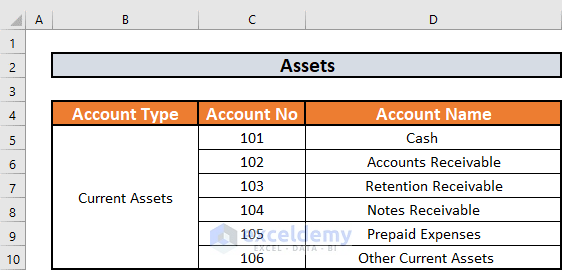

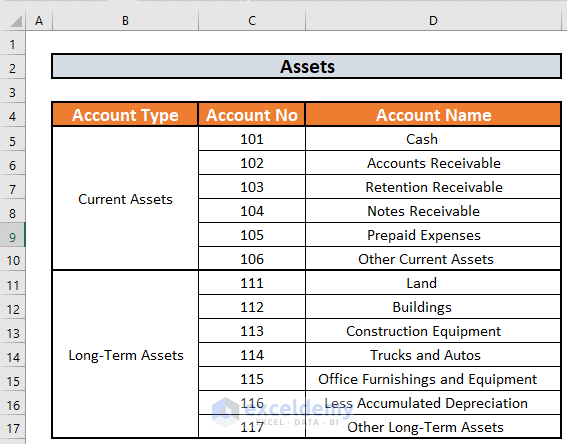

Step 1 – Prepare a List of Assets

- Current Assets include cash, accounts receivable, etc.

- Long-Term Assets include Land, Buildings, Vehicles, etc.

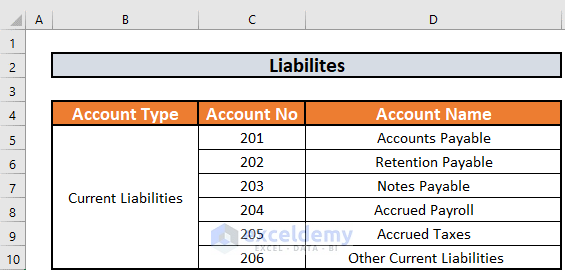

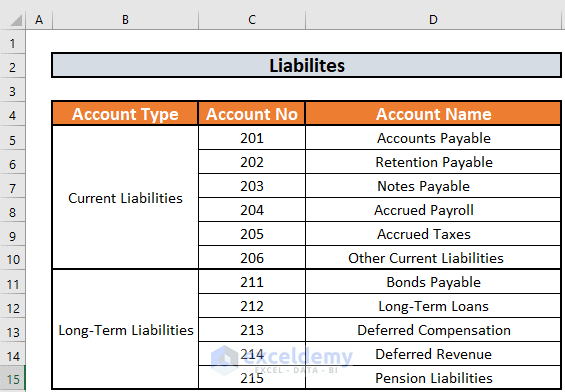

Step 2 – Make a List of Liabilities

Liabilities are the obligations that an organization has to pay to a business entity.

- Current Liabilities are the liabilities an organization has to pay within one year. These include Accounts Payable, Notes Payable, etc.

- Long-Term Liabilities are the liabilities an organization has to pay over one year. These include Bonds Payable, Long-Term Loans, etc.

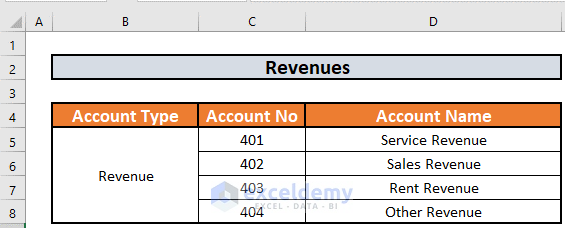

Step 3 – Create a List of Revenues

Generally, the accounting period is 1 year. Revenues are not only the money that an organization generates.

- Revenues include Sales Revenue, Service Revenue, etc.

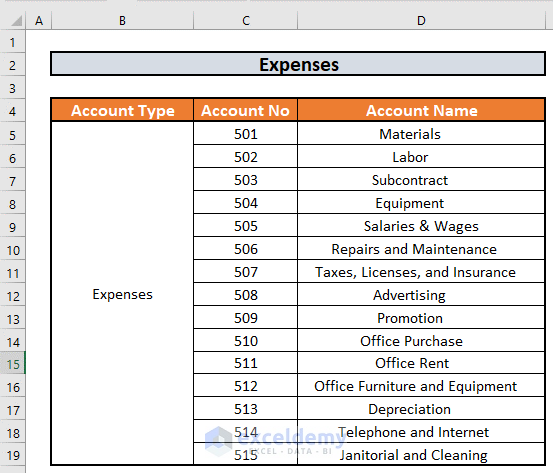

Step 4 – List Out Accounts Under Expenses

- Expenses include material costs, equipment costs, salaries and wages, office rent, etc.

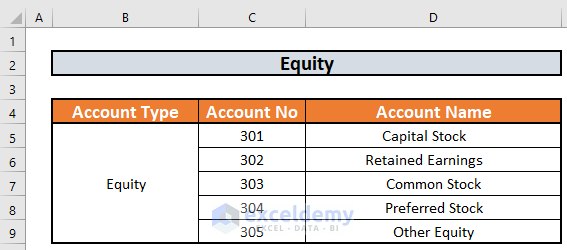

Step 5 – Prepare a List of Equity Accounts

- Equity (also known as Owner’s Equity) is the owner’s or shareholder’s contribution to the company. Equity includes Capital Stock, Retained Earnings, etc.

Things to Remember

- The chart of Accounts varies from one organization to another.

- Account Numbers are used for reference purposes.

Download the Practice Workbook

You can download our sample workbook to use as a template for your company and expand it if needed.

<< Go Back to Excel Chart of Accounts Templates | Accounting Templates | Excel Templates

Get FREE Advanced Excel Exercises with Solutions!