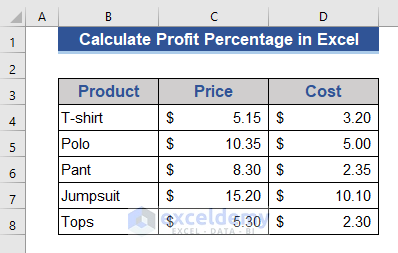

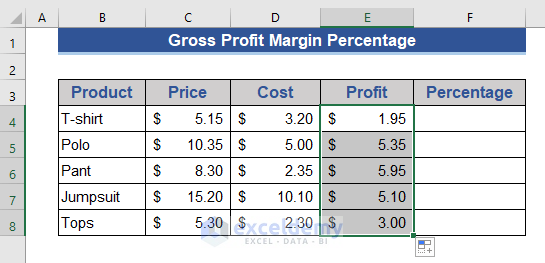

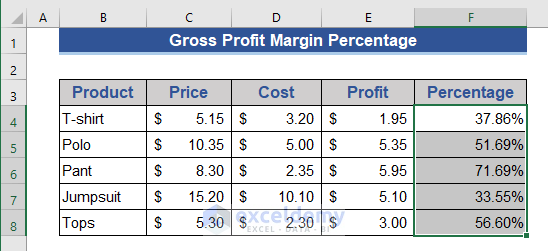

For each of the three methods in this tutorial, we’ll assume that you’re working from the following dataset of a clothing store with their selling price and the cost.

Method 1 – Use an Excel Formula to Calculate Gross Profit Percentage

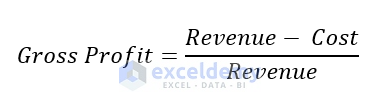

Gross profit is the simplest form of profit. We just deduct the cost of the product from the total revenue, and we get this. We do not consider other costs of business in this profit margin. It is a preliminary profit idea.

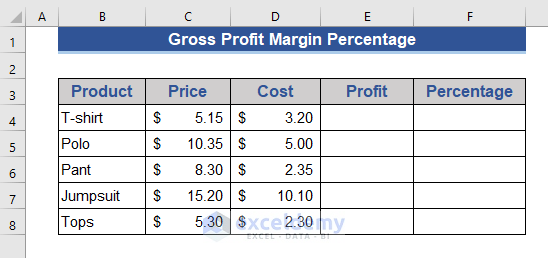

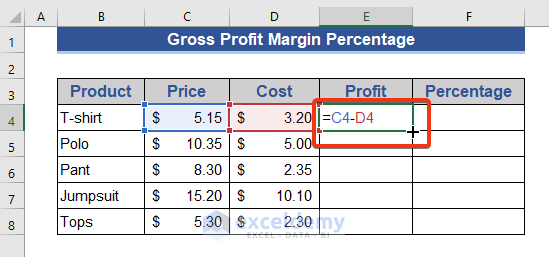

- Add two more columns to your table to show profit and percentage.

- Go to Cell E4 and enter the following formula.

=C4-D4

- Drag the Fill Handle icon.

You’ll get the profit by subtracting cost from revenue.

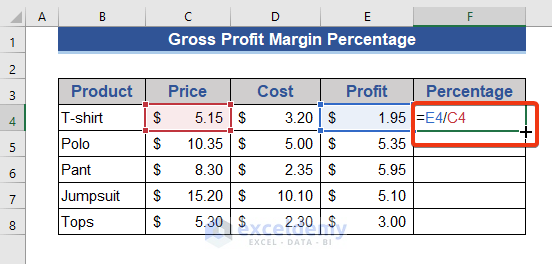

- Go to Cell F4 Then type the below formula.

=E4/C4

- Double click the Fill Handle icon.

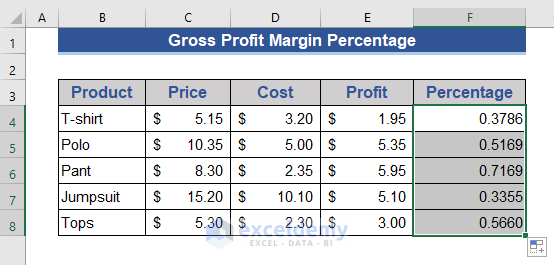

- You can see that we’ve got the results in decimal form. Now, we will convert this value into percentage form.

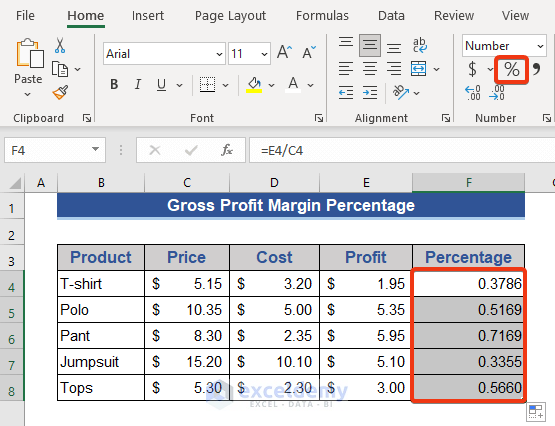

- Select all the cells of the Percentage column.

- Choose the Percentage (%) format from the Number group.

Look at the result and you should see the Gross Profit Percentage.

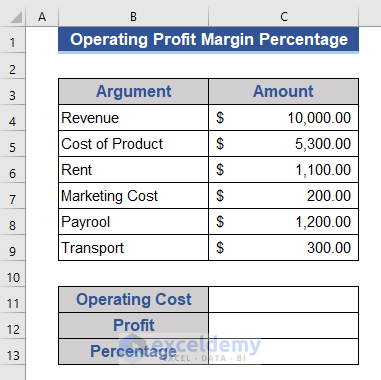

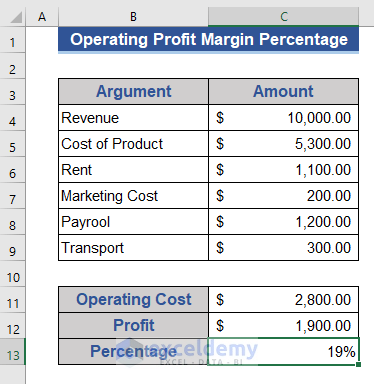

Method 2 – Calculate Operating Profit Percentage in Excel

We will get the Operating profit by deducting the operating cost and the cost of the product from the revenue. The operating cost includes transportation, the salary of employees, rent, marketing costs, and maintenance costs. The total operating cost is also known as SG&A.

The formula for Operating Profit is as follows:

In the below dataset, we have different operating costs from the product cost.

Steps:

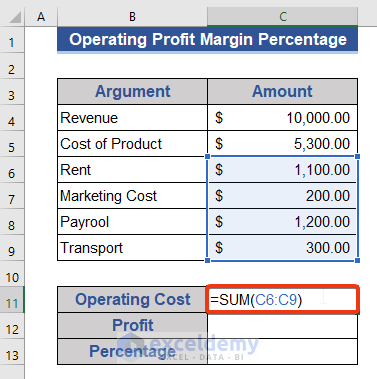

- Go to Cell C11.

- Type the following formula.

=SUM(C6:C9)

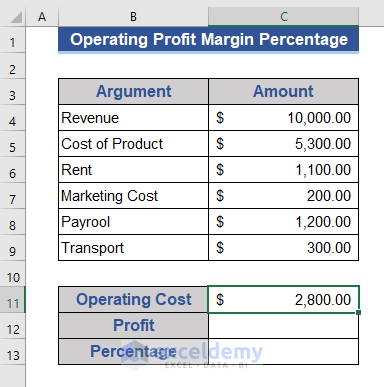

- Press Enter to get the result.

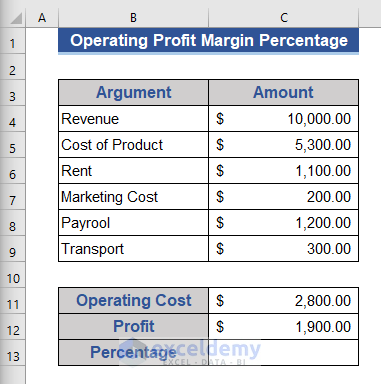

We get the total operating cost here. We will find out the operating profit by subtracting the cost of goods and operating costs from the revenue.

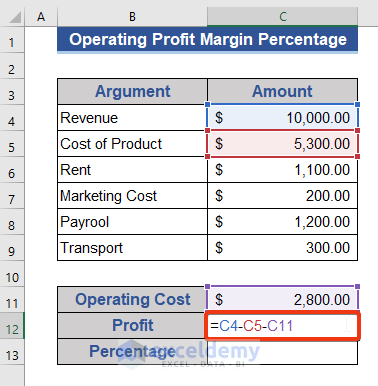

- Type the following formula into Cell C12.

=C4-C5-C11

- Hit the Enter button.

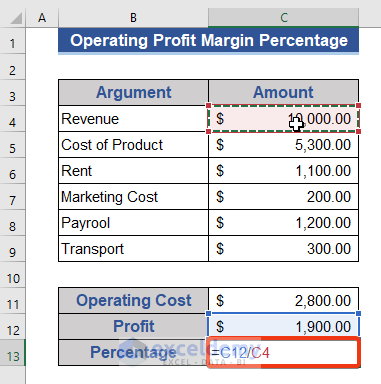

- To divide the profit by the revenue, enter the following formula into Cell C13.

=C12/C4

- Press the Enter button.

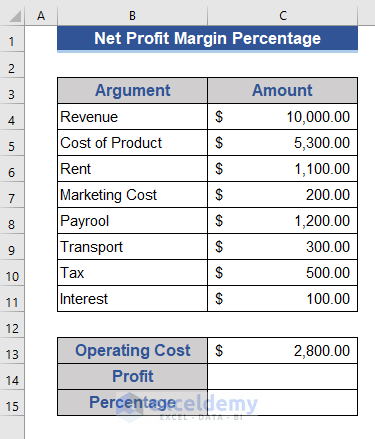

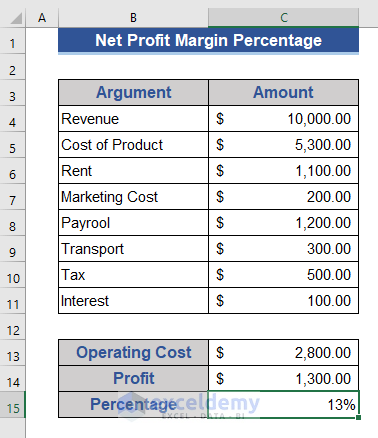

Method 3 – Determine Net Profit Percentage in Excel

Net profit is determined after deducting all the tax and interest along with the remaining costs from your revenue.

Steps:

- We have tax and interest in our dataset. And the operating cost already calculated.

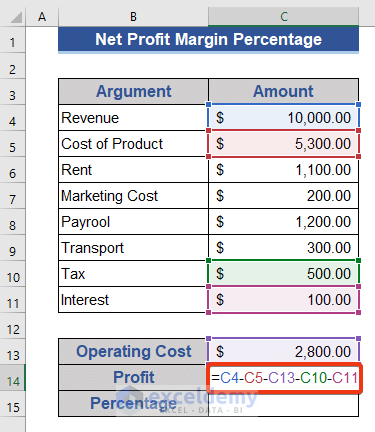

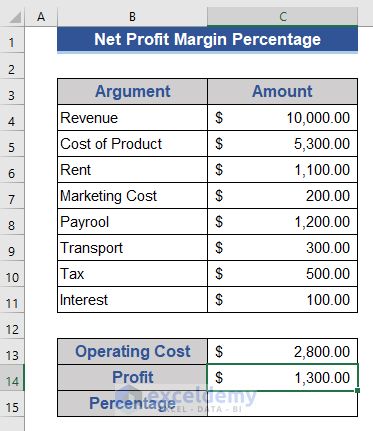

- Determine the profit by subtracting the tax, interest, and other costs.

- Type the following formula into C14.

=C4-C5-C13-C10-C11

- Press the Enter button to execute.

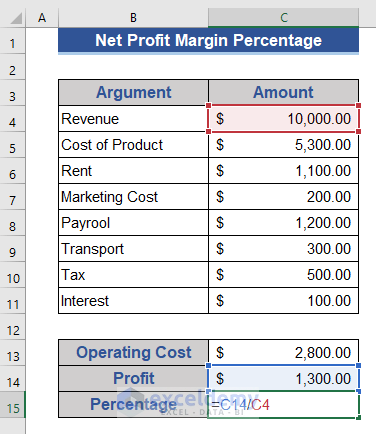

- Go to Cell C15.

- Enter the following formula:

=C14/C4

- Hit the Enter button to convert the result into a percentage.

Download Practice Workbook

Download this practice workbook to exercise while you are reading this article.

<< Go Back to Formula List | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!