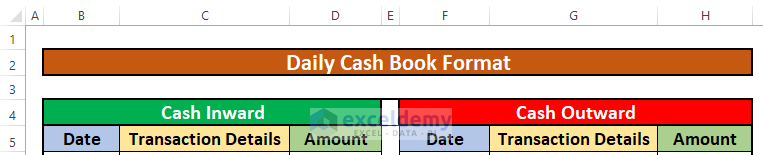

Method 1 – Create Daily Cash Book Header

Enter the heading of a cash book such as Daily Cash Book Format, Cash Inward, Cash Outward, Transaction date, Transaction Details, Transaction Amount, etc.

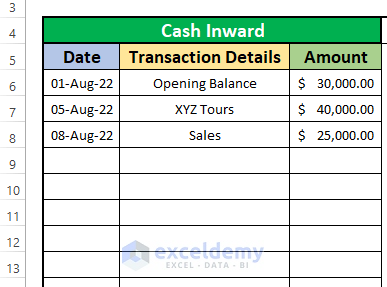

Method 2 – Make Cash Inflow Format

Input the cash inward details; Transaction date, Transaction Details, and Transaction Amount. The cash inward is the income of the XYZ group. Enter several types of Transactions in the Transaction Details column.

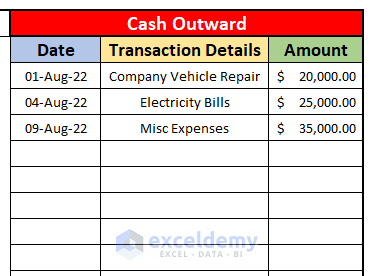

Method 3 – Create Cash Outflow Format

Input the cash outward details; Transaction date, Transaction Details, and Transaction Amount. The cash outward is the expenses of the XYZ group. Enter several types of Transactions in the Transaction Details column which has been given in the below screenshot.

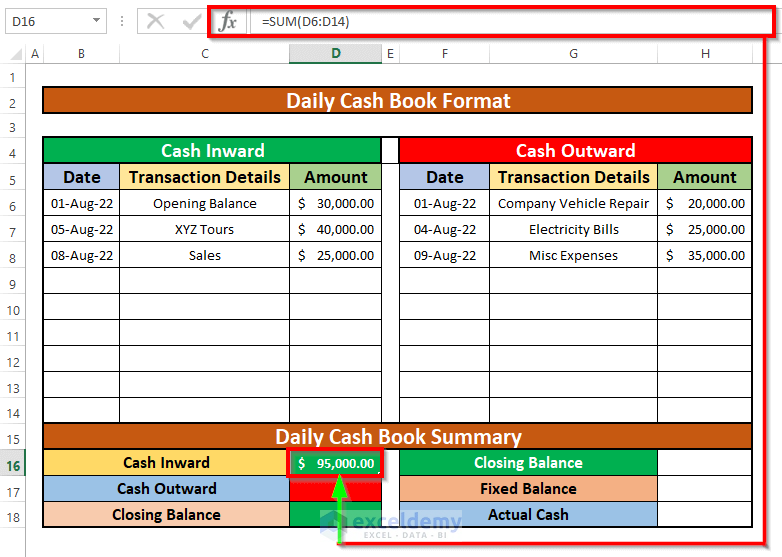

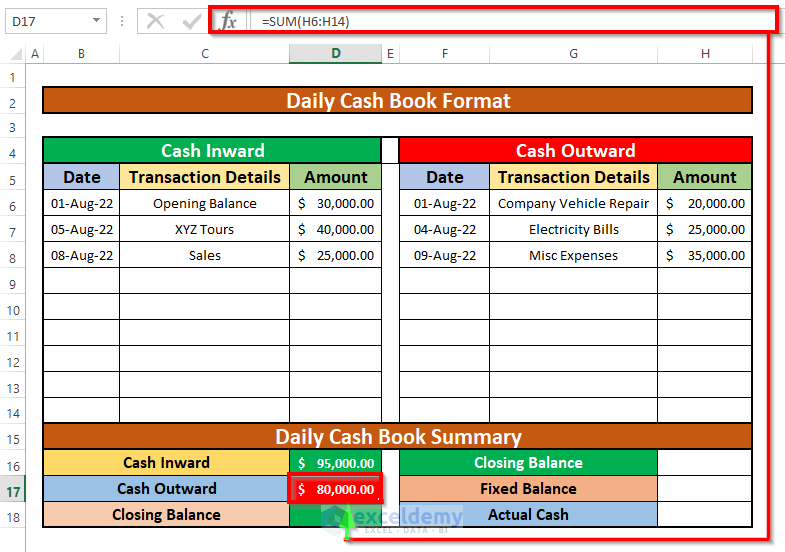

Method 4 – Make Summary of Daily Cash Book Format

Create a summary of the daily cash book using the SUM function and Mathematical formula.

- Select cell; write down the SUM function in that cell. The SUM function is,

=SUM(D6:D14)- Press Enter on your keyboard. Get the total Cash Inward of the XYZ group which is the return of the SUM function. The total Cash Inward is $95,000.00.

- Write down the SUM function in cell D17.

=SUM(H6:H14)- Press Enter on your keyboard. Get the total Cash Outward of the XYZ group which is the return of the SUM function. The total Cash Outward is $80,000.00.

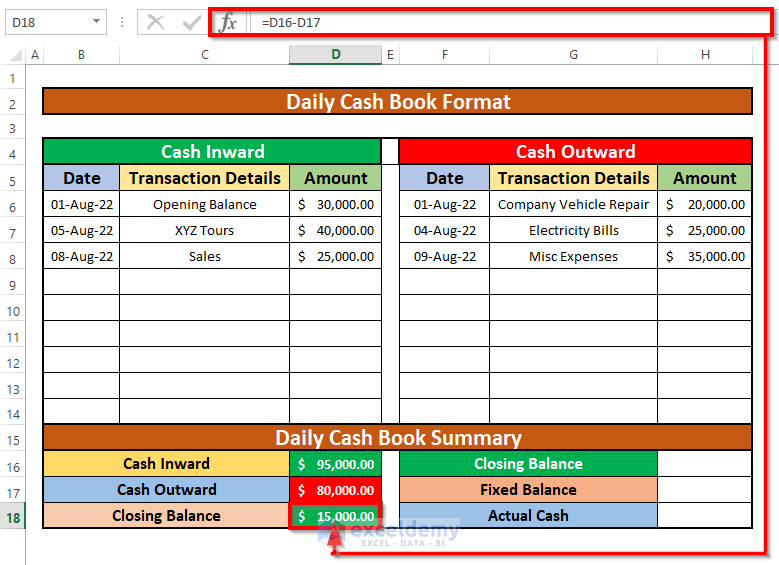

- Write down the Mathematical Subtraction formula in cell D18 to calculate the Closing Balance.

=D16-D17- D16 is the total Cash Inward and D17 is the total Cash Outward.

- Press Enter on your keyboard. Get the Closing Balance. The Closing Balance is $15,000.00.

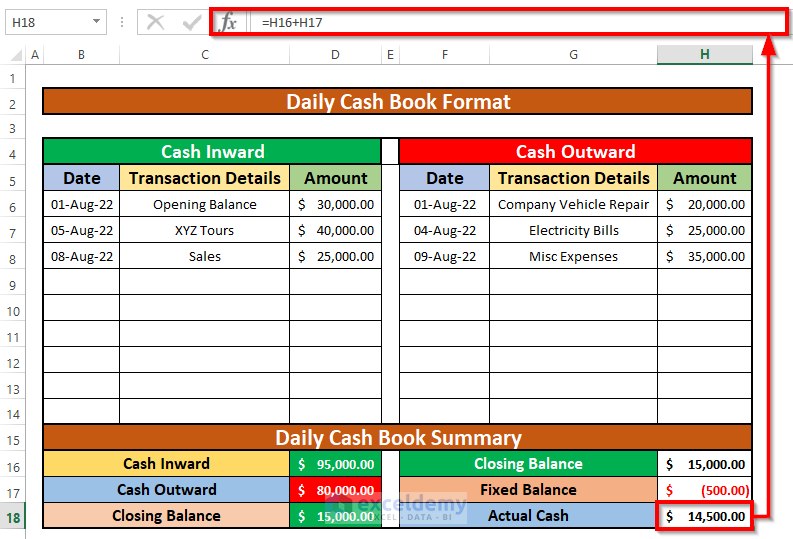

- Write down the Mathematical formula in cell H18 to calculate the Actual Balance.

=H16+H17- H16 is the Closing Balance and H17 is the Fixed Balance.

- Press Enter on your keyboard. As a result, you will get the Actual Balance. The Actual Balance is $14,500.00.

- Create a daily Cash Book format.

Bottom Line

#N/A! error arises when the formula or a function in the formula fails to find the referenced data.

#DIV/0! error happens when a value is divided by zero(0) or the cell reference is blank.

Download Practice Workbook

Download this practice workbook to exercise while you are reading this article.

<< Go Back to Excel Cash Book Templates | Accounting Templates | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!

what is a faxed Balance

Hello, SAJNA!

Thanks for your query!

I think you want to know about the fixed balance instead of faxed balance.

In a daily cash book, a fixed balance refers to a predetermined amount of money that remains constant throughout a specific period, such as a day. This fixed balance represents the starting cash on hand at the beginning of the day and is not affected by daily transactions. It is typically used to track and reconcile cash inflows and outflows accurately.

For example, let’s say a company starts the day with $1,000 in its cash register. This initial amount of $1,000 would be recorded as the fixed balance in the daily cash book. Throughout the day, various transactions occur, such as cash sales, cash expenses, and withdrawals. These transactions are recorded in the cash book, and the fixed balance is adjusted accordingly.

At the end of the day, let’s assume the company made $700 in cash sales, paid $200 in cash expenses, and withdrew $300 for petty cash. Despite these transactions, the fixed balance in the cash book would still remain $1,000. The final balance in the cash book would be calculated by adding or subtracting the daily transactions from the fixed balance. In this example, the final balance would be $1,000 + $700 – $200 – $300 = $1,200.

The fixed balance in the daily cash book helps ensure that the cash position is accurately tracked, and any discrepancies can be easily identified during the reconciliation process.

Regards

Md. Abdur Rahim Rasel (Exceldemy Team)