We’ll use the Excel PPMT function to find out the principal portion of the mortgage monthly payment. We’ll introduce the PPMT function first.

Introduction to Excel PPMT Function

- Summary

The PPMT function calculates the payment on the principle for a given investment based on periodic, constant payments and a constant interest rate.

- Syntax

PPMT(rate, per, nper, pv, [fv], [type])

- Arguments

| Argument | Requirement | Explanations |

|---|---|---|

| rate | Required | The annual interest rate of the mortgage (here, 5%). |

| per | Required | The period we want to work with. Here, we will enter as 1 as we calculate the principal amount for the first loan payment. |

| nper | Required | The total number of payments per mortgage (here, 60). |

| pv | Required | Present value: the principal amount (here $90,000). |

| [fv] | Optional | The future value is considered to be 0. |

| [type] | Optional | This indicates when the payment is due, usually entered as 0 or 1. |

- Return Value

The PPMT function returns the principal amount as a number.

How do you calculate the principal portion of a loan payment in Excel?

Apply the PPMT formula to calculate the principal portion of the mortgage payment. Follow the steps below to calculate.

Steps:

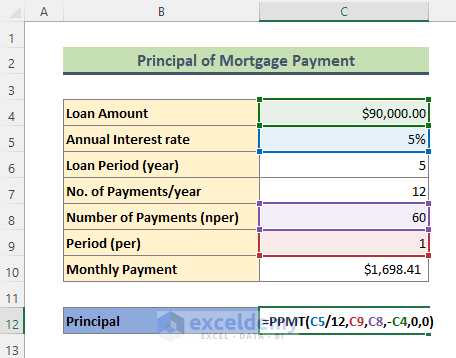

- Type the following formula in Cell C12. From the keyboard, press Enter.

=PPMT(C5/12,C9,C8,-C4,0,0)We divided the interest rate by 12 because 5% is actually annual interest, and there are 12 months in a year.

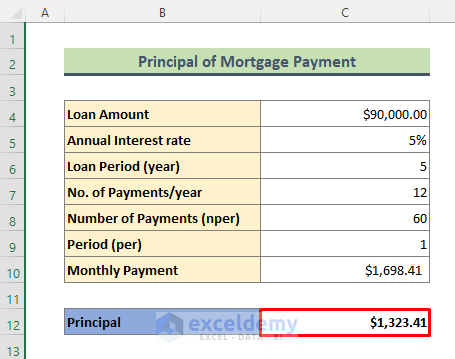

- The above formula will return the output below. Say that out of $1696.41 (the monthly payment of the mortgage), $1323.41 is the principal amount.

Excel IPMT Formula to Find Interest for a Mortgage Payment

Introduction to Excel IPMT Function

- Summary

The IPMT function calculates interest payment for a given investment based on periodic, constant payments and a constant interest rate.

- Syntax

IPMT(rate, per, nper, pv, [fv], [type])

- Arguments

All the arguments mentioned here are similar to those for the PPMT function (explained earlier in this article).

- Return Value

The IPMT function returns the interest amount as a number.

How do you calculate the interest of a mortgage payment in Excel?

Steps:

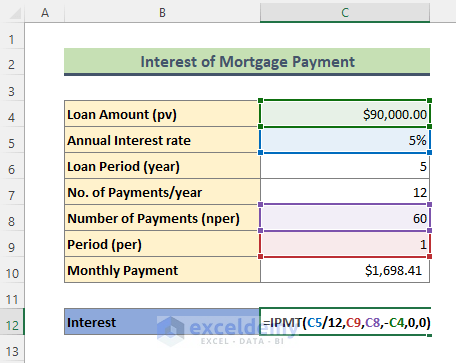

- Type the below formula in Cell C5. Then hit Enter.

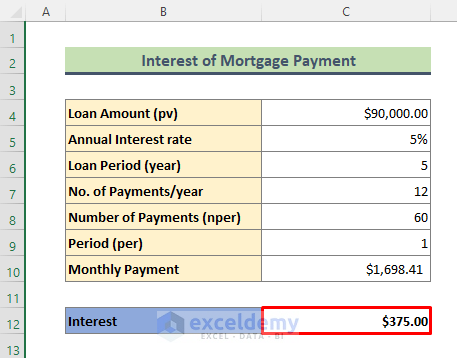

=IPMT(C5/12,C9,C8,-C4,0,0)- Get the result below. It indicates that $375 is the interest portion of our mortgage’s monthly payment ($1698.41).

Download Practice Workbook

You can download the practice workbook that we have used to prepare this article.

Things to Remember

- For ease of calculation, we have supplied pv (Loan Amount) as a negative number. You can enter pv as it is. In that case, the ultimate result will be negative because money will be subtracted from your bank account.

- While calculating the nper, multiply the loan period by the number of payments per year. In my case, I have used the below formula to get nper:

=C6*C7Similar Readings

- How to Use Formula for Car Loan Amortization in Excel

- How to Use Formula for 30 Year Fixed Mortgage in Excel

<< Go Back to Excel Mortgage Formula | Excel Formulas for Finance | Excel for Finance | Learn Excel

Get FREE Advanced Excel Exercises with Solutions!