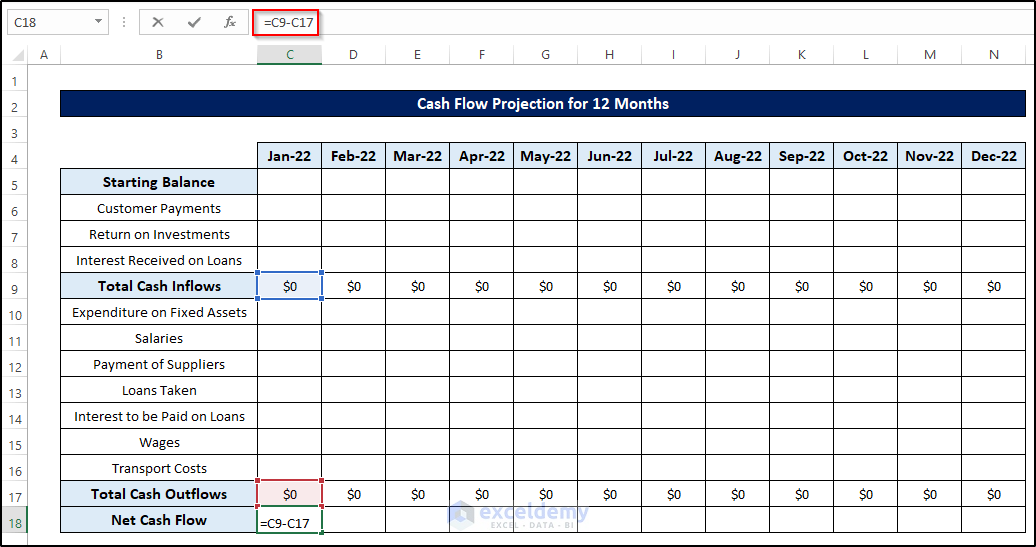

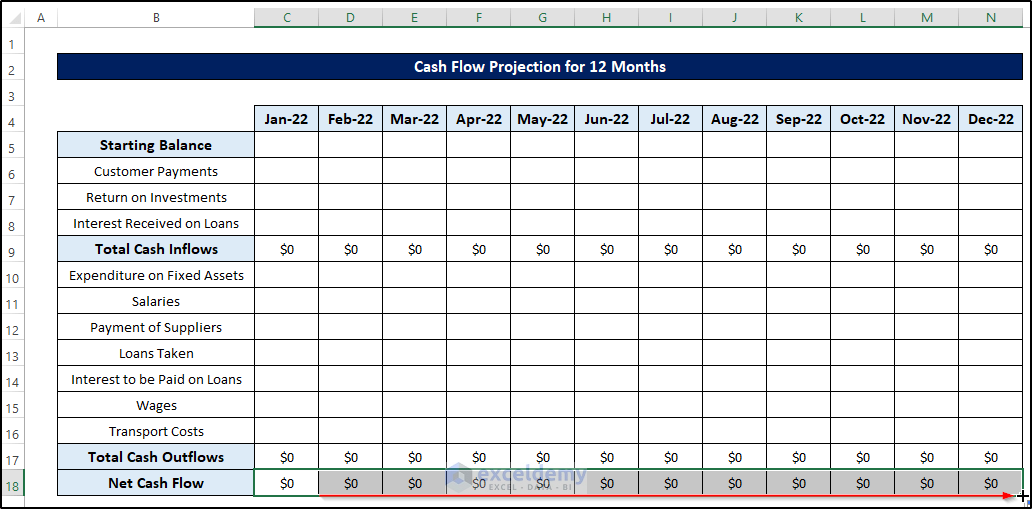

Step 7 – Compute the Net Cash Flow

- To compute net cash flow:

- Select C18.

- Enter the following formula.

=C9-C17- Press Enter.

- Drag the Fill Handle to N18.

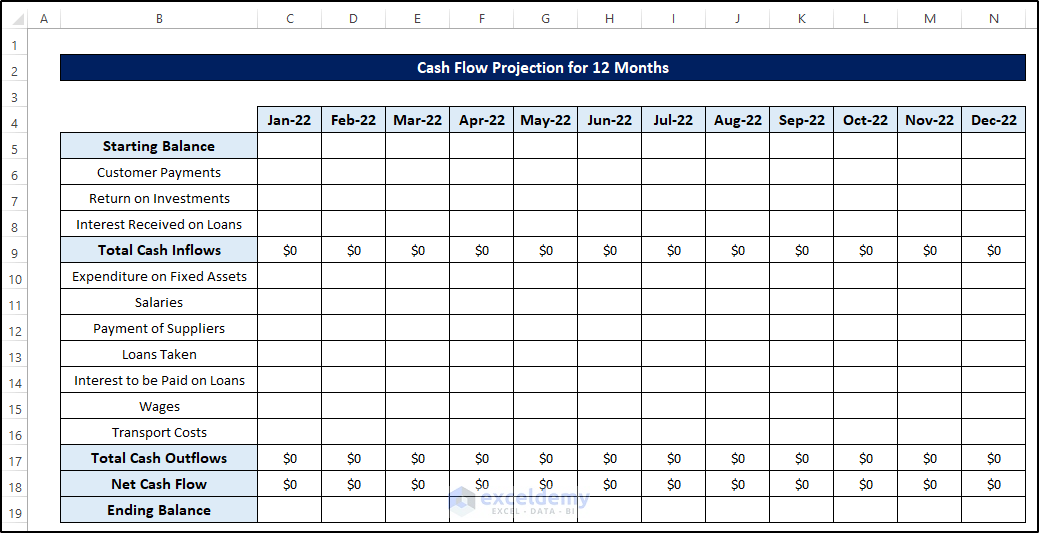

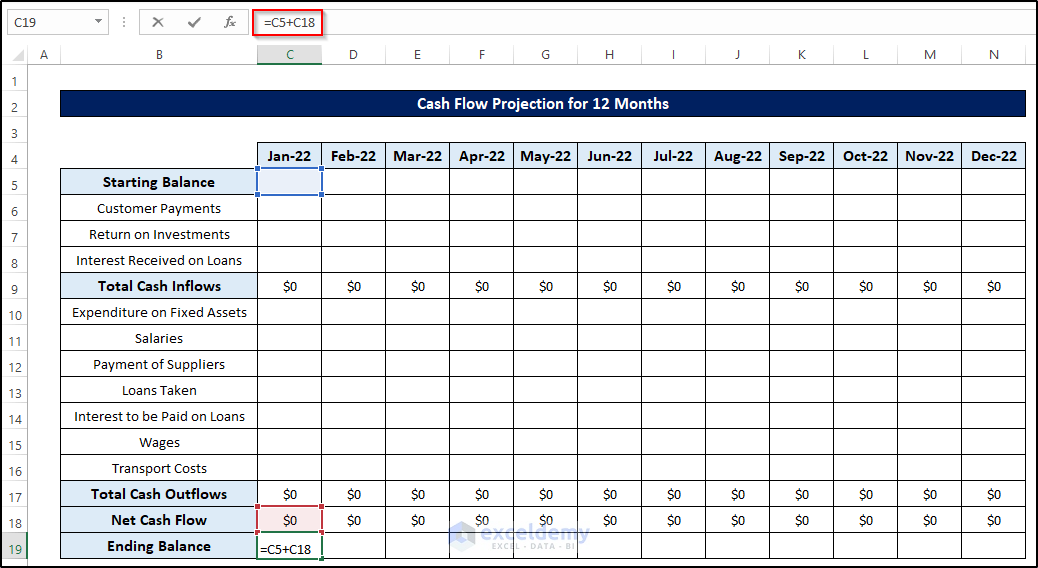

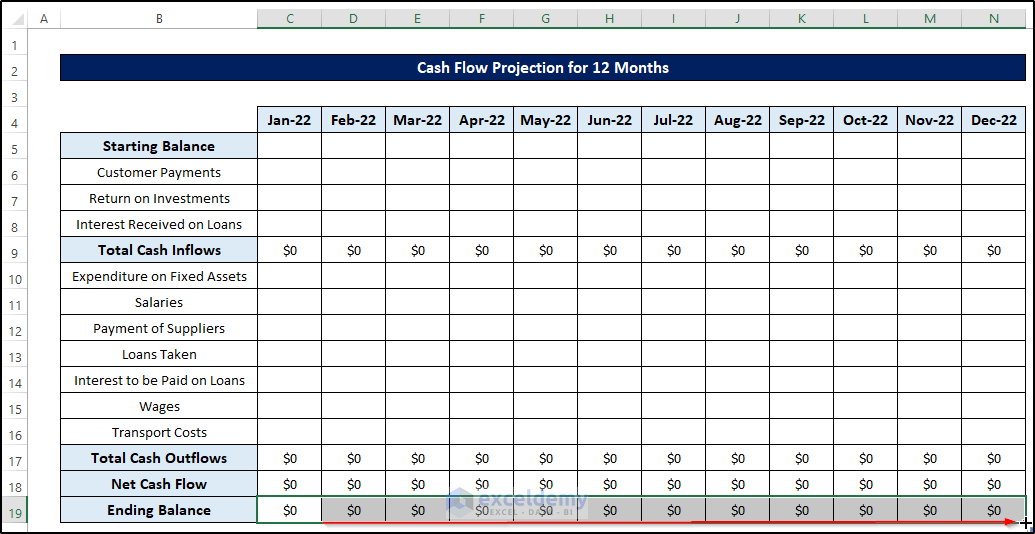

Step 8 – Calculate the Ending Balance

Prepare a row at the end of the cash flow projection.

- Select C19.

- Enter the following formula.

=C5+C18

- Press Enter.

- Drag the Fill Handle to N19.

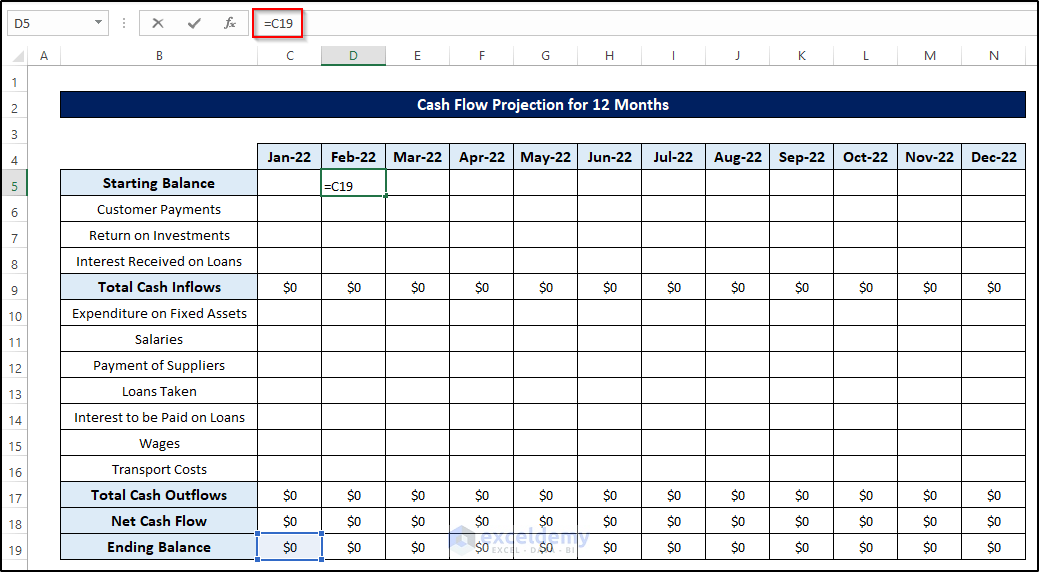

Step 9 – Replicate the Starting Balance Formula for the Rest of Cells

- Select D5.

- Enter the following formula.

=C19- Press Enter.

- Drag the Fill Handle to N5.

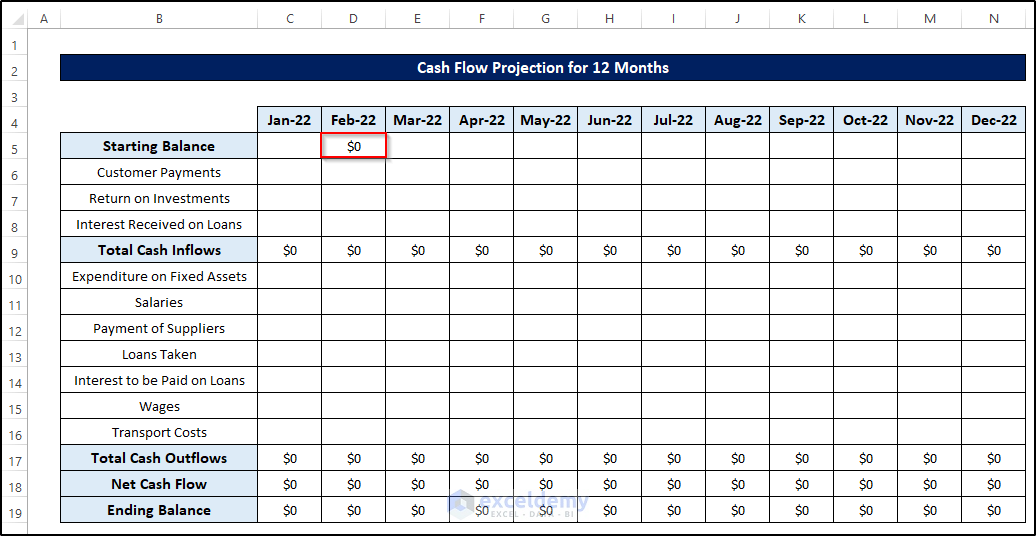

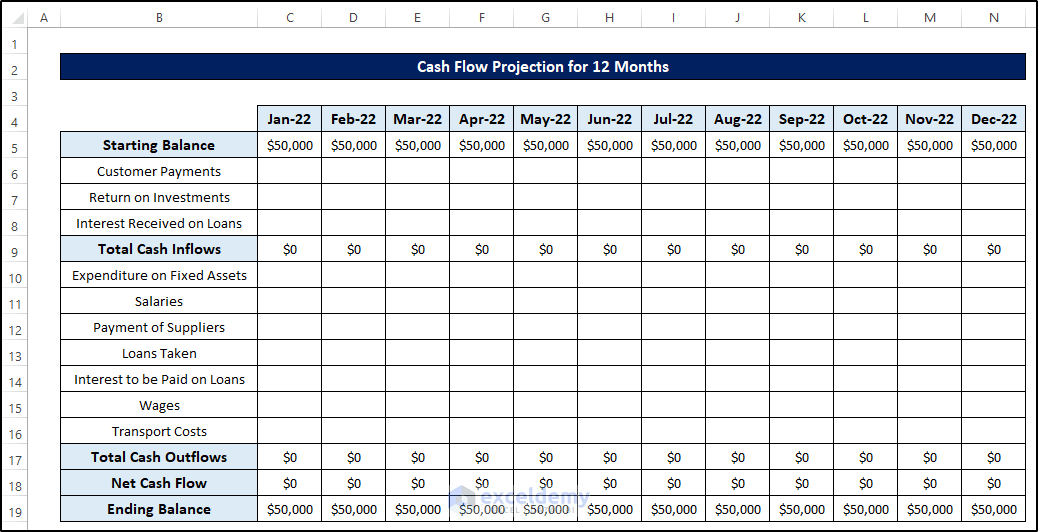

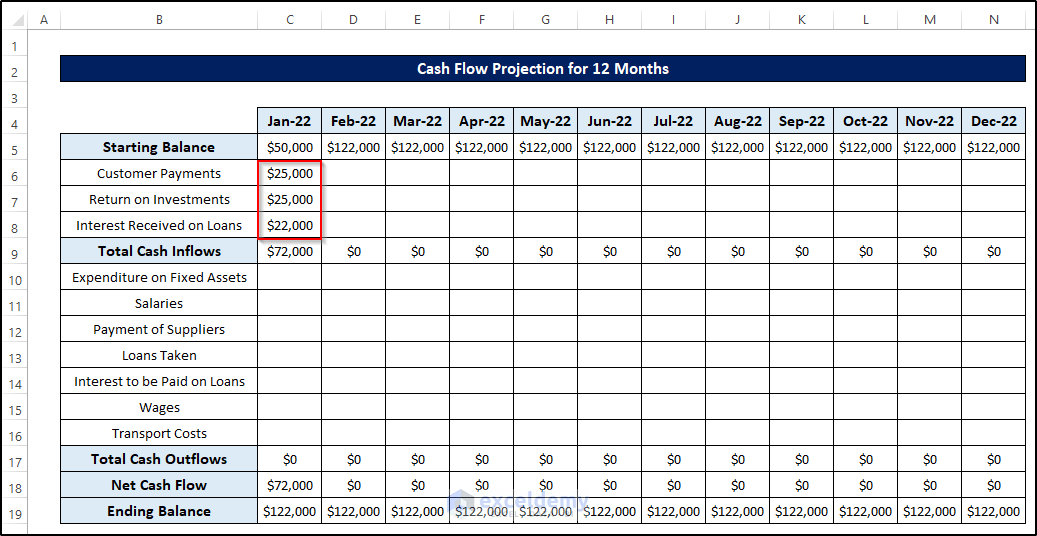

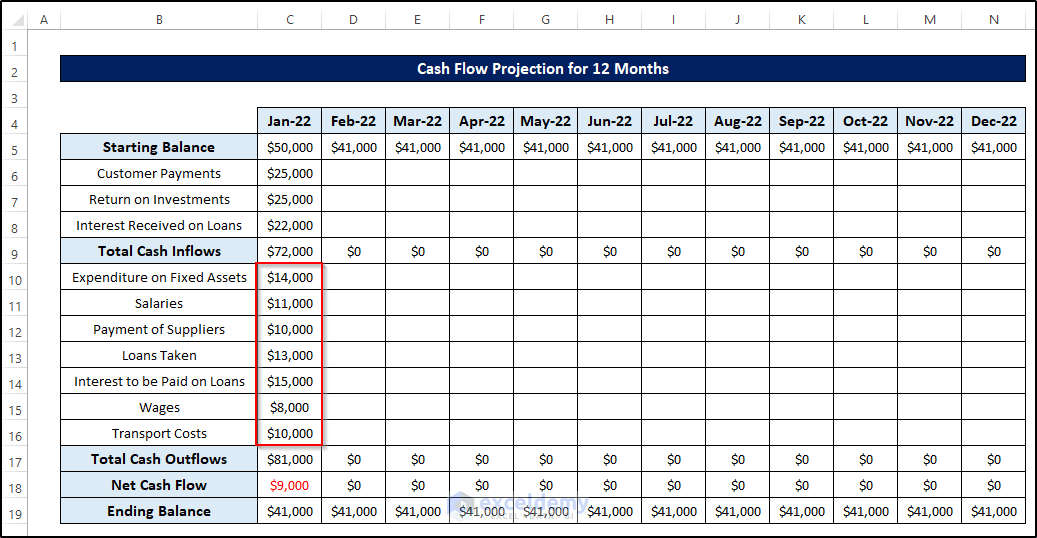

Step 10 – Verify the Cash Flow Projection Format

The cash flow projection format is complete.

- Enter a starting balance of $50000.

- Enter the cash inflow amounts and the total cash inflow cells are automatically updated.

- Enter cash outflow values and the total cash outflow will automatically update.

- This is the output.

Things to Remember

- When the net cash flow becomes negative, the ending balance will be less than the starting balance.

- A month’s ending balance is the starting balance of the next month. Link them.

Download Practice Workbook

Download the Practice Workbook below.

Related Articles

- How to Create a Real Estate Cash Flow Model in Excel

- How to Create Investment Property Cash Flow Calculator in Excel

- How to Make a Restaurant Cash Flow Statement in Excel

<< Go Back to Cash Flow Template | Finance Template | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!